Table of Contents

Mark Yusko is very optimistic about the future of Bitcoin

Interviewed on CNBC, investor and managing director of Morgan Creek Capital Management Mark Yusko shared his positive predictions regarding the evolution of the price of Bitcoin for this year 2024.

According to him, BTC could fetch $150,000 on the one hand thanks to the next halving, but also thanks to the momentum of the various Bitcoin spot ETFs, with the giant BlackRock at the head of the pack.

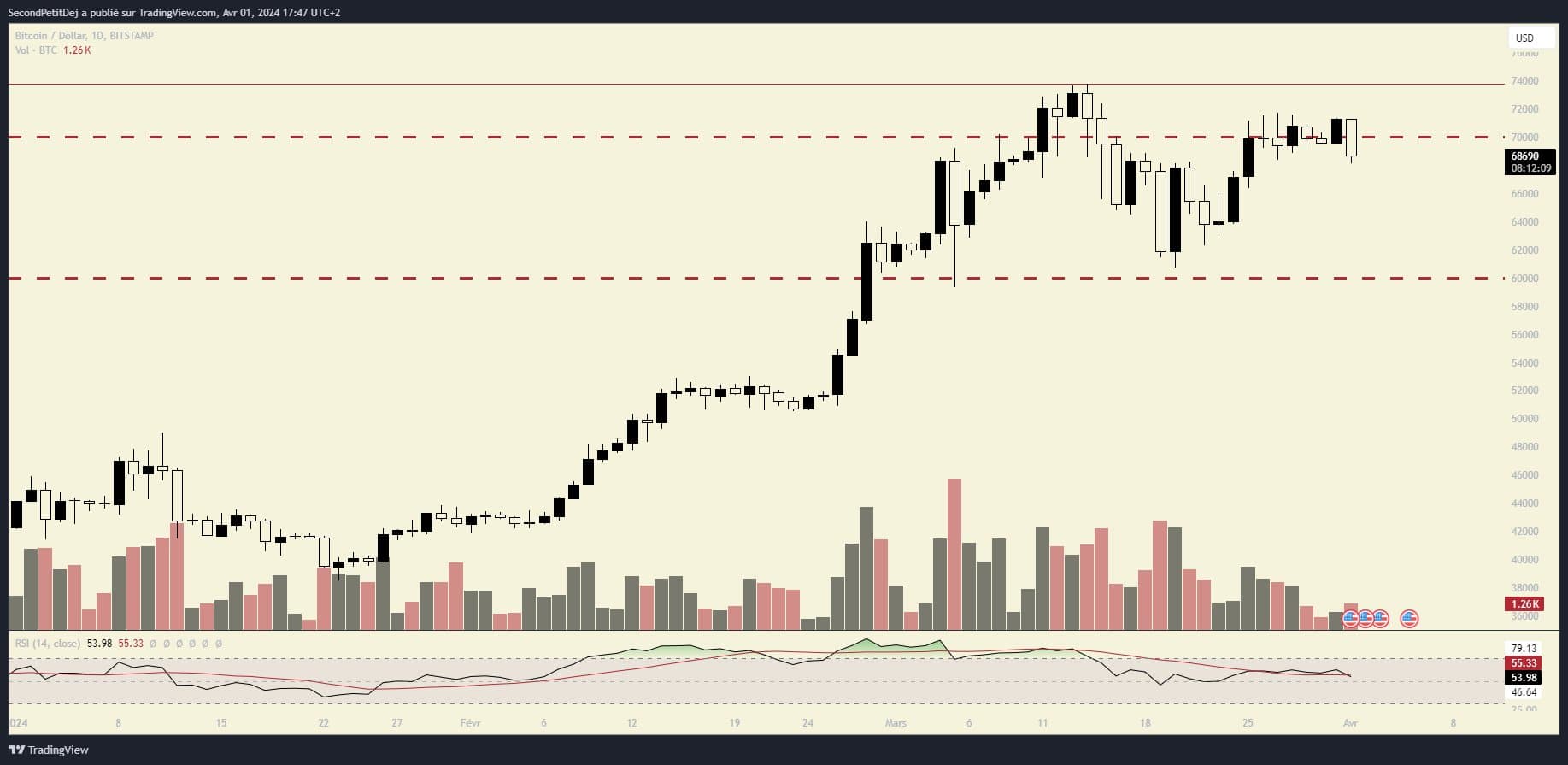

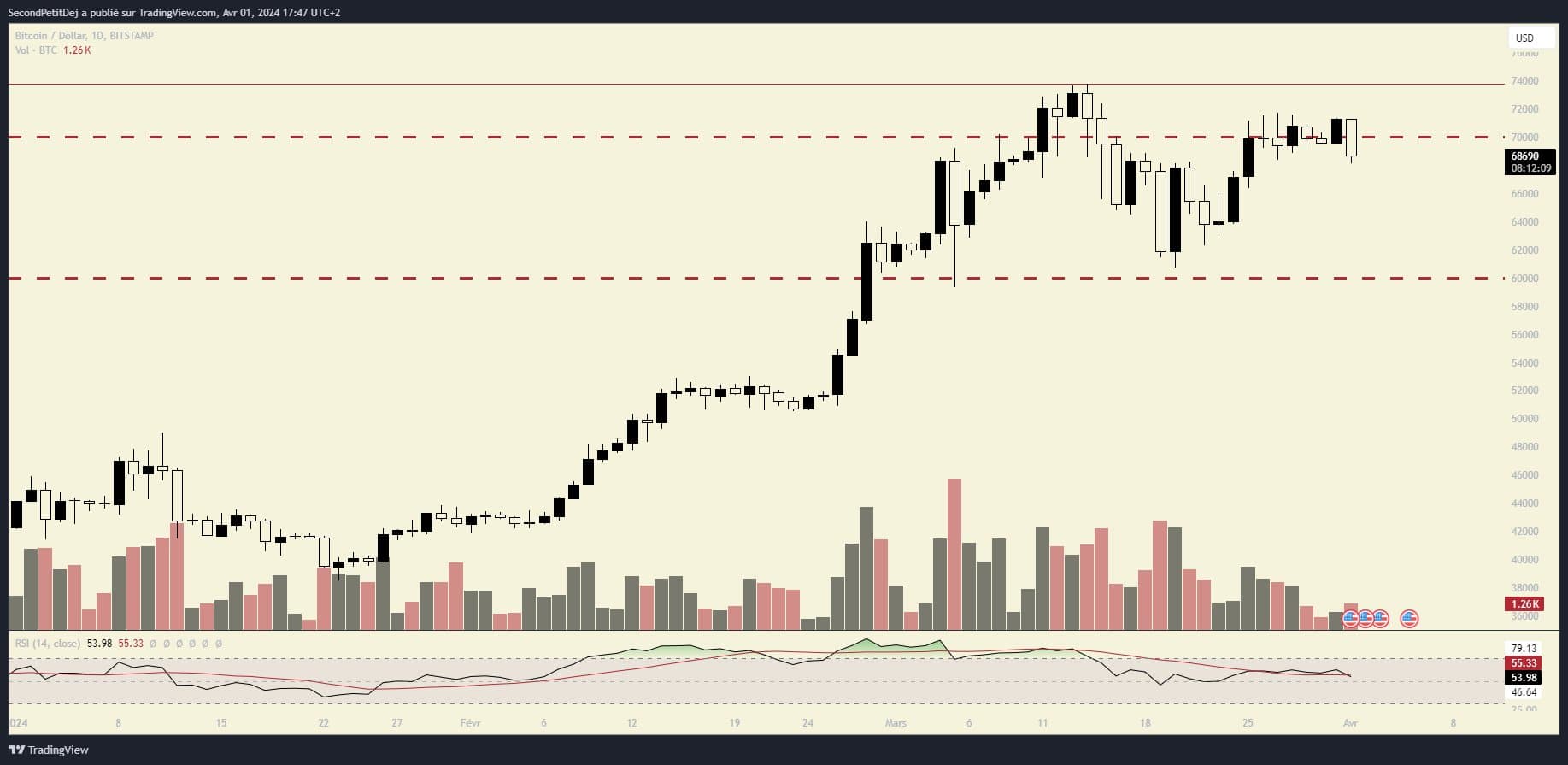

At the time of writing, Bitcoin is trading at around $68,700 . The king of cryptocurrencies is up more than 150% over the last 6 months, and it surpassed its previous all-time high of $69,044 by reaching $73,737 on March 14.

Evolution of the Bitcoin price since the start of 2024

According to the managing director of Morgan Creek Capital Management, an American investment management firm, Bitcoin has become a ” better form of gold “, and he says that investors should have at least between 1 and 3% of their portfolio allocated to BTC .

Historically pro Bitcoin, Mark Yusko had already declared in 2019 that one should “ take every chance to buy Bitcoin ”, and he affirmed in 2022 that all investors should have cryptocurrencies in their portfolio.

As part of his CNBC interview, the investor also said his company has exposure to shares of Coinbase , the largest cryptocurrency exchange in the United States. “ We think big things are in store for Coinbase, ” he said.

