2022 marks the time when modular blockchains are carried in triumph, victorious over the hard-to-solvable blockchain trilemma. However, 2022 can also be the year when decentralization, security and scalability are no longer contradictory, but work together in a common direction. This is the approach that Massa labs offers us.

Global vision

Based on the principle of a multithreaded directed acyclic graph (DAG), explained below, this new protocol heralds the new era of monolithic blockchains. More efficient and secure, but above all more decentralized. As we will quickly see, for Massa labs, decentralization is not subject to any concessions.

Before tackling the subject, a brief overview of the team.

Initially, the Massa blockchain was a research project led by 3 friends passionate about mathematics, who have now become co-founders. This is a point that stands out strongly in this project through the latent perfectionism with which each stage is approached.

- Sébastien Forestier – CEO – doctor in artificial intelligence.

- Damir Vodenicarevic – CTO – doctor in fundamental physics.

- Adrien Laversanne-Finot – CSO – doctor in quantum information.

Since the first research in 2017, the team has grown and now has around ten core devs , supplemented by “ support & compliance ” services. Proof of the strong competence and foresight of this team, the 23rd edition of the i-Lab innovation competition, organized by the Ministry of Higher Education, was an opportunity to see the Massa project win the prize for ‘innovation.

Decentralization

Endowed with a strong cypherpunk vision, the founders infused this DNA into their protocol until forming its genesis.

Massa labs thus aims to become the blockchain with the highest level of decentralization in the ecosystem.

As Damir mentions “ a blockchain can be considered a bad database, slow and expensive. One of the major contributions is decentralization. To move away from this attribute is to lose sight of its first asset. »

To do this, the choice of a Proof-of-Stake consensus was preferred. The latter has the advantage in terms of decentralization of not conferring economies of scale as permitted by Proof-of-Work via the acquisition of mining equipment .

However, PoS has inherent Achilles’ heels related to the distribution, the concentration of the native coin , the accessibility of the necessary hardware setup , as well as the amount to be staked in order to become a validator. A low number of validators means that a large part of security is left out.

Very particular care is therefore taken in the distribution of the Massa. The distribution of the latter will soon be made public, however no entity will be able to acquire more than 1% of the supply . What we currently know:

- During the private sale, 5 million euros were raised, an amount divided among 100 investment funds and individuals in 18 countries.

- The entire Massa team (including the founders) will take a (very) minority stake, with a vesting covering several years.

- During 2022 during the public sale, the acquisition will be made on the basis of KYC and will be capped in order to ensure maximum decentralization.

- Same rules concerning the rewards attributed to the community having participated in the testnet and to the future ambassadors.

The amount to be staked to become a validator is also a sensitive variable within a PoS consensus. The amount of coins required is still under study, but the team obviously wants to make it accessible to as many people as possible, the objective being to have as many validators as possible.

Even if no computational calculation is required in the consensus chosen by Massa, being a peer of a P2P network still requires a hardware setup .

Currently, during the testnet , it is possible to run a node on a simple Raspberry Pi. In the long term, it is advisable to have more substantial equipment, while remaining affordable, consisting of:

- 8 CPUs (4 physical);

- 16 GB of RAM;

- 1 TB of storage.

Furthermore, avoiding a concentration of validation power is an important point.

Within the testnet , for example, geographic concentration is examined. The scoring of each of the beta testers is therefore negatively impacted if their node is hosted in a place common to many others. This is to increase the independence of the network. During the mainnet , the vigilance concerning the concentration will take another form, that concerning the Custodians . Based on market analyzes that expose the stranglehold of certain entities on various PoS networks, Massa’s team is studying legal remedies that can prevent this. The objective is to limit the potential influence of these Custodians , influence which often comes from individuals who delegate their stake .

The primary objective of the project therefore remains decentralization in its noblest form, which also induces respect for the community and its choices. Governance via DAO is therefore to be expected, allowing users to decide on-chain on certain major points of the protocol.

Nakamoto’s coefficient

As just presented, the level of decentralization can depend on a large number of factors. However, a coefficient tries to quantify it: the Nakamoto coefficient. The current calculation is inspired by the Lorenz curve and the Gini coefficient, combining them with an approach based on subsystems.

