When Dose of DeFi launched in 2019, I noted that DeFi excited me not just because of the products and protocols being built, but also because DeFi as a meme had so much potential. Indeed, memes — or an idea, story or behavior that spreads in a culture — are increasingly driving market behavior in both crypto and traditional finance. With this in mind, we’ve come up with the five ideas (or memes) that defined 2021 (for those who love nostalgia, here’s where we were a year ago). And when it comes to DeFi, it’s not just the contents of a story that matters, but whether or not its complexity can be wrapped up into a meme and transported around the internet.

Sometimes, a meme is just a crystallization of a complex idea into one or two words. Other times, it’s a catch-all term for a market, product or service. Sometimes a meme is artificially manufactured, while others emerge from shared experiences.

And for all memes, the way that the story or idea is received is more important than its specifics. This is an important point to remember as we consider how influential the five memes that defined DeFi in 2021 will be going forward.

– Chris

The memes

1. A multichain world

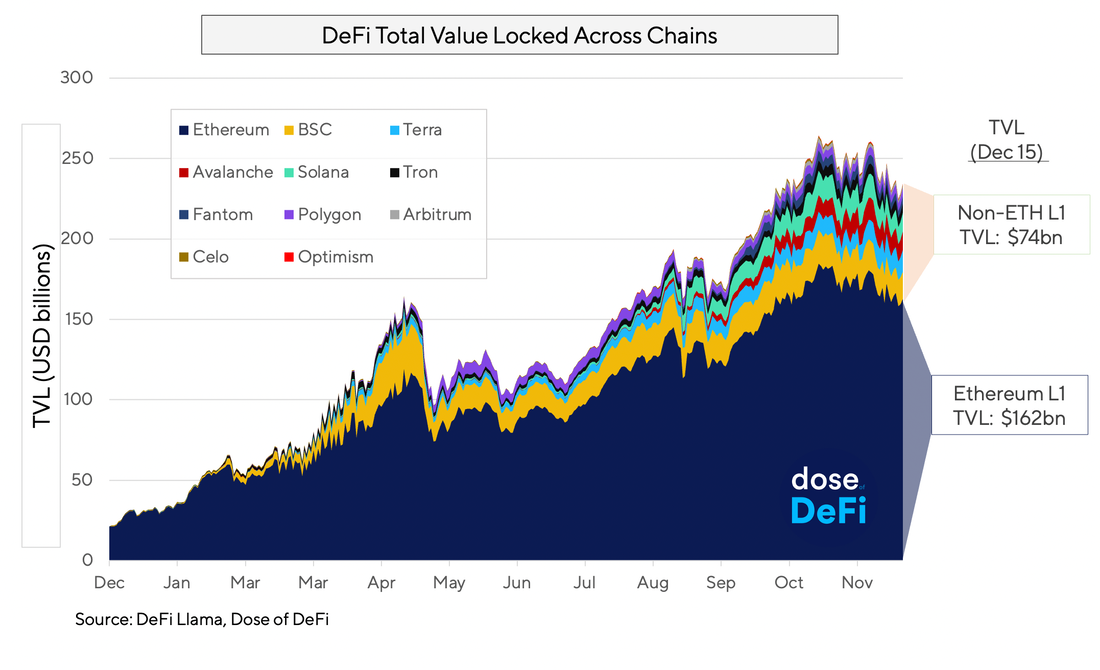

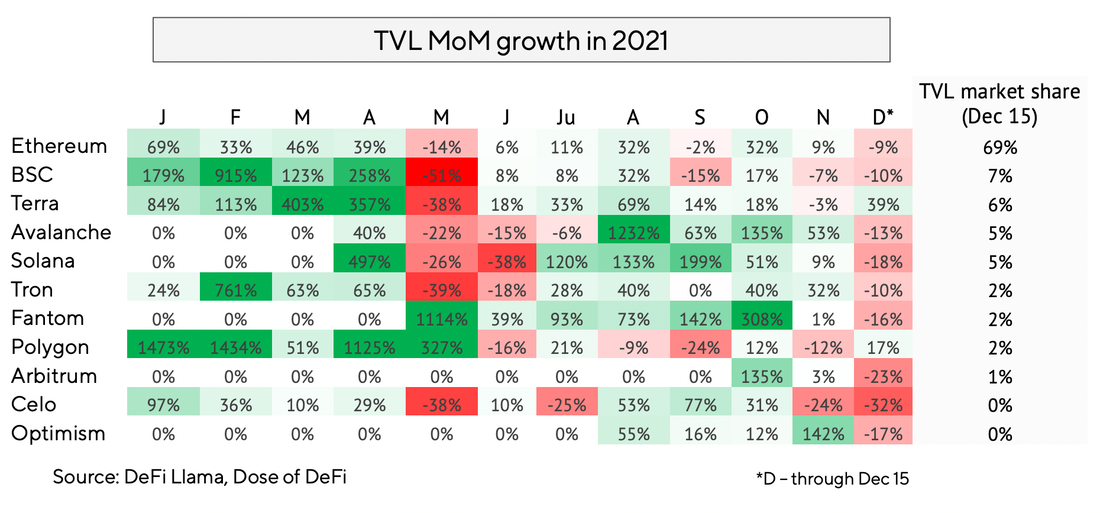

A year ago, there was little DeFi activity outside of Ethereum’s mainnet. Now, every DeFi project is deploying to multiple chains. Ultra-cheap chains like BSC, Polygon or Fantom are attracting the bulk of new DeFi users, though the long-awaited scalable blockchains have finally arrived. These newcomers consist of Layer 1’s like Solana and Avalanche, and Layer-2 scaling solutions like Arbitrum, Optimism (we’re still waiting on the ZK revolution, though). At the end of 2021, Ethereum mainnet makes up almost 70% of TVL:

Not much has changed in this space since our Multichaining in a maturing DeFi world post from October, except that the conviction of market direction is now even stronger. And it’s clear — at least to us — that there will not be one chain to rule them all. Along with L2 rollups, Ethereum may maintain 50%+ market share over the next few years but the rollup universe will be diverse in design and uses.

Perhaps the most interesting technical question that remains unanswered is around the prevalence of the EVM as the operating system for DeFi, and more importantly, whether that creates any moat for Ethereum the network (or ETH the asset)? EVM-compatible chains have been successful at using token incentives at attracting users. Will Optimism, Arbitrum and other Ethereum Layer 2’s launch tokens to compete?

Explore more: Binance Smart Chain begins the multi-chain DeFi era, Bridging to a multichain world

2. Rug pulls

Rug pulls may just be a reincarnation of the all-too-common exit scams, but rug pull as a meme aptly captured the euphoria of 2021. To us, scams and theft — while morally troubling — are not terribly revealing. More concerning, are the hacks and security exploits that shake confidence in DeFi.

There were a number of notable DeFi hacks this year. Our learnings from these are:

- Don’t underestimate DeFi’s complexity: Seemingly every week there’s a new type of exploit. Projects arm themselves with audits of their smart contracts, but even they fail to foresee the multitude of attack vectors. The latest example, Badger, had no exploit at the smart contract level. Instead, someone manipulated the front-end to make users sign approval transactions they weren’t aware of.

