Overview

What is Anchor Protocol?

Anchor is a savings protocol (i.e. a crypto savings account) that offers high Annual Percentage Yields (APYs) on Terra stablecoin deposits. Stablecoins are digital assets designed to mimic the value of fiat currencies like the dollar or the euro. Currently, the only stablecoin that Anchor supports is Terra USD, or UST, which was designed to track the US dollar with a 1:1 ratio. For a simple overview of stablecoins, click here.

Anchor is built on the Terra blockchain. Terra’s main objective is to become the leading facilitator of crypto-based e-commerce transactions, and to provide a secure stablecoin for use within crypto.

Terra is powered by its native token LUNA, which is used to stabilise the price of the stablecoins within the Terra ecosystem. For example, when 1 $UST is created, $1 worth of LUNA must be burned. Therefore, although UST mimics the US dollar, it is entirely decentralised because it is backed by LUNA tokens. For more on the Terra ecosystem, click here.

How does Anchor Protocol work?

The protocol operates as a decentralised ‘neobank’, meaning that it is not operated by a centralised authority.

In simple terms, Anchor establishes a money market between borrowers, looking to borrow UST, and lenders, looking to earn low-volatile yields on their UST.

Lenders will deposit some of their UST into Anchor’s money market pool. These coins will then be lent out to borrowers. Interest is distributed to lenders pro-rata, meaning that the amount each lender receives will be in proportion to their share of the pool.

In order for a user to borrow UST from Anchor, they must lock up one of two types of bonded assets: bonded ETH (bETH) or bonded LUNA (bLUNA); as collateral. A user must also borrow below the protocol’s maximum Loan-To-Value-Ratio (LTV). This ratio is an estimation of the relationship between the loan amount and the market value of the collateral asset. Generally, the higher the LTV ratio, the greater the risk of liquidation (i.e. losing your collateral).

By borrowing, users can gain access to liquidity (i.e. stablecoin assets) while retaining the price exposure of the asset used as collateral.

After these bonded assets are deposited, Anchor will automatically stake them (i.e. lock up these funds to help support a blockchain network in exchange for rewards). The yield generated from staking will be converted into Terra stablecoins, which will then be distributed out to depositors.

If the amount of yield generated is higher than the protocol’s target deposit rate, then the excess yield will be deposited into the ‘yield reserve’. However, if the amount of yield generated is less than the protocol’s deposit rate, the yield shortfall will be replenished by the yield reserve.

This tutorial will go over how to get set up on Anchor, borrow and lend UST, and utilise ANC tokens (Anchor’s governance token).

Getting Started

Setting up a Terra Station wallet

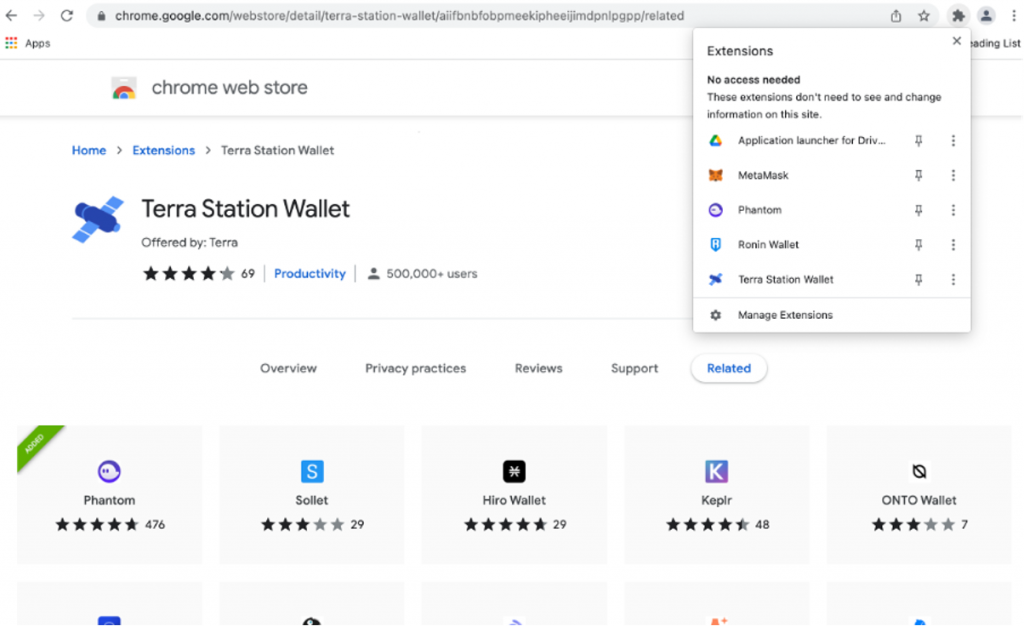

First, head to ‘Terra.money’ to download the Terra Station wallet. Note that there is a chrome extension as well as a desktop and mobile app available. For this tutorial, we’ll be using the chrome extension.

Once the chrome extension has been downloaded, you can pin the Terra Station wallet icon to your browser.

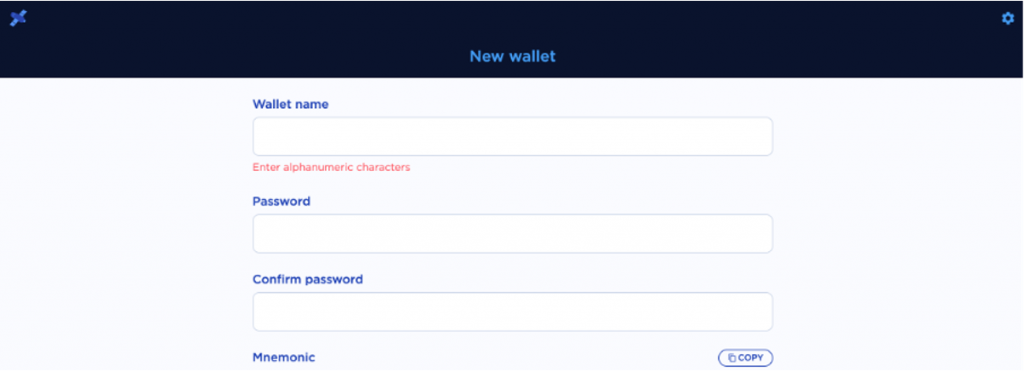

Next, you will need to create your Terra wallet. To do this, click on the wallet icon in the corner of your browser. In the pop-up screen that appears, press the ‘connect’ button and select ‘new wallet’.

On the following page, you’ll need to enter a name and password for your wallet. You’ll also be presented with a 24 mnemonic, which is your wallet’s recovery/seed phrase.