A blockchain is then interpreted as a system divided into a set of subsystems. It is then necessary to determine how many entities it is necessary to control in each subsystem so that a risk of collusion appears in the entire system.

The subsystems selected in the equation are:

- Plurality of validators (who gets the rewards?);

- Diversity of clients (by codebase) available to access the network;

- Number of developers (per commit over a given duration);

- Trade quantity (in volume);

- Decentralization of nodes (by number) geographically;

- Supply concentration level (by addresses);

- Etc..

This coefficient allows us to obtain an objective basis on which to compare different networks.

Various studies (notably that of Arxiv in 2021) base their calculation on the plurality of validators, assigning a score of 4 to Bitcoin and 3 to Ethereum.

On this same basis, the Massa blockchain obtains thanks to its approach a theoretical score of 1,000+.

What is the technical architecture?

Description

The Massa solution, formerly called Blockclique, is based on a multithreaded DAG structure.

This results in a monolithic blockchain with sharding of transactions resulting in executions on parallel threads , without final reconciliation.

Let’s dissect these terms:

“ Monolithic Blockchain ”

First of all, to be able to fully understand what a monolithic blockchain (otherwise called integrated blockchain) entails, it is necessary to present the 3 major components that make up a blockchain.

- Consensus defines the canonical truth about a blockchain’s data and keeps the network secure.

- Execution represents the calculations necessary for the evolution of the state of a blockchain.

- Data availability refers to the data hosted by each node.

Unlike modular blockchains of which the new Ethereum architecture is the figurehead, monolithic blockchains perform all the tasks mentioned above on layer 1. Thus, consensus, execution and data availability are ensured. by the same layer, which is the case of Bitcoin for example.

- The main advantage of monolithic structures is their resilience. Indeed, their security is directly dependent on the sum of the resources that work to respect the rules set by the consensus. In the case of monolithic blockchains, all resources secure the mainnet.

- Their main disadvantage, on the other hand, is their much greater subjection to the blockchain trilemma.

- The main advantage of modular structures is their significant scalability. Naturally when you divide the tasks and assign each of the parts to specific actions, you gain in efficiency.

- The main disadvantage of these blockchains is the flip side of the previously mentioned point. When the network is divided into several subunits, it is easier for an attacker to achieve a ratio sufficient to attack one of the subunits. The strength of a chain is always judged by the strength of its weakest link.

“ Sharding transactions with parallel threads ”

In order to be functional and prevent the risk of double spending, the vast majority of blockchains operate in sequential DAG.

- For the more technical: One vortex per sequence and a direct edge linked to each vortex.

- For the less technical: The blocks are produced one by one and are linked by a parent/child link.

In this classic arrangement (e.g.: Bitcoin), the referring blockchain is the one that is the highest (whose sum of difficulty is the highest).

The validators therefore take care of taking the transactions pending in the mempool in order to build a valid block according to the consensus in force. Then once the block is formed, it is propagated to the entire network and becomes the last block of the referent blockchain. This amounts to having a single channel, a single thread on which everything is done.

