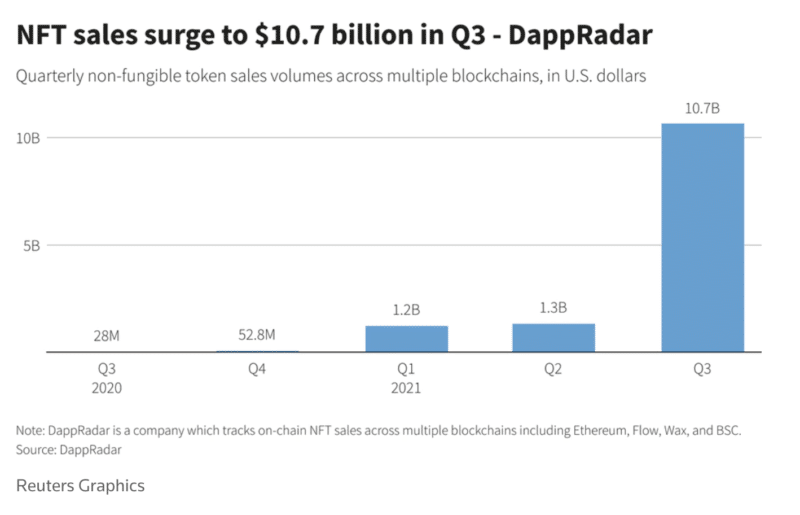

It looks like the summer of 2021 will be remembered as NFT (Non-Fungible Token) summer, following the DeFi summer we had in 2020.

Non-fungible means that something is unique and one-of-a-kind. NFTs are therefore unique digital tokens representing something.

NFTs have grown on the Ethereum blockchain, but they are also available on other chains like Solana. The future seems to be pointing towards a multichain space. One major problem with Ethereum is that gas fees needed to make transactions go through are very high, thus pricing out many smaller investors.

Anything digital can be made into an NFT on the blockchain; however, the most common form of NFTs is digital art. Images, audio and video files can also be sold as NFTs. Once a digital asset has been made into an NFT, it will be unique on the blockchain and can be traded in exchange for money, just like physical art would be.

I find the NFT space to be extremely fascinating for many reasons, and I’ll be gathering my notes here. The one thing that I would start off with, is that after looking at NFTs for a while, the regular crypto space (Bitcoin, Ethereum, etc) starts to look downright boring and run of the mill. If you thought understanding the valuation of cryptos like Bitcoin and Ethereum was very hard, the NFT space is just wild in comparison.

Buying Blue Chip NFT Projects

One of the best strategies for getting exposure to NFTs as a beginner is to stick with the so-called “blue chip” NFT projects.

While the prices for these projects are currently quite prohibitive (some popular ones have sold for more than $1 mln), you can invest in their fractionalized versions on the following sites:

- Fractional – the most popular fractionalization platform.

- NFTX – mint and trade NFT index tokens.

- Unicly

- nftfy

- Niftex

Apart from fractionalization, investors are increasingly forming Decentralized Autonomous Organizations (DAOs) to pool their funds and gain exposure to the priciest NFTs. Here are some examples:

- FlamingoDAO – minimum 330 ETH investment to join.

- ARK Gallery

- Beets DAO

- PleasrDAO

- ApeDAO

Minting NFTs

The best opportunity for huge profits lies in getting in early on a project, especially if you can be one of the original minters. Every project has an initial minting stage, which can last just a few minutes or hours if the project had already garnered a lot of attention prior to launch.

The minting stage can also lead to gas wars, so be aware of that and try to avoid them if at all possible.

There are hundreds of projects launching every week, so it’s hard to spot the best ones unless you’re already in some kind of community of knowledgeable NFT collectors. That’s when the benefits of being in NFT communities like the BAYC or Crypto Punks could be very useful. Alternatively, being part of an NFT collector DAO can serve the same purpose. In the latter, you might not need to do anything beyond buying tokens of the DAO itself, as the DAOs leaders will do all the research and purchasing themselves.

One tool I’ve used to discover currently hot minting projects is the site ultrasound.money. It features a burn leaderboard where projects being minted en masse typical show up. It’s just another way of sniping new and hot projects, but I’d still combine that with previous research through Discord groups relating to NFTs.

The best way to find good upcoming projects is through Twitter and Discord, but the key thing is to know who to follow and which Discord channels to be on. I haven’t yet figured out the best places yet but I will post here when I do. If anyone has any tips please let me know.

