What to expect from the Bitcoin (BTC) price for 2022? Although it is difficult to predict future market movements, let’s take a look at the context bequeathed to us by the year 2021 in order to adopt a global vision of market dynamics.

An uncertain start to the year for Bitcoin

How many see the start of 2022 as a wet firecracker for the cryptocurrency market?

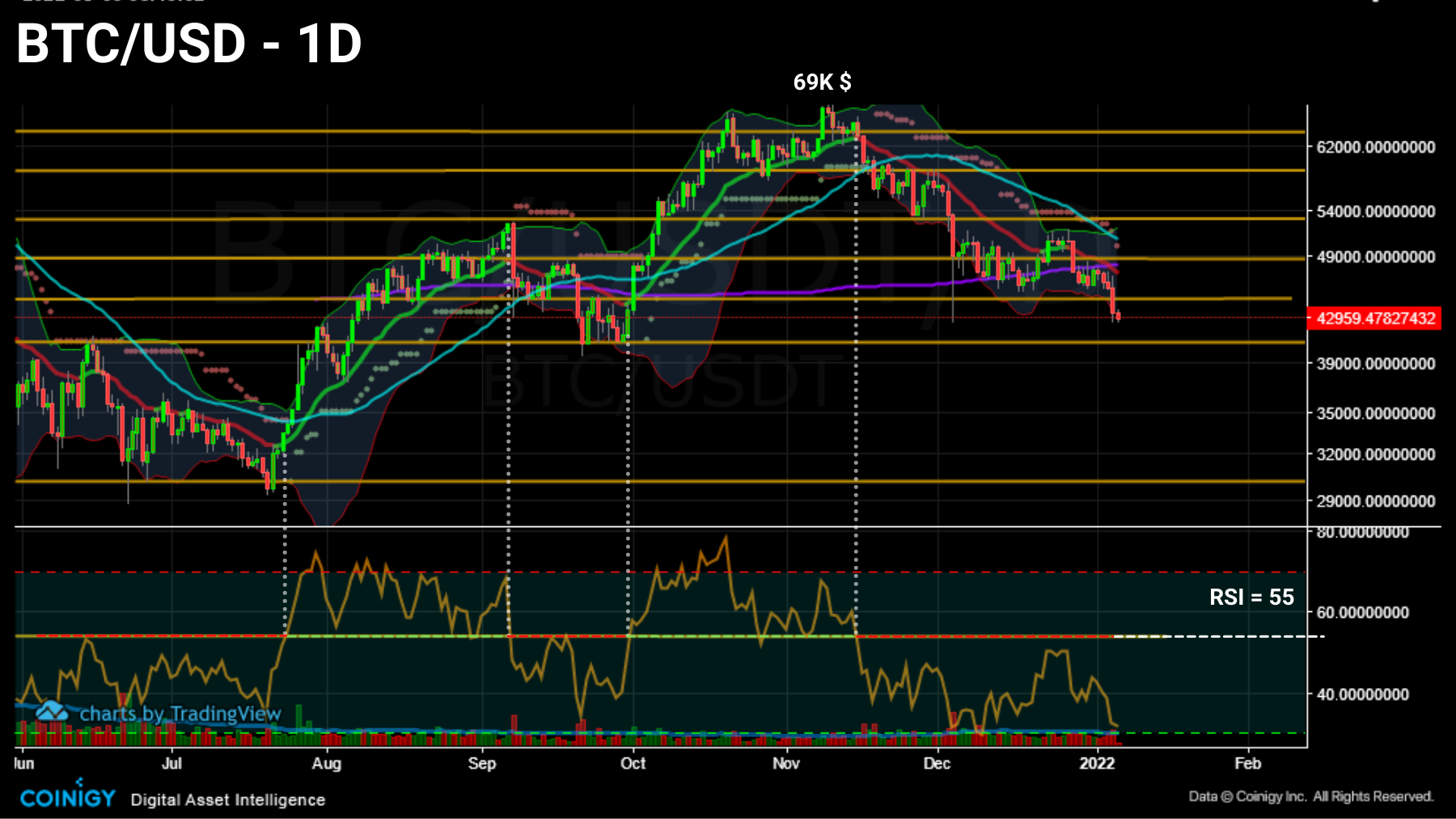

Bitcoin, having just broken the $ 46,500 support, is performing less well than expected, a fact interpreted by many analysts as a sign of market weakness .

Daily Bitcoin Price Chart (BTC) – Source: Coinigy

Flirting with the $ 43,000 following a new wave of long sell-offs , the short-term bitcoin (BTC) price action may cast doubt on many.

What to expect from this indecisive and erratic price action? While it is difficult to predict future market movements, we can at the very least study the context in which bitcoin (BTC) stands in order to take a holistic view of market dynamics.

