If you are looking to buy, sell, and trade cryptocurrencies on your smartphone, you’ll be pleased to know that there are heaps of options in the market. But, with so much choice, this can make it difficult to know which trading app to go with.

For example, are you looking to focus on an app that offers industry-leading fees, or are you more concerned about trading a specific pair? Either way, you need to perform in-depth research before taking the plunge.

Here are my top suggestions right away:

Spot crypto trading apps

- eToro – Best all-round crypto trading app

- Coinbase – Best crypto trading app for beginners

- Binance – Best range of tradable pairs

- CoinSmart – Another good option for beginners

Exchange and Earn Interest

- BlockFi – Best app for earning interest and borrowing – read my review

- YouHodler – read my review

Derivative Trading

Tokenized Stocks

High Yield Lending

Trading Bots

Buy Gift Cards, Vouchers and Top Up Airtime

Debit cards

To help point you in the right direction, here I discuss my top-rated cryptocurrency apps of 2021. On top of this, I also explain some of the key metrics that you need to look out for prior to selecting a provider.

Choosing a Suitable Platform

Before I delve into the best crypto trading apps of 2021, it is worth me quickly outlining what you need to look out for when searching for a broker/exchange that meets your needs.

In my view, the most important metrics are as follows:

Ownership or CFDs?

First and foremost, you need to assess what your short or long-term objective is. For example, are you looking to buy leading cryptocurrencies such as Bitcoin or Ethereum, and then hold on to the coins for several months or years? If so, you might be better suited for a cryptocurrency broker that accepts everyday payment methods.

Alternatively, if you are looking to actively trade cryptocurrencies to make frequent profits from every-changing price movements, you might be more suited for a CFD trading platform. This is because CFD providers typically allow you to trade cryptocurrencies without paying any commissions. As such, it’s only the spread that you need to take into account.

Note: CFDs (Contracts-for-Differences) track the market price of an asset. This allows you to speculate on cryptocurrencies without you owning the coins. Instead, you are speculating on the future price of the cryptocurrency.

Regulation

Regulation is a bit of a grey area in the cryptocurrency trading space. If using a CFD provider, then it is all-but-certain that the platform will be heavily regulated.

For example, the likes of eToro, IG, and Plus500 all hold licenses with the UK’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC). Other reputable license issuers include the Cyprus Securities and Exchange Commission (CySEC) and the Monetary Authority of Singapore (MAS).

At the other end of the spectrum, conventional cryptocurrency trading exchanges like Binance still operate largely unregulated. This is somewhat surprising when you consider the billions of dollars worth of trading activity that goes through its books each and every day.

Read more: How to buy exposure to Bitcoin through a regular stock broker

However, I would argue that Binance is still worth considering, as it has industry-leading security practices.

Supported Pairs and Financial Instruments

The term ‘Cryptocurrency Trading’ is somewhat of a broad one, not least because it can refer to several financial products. For example, if you’re looking to trade cryptocurrencies against the US dollar, you need to ensure your chosen app supports fiat-to-crypto pairs.

Alternatively, you might be looking to trade crypto-cross pairs. These are currency pairs that contain two digital assets. This might include BTC/ETH or XRP/ETH. If you’re a seasoned crypto trader looking to take things to the next level, then you’ll want to look out for things like margin trading, leverage, and short-selling facilities.

1. eToro – Best All-Round Crypto Trading App

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

So now that you know what factors you should be looking out for when selecting a crypto trading app, I am now going to discuss my number one pick – eToro. Launched in 2007, eToro is home to over 12 million traders around the world. You will have the option of trading via its main desktop site, or through a fully-fledged mobile app. The latter is available on iOS and Android devices.

eToro offers traditional assets as well as CFDs, which gives you ample flexibility.

For example:

- If you want to invest in cryptocurrencies, you can do this at eToro and retain 100% ownership. You can’t, however, withdraw the coins to a private wallet. As such, they will remain on the eToro platform until you decide to cash them out.

- If you want to apply leverage or short-sell cryptocurrencies, this is facilitated via CFDs.

- If you want to trade crypto-cross pairs, this is facilitated via CFDs.

See also: My crypto predictions for 2021

In total, eToro allows you to buy and sell 16 different cryptocurrencies in the traditional sense. This includes Bitcoin, Ethereum, Ripple, Bitcoin Cash, EOS, and more.

You can also trade cryptocurrency pairs – including both crypto-fiat and crypto-crypto. For example, you can trade cryptocurrencies against the USD, GBP, JPY, and EUR. You can also trade cross-pairs like EOS/XLM or BTC/EOS.

Fees and Commissions

On top of its vast offering of tradable cryptocurrency products, the eToro app stands out in the fee department.

Here’s why:

- Deposits: You can deposit funds with a traditional debit/credit card, e-wallet, or bank account without paying any fees. The only cost that is associated with financing your account is a 0.5% currency conversion charge for all non-USD deposits. In comparison to the likes of Coinbase – which charges 3.99% on debit card deposits, this is very competitive.

- 0% Commission: Whether you are buying cryptocurrencies or trading CFDs, you will not pay any commissions at eToro. You will, however, need to factor in overnight financing fees if trading CFDs. This is industry standard in the CFD space, and the charge will kick in for each day that you keep your position open past market hours.

- Competitive Spreads: Although not industry-leading, the spreads at eToro can be competitive – especially if you are investing in the long-run. You should expect to pay a wider spread when trading less liquid cryptocurrency pairs.

- Withdrawals: Getting your money out of the eToro crypto app and back onto your payment method is seamless. Best of all, the platform charges just $5 per withdrawal.

All in all, I think that eToro is very strong when it comes to trading fees and commissions.

Safety and Regulation

When it comes to the safety of your funds, eToro is regulated on three fronts. This includes the FCA, ASIC and CySEC. These three licensing bodies have an excellent reputation in the online brokerage space. They all have strict demands on the brokers and trading platforms that they regulate, such as:

- Requiring platforms to keep client funds in segregated bank accounts

- Performing regular auditors on the provider

- Asking platforms to request ID from all traders

- Clearly add warnings on the risks of trading financial instruments like cryptocurrencies

See also: Should you buy Bitcoin in 2021?

