Bitcoin (BTC) is bouncing off $40,000.

After having rejected the support of 40,000 dollars three times , the price of bitcoin (BTC) will have to overcome numerous technical resistances before resuming a sustainable rise.

Currently on track to reclaim the 21st MA (red), BTC is still within an order correction of over 35% from the new ATH of $69,000.

Bitcoin (BTC) daily price chart – Source: Coinigy

Continuing our global study of market dynamics , today let’s add to our prism the state of health of the Bitcoin network as well as the behavior of exchange flows and their relationship with the price of BTC in order to take cognizance of a wide range of metric at the start of 2022.

Network health status

Let’s start by looking at how far the Bitcoin network has grown over the past few months.

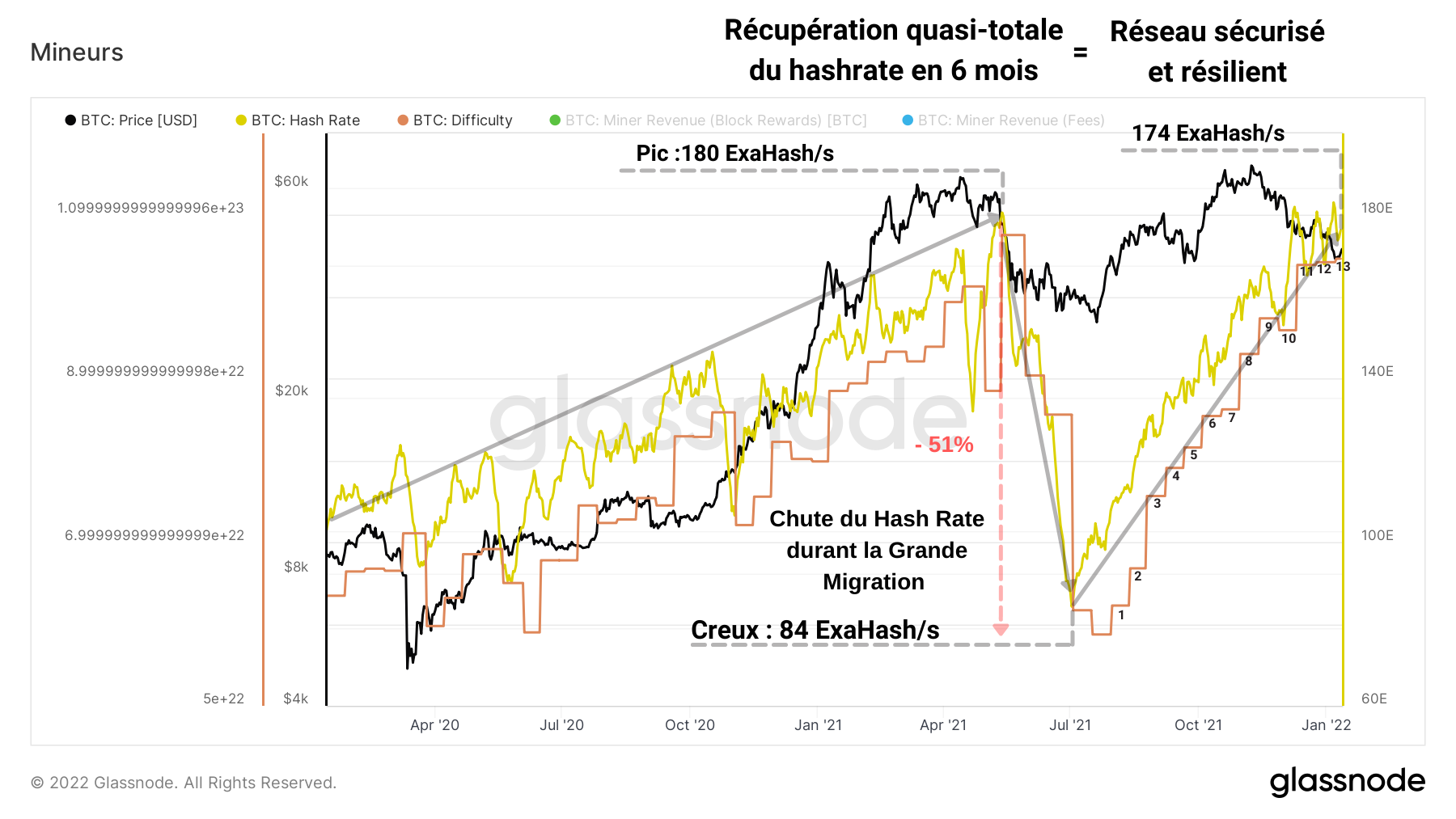

An essential network security parameter, the hash rate or ” hashrate “, the computing power needed to produce a new block, has continued to rise structurally since 2020 before plunging in May 2021.

