Launched in 2017, dYdX quickly established itself as one of the best decentralized trading platforms. Let’s find out what dYdX has to offer, from cryptocurrency trading and staking to weekly and daily competitions. Here is our full tutorial and review of dYdX.

1 What is dYdX?

2 How to trade cryptocurrencies on dYdX?

3 How to save your cryptocurrencies (staking) on dYdX?

4 Win prizes with weekly and daily competitions

5 Our opinion on dYdX and its ecosystem

What is dYdX?

A DEX with multiple features

The famous decentralized trading platform dYdX was founded in 2017 by Antonio Juliano, a former developer and engineer at Coinbase. Quickly, it became one of the largest platforms in the decentralized finance (DeFi) sector.

To date, dYdX allows its users to gain exposure to cryptocurrencies through various financial media , including perpetual contracts or Margin. In addition, the platform differs from traditional decentralized exchanges (DEX) by offering innovative features such as staking or daily and weekly competitions.

Initially, dYdX was implemented directly on the Ethereum (ETH) blockchain. The platform offered trading, staking, but also borrowing services, which are currently suspended. In 2021, dYdX opened up to perpetual contracts, building on StarkEx , a second-layer Ethereum solution developed by StarkWare.

In August 2021, the exchange experienced exceptional excitement following a massive airdrop of its eponymous governance token, the DYDX , largely rewarding the community. We will detail the specifics and advantages that this token can offer later in this tutorial.

Right now, dYdX has established itself as the go-to decentralized exchange . Faced with centralized competitors, such as FTX or Binance, dYdX does not pale in comparison. The exchange is seeing daily trading volumes approaching $1 billion .

The DYDX, governance and rewards token

On September 8, 2021, dYdX launched its governance token: the DYDX . In addition to offering governance power over the platform’s strategic decisions, this token plays the role of a true cornerstone. DYDX token holders get discounts on their trading fees, ranging from 3% for 100 DYDX , up to 50% for 5 million DYDX held.

In addition, by holding dYdX tokens, the platform also makes it possible to increase these monthly staking reward bonuses . From 100 DYDX, the rewards are boosted by 13.69% and it can exceed 80% for an amount of 1 million DYDX, as shown in the figure below.

Additionally, dYdX rewards users for their trading activity above $100,000 in volume. In total, tokenomics allocates 25% of the initial supply of DYDX tokens as rewards to traders , or 250 million tokens. These are distributed in batches of 3.8 million tokens every month. At the current price of the token, this would cover 80 to 120% of the platform’s costs.

At the time of writing, the DYDX token is trading for $1.26. Its market capitalization reaches $158 million, placing it 138th in the ranking of the most capitalized cryptocurrencies .

How to trade cryptocurrencies on dYdX?

Now that we have presented the dYdX platform, it’s time to go into detail and explain how to use it. Specifically, we are going to look at how to deposit funds and trade in dYdX perpetual markets.

Deposit funds on dYdX

dYdX allows you to buy cryptocurrencies directly from its platform. However, you will first have to deposit funds in your wallet. To do this, it will be necessary to connect your favorite digital wallet to the protocol (MetaMask, for example).

If you do not yet have a Metamask wallet, find our complete tutorial allowing you to install and use it . If this is your first connection to dYdX, you will need to verify that you are indeed the owner of this wallet by signing an initial approval transaction.

Then a window will open offering you to immediately deposit funds . You have the choice between several cryptocurrencies , including USDC, USDT, DAI or WETH. If this is not your first login, then you simply need to click on the “ Wallet ” tab then “ Deposit ” .

Likewise, if this is your first time interacting with a cryptocurrency on dYdX, you will need to authorize trading by signing an approval transaction with your wallet. Once this is done, and you have confirmed the deposit and validate the transaction on MetaMask.

Note that your deposit fees are waived if the amount is over $500. In addition, the few gas costs linked to the transaction are fully covered by dYdX , insofar as a deposit is made every three days.

Trader on the Perpetual market

Once your account is funded, all dYdX trading features are available to you. As of this writing, there are 37 cryptocurrency pairs available for trading . Among these, we obviously find Bitcoin (BTC), Ether (ETH) but also Solana (SOL) or Polygon (MATIC).

In order to trade on dYdX, all you have to do is choose the pair you are interested in. In the example below, we have selected the ETH/USD pair. First, three position opening options are available to you: Limit , Market or Stop . Then, you will have to select the dollar amount you want to spend, then click on Buy or Sell depending on your intentions.

The Limit function allows you to select the exact price at which you want to buy the asset in question. The Market function immediately triggers your purchase at the market price the instant you click. As for the Stop function , this one is a bit more complex.

You can choose Stop Limit , which allows you to set a price at which your Limit buy order is added to the order book. For example, if the price of Ether is at $1300, you can place a trigger price at $1250 and a buy price (or limit price on the platform) at $1225.

For the Stop Market functionality , the principle is the same except that the buy price is not chosen, it is at the market level when the trigger price is crossed. Finally, you can place take profit orders that work exactly the same way, but for sale: Take profit Limit and Take profit Market .

Note that you are exempt from trading fees on your first $100,000 in monthly volume. To take advantage of this, join dYdX and start trading by clicking the button below:

How to save your cryptocurrencies (staking) on dYdX?