Other Notable Features

In addition to low fees and a strong regulatory standing, the eToro crypto trading app offers several other features that are worth a quick mention.

This includes:

Copy Trading

The eToro app offers an innovative feature known as ‘Copy Trading’. Put simply, this allows you to browse the eToro platform looking for a cryptocurrency trader that you like the look of. Then, once you find a suitable trader, you get to mirror their portfolio like-for-like.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Not only this, but you can elect to copy all ongoing trades. As a result, you get to trade cryptocurrencies without lifting a finger. This is great if you have little to no experience of buying and selling digital currencies, or you simply don’t have the time to actively trade.

Other Asset Classes

I should also note that the eToro app is suitable for those of you that wish to diversify into other asset classes. For example, you can invest in ETFs and over 800+ stocks while retaining full ownership.

If it’s hard-core trading you’re after, you will also have access to indices, forex, hard metals, energies, government bonds, and more. These all come in the form of CFDs, so short-selling facilities are also available.

You can read my full eToro review to learn more about the platform.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework.

2. Coinbase – Best Crypto Trading App for Beginners

Although Coinbase won’t be the right crypto trading app for some of you, it likely will be if you are an absolute beginner. The reason that I say this is that the app is one of the easiest to use. In fact, even if you have little to no experience in trading cryptocurrencies, you should be fine with Coinbase.

The Coinbase application allows you to buy and sell all the major cryptocurrencies.

All of the above digital currencies can be purchased in the traditional sense, meaning that you retain 100% ownership. Unlike eToro, however, the Coinbase trading app allows you to withdraw your cryptocurrencies out to your private wallet. This is much more in line with the crypto ethos of practicing self-custody of your coins.

User-Friendliness

In terms of user-friendliness, it doesn’t get much better than Coinbase. Once you have downloaded its mobile app, you will then be asked to create an account. This requires some personal information alongside your government-issued ID. Regarding the latter, you’ll need to take a photo of your passport/driver’s license. After that, you can easily deposit funds with fiat currency.

In fact, if you want to start trading straight away, you can deposit funds with a debit card. Unfortunately, this will cost 3.99%, which is even more than Binance. Alternatively, bank transfers are typically free, although this will depend on your location. You will also need to wait a few days for the bank transfer to settle.

See also: Should you buy Ethereum in 2021?

Once you have a fully funded account, you can start buying and selling cryptocurrencies. You will be trading each cryptocurrency against the US dollar.

Trading Fees

When it comes to trading fees, Coinbase has a standard buy/sell rate of 1.5%.

- If you bought $1,000 worth of Bitcoin, this would translate into a commission of $15

- If you sold $10,000 worth of Bitcoin back to US dollars, you would pay $150

Admittedly, this isn’t as competitive as the other crypto trading apps I have discussed thus far. As a result, if you’re a complete newbie, you might need to trade in cost for convenience and user-friendliness.

Safety and Regulation

Coinbase has an excellent reputation with regulators in the US. It is registered with FinCEN as a Money Service Business, which means that it must comply with US regulations. At the forefront of this is the anti-money laundering laws surrounding KYC. Put simply, all Coinbase customers are required to identify themselves.

Coinbase is also in the processing of getting the green light from the SEC for a brokerage license. Outside of the US, Coinbase is also registered with the FCA. Internal security is also top-notch at Coinbase. For example, you’ll benefit from 98%+ of client funds being held in cold storage, as well as 2FA.

US-dollar accounts also benefit from FDIC Insurance, meaning the first $250,000 is covered. The Vault is also a handy security feature that you will find on the app, which puts a 48-hour time lock on all withdrawal requests.

You can read my full Coinbase review here.

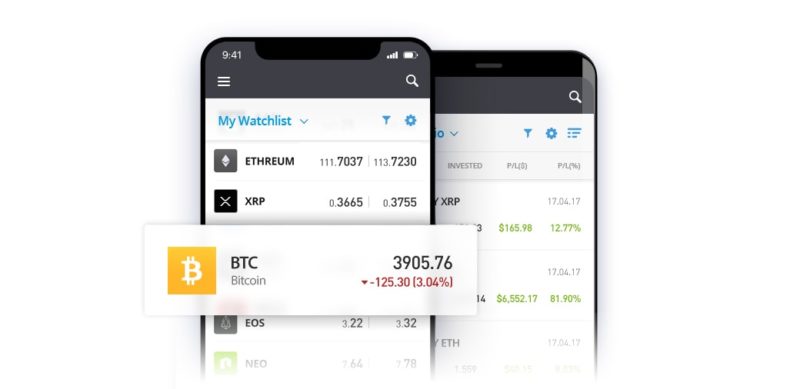

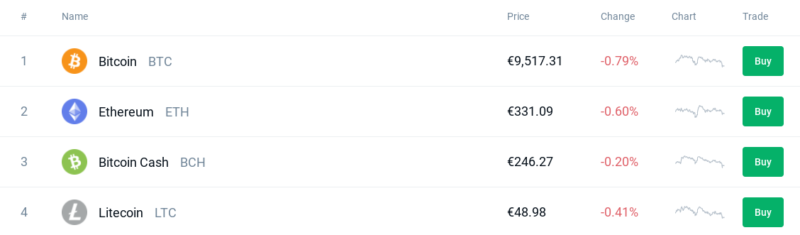

3. Binance – Best Crypto Trading App for Tradable Pairs

Binance needs no introduction in the cryptocurrency exchange circle – not least because it is responsible for some of the largest trading volumes globally. For example, in the last 24 hours alone Binance has facilitated over $9 billion in trading volume (as per CoinMarketCap).

While most traders will buy and sell pairs through the main Binance website, the provider also offers a trading app. This is available to download free of charge, and it’s compatible with iOS and Android devices. Much like in the case of eToro, you will have one central account that you can use across all devices.