It is extremely important to store this phrase safely and securely. If you lose access to your wallet, you’ll need this seed phrase to regain access. If someone gets a hold of your seed phrase, they’ll be able to access your wallet’s funds. It is advised that you make at least two physical copies of your recovery phrase (i.e. do not store it online or on a hackable device) and that you store these copies somewhere very safe (e.g. in a safe).

After you click ‘submit’, you will be asked to confirm your seed phrase. Lastly, click ‘create a wallet’.

Connecting your Terra wallet to Anchor Protocol

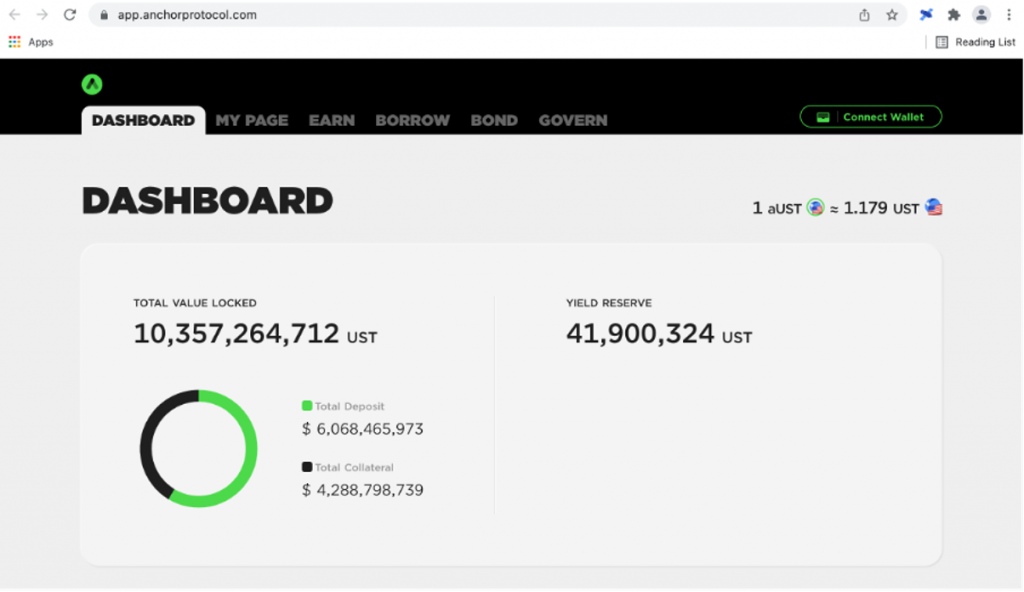

Head to ‘https://www.anchorprotocol.com’ and click the ‘dashboard’ button in the top right of your screen.

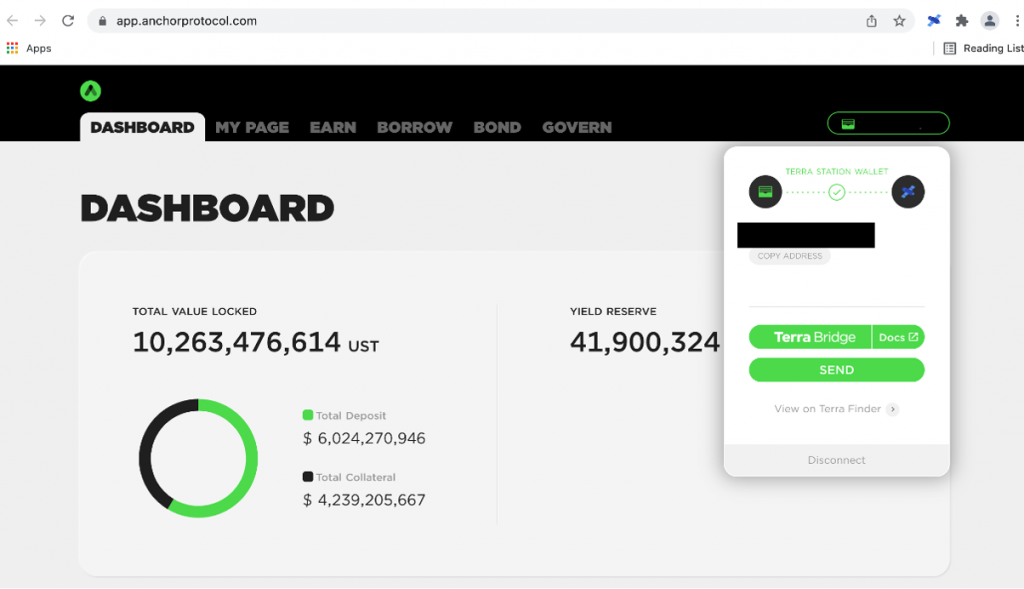

On the following page, click ‘connect wallet’ and select ‘Terra Station wallet’. You will then be asked for permission to connect. Following this, your Terra Station wallet should be connected.

Deposit some Terra tokens into your Wallet

Next, you’ll need to fund your Terra wallet with some tokens. You can buy UST on certain exchanges like Binance, KuCoin or Coinbase. For a full overview on how to use Coinbase, click here.

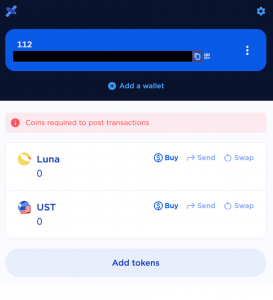

After you purchase some UST, you’ll need to send it to your Terra Station wallet. To do this, you will need your wallet’s address, which can be copied by simply clicking on the icon at the top of the main page of your Terra wallet, which is outlined in red below.

You can also buy LUNA tokens on an exchange, send them to your Terra wallet and then swap these tokens for UST.To do this, click the ‘swap’ button next to where your LUNA tokens are listed in your Terra wallet.

On the following page, enter the amount of LUNA you want to swap. After you do this, you will be shown the estimated amount of UST you will receive in return for your LUNA. The transaction fee will also be displayed. Click ‘next’ to finalise the transaction.

Borrowing on Anchor

Providing Collateral

To borrow UST, you will first need to decide which type of collateral asset you want to provide: bonded ETH (bETH) or bonded LUNA (bLUNA).

