The founder of Swan Bitcoin has published a very enlightening paper about the functioning of the stablecoin Terra (LUNA) and why it exploded in flight. Here is the summary.

Two types of stablecoin

First of all, let’s quickly distinguish between a traditional stablecoin and an algorithmic stablecoin .

A traditional stablecoin is a cryptocurrency backed by a fiat currency like the dollar. For every stablecoin in existence, the company that manages it holds one dollar in reserve. In principle, everything is fine as long as this company keeps its dollar reserves on hand, in full and in liquid form.

In other words, the company must not play around investing part of these reserves (in US debt securities, for example). Which is tempting since it never happens that 100% of stablecoin holders decide to convert them back into dollars at the same time.

However, this is in practice what these companies do. Then there is a risk. Imagine that the company has invested 70% of its reserves in US debt. It is enough then that more than 30% of the stablecoins ask to be converted into dollars for the company to no longer be able to maintain the “peg” of a stablecoin for a dollar.

The peg will be momentarily broken while selling US debt securities in order to recover hard dollars that can be exchanged against stablecoins .

Unlike the traditional stablecoin , the algorithmic stablecoin UST (Terra) does not rely on the dollar reserves it is supposed to represent. It is based on pools of tokens called LUNA.

The LUNA was put on sale for the first time during a private sale for investors (ICO) in which the Binance, OKEx and Huobi exchanges notably participated. Here is the list of suspects:

The sale was completed in August 2018 with a raising of $32 million. According to coinmarketcap.com , 385,245,974 LUNAs were created ex nihilo on this occasion. 10% went to Terraform Labs (the company that manages the Terra-LUNA stablecoin ), 20% to employees and collaborators, 20% to the Terra Alliance, 20% for price stabilization reserves, 26% for project supporters and 4% for liquidity.

It is not specified exactly how many LUNAs were distributed for free compared to those that were purchased with these 32 million dollars…

The operation of the stablecoin is quite simple even if it is never easy to grasp something totally new.

You need to deposit LUNA worth 1 dollar on the Terra Station to create 1 UST (https://station.terra.money/swap, the primary market of the UST). At this time, the LUNA tokens are “burned”, that is to say they are destroyed.

The peg of one UST for one dollar exists because (in theory) one can always exchange 1 UST for 1 USD of LUNA token on the Terra Station. In this case, it is 1 UST that is “burned” to create 1 dollar of LUNA token. We say “a LUNA token dollar” because the exchange rate between the LUNA and the dollar is fluctuating.

On one side you have the LUNA token whose dollar value fluctuates (it has gone from a few dollars to more than a hundred dollars). And on the other a UST whose value of 1 dollar is stabilized by selling it or buying it with LUNA.

So if UST is trading, say, on Binance (secondary market) for $0.99, one could:

- Buy on Binance 1 UST at a low price of 0.99 USD;

- Go to the Terra Station and exchange it for 1 USD of LUNA;

- Sell LUNA immediately and make a profit of 0.02 cents for every dollar.

The big problem with LUNA/UST…

The following is a translation of this paper written by Bitcoin Swan founder Cory Klippsten. The passages in square brackets are additions from yours truly to clarify certain things:

“Problems start to arise when Luna’s market capitalization becomes lower than UST’s. If the demand for UST exceeds that of Luna [in the secondary market], and the price of Luna drops, we could come to the situation where all LUNAs are worth less than all USTs.

[So everyone would start wondering because, as we said above, you can (in theory) always exchange 1 UST for 1 dollar of LUNA at the Terra Station.]

In response to this design vulnerability, Terraform Labs had to instruct UST holders not to exchange their USTs for USD in the secondary market because in this scenario the peg would fall below $1. Consequently, those who arbitrage to take advantage of small variations around the peg would be encouraged to defend parity by burning USTs [burning = buying back to destroy, which reduces the supply]. LUNAs would therefore be automatically created, which would cause their price to fall even further. This dynamic could create panic and induce investors to sell USTs and LUNAs in concert, creating a death spiral.