Trading NFTs

The biggest NFT platform is OpenSea, and that’s where most of the trading happens. You can also get a quick overview of which NFT projects are the most popular at any point in time. Make sure that you interact with original projects, as there are a lot of fakes and copycats. Look for the blue checkmark next to the project name to make sure it’s the original project you’re looking at.

Other Platforms

Other trading and minting platforms you should know about are:

The most interesting of these to me is Rarible. If you’re looking for a higher risk/higher reward investment, look into the RARI token, which you can buy on Kraken.

RARI has a total supply of 25m and is considered to be a utility token. By owning RARI tokens, users gain the ability to submit and vote on proposals to change its rules. This includes voting on possible fee changes, how those fees are spent and the rules governing creator promotion.

It is important to note that voting with RARI is non-binding, and that the Rarible company still needs to accept user decisions and implement them. However, Rarible’s goal is to eventually transfer power to a software-based system controlled by users called the Rarible DAO.

The idea behind buying the RARI token is to gain exposure to the growing NFT and digital content market or to have a say in how one of the leading NFT marketplaces develops.

You can also exchange NFTs in a P2P fashion on the following platforms:

Evaluating NFTs

A lot of the value accrued to NFTs is highly subjective, however, there are also important things to consider, such as an item’s rarity within its collection. Some other useful sites for evaluating NFTs:

- Rarity Tools – ranks project items by their rarity.

- NonFungible.com – analyze, track and discover NFTs.

- ICY Tools

- NFT Stats – statistics on best-selling items, price over time, volume, etc.

- Dune analytics – check this example for The Surreals project.

Keep in mind that the real drivers of value for NFTs of the PFPs type (personal profile pics) are the following:

- flex power

- community membership

1/ Bought my first NFT 2 months ago today without knowing a single soul in the space. What a fucking ride it’s been…

While I’ve been absurdly lucky financially I’ve been even luckier with something else — the community

— triumph (@_triumph36_) October 7, 2021

One of the best ways to judge whether an NFT project will do well or not is to check the Discord channel and see what kinds of conversations are taking place there. You want to ask questions like:

- Are the developers public? While many are anonymous, I maintain my idea that real names or companies behind projects are better. I don’t really understand this obsession with being anonymous.

- Where are the NFTs themselves stored?

There are 3 types of NFT:

-

- fully centralized NFTs (like NBA Top Shot), where no information is in a public blockchain;

- “pointers”, NFTs where the certificate of provenance is on a public blockchain, but the artwork itself is elsewhere;

- fully on-chain NFTs

Most NFTs fall under the first two categories. Surprisingly few NFTs today attempt to use the blockchain itself as a medium and storage. The innovation of NFTs is not to have a database of certificates of provenance linked to an artwork stored elsewhere. The innovation is to have the token be the artwork itself. Fully on-chain NFTs are the closest you can get to holding a physical artwork. Autoglyphs were the first fully on-chain art. Created in 2019, they’re a completely self-contained mechanism for the creation and ownership of an artwork.

What I’ve Done So Far

During NFT summer I didn’t do much except curiously following things and trying to understand what all the fuss was about. I have limited time these days as my kids and training take up the majority of my days. Indeed one of the biggest issues with NFT investing is that things happen very fast, and if you’re not there at the right time you’re going to lose out on most of the gains. Those who do this professionally basically spend all their days on crypto Twitter and Discord channels, trying to separate the chaff from the grain and position themselves for a bet on the next big thing.

However, one of my close friends has been pretty active with NFT purchases, and I’ve thus been privy to the wild ride of NFT summer through him.

My first foray into NFT world was by bidding on a Nouns item through a partybid, however unfortunately our bid was unsuccessful, and the NFT eventually sold for 200 ETH, while the party’s pool was around 190 ETH. From that experience I really understood why ETH’s gas fees are a problem as of mid-2021, since every transaction costs a good chunk of money in transaction fees alone, making any investment below $500 not worth doing.

The PunkScape is the background image designed to accompany a CryptoPunk.

I later managed to get my hands on an NFT, this time a OneDayPunk. This was a spur-of-the-moment purchase based on the recommendation of my friend. I was not sure I’d make my money back on this investment but it is quite an interesting project that helped me understand the buying process better. Two interesting factors of OneDayPunk:

- The actual value creation happens once the PunkScapes are released, so at minting stage you’re betting on a future event creating value.

- There are 10k punks but only one is allowed per wallet, in a way preventing people from scooping up many PunkScapes.