This event, known as the “ Great Migration ” is due to the exodus of miners located in China.

Forced to disconnect their machines in search of a more lenient jurisdiction, these entities also had to liquidate part of their BTC in order to finance their relocation.

Bitcoin (BTC) hashrate chart – Source: Glassnode

Result: these miners, mostly resettled in Texas or Kazakhstan, caused by their displacement a 51% drop in hashrate.

However, it will take more to bring down the global distributed network that quickly recovered from this logistical attack.

Indeed, eight months and twelve positive mining difficulty adjustments later, the hashrate is approaching its ATH and once again demonstrating its resilience.

However, although miners are busy securing Bitcoin, one of the drivers of its adoption lies in the entry of new entities into the network.

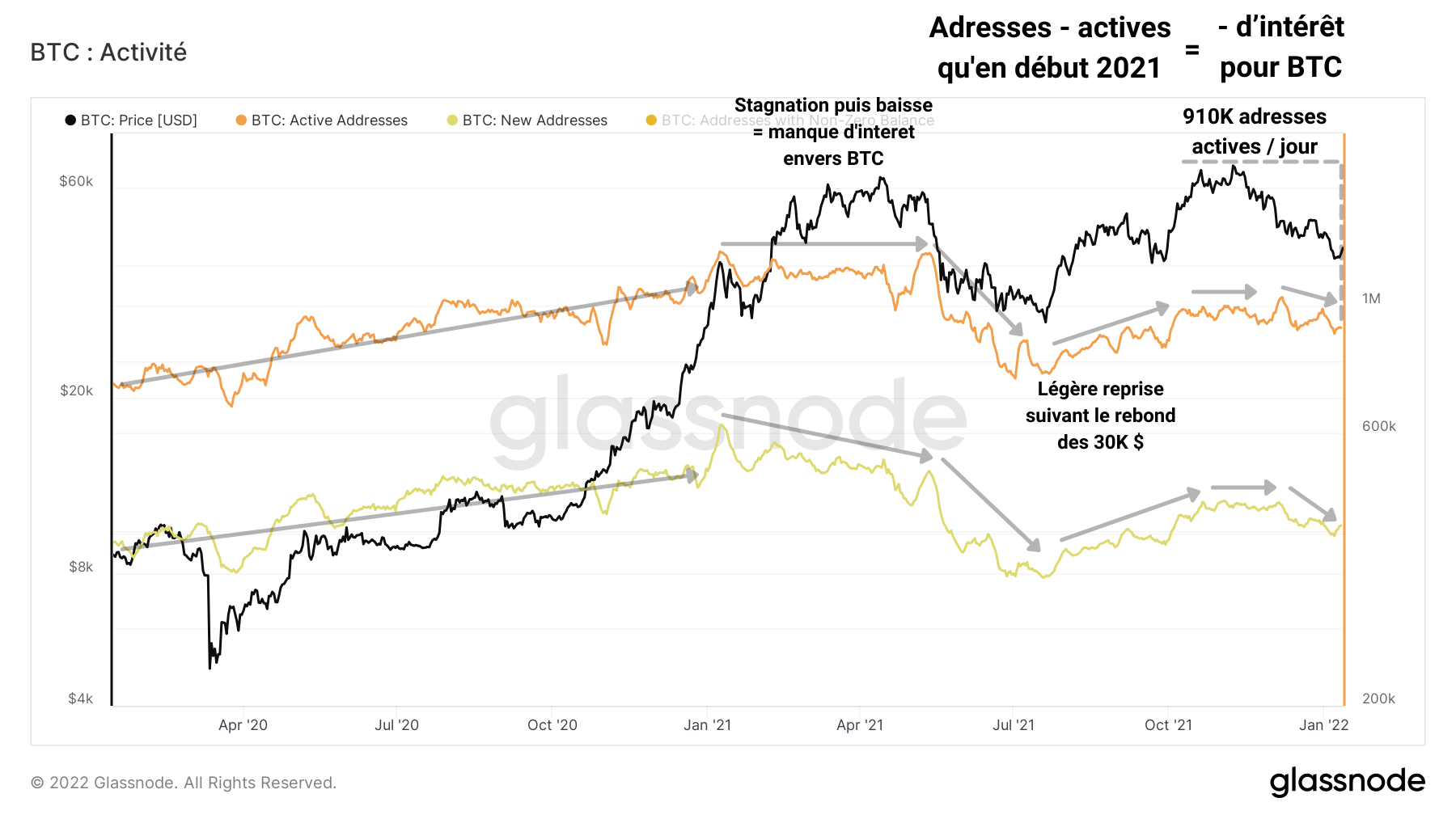

Using the number of active addresses and the number of new addresses created , we can obtain an acceptable proxy of the overall trend of participant engagement .