The dYdX platform offers the possibility of staking cryptocurrencies in order to access several benefits. This makes it possible to generate interest, to participate in the governance of the protocol but also to recover part of its trading costs.

It should be noted that this staking system is based on 28-day periods, also called Epoch. Rewards are calculated based on how much USDC each holds relative to other users in the liquidity pool. For example, as of this writing, this one contains $81 million USDC.

Concretely, your reward will be calculated as follows: 0.17 DYDX (at the time of writing these lines) per day and for 1000 USDC deposited in staking. This therefore represents a return of 6.2% per year , excluding compound interest. Note, however, that this value varies depending on the amount deposited in the liquidity pool .

In order to stake your cryptocurrencies, start by clicking on the Governance button .

This is where your dashboard appears. You will need to click on the Stake tab in order to save your USDC into the liquidity pool . Choose the amount you wish to allocate and click on validate. Here you are, you have saved your cryptocurrencies on the dYdX protocol.

dYdX Staking Option and USDC Liquidity Pool

For information, in order to withdraw your USDC from the liquidity pool, you will have to claim it 14 days before the end of each Epoch. This period is called a blackout window, and therefore prevents you from withdrawing your funds during it. To start staking your cryptocurrencies, join dYdX by clicking on the link below:

Win prizes with weekly and daily competitions

The trading rewards distributed by dYdX

The dYdX platform also allows you to generate rewards based on your trading activity . The higher your activity volume and fees spent, the more chance you have of winning DYDX tokens. Each Epoch is rewarded with 3.8 million DYDX, or approximately $4.75 million at the time of writing this article. You will share this amount with other users, in proportion to your activity on dYdX.

You can track the progress of your rewards in the Rewards tab of dYdX. DYDX tokens earned through the trading rewards option will be transferable at the end of each Epoch. However, you will have to wait about 7 days after the end of the Epoch to claim your tokens.

dYdX competitions

One of dYdX’s most popular features is the trading league . This one-of-a-kind product adds a gaming dimension to trading on the platform. To get there, simply click on the Competition tab in your dYdX app.

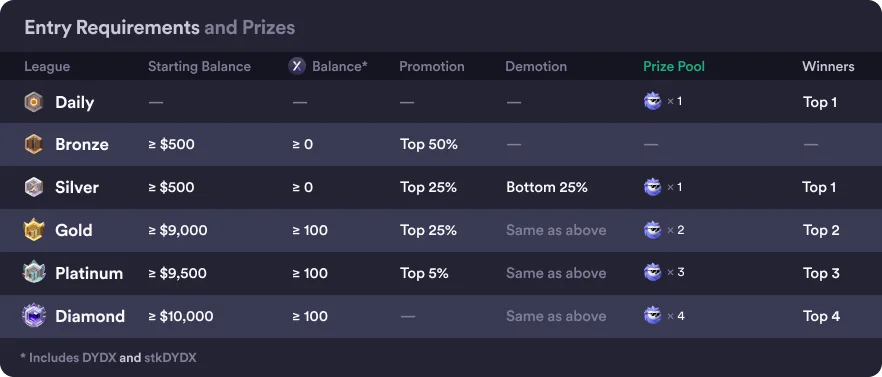

Specifically, traders compete on a weekly basis . Each week is a new season, with the possibility of being promoted or demoted at the end of it depending on his performance. Here are the entry requirements for each league and the potential associated rewards:

Different levels of dYdX trading leagues and eligibility requirements

Note that the competitions start every Tuesday around 5 p.m. Prizes are distributed at the end of each season, directly to your dYdX wallet. To win, it is not enough to have generated the most earnings, but rather the largest percentage of profits . This puts all traders on an equal footing, no matter how much money is held in their portfolios.

In parallel, dYdX also organizes daily competitions , totally independent. These distribute rewards to the best traders of the day, namely those who have printed the best profit percentages. Among the possible wins is one of dYdX’s 4,200 NFTs , whose prizes reach several thousand euros.

Our opinion on dYdX and its ecosystem

Undeniably, the dYdX platform seems to be appreciated by traders , as evidenced by the higher trading volumes than its main competitor, Uniswap. Although still far behind the centralized behemoths Binance and FTX, dYdX has still been able to capture significant market share in recent months.

Indeed, with the regulation of the industry fast approaching, more and more investors are leaning towards solutions without KYC , that is to say which do not ask to reveal their identity. The dYdX platform is one of them, since the only entry requirement is to hold a digital wallet.

Generally speaking, the platform fees are relatively low . Regarding deposits and withdrawals, they are non-existent if we neglect the gas costs linked to the blockchain. About the perpetual market, transaction fees are only 0.05% for Makers and 0.10% for Takers .

Note also that it is possible to significantly reduce its transaction costs, from 3% to 50% depending on the quantity of DYDX tokens held . Another important information, the first $100,000 of monthly volumes are exempt from transaction fees , regardless of the size of your portfolio.

In addition, the platform is fully available in French , which will remove an accessibility barrier that exists with many competing exchanges. In short, the platform is very complete and has many advanced features. If you are familiar with the world of cryptocurrencies, then dYdX will satisfy you .