This purchase was another confirmation that with current gas prices it doesn’t make sense to make small investments. The price I paid for the NFT was 0.02 ETH but the gas price itself was 0.027177 ETH, even higher than the NFT itself. That means that in order to break even the value of my NFT has to double in price, and that’s not considering the gas needed to make the sale from my end.

I later minted a few PunkScapes and sold one for 0.06 ETH, which is more or less double what I minted it for, but when you consider the fees it’s more or less breakeven. I hope to profit from the rest of the PunkScapes I own as the project has taken steam very rapidly and the fundamentals are solid.

I think that derivative projects are a very good bet as an investment, since you’re building on a project that is popular and has holders with a high net worth, thus they can easily scoop up the derivative NFTs if they provide value, as in the case of PunkScapes, which are a derivative of the CryptoPunks, and are meant to be used as a background to the punks. As more and more punk owners buy the PunksScapes, they will become a must-have for all other punk owners, and the price grows.

Other purchases:

- Robotos – I love the Discord group and the artist himself is well-known. He is super active in working on the project, and there will be further airdrops to holders or Robots, apart from a game.

- Diamond Hands – I like the diamond hands concept and they have a solid team. They are also fractionalizing blue-chip NFTs and airdropping them to DH holders, which they describe as DeFI and NFTs combined. I like original use cases like this so I want to be involved as a learning experience. If I don’t buy I’m not incentivized to keep in the loop on the team’s Discord, check prices, etc. So I buy to learn.

- The Surreals – Nice artwork, not sure about the long-term roadmap, but it’s quite unique in terms of artwork, so I took the plunge.

Other Interesting Projects I Considered

- Entropes – another project I really like in terms of both the art and the mechanics behind how it is being generated. The floor is at 0.2 ETH as I write this (early October 2021) but I can definitely see this going slowly but surely higher. It’s been featured on the Opensea frontpage to0 so that helps. Unfortunately, development and Discord aren’t very active, and the artwork itself is not made for the masses, so it could also struggle to get any traction.

- The Arcade OG Series – amazing art from a famous guy (co-founder of Atari). It was dropped on Makersplace and honestly, I hadn’t used the platform before so I decided to sit this one out. Probably a mistake as the drop was very successful.

I plan to buy Jungle Freaks and Doodles next.

Creating your own NFTs

I’d love to try my hand at creating a new NFT project, so if you are interested in that feel free to contact me with your ideas.

In the meantime, here is a quick guide to creating NFTs.

Are NFTs Art?

The majority of people that see NFTs for the first time are a bit perplexed at what they see, and even more so by the prices being paid for some of these pieces.

A valid question is whether these NFTs can be considered art. In my opinion, while a lot of the projects are trash or copies of famous projects, there is no doubt that the best projects are art.

I struggled myself to understand why these would be art pieces, especially because the “weird” artworks I was seeing within most projects conflicted with my idea of art. Upon further reading, however, I realised that my own ideas of art were very limited, and it drove me towards learning more about art and how to appreciate and understand it.

Here’s a Twitter thread of where NFTs fit in the history of art:

Not understanding the significance of the NFT movement has been a million dollar opportunity cost for me.

I studied the last 250 years of art history to grasp the consequence of this moment.

Here's the knowledge you need to identify the next million $ NFT 👇🧵

— joshgordon.eth (@justwavyj) September 26, 2021

As for learning about art in general, I’ve started a course about European art history on Wondrium, which is a platform I use for educating myself on various topics like math, history, electronics etc. I basically use it instead of a Netflix subscription and you’ll usually find me following some course on most evenings after putting the kids to sleep.

I’ve learnt that for every art piece or project, I need to consider the following points

- Subject

- Interpretation – how the subject is expressed

- Style – the means of interpretation (each artist has his own style)

- Context – contemporary political events, artist’s own life, historical period

- Emotion – our response to the art

The Future of NFTs

I am absolutely fascinated by the possibilities that NFTs are enabling, and beyond the current price bubble, I expect NFTs to play a significant role in the future of crypto, with lots of real-world applications up for grabs once the technology matures and regulations catch up.

One area that is already growing is borrowing and lending through NFT collateralised loans. These are the best sites for lending NFTs:

The way it works is that you can take your NFTs and use them as collateral for a crypto loan. You can also take the other position and accept someone’s NFTs as collateral in return for giving them a loan in crypto.

What do you think of the NFT space? Are you invested in any projects? Let me know in the comments section below.

Sites for News and Articles about NFTs

- NFT Now – news

- NonFungible – news and stats

- Niftyselects – drop calendar

- NFTSolana – Solana NFT calendar