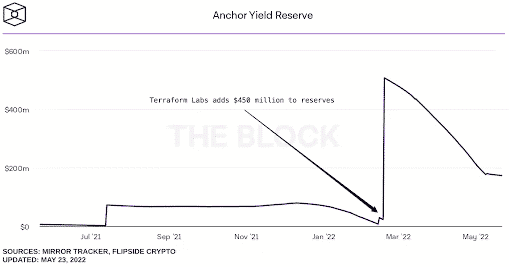

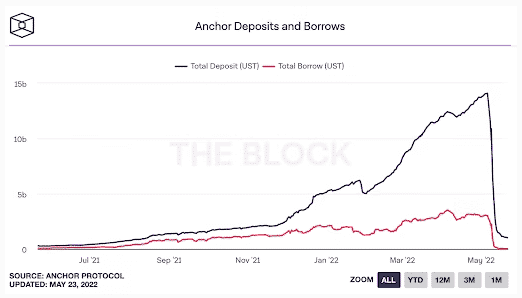

To address this, Terraform Labs created an artificial demand for USTs by offering a 20% return on USTs in the Anchor protocol, also built by Terraform Labs. This yield was primarily funded by Terraform Labs through the sale of its LUNA reserves. To avoid collapse, Terraform Labs had to continually pump its reserves to pay this 20% per year to UST holders to maintain an artificial demand for UST. This is what happened in mid-February, when the yield reserve was watered with 450 million dollars to continue the Ponzian charade.

Prior to the attack that blew up the UST stablecoin, the maximum total value locked in the Anchor protocol had gone through a peak of over $14 billion. Obviously this was not viable since the reserves of TerraForm Labs were going to be continuously drained to fund this gigantic 20% return for UST holders.

To compensate for the rapid expansion of UST supply and the inherent fragility of the peg mechanism, Terraform Labs created the Luna Foundation Guard (LFG) by donating $4 billion from Luna as well as raising $1 billion dollars in a private sale led by Jump Cryptol and Three Arrows Capital. LFG’s goal was to buy large amounts of bitcoin as a defense mechanism or in case the peg threatened to break. These bitcoin reserves had to be sold to support the price of the UST, much like an emerging market central bank selling its foreign exchange reserves to support its fixed exchange rate (peg) with the dollar.

Find here the amounts held in the Luna Foundation reserve before the start of the crisis.

This Ponzi scheme was a perfect opportunity for an opportunistic short seller willing to take a bet that Terraform Labs would not be able to defend the peg in the event of large volumes of UST sales.

Crash Timeline

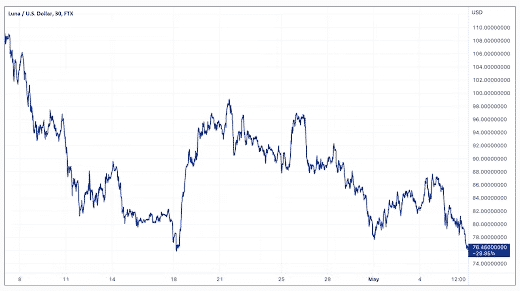

From April 7th to May 7th things started to go downhill for Luna/UST when the whole crypto market crashed taking with it the LUNA which dropped in price about 30% from 108 to 76. dollars for a LUNA.

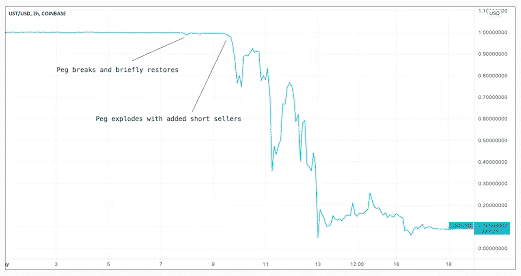

Due to the rapid increase in the supply of UST by investors attracted by the 20% yield of the Anchor protocol, doubts have arisen as to the ability of LUNA to serve as collateral given its falling price. In doubt, some investors began to sell USTs for fear that the market capitalization of LUNA would no longer be sufficient to cover all the USTs in circulation. The peg finally broke on May 8 before recovering briefly.

An epic short selling opportunity then presented itself. In the same way that George Soros bet in 1990 that the Bank of England did not have enough foreign exchange reserves to maintain its fixed exchange rate with the dollar (by borrowing for 10 billion pounds sterling which he sold against the dollar), a short seller bet that the Ponzi Luna/UST was not viable and proceeded to attack the peg.

The latter first borrowed 100,000 BTC in order to sell them and rock the entire crypto market. He then concluded an over the counter (i.e. outside the market) transaction of one billion dollars in UST which they also began to sell systematically to exercise a pressure on the Luna/UST peg.