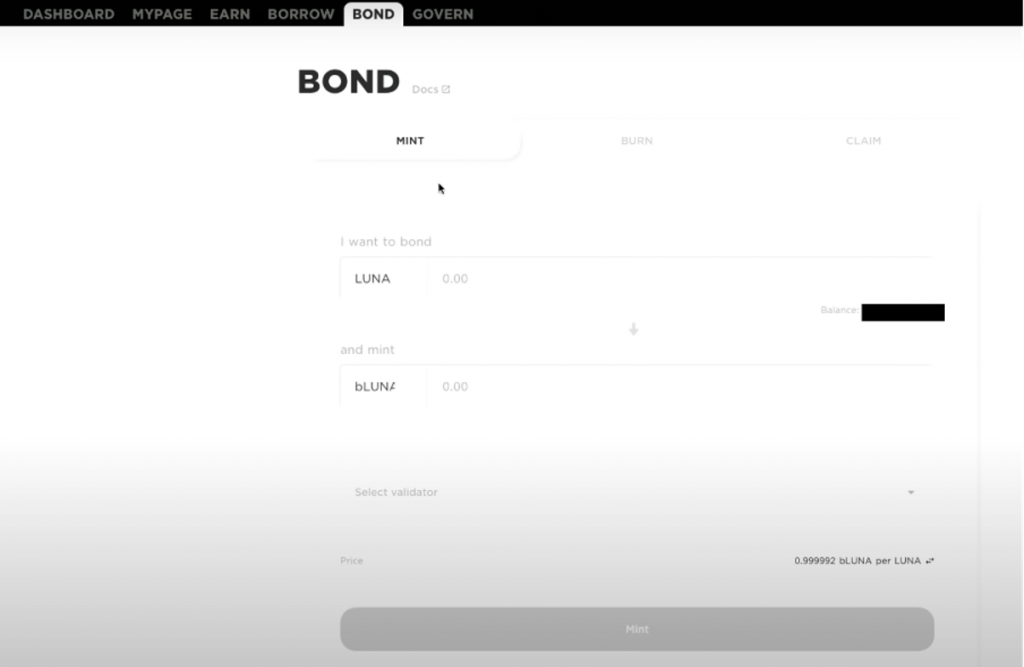

If you have some LUNA tokens in your Terra wallet, it’s very easy to convert these tokens to bLUNA. Click bond’ at the top of the screen and select the ‘mint’ tab.

Here, type in the amount of LUNA you want to convert to bLUNA. Your LUNA balance in your Terra wallet will be displayed on this screen. If you want to convert all of the LUNA in your wallet, simply click on the balance and the corresponding amount of bLUNA you will receive will be displayed.

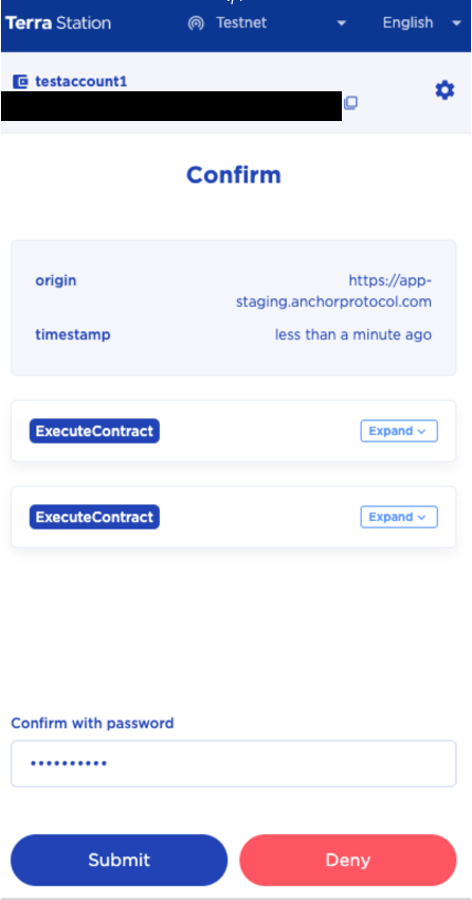

Next, select a validator and click ‘mint’. You will be prompted to confirm this transaction in your wallet.

Note that each time you are required to approve a transaction via your Terra wallet, you will be charged a small fee to process the transaction.

Providing bETH as collateral is much more complex. You’ll first have to buy some ETH, and then swap this ETH into wrapped ETH on an exchange such as UniSwap. You will then need to swap the wrapped ETH into Lido Staked Ether (STETH). STETH will then have to be converted into bETH on Lido finance, which you can then send to your Terra wallet. To convert bETH back to ETH, you have to go through this process in reverse. Using bLUNA is much less hassle!