In order to better understand the behavior of the Bitcoin network and its native BTC token at the start of the year, let’s review the evolution of the state of profitability of spending and the maturation of BTC tokens , before taking the pulse. of vital signs of the network in a future publication.

Profitability dynamics of spending

Let us begin our study by observing the profits and losses made on the chain over the last few months.

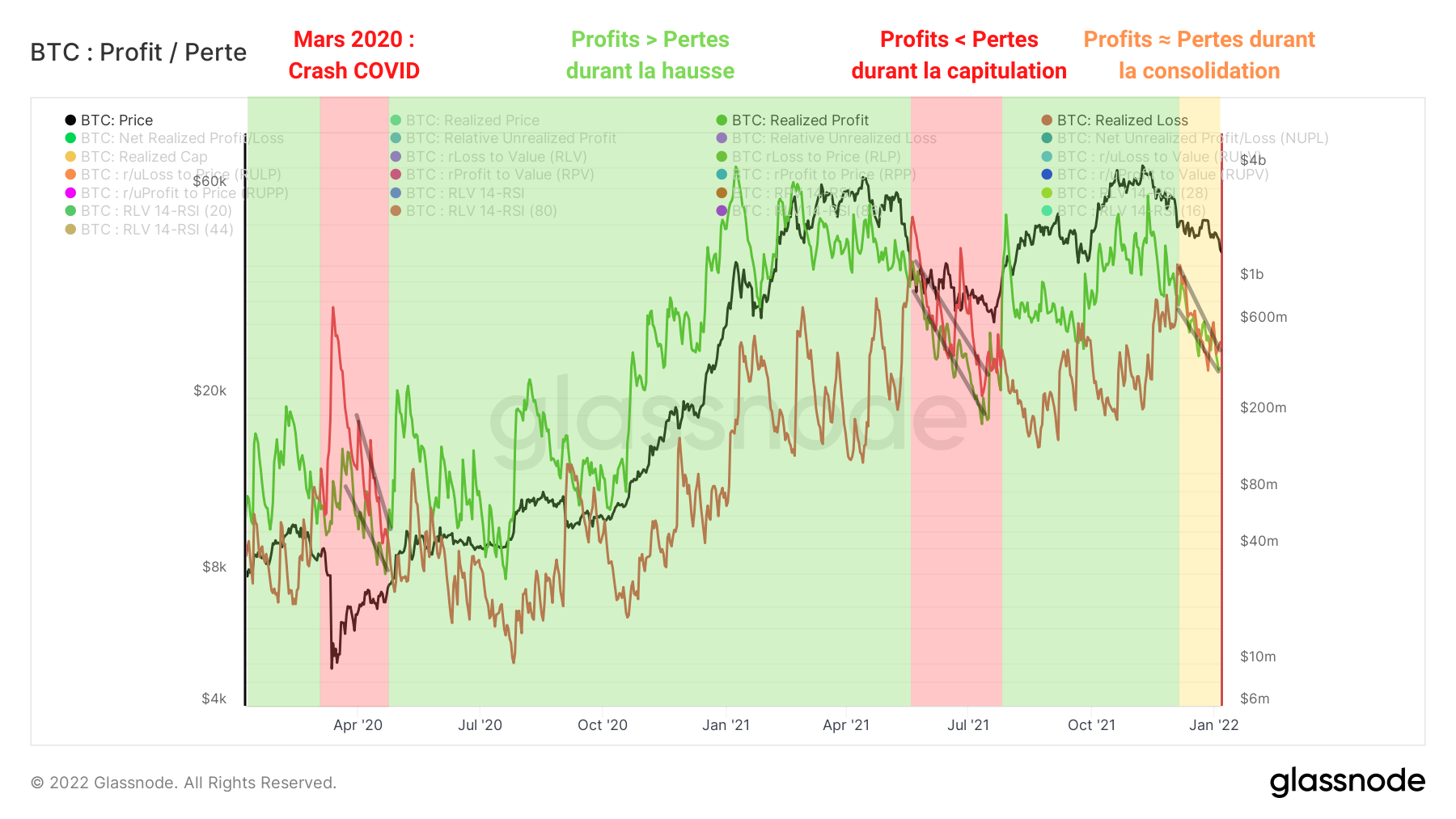

Reflecting the spending behavior of participants, the graph below represents the evolution of successful (green) and unsuccessful (red) spending over time.

Bitcoin realized profit and loss graph (BTC) – Source: Glassnode

We can identify several distinct periods in the years 2020 and 2021.

March to April 2020 : Following announcements of a pandemic, markets panic and drag BTC into their downfall . The losses greatly exceed the gains and many participants give up their chips to strong hands (LTH) by selling at a loss.

From May 2020 to April 2021 : BTC breaks free from its old ATH ($ 20,000) and begins a powerful upward phase . Realized gains accelerate and then far exceed realized losses while LTHs realize part of their profits.