- Human factors still exist: The SushiSwap case showed that even “decentralized” teams tend to organize themselves into hierarchies. And with the fight for a place at the top of a hierarchy, team members may take actions detrimental to the interests of the project.

- Decentralization delays: With the Compound hack, the team knew about the vulnerability issue, but had to wait for a proposal to pass a vote before it could be fixed.

- Hacker wars have grown: The Cream hack showed that in DeFi these days, it’s not only Black-Hat hackers that are trying to make money, but (very probably) experienced DeFi developers are also engaging in order to inflict reputational/financial damage to competitors. Also, flash loans are being used again.

- Bridges need security development: In a nutshell, bridges add an extra link; so they need to be as secure and decentralized as blockchains (and it took a lot of blood, sweat, and tears to reach the current level of safety of major blockchains). Rogue team members, insufficient capital in staking, smart contract bugs, and architecture faults could all lead to more hacks in 2022.

3. DeFi 2.0

Sometimes, the meme inspires the movement. Other times, the meme is playing catch up. With DeFi 2.0 it’s definitely the latter, and if we’re being honest, it’s a pretty lazy meme. Yet it has stuck — as evidenced by the emergence of a new generation of DeFi products and services.

When the concept of yield farming (when new projects incentivize liquidity providers by distributing their token) seemed to become the standard way to bootstrap liquidity, OlympusDAO burst onto the stage, suggesting that instead of receiving incentives for temporarily providing liquidity, users should buy the protocol token with their liquidity. So far it seems to have worked for Olympus and a number of projects that use Olympus Pro platform to bootstrap liquidity in this way. It appears that long-term this is definitely a better solution than the first generation of yield farming, as projects end up owning more of their own liquidity. Broadly speaking, this is in line with the larger protocol-controlled value (PCV) trend. Earlier this year, Fei launched a stablecoin backed by assets provided by investors. PCV is different from user liquidity in that a protocol can direct such “treasury assets” according to its needs — to invest in lending/staking/vault protocols for higher returns, or adjust the market price of its token.

Another common characteristic of DeFi 2.0 protocols is that they are serving businesses instead of the consumer. Tokemak helps DAOs to direct their treasuries where needed by doing the following: a DAO stakes their token into a pool and invites the holders of the project’s token to do the same. After acquiring Tokemak tokens, the DAO can direct this liquidity where needed — for example into swaps. Tokemak makes it easier for DAOs to create a pool without the need to provide the other side of the pool pair. For retail token holders, it also saves a lot of mental work, as now instead of manually providing liquidity across the swaps/pairs, they can pour it into one place. As a result, DAOs can be more agile with their liquidity in response to market changes or industry developments. There are some trade-offs though, for example, the reliance on the Tokemak’s token Toke (but we won’t go into the details in this summary).