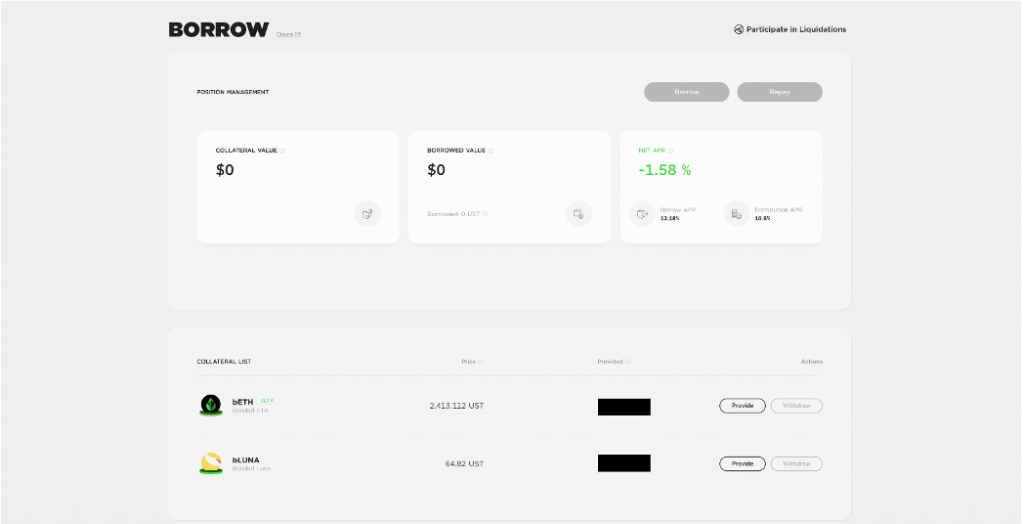

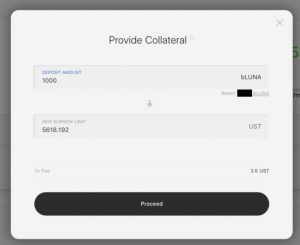

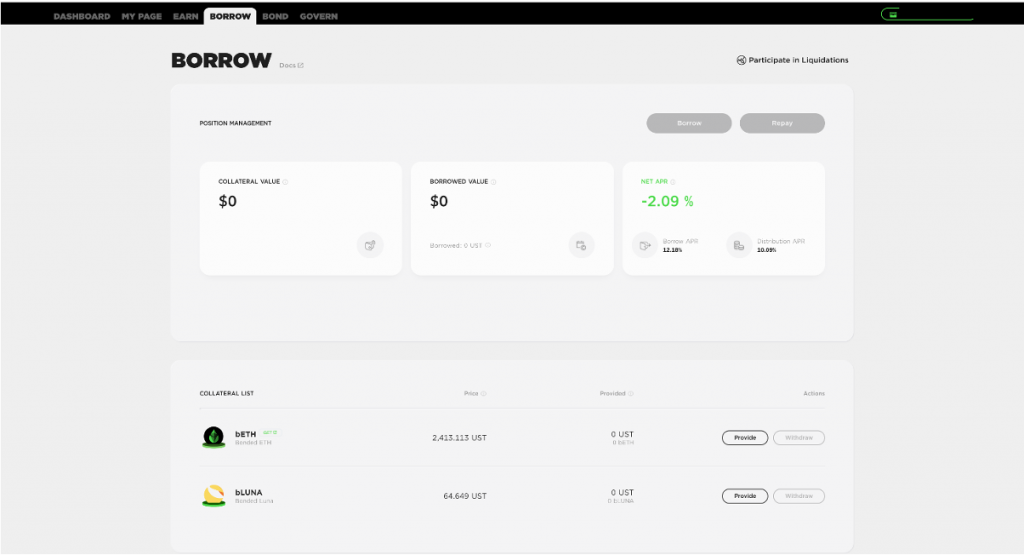

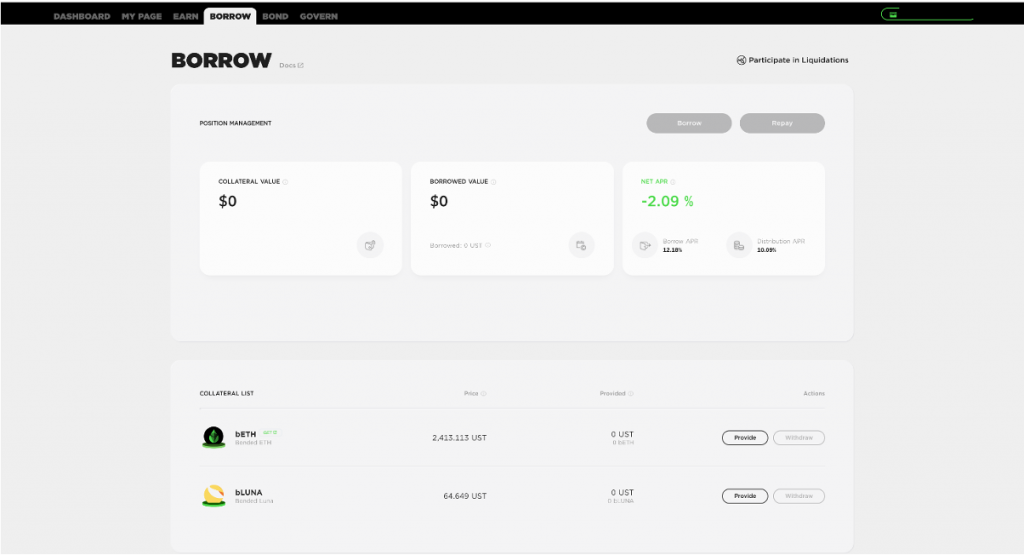

Next, navigate to the ‘borrow’ page. On this page, scroll down to the ‘collateral list’ and click the ‘provide’ button beside whichever asset you want to use as collateral.

In the pop-up screen that appears, you will need to enter the amount of collateral that you want to provide. The corresponding borrow limit (i.e. the max UST you can borrow with this collateral) will be displayed.

Once you click ‘proceed,’ you will be prompted to approve the transaction in your Terra Station wallet. Again, you will be charged a small transaction fee.

After this is done, you will have provided your collateral!

Borrowing UST

Now that you have provided collateral, you can borrow some UST.

The ‘borrow APR’ value represents the gross rate of interest that borrowers will pay on their loan.

As a means of offsetting this interest rate, Anchor distributes ANC tokens to borrowers. ANC is the protocol’s native token, and is used as a governance token. This means that ANC token holders possess protocol voting rights (e.g. can create or participate in voting polls in the ‘govern’ section). It’s also possible to trade and swap these tokens on Anchor, which we will go over later. The ‘distribution APR’ value represents the amount of ANC token-based interest that borrowers will receive.

The ‘net APR’ value is calculated by subtracting the ‘distribution APR’ from the ‘borrow APR’ value.

Note that these values are subject to fluctuation, which is an important risk to consider.

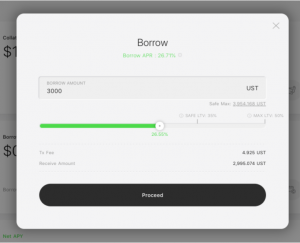

Click the ‘borrow’ button on this page. In the pop-up screen that appears, enter the amount of UST you want to borrow.

You can also select the amount you want to borrow by LTV ratio using the slide bar. As previously mentioned, the higher the LTV ratio, the greater the risk of liquidation (i.e. losing your collateral).

When you click ‘proceed’, you will be prompted to approve this transaction in your Terra Station wallet.

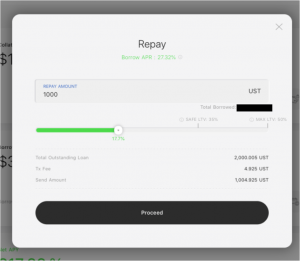

Repaying a loan

To repay a loan, click the ‘repay’ button on the borrow page.

On the following pop-up screen, enter in the amount of stablecoins you want to repay. The total amount borrowed will be displayed on this screen.

Note that you can also specify the amount you want to repay using the LTV ratio slide bar. After clicking ‘proceed’, you should be prompted to confirm this transaction in your Terra wallet.