May to mid-July 2021 : Demand is no longer sufficient to support strong hands selling pressure . A major event known as the ‘Great Migration’ is causing market participants to panic. Strong bearish volatility sets in and forces some players to take losses as the market capitulates and then consolidates at the $ 30,000 level.

August to December 2021 : The market resumes its rise, forming curved highs similar to the April market top. A period of moderate profit-taking sets in as BTC forms a new high near $ 69,000.

From December 2021 to the beginning of January 2022 : Following a cascade of liquidations resulting from the derivative markets, the market corrects and begins a range between $ 52,000 and $ 46,500 . Profits and losses are converging on the downside, a sign that the market has not yet made a decision on the trend to follow.

Highlighting these periods makes it possible to gauge the state of profitability of the market at time t and thus identify buying or selling opportunities.

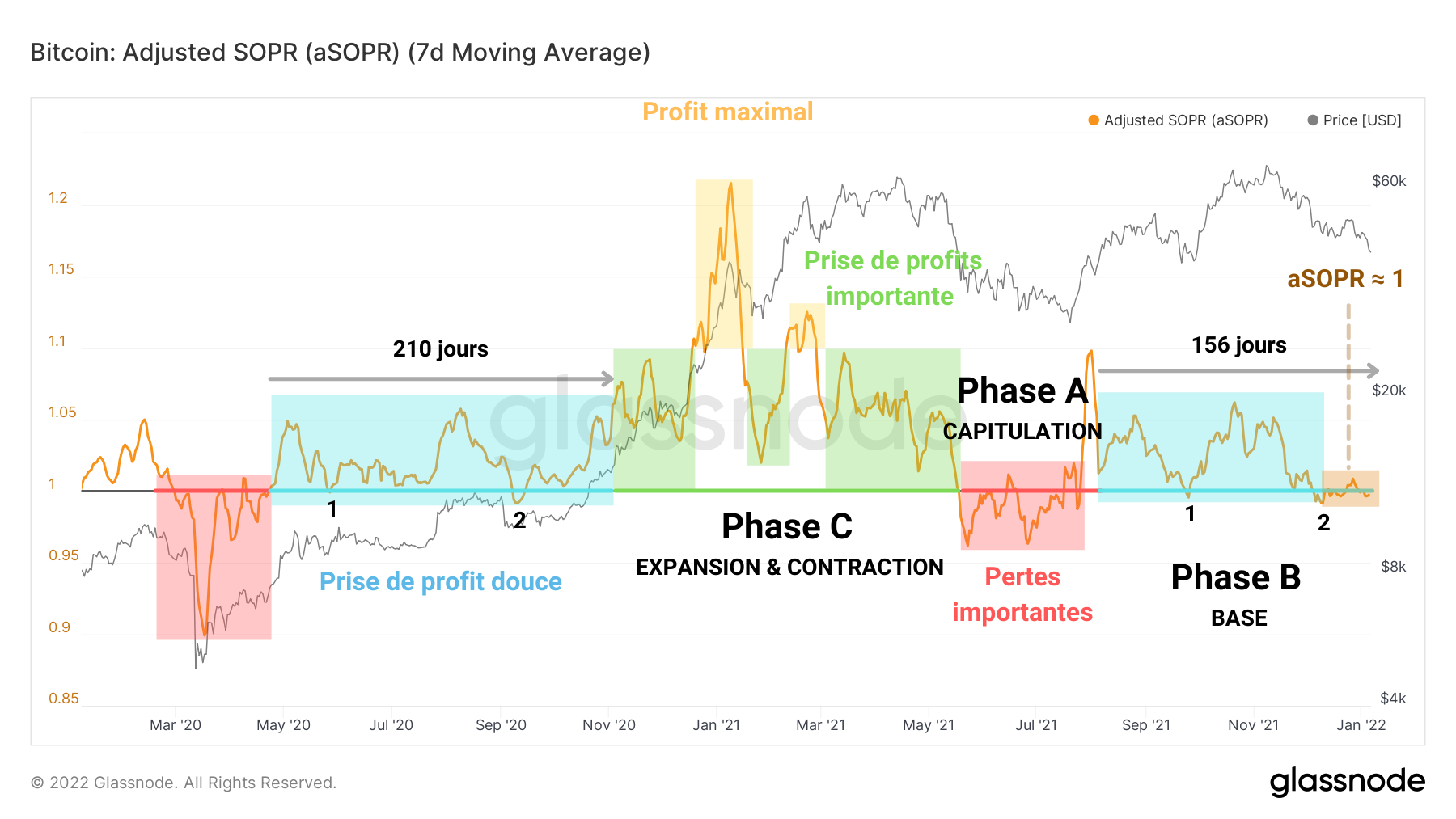

By dividing the realized value of a UTxO when it is destroyed by the value at its creation, the aSOPR pushes the research further by allowing us to quantify the state of profitability of the tokens deposited over a given time.