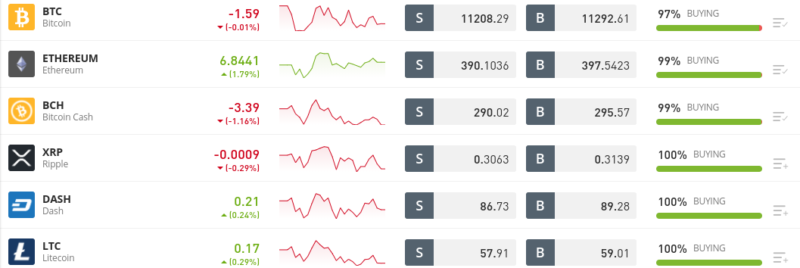

One of the stand-out features of Binance is that it offers a significant number of cryptocurrency pairs. In fact, this stands at well over 600 pairs at the time of writing.

This means that you will have access to cryptocurrencies of all shapes and sizes. For example, if you’re looking to trade the likes of Bitcoin, Ethereum, or Bitcoin Cash – you will benefit from heaps of pairs at your fingertips. Alternatively, if you want to access less liquid projects like Troy, Polymath, or Status, Binance also has you covered.

Trading Structure

Binance does not offer CFD products. On the contrary, you will be buying and selling cryptocurrencies in the traditional sense. You will, however, still be trading pairs.

For example,

- You wish to trade Bitcoin against Ethereum. As such, you will need to trade ETH/BTC.

- We’ll then say that the pair is priced at 0.0348. This means that for every 1 ETH, you get 0.0348 BTC.

- Much like real-world currencies, the value of ETH/BTC will go up and down on a second-by-second basis.

- You then need to stipulate whether you think the price of the pair will go up (buy order) or down (sell order).

Once you place an order via the Binance trading app, the position will remain open until you decide to close it. Once you do, your profit or loss will be determined by whether you speculated correctly, and by how much.

On top of spot trading pairs, the Binance app also gives you access to more sophisticated products. This includes the platform’s Perpetual Futures Contracts, which allows you to apply leverage.

As the structure of the derivatives offered by Binance falls outside of traditional trading regulations, it is able to offer leverage of up to 1:125. This means that a $200 account balance would permit a maximum trade value of $25,000.

Fees and Commissions

In terms of trading fees at Binance, the platform is largely very competitive.

For example:

- The highest trading commission charged by the Binance app is 0.1%. This is charged at both ends of the trade. For example, let’s say that you trade $500 worth of BTC/XRP. This would cost you just $0.50 in commission. if you then sold the pair when it was valued at $550, you would pay $0.55 in commission. This is extremely competitive.

- You can get your trading fees down to even lower percentage rates if you make use of the BNB Coin. This is Binance’s native cryptocurrency token.

- If you’re keen to trade Perpetual Futures Contracts via the Binance app, this starts at just 0.02%.

With that being said, if you plan to deposit fiat currency into Binance with your credit card, this can be costly. This comes out at the higher of 3.5% per transaction or 10 USD.

On the other hand, if you are able to deposit funds with a cryptocurrency, then no fees are charged by Binance. In terms of withdrawing cryptocurrencies, you will pay a charge that is similar to the blockchain mining fee for the respective coin or token.

Safety and Regulation

Binance is not regulated by any single government entity or national regulator. This means that you can never be 100% sure just how safe your money is. On the flip side, Binance does have an excellent reputation in the space and crucially – is responsible for billions of dollars worth of trading volume each and every day.

Although it operates without a license, there are several safeguards in place to ensure your account remains secure. This includes everything from 2FA (Two-Factor Authentication), address whitelisting, cold storage, anti-phishing tools, and ‘SAFU’.

The last safeguard is Binance’s Secure Asset Fund for Users. This is a reserve pot that grows over time. If the unfortunate happens and Binance is hacked, the pot will be used to compensate victims.

You can read my full Binance review to learn more about this platform.

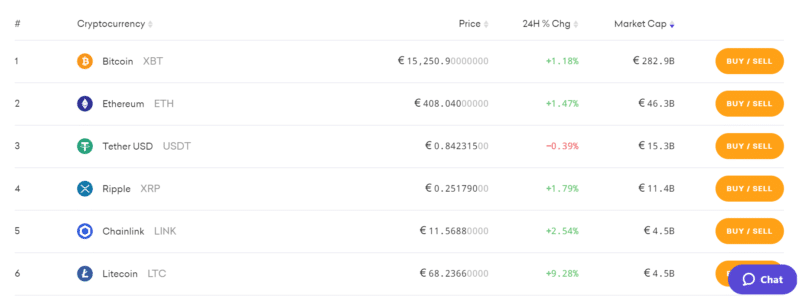

4. CEX.IO

CEX.IO is a well-established cryptocurrency platform that has built a solid reputation over the past eight years. It has proved its commitment to safety and security with stellar customer service.

The trading platform itself comes with a sizable range of tools that can be extremely useful for both novice and advanced traders alike. The demo account is one of the most beneficial features – allowing you to hone your trading skills before taking the plunge with real money.

Although the cryptocurrency exchange might not give you access to the widest range of digital coins, the platform is still expanding. There are additional tools being lined up that will introduce new functionalities to the platform such as crypto-savings and custody accounts.

Further reading: My CEX.IO in-depth review

Although CEX.IO is primarily a crypto exchange, the platform offers several other notable features that make it a one-stop-shop for digital currency enthusiasts:

- Instant Buy

- Staking

- Crypto loans

Read my CEX review for more information on these features and a full breakdown of all the products on offer by this exchange.

The positive reputation that CEX.IO has built over the years is a true indication of how well the platform serves its customers’ needs.

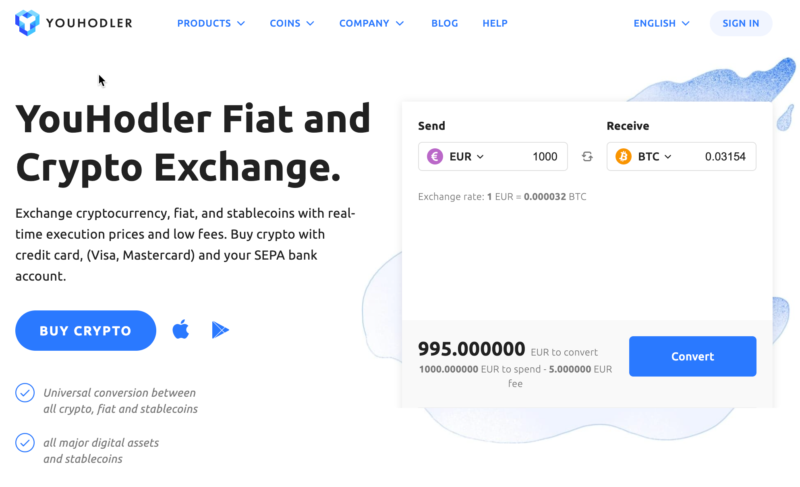

5. YouHodler – Best Crypto Trading App for Earning Interest and Loans

Although not uniquely a trading app, YouHodler is an interesting platform that offers a full range of cryptocurrency-based products. At the forefront of this is the ability to earn interest on your cryptocurrency holdings that otherwise – would be sat idle in your private wallet.