Bitcoin (BTC) Active Address Graph – Source: Glassnode

It seems then that the entry rate of new entrants has been falling since the capitulation in May. Ditto for pre-existing active addresses.

This indicates a lack of participant interest in bitcoin , a sign that 2021 has not been a particularly prolific year in terms of organic adoption.

However, we can qualify this statement by the fact that large companies such as MicroStrategy , Grayscale or nations such as El Salvador have nevertheless entered the market with the firm intention of remaining there.

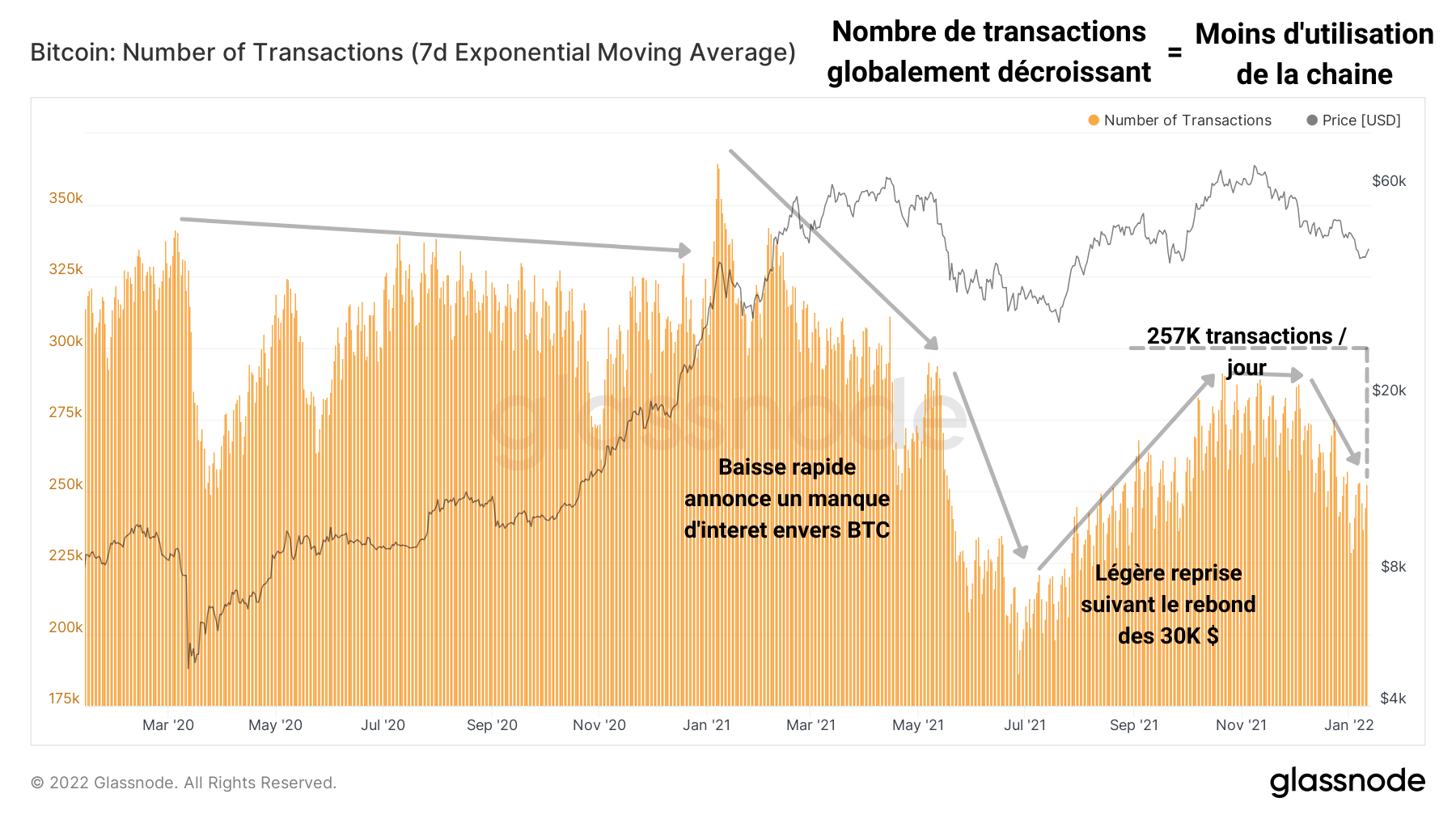

Corroborating this lack of interest, the number of transactions carried out on the chain has been in structural decline since the beginning of 2021.