Bitcoin (BTC) aSOPR chart – Source: Glassnode

This ratio separates the periods observed above into three phases.

Phase A – Surrender : Tokens are sold below their base cost (aSOPR> 1) , large losses are made (red) as the price of BTC falls.

Phase B – Base : Neutral (aSOPR ≈ 1) or moderately profitable (blue) expenses . This period precedes strong bullish impulses and euphoria phases.

Phase C – Expansion and Contractio n: The market accelerates upward as participants make increasing gains (green) until maximum profit taking (yellow). Profitability decreases, which can lead the market to capitulate.

Having formed a base for three weeks, aSOPR prints values close to 1, a sign that the tokens sold are very close to their base cost.

For a healthy rise to be built, it would be ideal to see aSOPR break out of its zone of neutrality to test it as a support, in order to start a phase C.

Otherwise, aSOPR could dip below 1, which should act as resistance if the market capitulates.

The study of the realized losses indicates to us that a strong period of negative profitability is not to be ruled out.

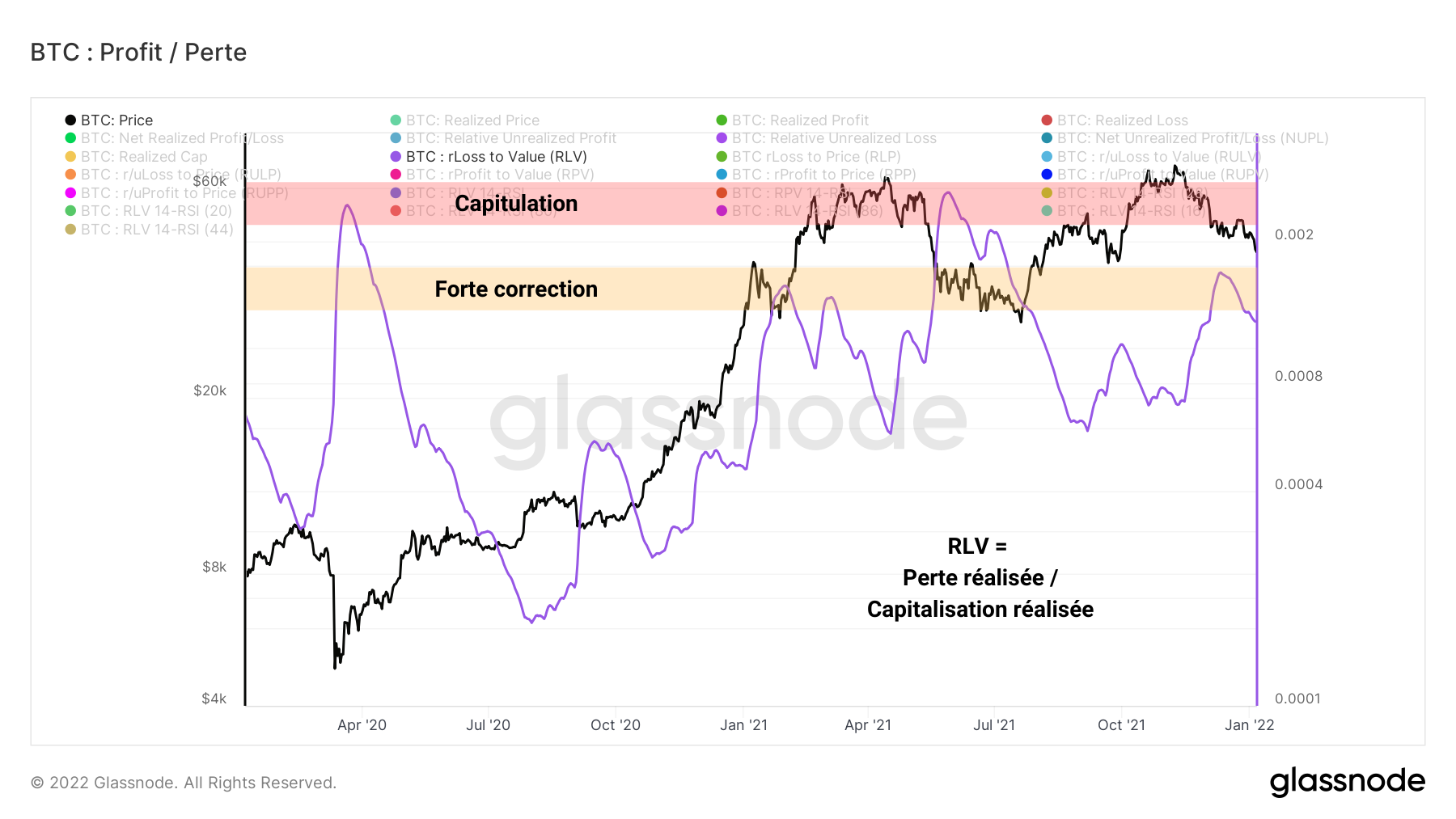

Bitcoin RLV (BTC) ratio chart – Source: Glassnode

Following our observations of December 17 , the RLV ratio , weighting the losses realized by the realized market value, indicates that the pain suffered by investors is less substantial than during the capitulation events of March 2020 and May 2021.