The way it works is as follows. You deposit your chosen cryptocurrency into your unique YouHodler wallet. You can do this directly from within the mobile app. Then, depending on the digital currency you deposit and the length of time you keep the coins locked away, you could earn up to 12% in interest per year.

Bitcoin yields a maximum of 4.8%, albeit, this is still competitive. In addition to being able to earn interest, the YouHodler app also supports cryptocurrency loans. In fact, you can get an LTV (Loan to Value) of up to 90% on the digital currency you deposit, with the proceeds being paid in fiat money.

See also: My in-depth YouHodler review

This might suit those of you that wish to release some of the funds you have tied up in cryptocurrency, without being forced to cash out. In turn, if the value of the coin you deposit goes up while the loan is outstanding, you will still benefit from the upside.

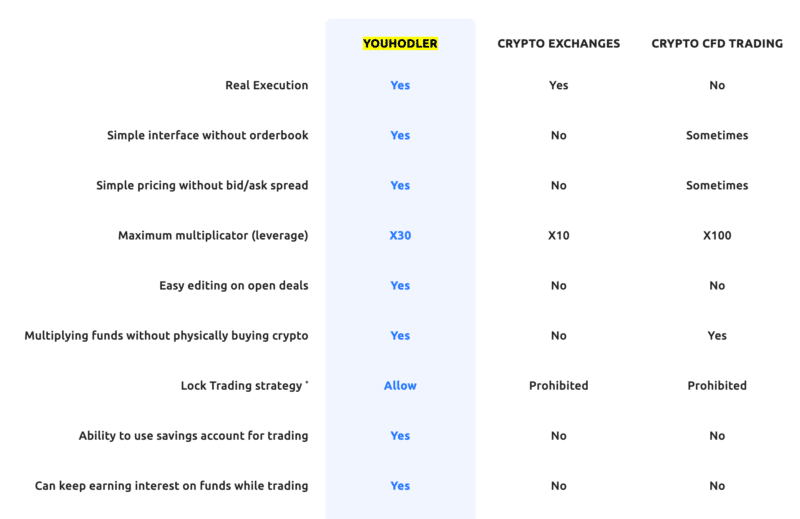

On the trading side, YouHodler has introduced a number of innovative trading features, such as Multi Hodl for crypto margin trading. Turbo loans can also be used to your advantage.

For many people, Multi HODL is better than Margin Trading on Exchanges or CFD Trading.

Multi HODL combines the best of both crypto exchanges and CFD trading into one. It offers a simple and intuitive interface, convenient trade management, and FREE leverage.

You can also use YouHodler to buy cryptocurrencies directly from your account using fiat currencies (EUR, USD, GBP etc).

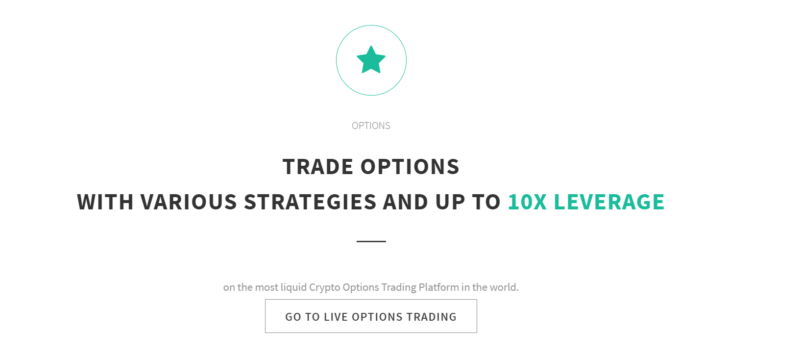

6. Deribit – Best All-Round Bitcoin Options Trading Platform

The real-world screenshot examples I gave above were taken from Deribit. This platform is focused exclusively on cryptocurrency derivatives and offers both Bitcoin futures and options. I like Deribit for several reasons.

In terms of its Bitcoin options markets, the platform offers heaps of contract durations. This runs from daily, weekly, monthly, quarterly, and right up to 10-months. As such, Deribit is great if you want to purchase longer-term options.

Additionally, each of the aforementioned contract durations comes with heaps of strike prices. In the example I gave earlier on 10-month contracts, this varied from $8,000 to $40,000 – which gives you plenty of flexibility to deploy an options trade that meets your requirements.

In terms of minimums, you can purchase from just 0.1 BTC of an options contract. As such, if the premium on your chosen market has a USD-value of $4,000 – you would need to outlay $400. You can, however, also apply leverage to your options trade – meaning that your financial outlay can be reduced by a considerable amount.

There is plenty of liquidity at Deribit, too – so you should never have any issues entering and exiting the market. However, I should make it clear that Deribit also comes with its flaws. At the forefront of this is that the platform only hosts European-style options.

As I mentioned earlier, this means that you need to wait for the contracts to expire before you can realize your profit or loss. In other words, you can’t offload your calls or puts before they expire. Additionally, Deribit does not accept fiat currency deposits. Instead, you need to fund your account with Bitcoin.

If you don’t have any Bitcoin to hand, you will first need to buy some and then transfer it over to your Deribit account. In terms of fees, you will initially pay a commission of 0.03% of the underlying contract value. When the contracts expire, you then pay a settlement fee of 0.015%.

Finally, Deribit is not regulated. After all, it allows you to trade cryptocurrency derivatives with leverage. The platform does, however, note that it keeps 99% of its Bitcoin holdings in cold storage. The balance is kept in hot wallets to facilitate withdrawal requests.