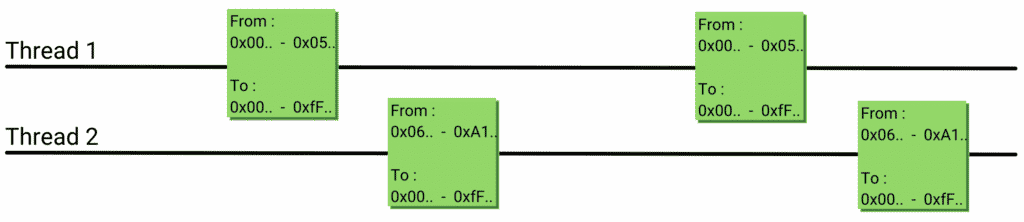

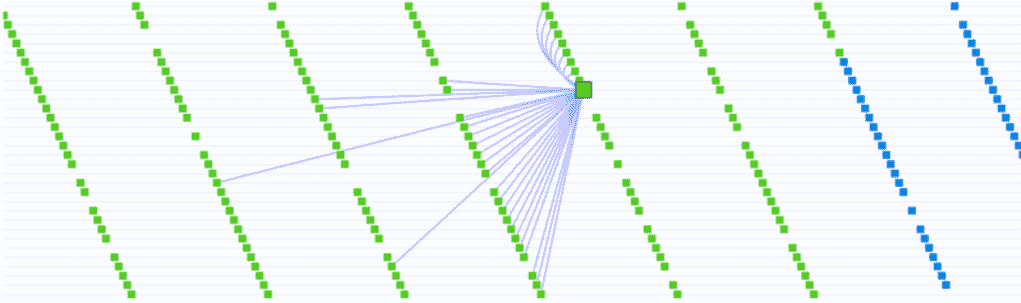

The Massa team then came to propose a new architecture, made up of 32 threads , which made it possible to parallelize the data structure. Each block created in a specific thread thus has 32 parent blocks.

The problem you will tell me is therefore: how to avoid that an address can carry out a double expenditure by executing the same transaction in two different threads? To do this, Massa allows each of the addresses to spend only through a single thread . This being defined by the first bits of the address.

Each thread thus has transactions with only a defined address range as input and all the potential addresses of the network as output.

A unique property therefore emerges: the possibility of creating forks and desynchronizations without risk of corruption of the blockchain.

Where in standard blockchains it is necessary for nodes to have the latest block to be able to create the next one, with the Massa blockchain validators can work on a new block without owning all the latest ones.

Example :

- JOE owns 50 Massa and his address is set as sender on Thread 1

- BOB owns 10 Massa and his address is set as sender on Thread 4

- JOE wants to send 5 Massa to Bob.

- A validator is responsible for creating the new block (N+1) of Thread 1.

- It retrieves JOE’s transaction from the mempool.

- As long as the last block (N) of thread 1 has a state where the balance of JOE is > 5 Massa, the transaction will be valid.

- The validator can therefore parent the last known blocks of the 31 other threads , even if forks are present, because in none of them the balance of JOE could have fallen. At best, JOE’s balance can only be higher.

- Indeed JOE can only spend his balance through Thread 1. However, he can receive coins and tokens from transactions from all threads .

- In this example, JOE will therefore credit BOB’s balance with 5 Massa via a transaction on Thread 1. When BOB in turn wishes to spend all or part of his balance, he will do so via Thread 4.

This solution therefore makes it possible to ensure sequential consistency of the debits for each address, while allowing a slight desynchronization of the credits .

In picture, it looks like this:

“ Without final reconciliation ”

Other solutions such as Elastico, Zilliqa, Iota also offer approaches based on transaction sharding .

However within these protocols, the nodes must regularly agree on the reference blockchain and the canonical blocks in order to avoid double spending. This is called a reconciliation phase, often managed by a centralized process. Beyond having already proven its security limits with the shutdown of Iota in 2020, this reconciliation phase considerably restricts the benefits of the parallelization offered by transaction sharding .

Network potential

Theoretical transaction count: 10,000 transactions/second

Network average block time: 2 blocks/second

Average block time per thread : 1 block every 16 seconds

Finality time: This is a huge topic, because what is often compared between the various protocols is the nominal finality. If everything goes well, a few seconds are enough to know if a transaction has been concluded (validated by the network).

However for an extreme finality of 10^-15 over 100 years, during an attack with 40% of the stake which would break the system, a finality of 30 to 40 seconds is necessary .

For an acceptable and usable daily purpose, 15 to 20 seconds are enough. The size of the transaction will define the finality time considered appropriate by the parties involved.

Choice of interpreter: Web assembly

Web assembly makes it possible to reach a much larger community of developers. The team envisions this interpreter eventually becoming the standard as it allows many developers to develop in the language they are most comfortable with. A project depends in part on its community of developers, so this is a major point.

Moreover, the multithreaded structure proposed by Massa has other potential advantages.

Even if they are not currently considered, it is technically possible:

- To have threads with reduced block sizes and a higher frequency therefore a shorter finality.

- To have threads under interpreter EVM and others in Web assembly.

- To have threads specific to certain uses and transactions.

- Etc..

What are the new perspectives?

The advantages of Massa labs do not stop at an ultra decentralized and scalable blockchain, the value proposition goes beyond these two aspects.