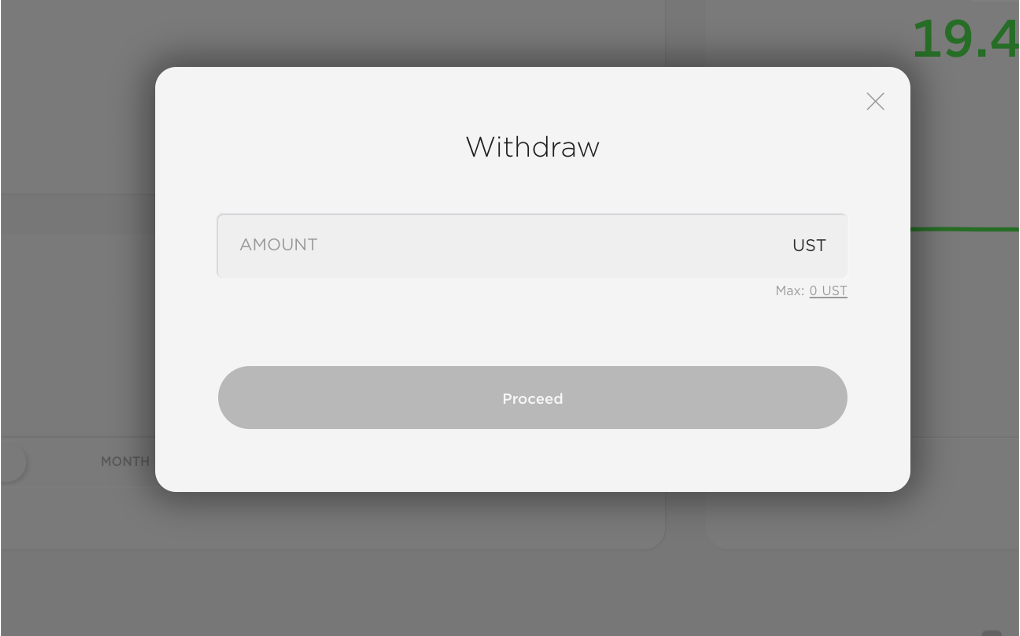

Withdrawing Collateral assets

After you repay your loan, you will be able to withdraw your collateral assets by clicking on the ‘withdraw’ button next to the asset on the borrow page.

Next, enter the amount of collateral that you want to withdraw. Again, you can also specify the amount you want to repay using the LTV ratio slide bar.

Once you click ‘proceed’, you should be prompted to confirm the transaction.

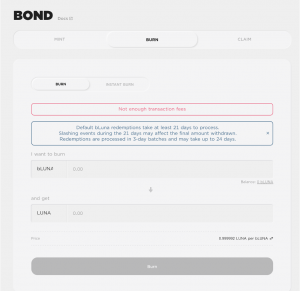

Converting bLUNA tokens to LUNA tokens

To convert bLUNA tokens back into LUNA tokens, click the ‘burn’ tab on the ‘bond’ page.

Here you will have the option to burn at the standard transaction speed (can take up to 24 days), or to convert your tokens using instant burn (faster transaction speed but higher transaction fee).

Once you have decided, enter in the amount of bLUNA you want to convert and click ‘burn’. As always, you will have to approve this transaction in your Terra wallet.

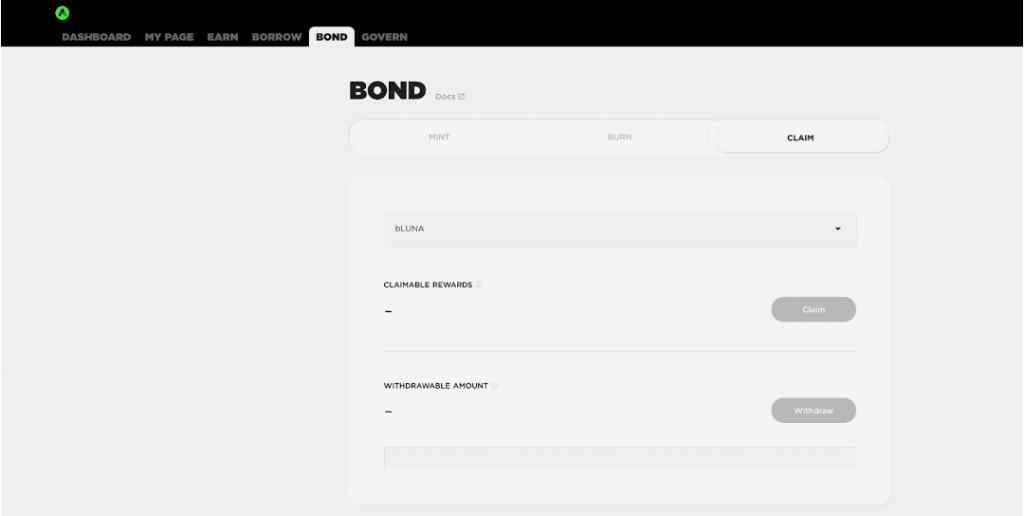

After the transaction has been processed, you will be able to reclaim your LUNA tokens by navigating to the ‘claim’ tab in the bond page.

Staking ANC tokens

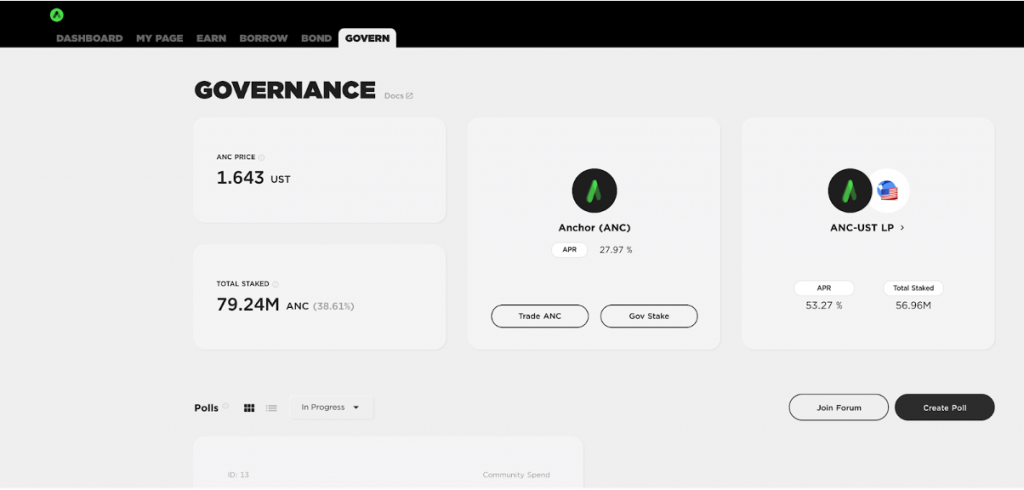

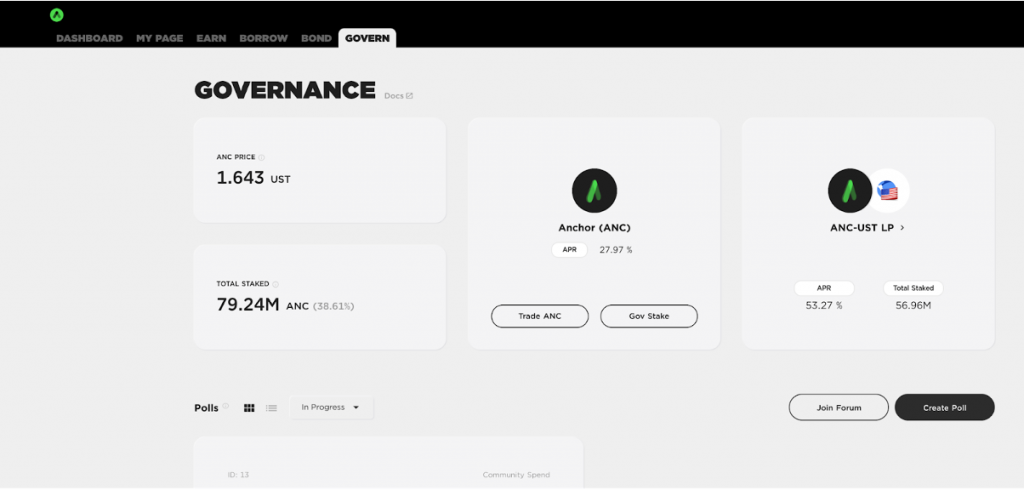

ANC tokens can be staked on Anchor to earn additional ANC. To do this, click ‘govern’ at the top of the screen.