7. FTX – Best Platform for Bitcoin Derivatives With Leverage of up to 101x

FTX is an online exchange that primarily focuses on cryptocurrency derivatives. This platform allows you to trade not only Bitcoin options but also Bitcoin futures and other ERC20 tokens. Perhaps, the most impressive part of FTX is that it allows you to trade Bitcoin options with leverage of up to 101x.

The exchange gives you total flexibility when it comes to defining your Bitcoin options position. For example, you can set pretty much any strike price as well as expiration time. However, instead of listing dozens of order books, FTX employs a Request for Quote (RFQ) system.

This allows you to design a Bitcoin option contract exactly as you want it. You can choose between a call/put, set the strike price, expiration date, the number of coins, and whether you want to buy or sell. When you have finalized your option parameters, FTX will send you a quote in a matter of seconds. It is entirely up to you to decide whether you want to accept the offer or not.

With that said, if you don’t accept any bids or offers, your RFQ will disappear within five minutes. BTC options come with a maker and taker fee system that will vary depending on your 30-day volume. However, FTX also puts a cap on the fee for Bitcoin options based on a unique formula. This ensures that even if you trade with low stakes, you will not be charged a hefty sum in fees.

Additionally, FTX users can also benefit from Fiat deposits and withdrawals. You can process your payments through a credit/debit card or via a bank transfer. In summary, there is plenty to like about FTX. However, the main drawback here is that Bitcoin options are not accessible for US residents.

8. CoinSmart – The most accessible crypto exchange in Europe and Canada

CoinSmart takes the cryptic out of crypto. They’ve designed a platform that caters to Europeans with all levels of crypto literacy. If you’re an advanced trader you get all the bells and whistles of an advanced exchange. If you’re just getting started, you’ll love the platform’s ease of use and how everything just falls into place. The best thing I like about CoinSmart is how they don’t shy away from providing actual human support. They offer 24/7 omnichannel live support. CoinSmart is probably one of the very few if not the only exchange that does this.

The setup is very smooth and KYC is lightning quick. Their smart trade feature lets you convert one supported coin to any other supported coin without needing to go into Bitcoin first. True one-click trading with very competitive pricing. CoinSmart started in Canada and has quickly grown to Europe.

Euro, USD, CAD supported. Fund through SEPA, Interac, Wire Transfer or buy crypto through credit card.

CoinSmart is safe and secure. In Canada, it is registered with FINTRAC and it also has the necessary licenses in Europe.

If you want to Buy Bitcoin with Euro, give CoinSmart a try.

9. NSBroker – Best Advanced Trading App for Crypto CFDs

If you like the sound of trading cryptocurrencies in the shape of CFDs, it’s well worth checking out NSBroker. The platform gives you access to five digital currencies – namely Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash. Each of these five cryptocurrencies can be traded against the US dollar at a commission rate of just 0.5% per slide.

This means that you will pay this fee when you open your crypto CFD position and again when you close it. For those of you seeking leverage, NSBroker offers 1:2 on its cryptocurrency trading markets.

See also: My NSBroker review

Outside of cryptocurrencies, the mobile app also offers markets on forex, precious metals, energies, and indices. Licensed by the MFSA in Malta, NSBroker allows you to deposit funds with a debit/credit card, Skrill, Neteller, or bank wire. Finally, all trades are facilitated vias the MT5 app – which comes jam-packed with tools and features.

Open an account with NS Broker

10. IQ OPTION – Regulated Bitcoin Options Platform

One of the most attractive features of IQ Option is that it is one of the few regulated trading platforms that gives you access to Bitcoin options. The platform is licensed by the CySEC in Cyprus.

Bitcoin trading on IQ Option is facilitated through CFD trading. As such, you have the option to benefit from a bearish market by short-selling the coins without ever needing to take ownership of the asset. In addition, you can also get leverage of up to 100x on your cryptocurrency positions, with a minimum stake of just $1.

Apart from Bitcoin, you can also trade 12 other cryptocurrencies, along with forex, stocks, and commodities. IQ Option also allows you to polish your trading patterns through a practice account. However, unlike some other platforms, there is no limited usage here. Instead, you can use the paper trading facility for as long as you wish.

In other words, you can backtest your patterns whenever you want on this platform. IQ Option also gives you a lot of flexibility when it comes to deposits and withdrawals – with a long list of supported payment methods. This includes credit/debit cards, wire transfers, PayPal, Neteller, and Skrill. You can also start trading with a minimum deposit of just $10.

IQ Option also has an exclusive product – FX options that are dedicated to speculating on currency pairs. If you need to practice trading these complex instruments, IQ Option offers a full-access demo account. Coming to the trading fees involved – all CFDs on cryptocurrencies will require you to pay a swap fee that varies between 0.01% to 0.06%.

This can also extend up to 1.7% for overnight positions. For trading options, any fees charged will be included in the premium. Although IQ Options have a variety of financial products, it is best reserved for those with a thorough understanding of the respective derivative.

CFDs are complex instruments and entail a high risk of losing money rapidly due to leverage.

76% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

TradeSanta – Best app for automated trading

TradeSanta is an automated trading platform that provides a wide range of tools to set up trading bots. TradeSanta is perfect for those just starting out with automated trading thanks to its user-friendly interface. At the same time, it provides a wide range of tools for more advanced traders.

How It Works

To set up a trading bot first you need to choose an exchange to trade on. After you connect the exchange, choose a pair to trade and decide whether you will play on the rise or fall of the coin’s value. Once that is done, choose one of the provided templates or set up the bot’s parameters from scratch.

The bot will place the first order and then a take profit order that will bring you the desired earnings.

Features

- Major exchanges such as Binance, Coinbase, Kraken, Huobi, Okex and HitBTC

- Grid and DCA strategies

- Stop Loss, Trailing Stop Loss and Trailing Take Profit

- Virtual trading

- Manual trading on multiple exchanges in one interface

- Futures trading

Security

To trade via automated bots the only thing you need is an exchange account. TradeSanta connects to the exchanges via API, the withdrawal option is disabled by default. TradeSanta does not have any access to your funds, the bots can only place and cancel trades.

TradeSanta takes security seriously and offers 2FA authentication to further secure accounts.