We will therefore have to be careful not to see this ratio grow over the next few weeks if we hope for a resumption of the rise in the price of BTC.

Maturation dynamics of BTC tokens

Regarding the maturation of tokens, the last few months have provided us with a classic case study that we will review together.

When a UTXO is created, it accumulates what are known as Token Days (DD) as it ages and matures. When this UTXO is spent, its JJ count is destroyed and reset to zero. This is called rejuvenation .

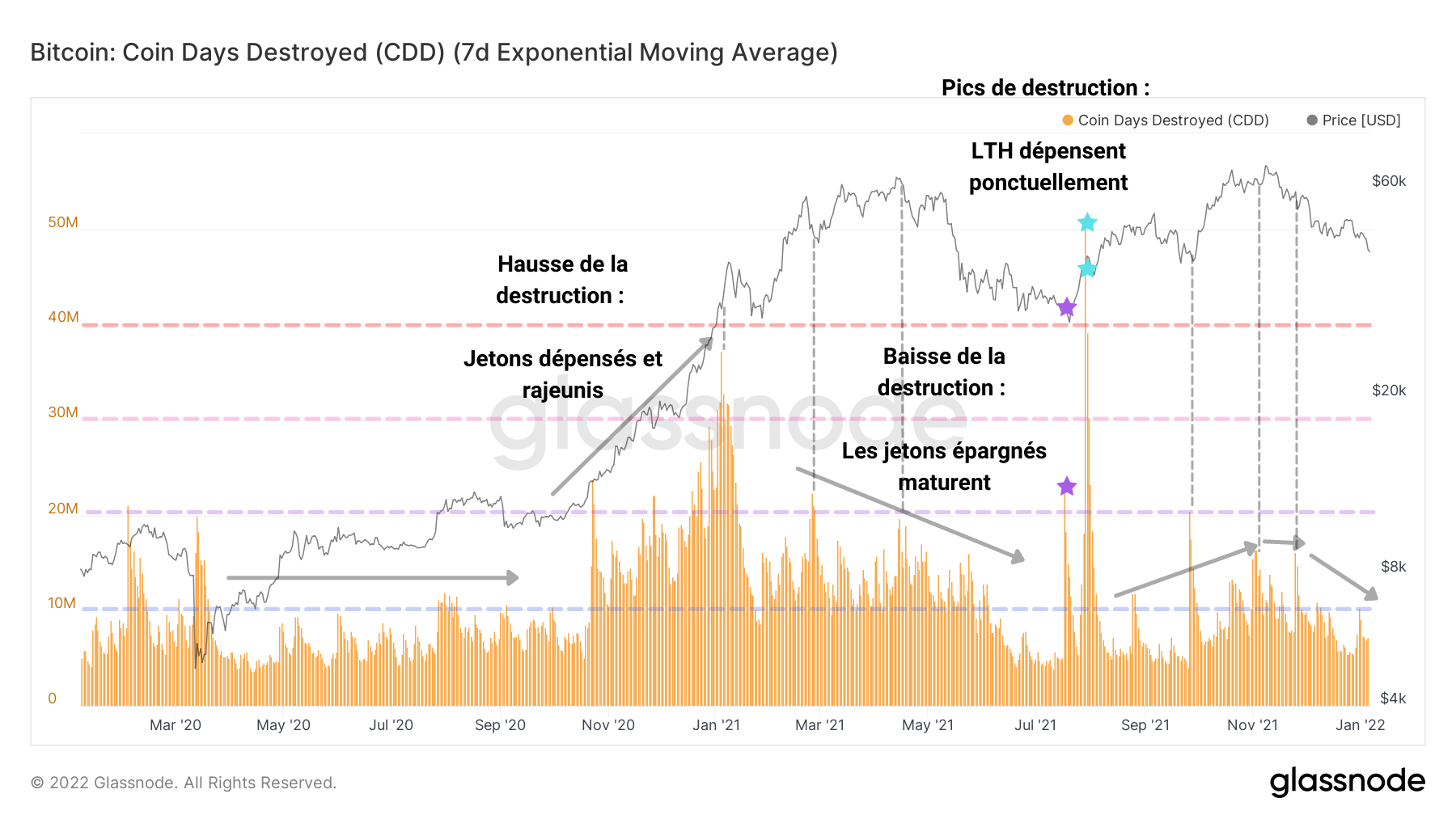

The graph below shows the evolution of the count of days of tokens destroyed (DDD) over a given period.

Following a phase of destruction indicating a coordinated spending of old tokens at the end of 2020, the market has seen two declines in the JJD account, a sign that the tokens are remaining dormant and maturing.

