The largest cryptocurrency had a particularly turbulent year 2021. Between the ban on mining in China, a few crashes and great booms, what to remember from the period? We take stock in this article.

Bitcoin (BTC) price ends 2021 sharply higher

The price of Bitcoin is of course the element which is the most observed to follow the evolution of the cryptocurrency. And this year, it has not silenced its reputation for volatility. After starting 2021 on the hats, he hit an all-time high (ATH) in April , topping $ 65,000 for the first time.

But this fine performance was followed by one of the biggest crashes in its history in May: the BTC was close to $ 30,000 . Since then, the recovery had been more timid, with some ups and downs. At the end of the year, however, things accelerated: Bitcoin’s price hit a new all-time high at over $ 68,500 .

In the end, Bitcoin ends the year 2021 a little more at half mast: it is exchanged this morning for 48,000 dollars. But the progression remains clear: this corresponds to + 76.9% over the last twelve months . Its capitalization currently exceeds 906 billion dollars.

Mining: a hashrate who recovered from the Chinese exodus

One of the biggest news of the year was the Chinese government’s progressive mining restriction , which went so far as to be banned last summer. China at one point accounted for up to 65% of the global hashrate (or hash rate) , so the consequences have been particularly impactful for the Bitcoin network as a whole.

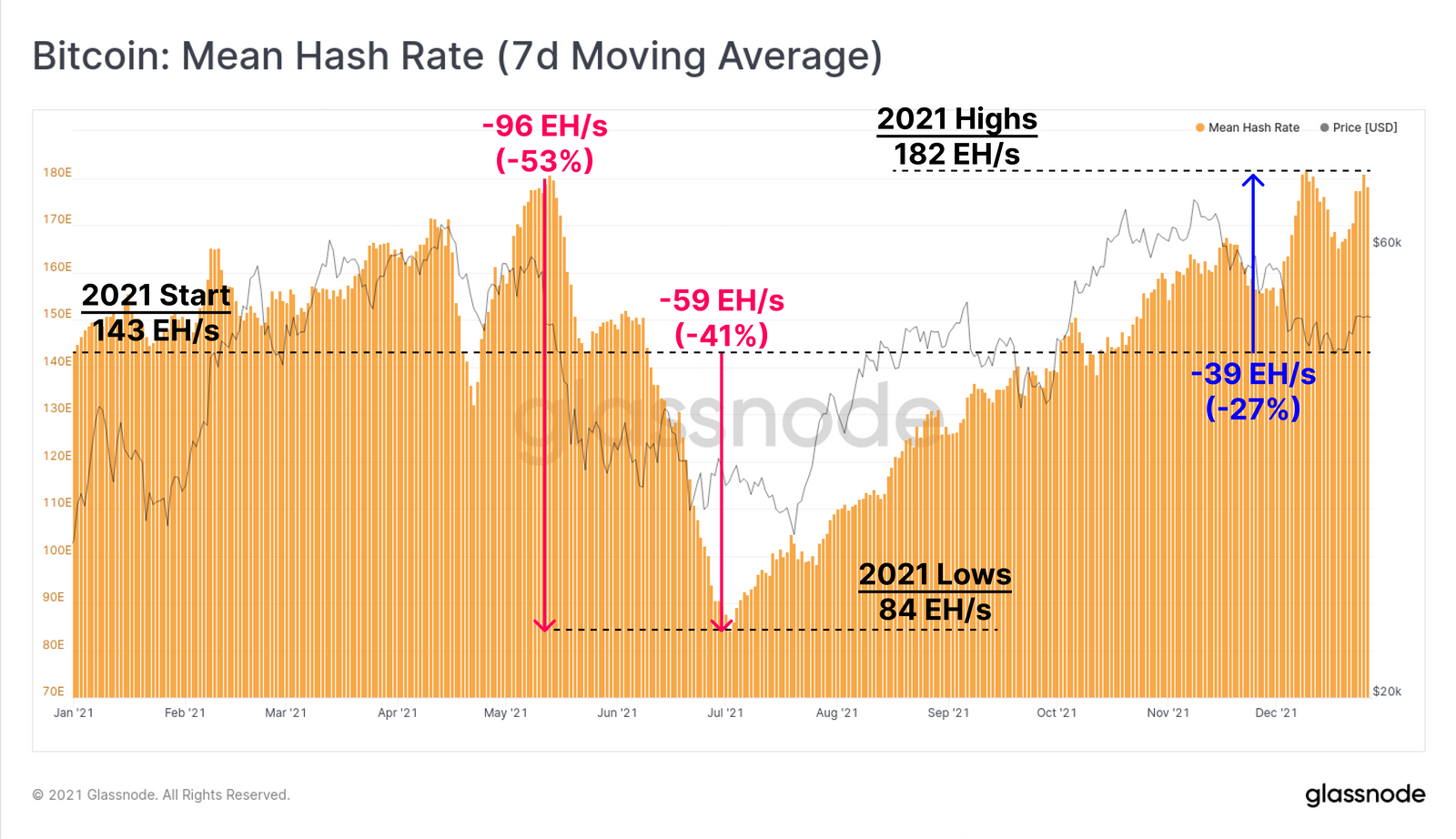

In total, the average hashrate dropped -53% in a matter of weeks , a direct result of mining farm closures. At its lowest, it only reached 84 pe / s:

Bitcoin hashrate (BTC) progress in 2021 – Source: Glassnode

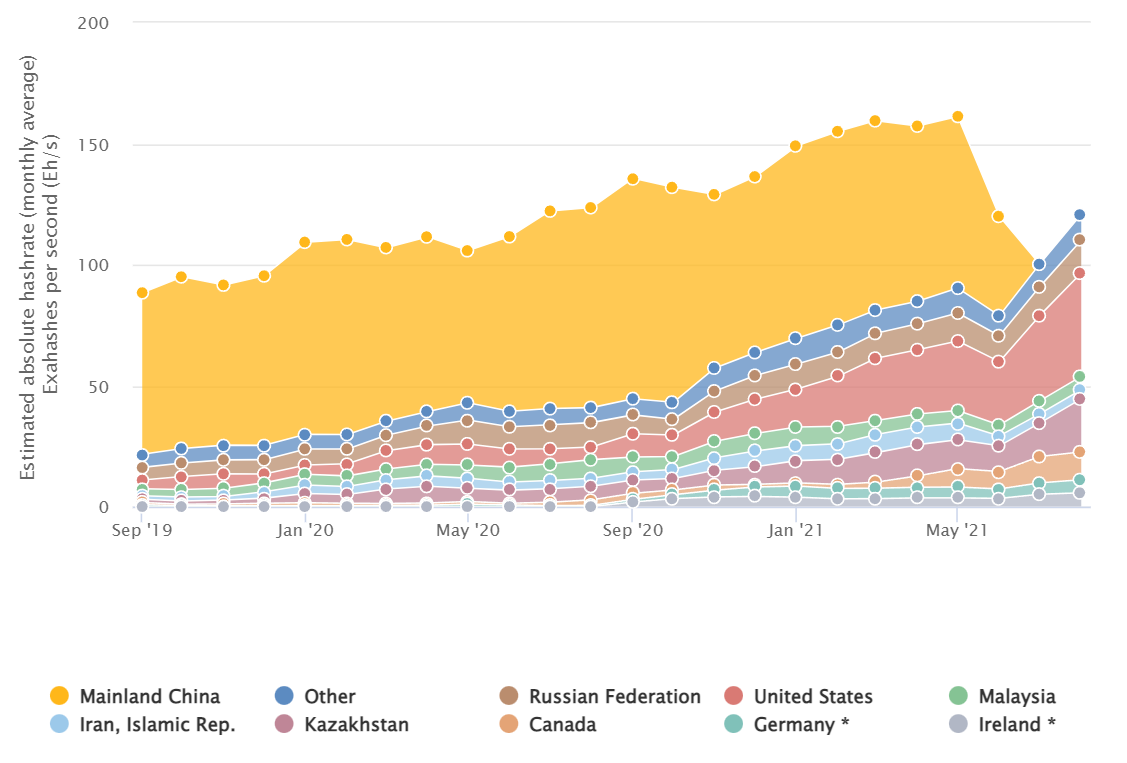

Since then, the great migration of minors to new territories has taken place. The United States has become the country producing the most hashrate (35% last August). They are followed by Kazakhstan (21%), as well as Russia and Canada (11% each):

Evolution of the hashrate by country until August 2021 – Source: CBECI

Against all odds, the hashrate Bitcoin has quickly recovered from this upheaval , and even reached the end of the year new records. This is further proof of the incredible resilience of the Bitcoin network.