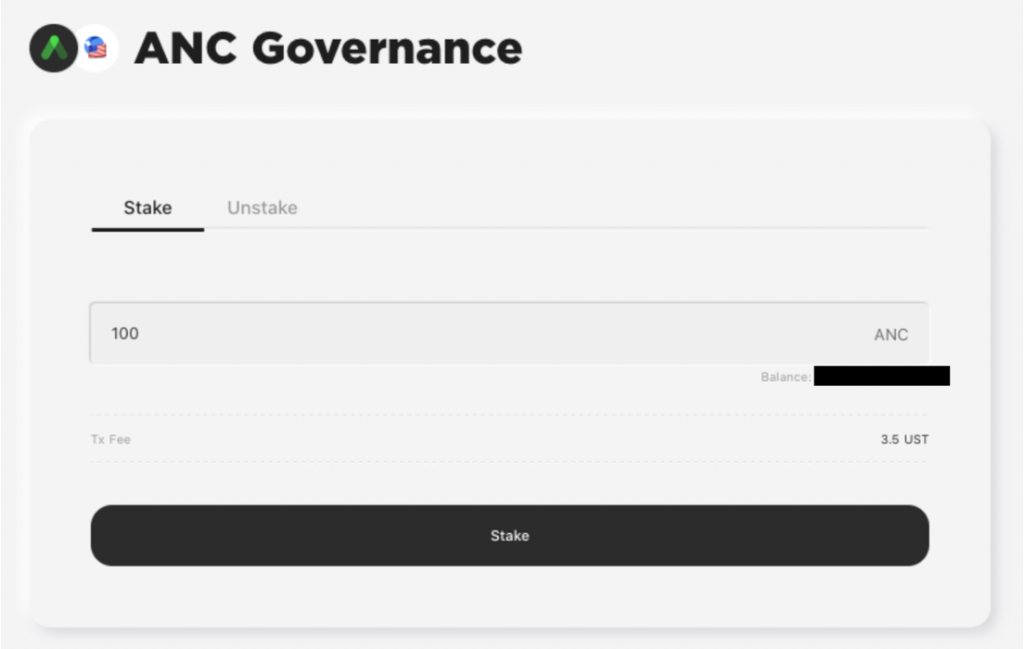

Here, you will be able to see the percentage APR (i.e. return rate) for staking ANC. Next, click ‘Gov stake’.

On the following page, select the ‘stake’ tab and enter how much ANC you want to stake. When you click ‘stake’, your Terra wallet will prompt you to confirm the transaction. Following this, your tokens will be staked!

To withdraw these tokens, select the ‘unstake’ tab and simply enter the amount of tokens you want to unstake.

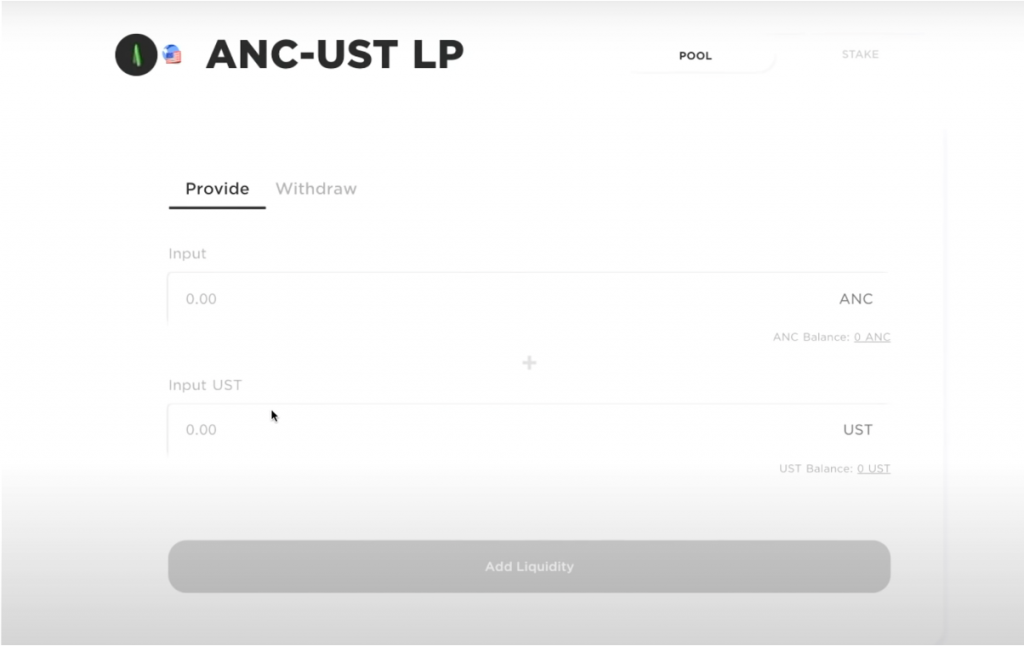

It’s also possible to provide liquidity (i.e. placing crypto assets in liquidity pools to facilitate trading in exchange for rewards) to the ANC-UST liquidity pool. Note that you will need to provide both ANC and UST tokens as a trading pair.

To do this, navigate back to the governance page, and this time click on the ‘ANC-UST LP’ option.

On the following page, select the ‘provide’ tab.

When providing liquidity, you are required to supply tokens in the same ratio that they exist in the liquidity pool. If you enter in an amount of one token, the corresponding amount of the other that you’ll need to provide will be shown.

After you have done this, click ‘add liquidity’. Once you approve the transaction in your Terra wallet, you will have provided liquidity!

You can easily withdraw these tokens from the liquidity pool by clicking on the ‘withdraw’ tab. Note that the amount of tokens you receive back may not be equal to the amount that you initially provided due to impermanent loss. This is an important risk to consider when providing liquidity.

Buying and Selling ANC tokens

Anchor web application facilitates the trading of ANC tokens with UST, which is supported by the ANC-UST liquidity pool.