Bitcoin (BTC) JJD Account Chart – Source: Glassnode

It appears that the phases of rejuvenation of old tokens coincide with the impression of new highs , with the increasing price prompting strong hands to realize the gains of their tokens dormant for several months, sometimes several years.

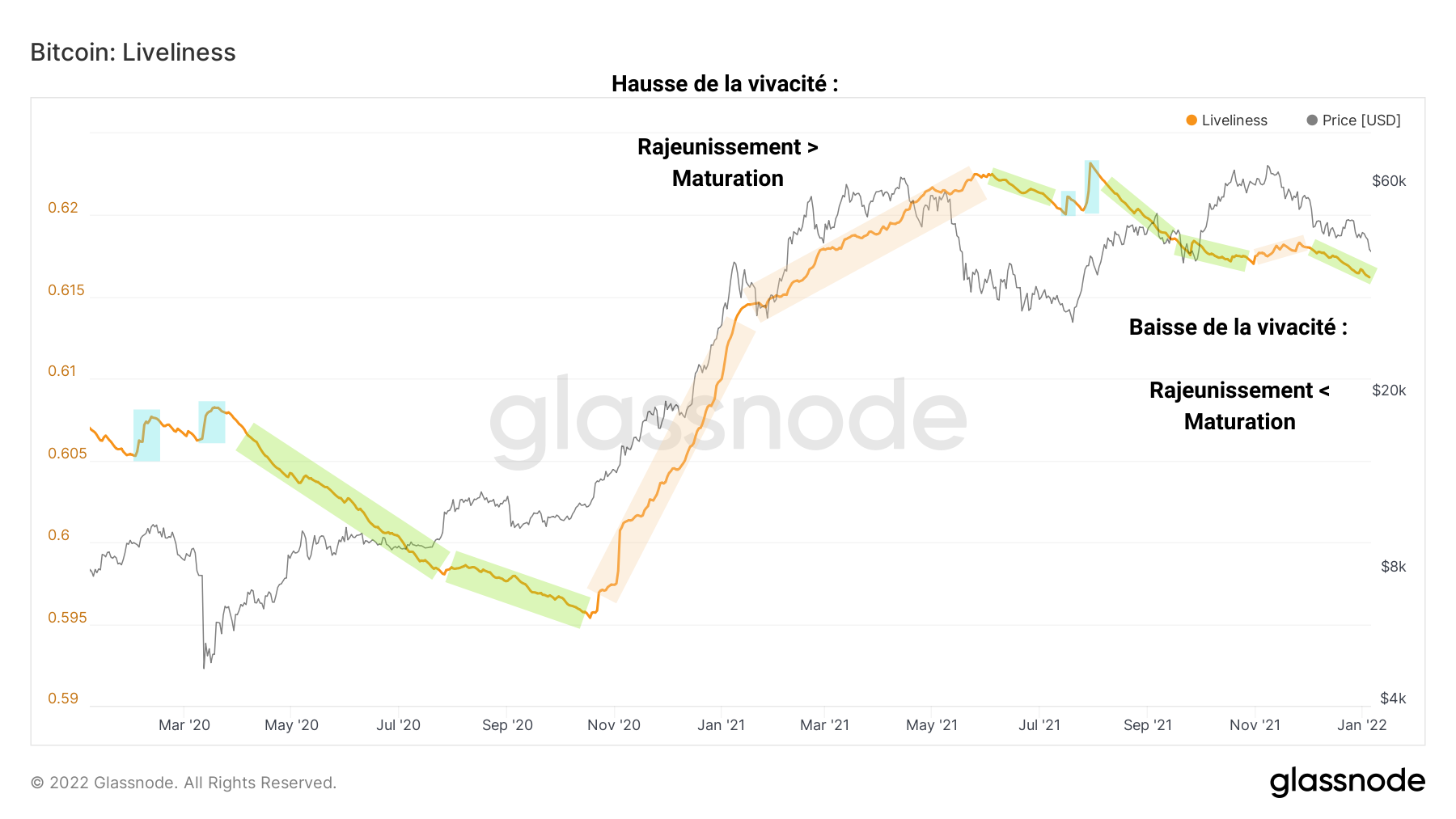

A step further, the liveliness allows us to understand how the JJD evolves vis-à-vis the JJ created by maturation.

This indicator, defined as the ratio between the DDs and the sum of the DDs that have never been created, makes it possible to define the rate of rejuvenation or maturation of the tokens.

Bitcoin Vividness Chart (BTC) – Source: Glassnode

Thus, from November 2020 to May 2021, rejuvenation (beige) takes precedence as the price of BTC rises and then slows down before correcting.

Several maturation periods (green) then begin during which most of the tokens present on the chain mature.