The Verdict

In summary, there are many crypto trading apps to choose from. No two apps are the same, so you need to spend some time exploring what you are looking to prioritize. As I have discussed in this article, certain crypto trading apps are suited for certain requirements.

For example, if you’re looking for an app that hosts hundreds of crypto trading pairs, then you might be best suited for Binance.

On the other hand, if you’re more concerned with user-friendliness, eToro or Coinbase might be more up your street.

Read more: The Best Books about Bitcoin and Crypto

With the rise of crypto interest platforms like YouHodler and BlockFi, you can also hold on to your purchased Bitcoin and earn interest on that crypto. If you haven’t come across these platforms, I would highly recommend you look into them.

Staking is another option for those who have significant crypto assets and want to hold them but at the same time accrue more value.

Spot crypto trading apps

- eToro – Best all-round crypto trading app

- Coinbase – Best crypto trading app for beginners – my review

- Kraken – read my review

- CEX.IO – read my review

- Changelly– read my review

- Swan Bitcoin – great for dollar cost averaging Bitcoin

Exchange and Earn Interest

- BlockFi – Best app for earning interest and borrowing – read my review

Buy Gift Cards, Vouchers and Top Up Airtime

Trading Bots

Trading Bots

To help point you in the right direction, here I discuss my top-rated cryptocurrency apps of 2021. On top of this, I also explain some of the key metrics that you need to look out for prior to selecting a provider.

eToro – Best All-Round Crypto Trading App

So now that you know what factors you should be looking out for when selecting a crypto trading app, I am now going to discuss my number one pick – eToro. Launched in 2007, eToro is home to over 12 million traders around the world. You will have the option of trading via its main desktop site, or through a fully-fledged mobile app. The latter is available on iOS and Android devices.

eToro offers traditional assets as well as CFDs, which gives you ample flexibility.

For example:

- If you want to invest in cryptocurrencies, you can do this at eToro and retain 100% ownership. You can’t, however, withdraw the coins to a private wallet. As such, they will remain on the eToro platform until you decide to cash them out.

- If you want to apply leverage or short-sell cryptocurrencies, this is facilitated via CFDs.

- If you want to trade crypto-cross pairs, this is facilitated via CFDs.

See also: My crypto predictions for 2021

In total, eToro allows you to buy and sell 16 different cryptocurrencies in the traditional sense. This includes Bitcoin, Ethereum, Ripple, Bitcoin Cash, EOS, and more.

You can also trade cryptocurrency pairs – including both crypto-fiat and crypto-crypto. For example, you can trade cryptocurrencies against the USD, GBP, JPY, and EUR. You can also trade cross-pairs like EOS/XLM or BTC/EOS.

Fees and Commissions

On top of its vast offering of tradable cryptocurrency products, the eToro app stands out in the fee department.

Here’s why:

- Deposits: You can deposit funds with a traditional debit/credit card, e-wallet, or bank account without paying any fees. The only cost that is associated with financing your account is a 0.5% currency conversion charge for all non-USD deposits. In comparison to the likes of Coinbase – which charges 3.99% on debit card deposits, this is very competitive.

- 0% Commission: Whether you are buying cryptocurrencies or trading CFDs, you will not pay any commissions at eToro. You will, however, need to factor in overnight financing fees if trading CFDs. This is industry standard in the CFD space, and the charge will kick in for each day that you keep your position open past market hours.

- Competitive Spreads: Although not industry-leading, the spreads at eToro can be competitive – especially if you are investing in the long-run. You should expect to pay a wider spread when trading less liquid cryptocurrency pairs.

- Withdrawals: Getting your money out of the eToro crypto app and back onto your payment method is seamless. Best of all, the platform charges just $5 per withdrawal.

All in all, I think that eToro is very strong when it comes to trading fees and commissions.

Safety and Regulation

When it comes to the safety of your funds, eToro is regulated on three fronts. This includes the FCA, ASIC and CySEC. These three licensing bodies have an excellent reputation in the online brokerage space. They all have strict demands on the brokers and trading platforms that they regulate, such as:

- Requiring platforms to keep client funds in segregated bank accounts

- Performing regular auditors on the provider

- Asking platforms to request ID from all traders

- Clearly add warnings on the risks of trading financial instruments like cryptocurrencies

See also: Should you buy Bitcoin in 2021?

Other Notable Features

In addition to low fees and a strong regulatory standing, the eToro crypto trading app offers several other features that are worth a quick mention.

This includes:

Copy Trading

The eToro app offers an innovative feature known as ‘Copy Trading’. Put simply, this allows you to browse the eToro platform looking for a cryptocurrency trader that you like the look of. Then, once you find a suitable trader, you get to mirror their portfolio like-for-like.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Not only this, but you can elect to copy all ongoing trades. As a result, you get to trade cryptocurrencies without lifting a finger. This is great if you have little to no experience of buying and selling digital currencies, or you simply don’t have the time to actively trade.

Other Asset Classes

I should also note that the eToro app is suitable for those of you that wish to diversify into other asset classes. For example, you can invest in ETFs and over 800+ stocks while retaining full ownership.

If it’s hard-core trading you’re after, you will also have access to indices, forex, hard metals, energies, government bonds, and more. These all come in the form of CFDs, so leverage and short-selling facilities are available.

You can read my full eToro review to learn more about the platform.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

Coinbase – Best Trading App for Beginners

Although Coinbase won’t be the right crypto trading app for some of you, it likely will be if you are an absolute beginner. The reason that I say this is that the app is one of the easiest to use. In fact, even if you have little to no experience in trading cryptocurrencies, you should be fine with Coinbase.

The Coinbase application allows you to buy and sell all the major cryptocurrencies.

These cryptos can be purchased in the traditional sense, meaning that you retain 100% ownership. You can keep the purchased cryptos on the exchange itself, which is handy if you’re going to be trading them. Coinbase has never suffered any hacks and is one of the safest exchanges for the custody of your coins. Alternatively, the Coinbase trading app allows you to withdraw your cryptocurrencies out to your private wallet. This is much more in line with the crypto ethos of practicing self-custody of your coins.