[Who sold this large amount of UST outside the market? Is it Do Kwon, the founder of the stablecoin Terra-LUNA?

Facing the abnormal downside pressure, a classic bank run unfolded on the side of the Anchor protocol. Investors all rushed at the same time to withdraw their USTs in order to quickly convert them back into LUNA and then into real dollars. Investors panicked and billions of UST deposits were withdrawn from the Anchor protocol in just a few hours.

These panicked users removed their USTs from Anchor to burn them and get LUNAs. Each user who sold then had a choice to make:

1) Keep its LUNA, whose supply was increasing rapidly (and therefore its price was collapsing);

2) Sell your LUNA for dollars;

Most chose the second solution.

At that time, short sellers doubled down on their sales of UST to the last (for about $650 million). We then observed a significant break in the pair Luna/UST, causing even more panic. The price of Luna began to drop very rapidly until the fateful point where all of the USTs were no longer fully guaranteed by all of the LUNAs. A classic death spiral then set in, with investors rushing for the exit, causing LUNA and UST prices to plummet simultaneously.

This is where LFG stepped in by allegedly selling off its LUNA and Bitcoin reserves to buy back USTs to try and stop the bleeding. However, the fall in the prices of Luna and UST was accompanied by a parallel fall in the price of bitcoin due to the sale of tens of thousands of its bitcoins by LFG. (Note: It is still unknown if they actually sold the bitcoins).

Ultimately, LFG’s efforts were a lost cause. Like emerging markets draining their reserves in an attempt to prop up their fixed currency peg, LFG depleted its reserves without being enough to protect the peg which collapsed further.

Investors continued to massively sell their USTs, automatically leading to the creation of more and more LUNAs until hyperinflation. Luna’s supply went from around 725 million units to 6.9 trillion, an increase of almost 1,000,000%, in a single day.

At that time, mass was said. The peg had completely collapsed and $40 billion came out of the Terra-LUNA ponzi.

New details surrounding the Luna/UST crash continue to arrive with each passing day. Small investors are reported to have lost all their savings, companies have suffered massive losses, founder Do Kwon has been fined $78 million for alleged tax evasion, and numerous ongoing investigations are ongoing. state of evidence of the existence of whales having abandoned their positions shortly before the facts. Additionally, there are still many unknowns as to whether LFG actually sold the bitcoins or if management held on to them.

This Twitter account is currently investigating and I suggest you follow it to follow the progress of this case. I don’t think things will stay that way. I believe that new accusations will emerge about the operators and main investors of this giant Ponzi scheme. In the meantime, the founders of Terra-LUNA are already putting the cover back and are currently trying to resuscitate this failed project by launching Terra 2.0. I don’t understand why anyone would invest their money with these people again.

Unfortunately, Mr. and Mrs. Everybody are usually the big losers in these kinds of events. Many of the big companies that invested in this stablecoin were able to exit before the crash with massive profits on the way. Strangely, some felt the need to brag about it. Joey Krug, CIO of Pantera Capital, admitted that they had sold 80% of their position in Luna before the crash. Additionally, Pantera Capital partner Paul Veradittakit apparently bragged about turning his $1.7 million investment in Luna into around $170 million. So is Galaxy Digital CEO Mike Novogratz.

UST/Luna totally collapsed but fortunately the first investors got out just in time.

“Pantera Capital saw its $1.7 million investment grow into $170 million.”

These people promoted an obvious ponzi before pulling out just before the collapse. Either they knew it was a ponzi and the hundreds of millions raised are illegitimate or they were very lucky and shouldn’t be handling money. There is no third option. From their own comments, it seems they knew exactly what game they were playing, but just didn’t care about the small investors who got washed out.

We will see what the investigations reveal regarding these large investors and other insiders involved in the Terra-LUNA (UST) crash. It is rumored that the short seller protagonist of the collapse of this Ponzi would have pocketed more than 800 million dollars. »

[Which is probably only the tip of the iceberg given that nearly $40 billion was in this ponzi before the collapse.]

We invite English speakers to read the English version of this paper . You will find more information there, including a nice introduction that we have not translated, but which is worth reading. In conclusion, remember that if ” you don’t understand where the performance comes from, it’s because you are the performance”…