High added value content that is quick to consume

Bitcoin: long-term investors dominate 2021

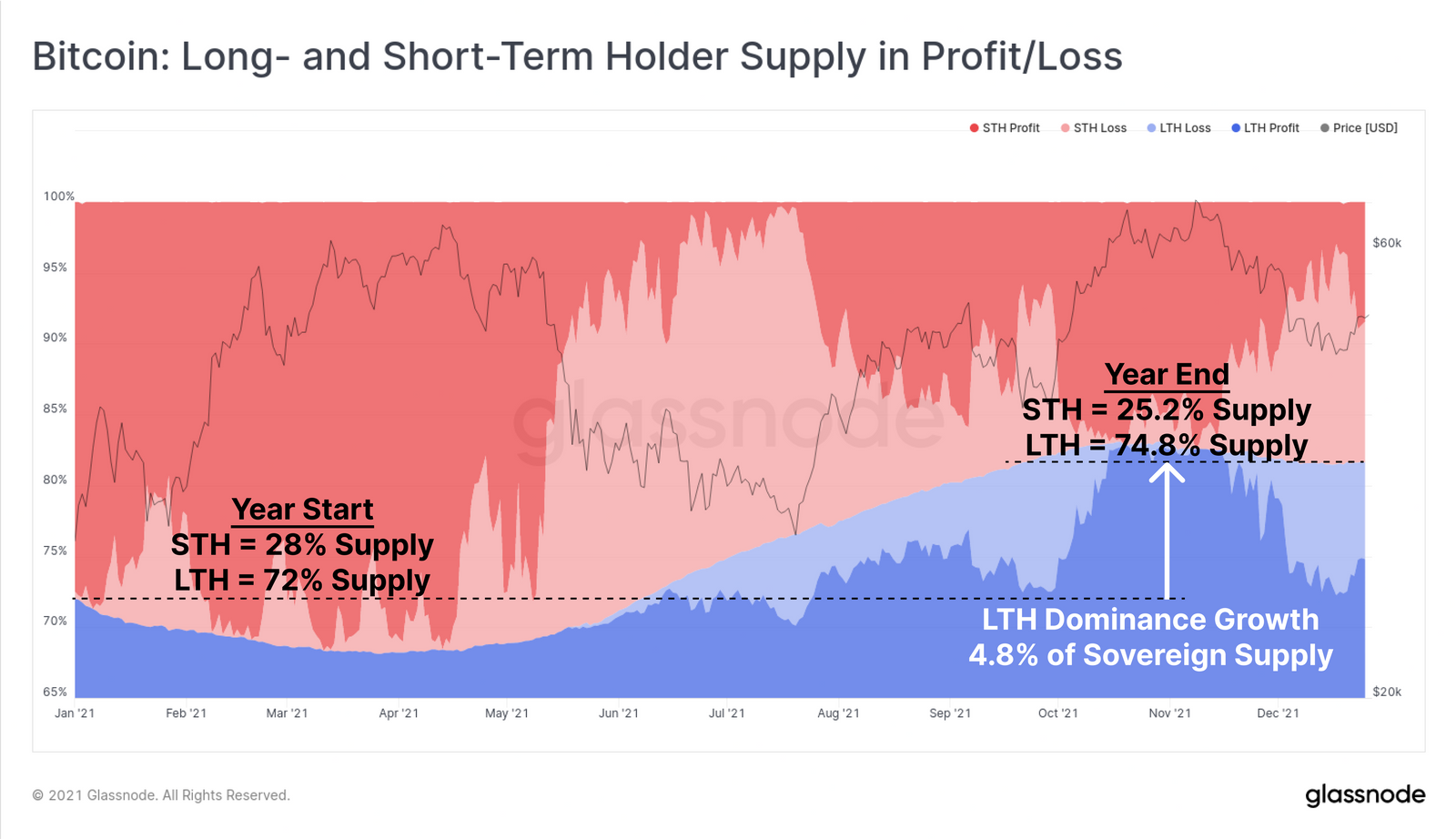

The general public’s interest in Bitcoin and cryptocurrencies was confirmed in 2021. Non-fungible tokens (NFTs) burst into the discussions, and records for major cryptocurrencies have attracted a new fringe of investors. Both old and new at this stage seem determined to hold onto their BTCs for the long term .

At the end of the year, 74% of the bitcoin supply is indeed stored in holders’ wallets over the long term, a similar share at the start of the year, where they represented 72%:

Long / short term holders and their profits – Source: Glassnode

All of this is confirmed by the cryptocurrency stocks on the exchange platforms. When these decline, it is universally seen as a sign that investors are moving their coins to cooler wallets, and therefore not planning to trade them anytime soon.

In 2021, the number of BTC stored on exchange platforms fell by -2.6%, or 67,800 BTC. However, keep in mind that the price of Bitcoin has climbed over the period, which means that the price in USD of these BTCs is not the same as at the beginning of the year. All this therefore indicates that it is the “ hold ” that continues to dominate investor strategies.

What prospects for the year 2022?

All of this brings us to 2022. What are the prospects for Bitcoin? Will its price see the highs so hoped for by investors? In the matter, it would take a crystal ball to say it with certainty, but the majority of experts seem confident.

As of mid-December, Bloomberg analysts estimated that Bitcoin was still racing to hit $ 100,000 in 2022 , explaining:

“ We expect wider adoption to prevail and outshine most issues , such as the nearly 50% correction seen in 2021. […] Bitcoin appears to be on a path to 100,000. dollars. We see Bitcoin heading into 2022 with a bull market that has taken a hiatus, and has been renewed. “

This oh so psychological threshold of 100,000 dollars seems shared by other analysts … Even if some are more cautious. The JPMorgan institution thus sets a price target of 73,000 dollars for the year 2022, even if it envisages a record of 146,000 dollars in the longer term.

What is certain is that BTC has started to gain the attention of investors looking for a haven, as fears of lasting inflation weigh on the dollar. What some call “ digital gold ” could therefore continue to establish itself as a viable alternative in 2022