User-Friendliness

In terms of user-friendliness, it doesn’t get much better than Coinbase. Once you have downloaded its mobile app, you will then be asked to create an account. This requires some personal information alongside your government-issued ID. Regarding the latter, you’ll need to take a photo of your passport/driver’s license. After that, you can easily deposit funds with fiat currency.

In fact, if you want to start trading straight away, you can deposit funds with a debit card. Unfortunately, this will cost 3.99%, which is even more than Binance. Alternatively, bank transfers are typically free, although this will depend on your location. You will also need to wait a few days for the bank transfer to settle.

See also: Should you buy Ethereum in 2021?

Once you have a fully funded account, you can start buying and selling cryptocurrencies. You will be trading each cryptocurrency against the US dollar.

Trading Fees

When it comes to trading fees, Coinbase has a standard buy/sell rate of 1.5%.

- If you bought $1,000 worth of Bitcoin, this would translate into a commission of $15

- If you sold $10,000 worth of Bitcoin back to US dollars, you would pay $150

Admittedly, this isn’t as competitive as the other crypto trading apps I have discussed thus far. As a result, if you’re a complete newbie, you might need to trade in cost for convenience and user-friendliness.

Safety and Regulation

Coinbase has an excellent reputation with regulators in the US. It is registered with FinCEN as a Money Service Business, which means that it must comply with US regulations. At the forefront of this is the anti-money laundering laws surrounding KYC. Put simply, all Coinbase customers are required to identify themselves.

Coinbase is also in the processing of getting the green light from the SEC for a brokerage license. Outside of the US, Coinbase is also registered with the FCA. Internal security is also top-notch at Coinbase. For example, you’ll benefit from 98%+ of client funds being held in cold storage, as well as 2FA.

US-dollar accounts also benefit from FDIC Insurance, meaning the first $250,000 is covered. The Vault is also a handy security feature that you will find on the app, which puts a 48-hour time lock on all withdrawal requests.

You can read my full Coinbase review here.

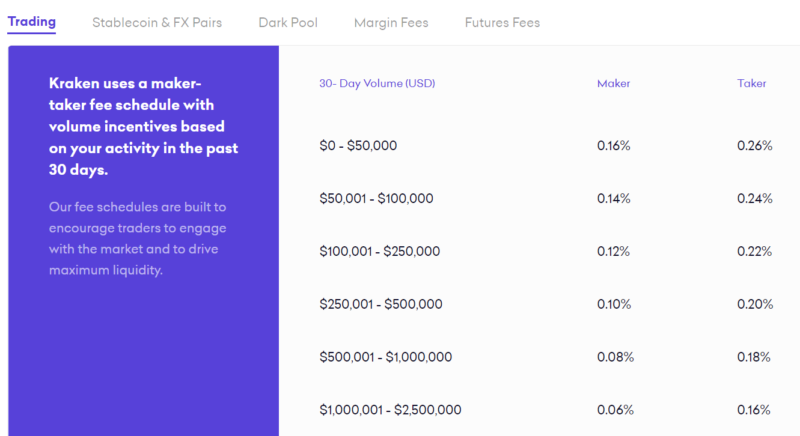

Kraken – An Alternative to Coinbase

It’s somewhat difficult to get away from Kraken. This is because the platform ticks most of the right boxes for crypto investors worldwide. While Coinbase is the biggest USD-volume exchange, Kraken comes in a close second. It dominates the EUR markets in Europe though.

So, in order to buy Bitcoin at Kraken, all you need to is a bank account. The easiest way to make a deposit in USD is to transfer the funds via FedWire or SWIFT.

You can, of course, also transfer other currencies, including GBP, CAD, EUR, JPY, CHF and AUD.

You only need to deposit a minimum of $1 and deposits are free too – so far so good.

In terms of Bitcoin trading fees, Kraken the platform utilizes a market maker/taker system. If you’re just planning to use the platform to buy Bitcoin, then you are a market ‘taker’. As such, unless you are planning to trade more than $50,000 in a single month, you will pay a commission of 0.26%.

As such, if you were to buy $100 worth of Bitcoin, you would pay a fee of $0.26. Don’t forget, you’ll also pay a 0.26% commission when you eventually get around to selling your Bitcoin. Nevertheless, buying Bitcoin at Kraken can be done in a hugely cost-effective manner.

In terms of regulation, Kraken isn’t licensed in the same way as a traditional online stockbroker or CFD platform. But, launched way back in 2011, the platform is one of the oldest cryptocurrency exchanges in the space.

Crucially, it complies with all U.S. regulations on anti-money laundering, and thus – all users must have their identity verified. Finally, I should also note that Kraken is extremely user-friendly. As such, if this is your first time investing in a cryptocurrency online, Kraken is a good option and alternative to Coinbase. It might not be as easy to use as Coinbase, but the fees are lower.

Read More: You can find my full Kraken review here.

IQ OPTION – Regulated Bitcoin Options and Futures Exchange

One of the most attractive features of IQ Option is that it is one of the few regulated trading platforms that gives you access to Bitcoin futures.

Bitcoin trading on IQ Option is facilitated through CFD trading. As such, you have the option to benefit from a bearish market by short-selling the coins without ever needing to take ownership of the asset. In addition, you can also get leverage of up to 100x on your cryptocurrency positions, with a minimum stake of just $1.

Apart from Bitcoin, you can also trade 12 other cryptocurrencies, along with forex, stocks, and commodities. IQ Option also allows you to polish your trading strategies through a practice account. However, unlike some other platforms, there is no limited usage here. Instead, you can use the paper trading facility for as long as you wish.

In other words, you can backtest your strategies whenever you want on this platform. IQ Option also gives you a lot of flexibility when it comes to deposits and withdrawals – with a long list of supported payment methods. This includes credit/debit cards, wire transfers, PayPal, Neteller, and Skrill. You can also start trading with a minimum deposit of just $10.

Over the years, interest in binary options has boomed – encouraging IQ Option to introduce more products along the same line. Now, you can also choose between a High/Low binary option, as well as a Turbo option, with an expiration period that lasts up to five minutes. That said, as Turbo options are considered super-risky (and perhaps not too dissimilar to gambling) – they are not accessible in the European region or USA.