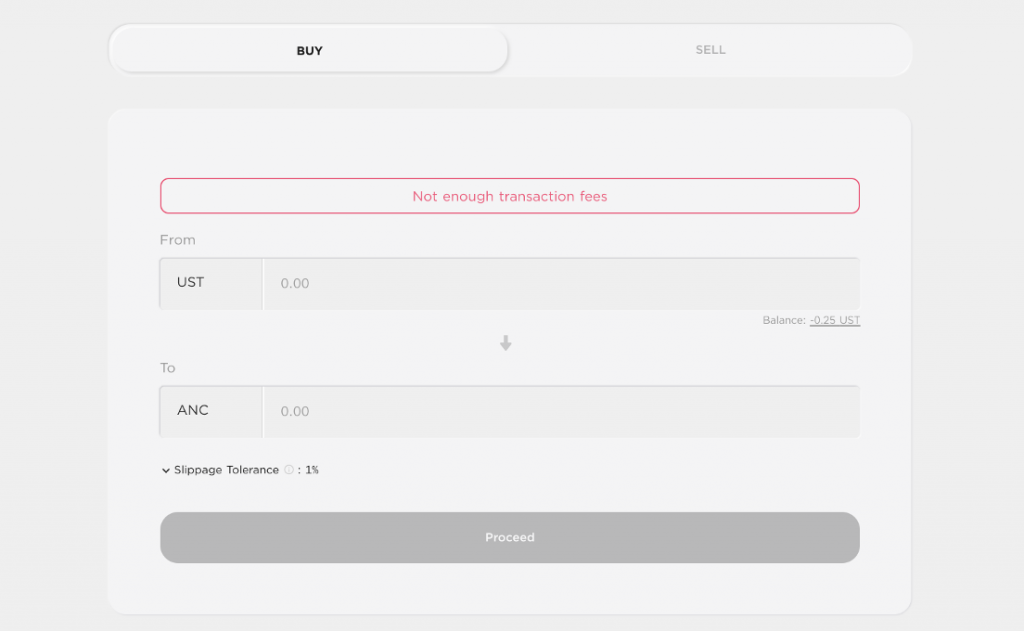

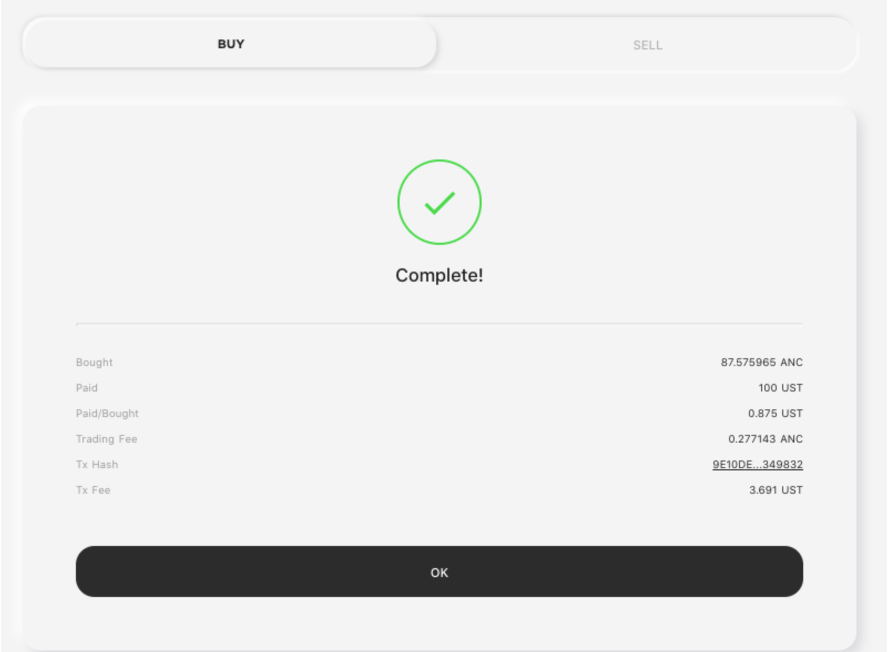

First, navigate to the ‘govern’ page and click ‘trade ANC’.On the following page, you’ll have the option to buy ANC with UST, or sell ANC in exchange for UST.

Once you have entered in the amount you want to buy/sell, click ‘proceed’. You will then have to approve the transaction in your Terra wallet to complete the process.

Lending tokens

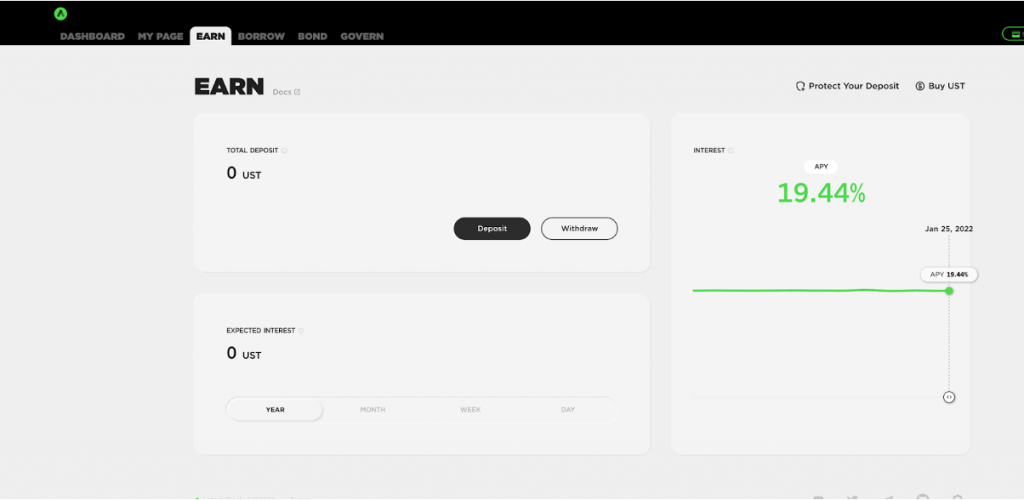

The process of Lending tokens on Anchor is very straightforward. Start by navigating to the earn page.

The current returns rate for lending will be displayed on this page. This value is relatively stable, and usually remains close to 20%.