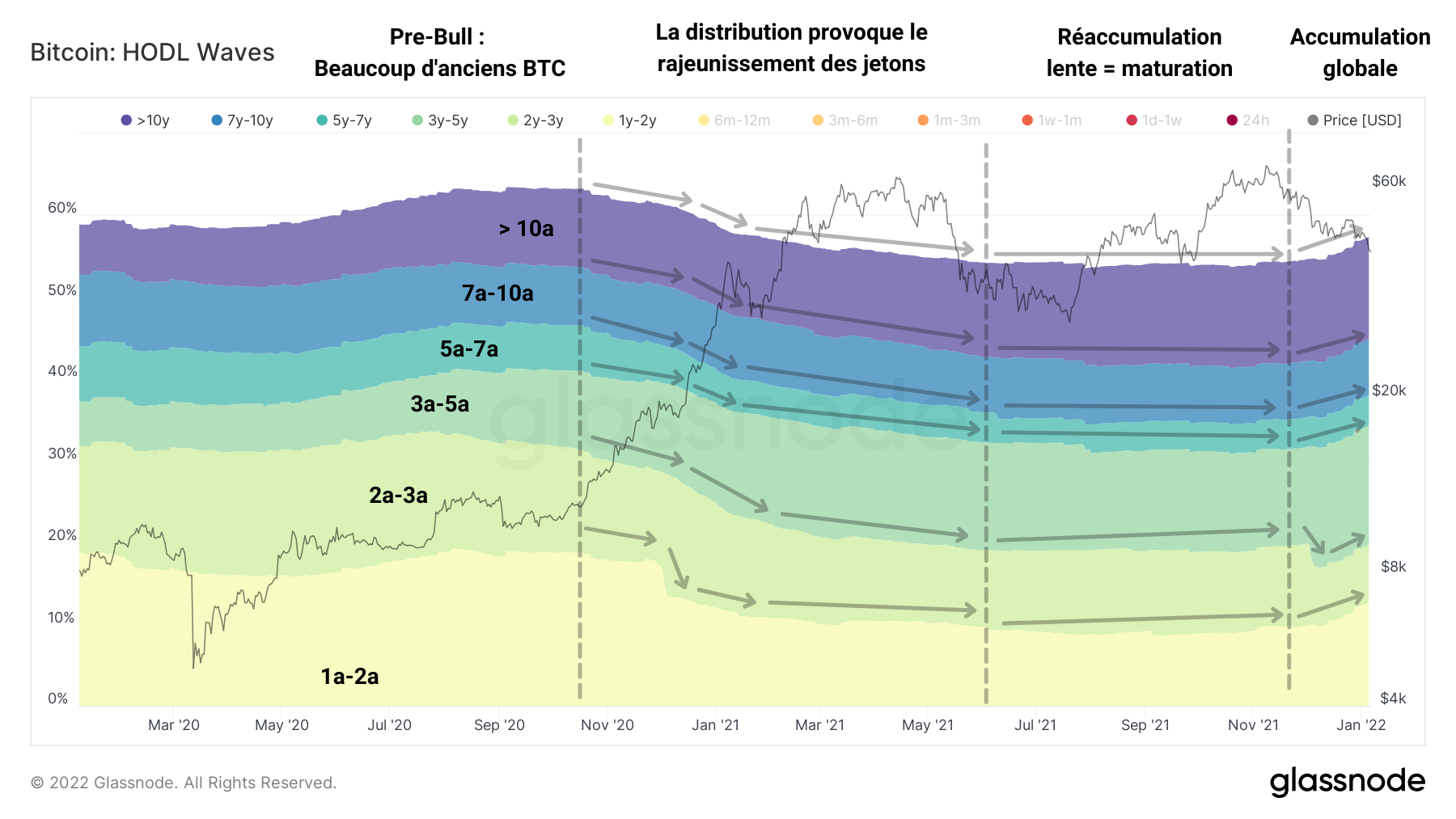

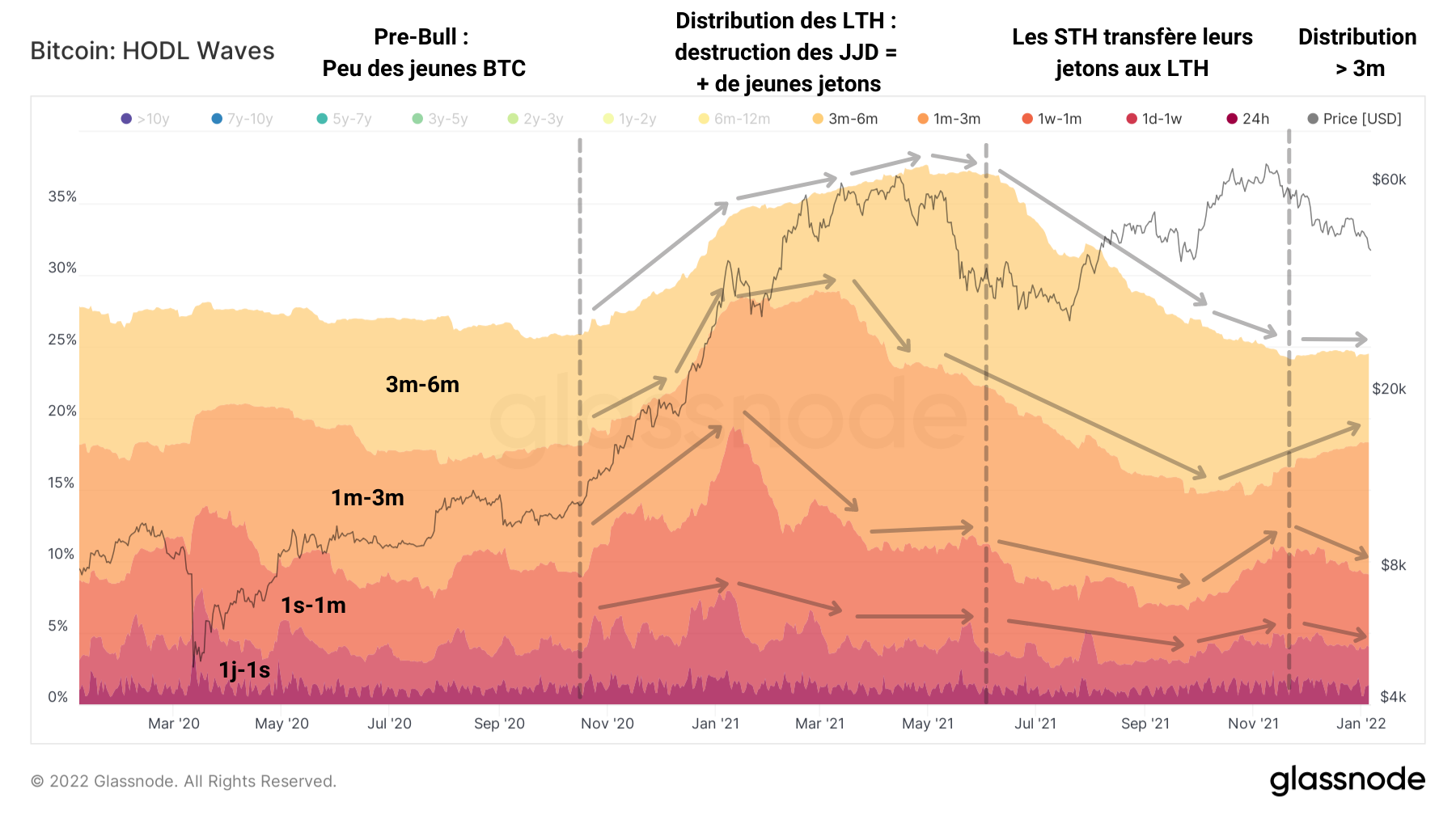

Moreover, these maturation / rejuvenation dynamics coincide with the periods of accumulation / distribution of the cohorts that we observe since the month of November, visible via the HODL waves.

This metric represents the age of all existing BTC tokens in the form of bands, which as they become more or less thick, form waves of identifiable trends.

Let’s split this metric into two here:

- On the one hand, tokens older than 6 months , in cool color, are held by LTHs and are less likely to be sold due to market pressure.

- On the other hand, tokens less than 6 years old , symbolizing STH with warm colors, are more sensitive to volatility and emotionality.

Here again, we can detect the behavior of long-term investors through the evolution of the age of the tokens.

Bitcoin (BTC) 6-month HODL wave chart – Source: Glassnode

From November 2020, HODL waves greater than 6 months have adopted a downward trend, a sign of the distribution of tokens from LTHs to STHs.

It is during this phase that the JJ count of BTC spent drops back to zero as strong hands make large profits.

During the May capitulation, these participants in the long-term view will then accumulate these same tokens given away at low prices by short-term traders who bought near the top.

Maturation begins again before a minority of LTHs sell their BTCs close to the new ATH in November.

However, this selling pressure is mitigated , given the fact that liveliness is declining, as indicated above.

The behavior of short-term investors, often at odds with that of LTHs, corroborates this fact.

Bitcoin (BTC) less than 6 months HODL wave chart – Source: Glassnode

Although the bands corresponding to tokens less than three months old are on the decline, the upper bands continue to grow, a sign that many tokens are maturing and crossing the age bands , evolving into increasingly cooler colors.

So after LTHs made some profits in November, STHs that bought tokens in the past three months joined in the selling pressure in December, along with speculators in the derivative markets.

Synthesis

Ultimately, it seems that the profits and losses overlap without a clear direction being quite validated. The state of profitability is at a standstill and will deserve special attention in the coming weeks.

Since December, a partial distribution has taken place without this dynamic affecting the greedy accumulation of participants from all cohorts. Despite unattractive price action, many are holding onto their chips and proving their conviction.