In addition, you can also access Digital options – that you can use to speculate on the extent of price change. In simpler terms, if the price for the underlying asset manages to reach the strike price you have set, then you can get a payout as high as 900%. However, if it does not, then no matter how close the price is – you will lose the entire stake. More importantly, Digital options also have a predefined expiration time of five minutes.

Although IQ Options have a variety of financial products, it is best reserved for those with a thorough understanding of the respective derivative.

CFDs are complex instruments and entail a high risk of losing money rapidly due to leverage.

76% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

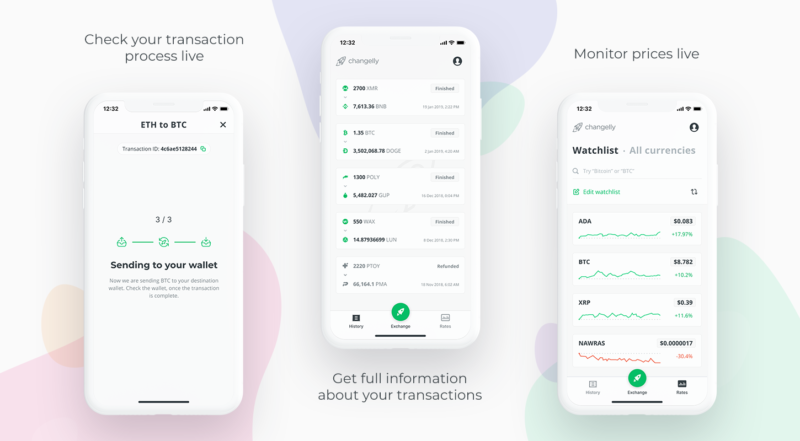

Changelly

Changelly is a cryptocurrency exchange that does things a little bit differently from the status quo. The main concept of this platform is that it will aim to get you the best price possible when you buy cryptocurrencies. It does this through an in-house algorithm that is able to scan major exchanges in real-time.

Changelly offers a good selection of digital currencies – both large and small. For example, if you’re looking for large-cap projects – you’ll find the likes of Bitcoin, Ethereum, Ripple, Chainlink, and Bitcoin Cash.

Further reading: My Changelly review

You will also find a relatively extensive list of less liquid altcoins – such as Energi, BitDegree, Bitcoin Diamond, Numeraire, and Power Ledger.

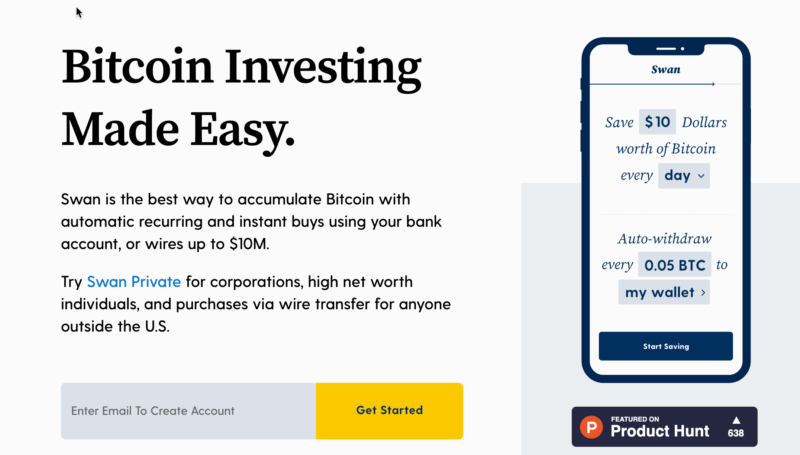

Swan Bitcoin

Swan is the best way to accumulate Bitcoin with automatic recurring and instant buys using your bank account, or wires up to $10M. The idea behind this product is to slowly but steadily build up your Bitcoin stash, and yes, Swan is all about Bitcoin so you won’t be able to buy any other cryptos on Swan.

On the other hand, Swan Bitcoin is a company that is 100% focused on the Bitcoin mission, and as such they provide a lot of educational materials and even a popular podcast, so if you are only interested in Bitcoin this is a good option for you.

How It Works

A simple savings app does all the work for you.

- Link any US bank account.

- Buy Bitcoin daily, weekly, or monthly.

- Bitcoin automatically delivered to your wallet or stored for free with a secure licensed and regulated custodian.

Buy Bitcoin on Swan and get $10 of free Bitcoin

TradeSanta – Best app for automated trading

TradeSanta is an automated trading platform that provides a wide range of tools to set up trading bots. TradeSanta is perfect for those just starting out with automated trading thanks to its user-friendly interface. At the same time, it provides a wide range of tools for more advanced traders.

How It Works

To set up a trading bot first you need to choose an exchange to trade on. After you connect the exchange, choose a pair to trade and decide whether you will play on the rise or fall of the coin’s value. Once that is done, choose one of the provided templates or set up the bot’s parameters from scratch.

The bot will place the first order and then a take profit order that will bring you the desired earnings.

Features

- Major exchanges such as Binance, Coinbase, Kraken, Huobi, Okex and HitBTC

- Grid and DCA strategies

- Stop Loss, Trailing Stop Loss and Trailing Take Profit

- Virtual trading

- Manual trading on multiple exchanges in one interface

- Futures trading

Security

To trade via automated bots the only thing you need is an exchange account. TradeSanta connects to the exchanges via API, the withdrawal option is disabled by default. TradeSanta does not have any access to your funds, the bots can only place and cancel trades.

TradeSanta takes security seriously and offers 2FA authentication to further secure accounts.

The Verdict

In summary, there are many crypto trading apps to choose from. No two apps are the same, so you need to spend some time exploring what you are looking to prioritize. As I have discussed in this article, certain crypto trading apps are suited for certain requirements.

For example, if you’re looking for an app that hosts many crypto trading pairs, then you might be best suited for Kraken.

On the other hand, if you’re more concerned with user-friendliness, Coinbase might be more up your street.

Read more: The Best Books about Bitcoin and Crypto

With the rise of crypto interest platforms like YouHodler and BlockFi, you can also hold on to your purchased Bitcoin and earn interest on that crypto. If you haven’t tried these platforms yet, I would highly recommend you look into them.

Staking is another option for those who have significant crypto assets and want to hold them but at the same time accrue more value.