Bitcoin (BTC) transaction count chart – Source: Glassnode

In addition to not experiencing significant growth, the network is also less and less used by participants already present in the market.

It is very likely that the capitulation of May has ejected many entities, which are not yet ready to return to the market.

The unprecedented price action of the year 2021, marking the introduction of curved highs and lows close to Wyckoff’s distribution and accumulation figures , has also played a major role in sowing doubt among some players, unaccustomed to such dynamics.

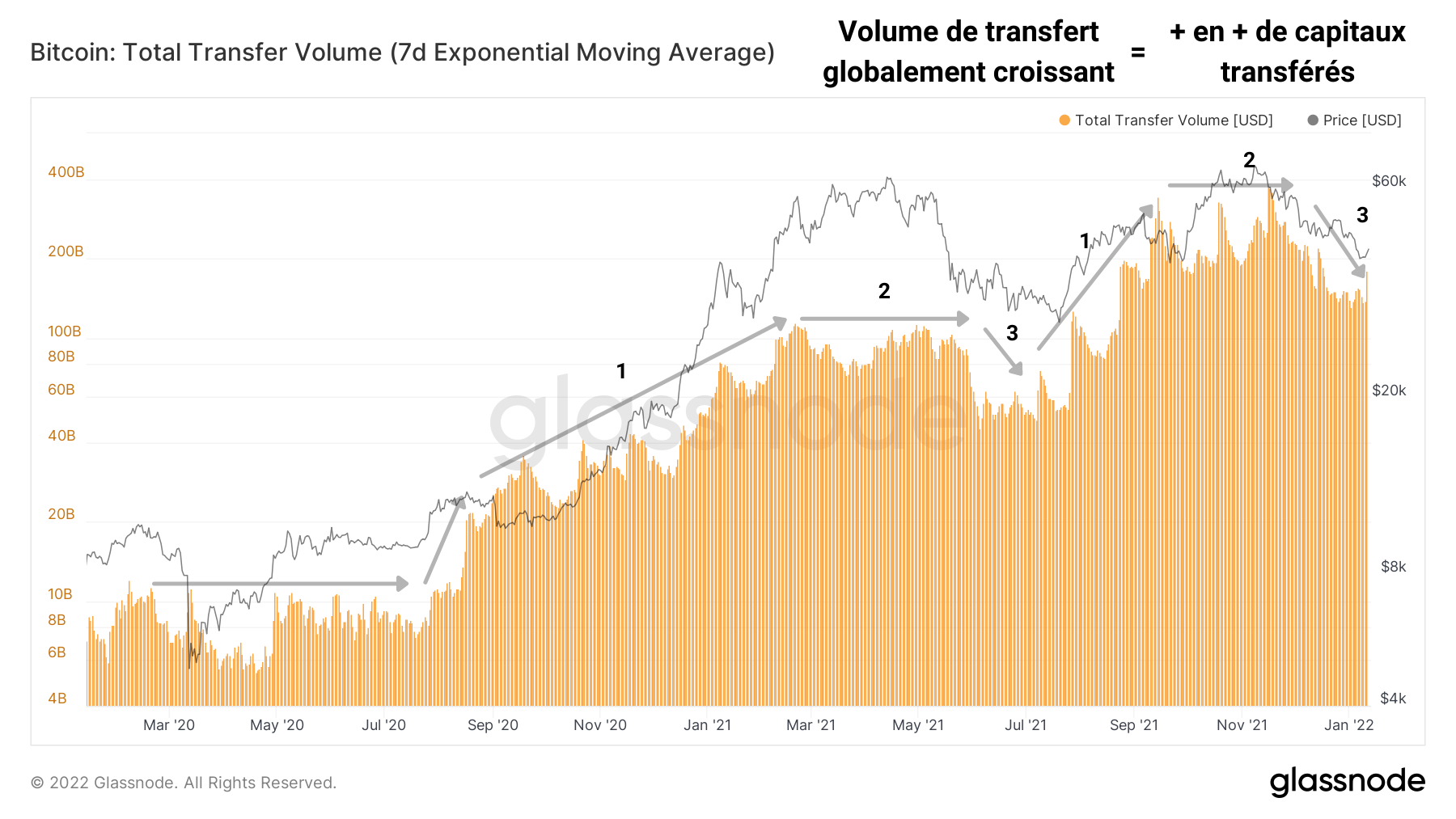

Yet, it seems that this lack of interest has not prevented the network from enabling the transfer of large volumes of capital. In fact, the increasing transfer volume tells us that more and more funds are being sent to the chain .

Bitcoin (BTC) Transfer Volume Chart – Source: Glassnode

So, although the number of incoming and active participants is low compared to previous cycles, the Bitcoin network experiences fewer, but larger transactions .