Listed on Nasdaq, Coinbase shares ($COIN) have gained 253% over the last 6 months, more than Bitcoin.Buy cryptos on eToroInvesting in cryptocurrencies is offered by eToro (Europe) Ltd as a PSAN registered with the AMF. Investing in cryptoassets is very volatile. There is no consumer protection. Investing is risky

Halving, the driving force behind the evolution of BTC for the year 2024?

The Bitcoin halving will now take place in less than 20 days . This quadrennial event, which aims to halve the issuance of BTC with each mined block, is expected to occur around April 19.

Historically, halving has always had a positive effect on the price of Bitcoin , in the more or less long term.

Thus, according to Mark Yusko, history should repeat itself with a surge in the price of Bitcoin by the end of the year . However, this increase should be followed by a bear market, according to the investor.

After the halving, you get a lot of interest in the asset, a lot of people enter out of fear of missing out, and we normally go up to about 2x fair value in the cycle. The big move happens after the halving. It starts to become more… parabolic towards the end of the year. And, historically, about 9 months after the halving, so somewhere around Thanksgiving, Christmas, we see the price peak before the next bear market.

A major event to be compared with the attraction of spot Bitcoin ETFs, launched last January and having met with great success with American investors. As of this writing, spot Bitcoin ETF issuers hold more than $59 billion in BTC, or more than 4.25% of the supply .Zengo: the ultra-secure mobile wallet for your cryptos

Sources : TradingView, CNBC