Another theme that unites 2.0 projects is that they build on top of existing DeFi infrastructure. Alchemix protocol is a good example here, where protocol allows users to “tokenize the future yield”. Let’s say someone has savings and would like to borrow against these savings for an immediate purchase. They can deposit USD100,000 and borrow USD20,000 for this purchase. Alchemix will invest the collateral in Yearn or other yield-generating platforms and use the generated interest to repay the debt for the user. Once the debt is repaid, the deposit is returned in full amount. This way it’s possible to finance a purchase with the future yield without sacrificing the capital. Alchemix is one of the examples of how DeFi 2.0 protocols innovate by building on top of DeFi 1.0’s primitives, and we will see more of such innovation in 2022.

Go further with August’s article on Ohm and USD-independent stable assets.

4. MEV

MEV, or miner-extractable value, was the winning combination of letters that won out to describe the rent or tax that miners can earn by reordering transactions after they are submitted but before they are confirmed. Front-running is as old as trusted intermediaries, but intermediaries were supposed to be eliminated with public blockchains. That’s what makes MEV so concerning; it’s an existential threat to the promise of decentralization and censorship-resistance.

Looking ahead, there are three main things to ponder:

- Is MEV inevitable, or could new designs, like fair-sequencing systems or auctioning off MEV, eliminate it?

- What about cross-chain MEV? Will the juiciest opportunities be on discrepancies across chains?

- Will trusted validators, like the major exchanges or staking pools, extract MEV in PoS networks?

For more, check out The Era of MEV or MEV: Standoff, truce, or a never-ending saga?

5. Stablecoins

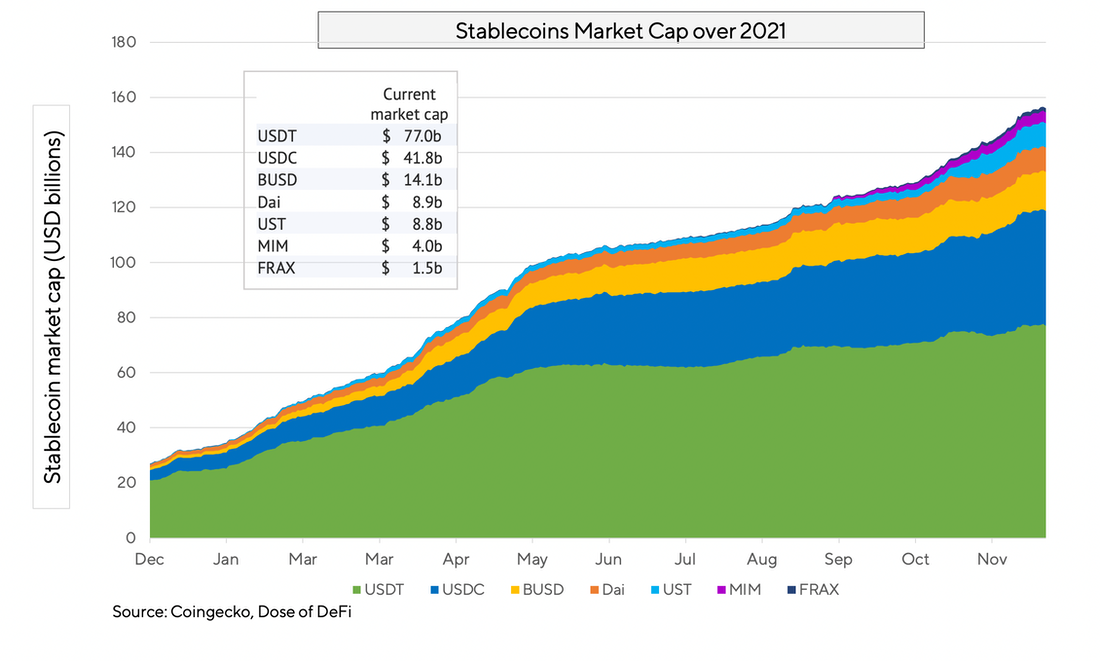

Stablecoins may be the most underrated meme of 2021. It’s a terribly simple concept — dollars on the blockchain — but their 2021 was not just about market growth or their new innovative designs, but by the fact that stablecoins are entering the lexicon of Wall Street and Washington (and financial and political centers of power around the world). Talk about CBDCs has waned, but digital fiat currencies have not.

Instead of launching their own government-issued digital currencies, governments are playing catch up and trying to regulate the existing stablecoin market. Industry players have been more than willing to play along, banking on a potential 100x growth in market size if the largest financial institutions use stablecoins.

On the other end of the spectrum is trust-minimized stablecoins, or stable assets that aren’t pegged to any fiat currency. We are bullish on innovation in stablecoins being a way for credit dissemination in DeFi, but are still waiting on this to come to fruition.

In 2022, stablecoins may well be less meme worthy, with a focus on what government bodies around the world — but primarily in the US — do to bring stablecoins into the regulatory fold.