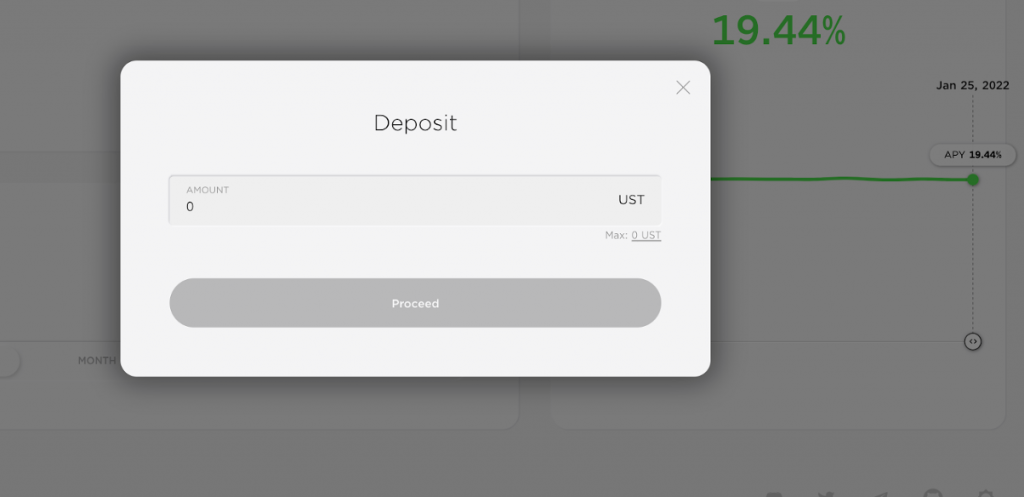

When you click ‘deposit’, a pop-up screen like this should appear.

Next, enter in the amount of UST you want to deposit and click ‘proceed’. Once you confirm this transaction in your Terra wallet, your UST will be deposited!

Lenders are given Anchor Terra or aTerra tokens in exchange for their deposit. These aTerra tokens represent a lender’s share in the money market pool. Lenders will receive interest through the value appreciation of these aTerra tokens. In other words, as the deposit accumulates interest, you will be able to exchange these aTerra tokens for an increasing number of stablecoins.

You can withdraw your funds at any time. To do this, click the ‘withdraw’ button on the earn page.

Enter the amount of UST you want to withdraw, click ‘proceed’ and verify the transaction in your Terra wallet.

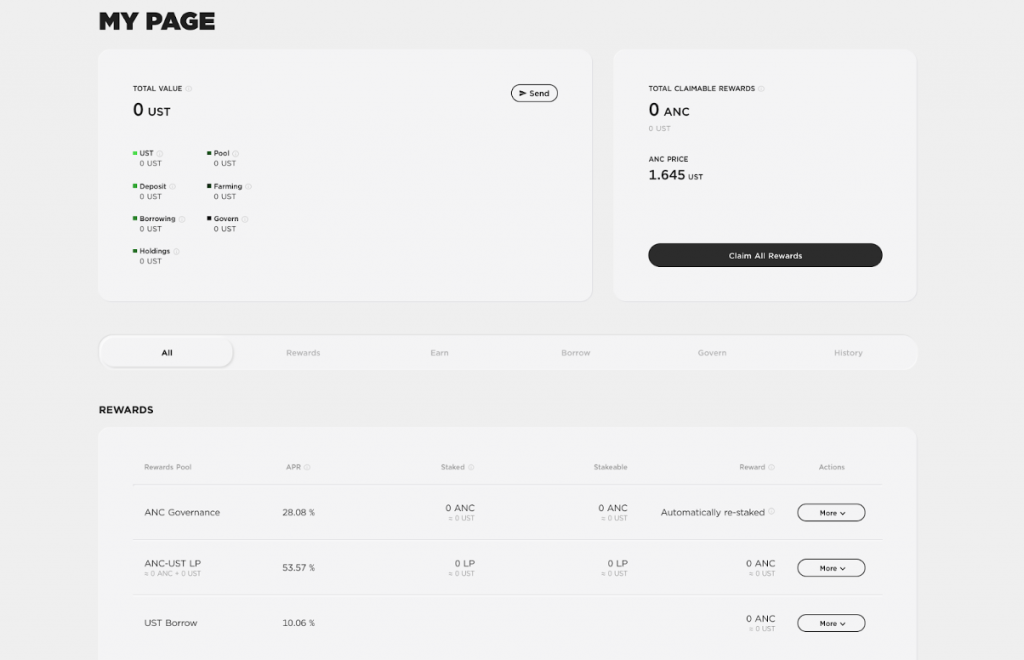

Claiming rewards

Navigate to ‘my page’.

At the top of this screen, you have the option to ‘claim all rewards’ in a single transaction. If you want to claim specific rewards (i.e. tokens earned from providing liquidity), then scroll to the ‘rewards’ section towards the bottom of this screen.

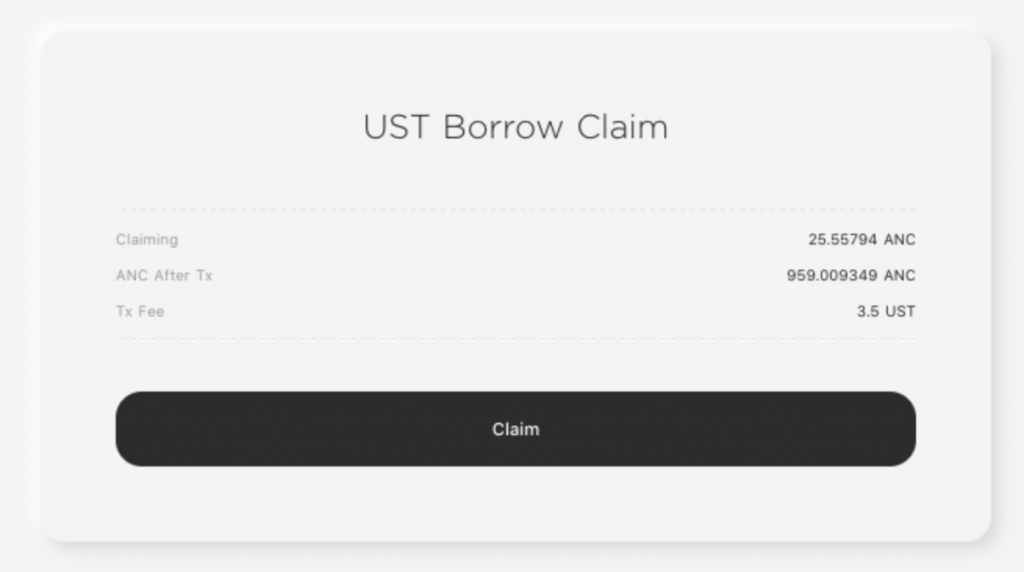

Click on ‘more’ beside the rewards you want to claim. In the drop-down menu that appears, select ‘claim’ (or ‘unstake’ in the case of ANC Governance).

On the following pop-up screen, click ‘claim’ again.

Once you approve the transaction, your rewards should appear in your Terra wallet!

Comment and share if you found this tutorial helpful! To learn more about Anchor Protocol, click here