The real Web3

One of the current problems when we talk about Web3 is that it is often a centralized website that allows interaction with smart contracts via a connected wallet. And it is these access points that can cause problems, due to immutability and security much less strong than a blockchain. A source of potential flaw that Badger DAO would have done well in December 2021, which the front-end attack cost $ 120 million.

Ideally, it is everyone’s responsibility to check at each of our connections that a blockchain interaction website has not been tampered with. Which is obviously not viable.

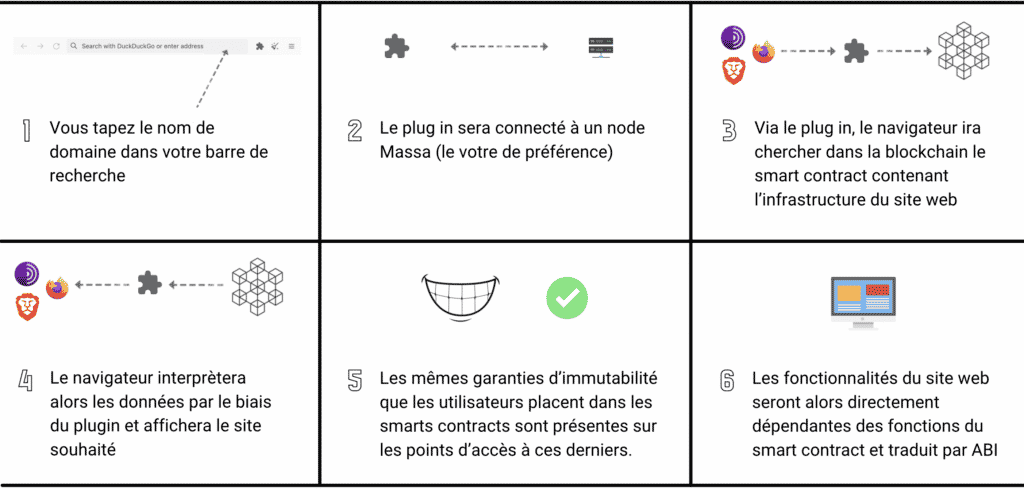

The idea of Massa labs is to solve this problem by pushing the concept of the ENS ( Ethereum Name Service ) further. Why have just one address to send coins and tokens to? Couldn’t this system be used to display decentralized websites?

The solution is therefore to store the critical elements of a website directly in a smart contract . Here we are not talking about the design, the UI/UX, but about the interaction of the site with smarts contracts , minimal elements which are in themselves not very bulky. To do this, tools/ frameworks will make it possible to implement JavaScript libraries in the form of smart contracts . These will interact with a plug-in and can be used by the browser to display the entire infrastructure of the website.

A diagram is needed:

Currently a POC has been created and will soon be offered to the community during the testnet phase .

We will touch here the quintessence of a completely decentralized Web3 experience. From domain name resolution, to website interaction and website hosting, nothing will go through centralized servers.

Autonomous smart contracts

This is one of the great innovations proposed by Massa. Currently, a smart contract does not run without an external call from one of its functions. In order to overcome this, these autonomous smart contracts will themselves perform function calls on their program according to pre-established rules.

Today to perform this kind of action in an automated way, it requires the support of an off-chain infrastructure , such as bots that will send requests to the node .

This novelty directly linked to the blockchain infrastructure, at the heart of the protocol, gives the possibility of paying an amount of gas upstream for future executions. This amounts to a form of asynchronous programming of smart contracts and the prospects for on-chain automation are enormous.

To cite just a few examples:

- Event-driven functions such as “Wake up such smart contract in 5 blocks and execute function X”.

- Automated actions such as “If Y occurs on smart contract 1; call function Z on smart contract 2, then on smart contract 3…”.

- Lending/borrowing protocols where an automatic liquidation of under-collateralized positions will be triggered via an on-chain bot .

- Implementation of on-chain arbitration bots between several DeFi protocols. Automatic reproductions of NFTs as made “manually” on the model of Cryptokitties.

- Etc..

The execution environment for these autonomous smart contracts will also be unique since Massa labs has created its own VM.

To deploy the full potential of this innovation, the team also plans to produce a few applications based on the core-team , as well as launching a Grants program to attract other developers.

A demonstration was carried out during the Paris Blockchain Week Summit that it is possible to reproduce at home. To do this :

- Install the Massa wallet as an extension (https://github.com/massalabs/massa-wallet)

- Create a wallet directly on the extension (compatible with Firefox and Chrome)

- Go to the URL massa://gameoflife

The demo may take a while to load. Note that everything that will appear then runs on the Massa blockchain. No centralized server is called during this process .

What is the current status of the network?

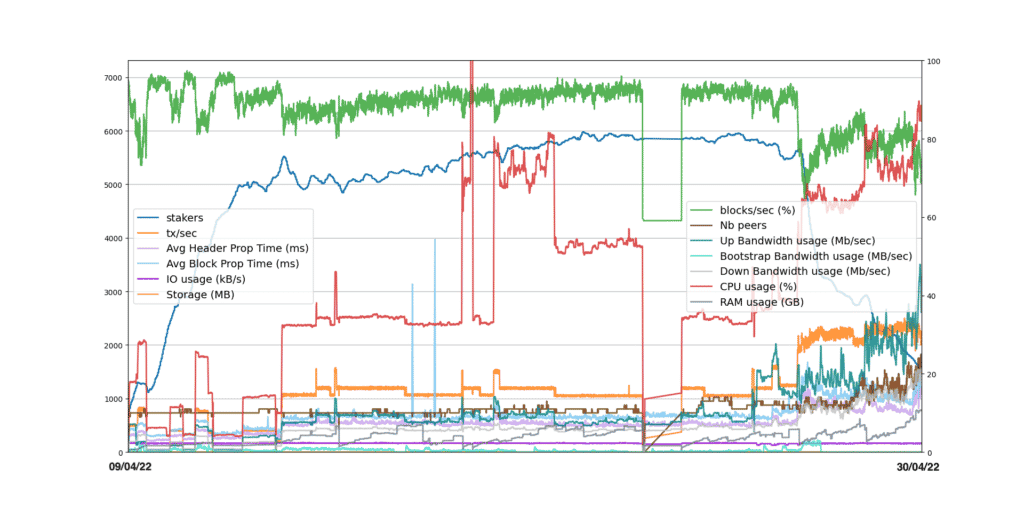

As I write these words, the network has just started episode 10 of its testnet and the results of episode 9 are to be analyzed below.

Episode 9

The network peaked at 5,900 validator nodes ! Which is more than 90% of current blockchain mainnets . This is largely a direct consequence of the low hardware setup needed to run a node.

Moreover, the interest for the ecosystem is growing and it testifies to the sensitivity of the users on the questions of decentralization.

The rise in power of the network can also be seen in a 20% increase in transactions per second compared to the previous episode: 1,200 txps on average. The end of the episode also gave rise to a more thorough performance test, rising to 2600 txps for more than 2000 nodes remaining operational at these levels.

One of the major developments in this episode concerns the transaction propagation mechanism (version 9.2).

This allowed an optimization of the amount of bandwidth used, as well as excellent stability by blurring any predominance of the CPU over the RAM.

Episode 10 (ongoing)

With its version 10.1, the network offers here its most stable and efficient version ever designed by addressing an optimization to slight RAM leaks observed in previous episodes.

It is with this approach of continuous improvement, transparent and close to its users that the team works on the iterations of the network until the release of the mainnet .

What about mainnet ?

Many steps are still to be completed before the launch of the mainnet planned for Q4 2022. The exact roadmap should be released during Q2 2022

Conclusion

The solution proposed by Massa labs is promising both through its deep architecture based on a multithreaded DAG and through the innovations provided.

The strong point of this blockchain is its response to the trilemma presented by Vitalik, combining decentralization and maximum security with a layer 1 that can manage up to 10,000 transactions/seconds.

The team was particularly active during events in April. It was possible to meet them at:

- General talk on April 8 at PiX Lille;

- Workshop at the PBWS from April 13 to 14 in Paris;

- Hackaton Kryptosphere from April 23 to 24 in Lyon.

Many other events will be organized and will be announced on the official discord . All information about launching a node is available on the official Github . And if you want to join the adventure, they are recruiting !