Last week of December: bitcoin (BTC) is still moving within its range while the derivatives markets are experiencing a resurgence of power that should not be overlooked. In addition, the commitment of participants to the chain is struggling to return to the levels established at the start of 2021. On-chain analysis of the situation.

Seventh low-range test for bitcoin (BTC)

Testing for a seventh time the low of the range between $ 52,000 and $ 46,500 , the price of bitcoin (BTC) rejects the 21 eMA daily and closes the 200 sMA daily.

Daily Bitcoin Price Chart (BTC) – Source: Coinigy

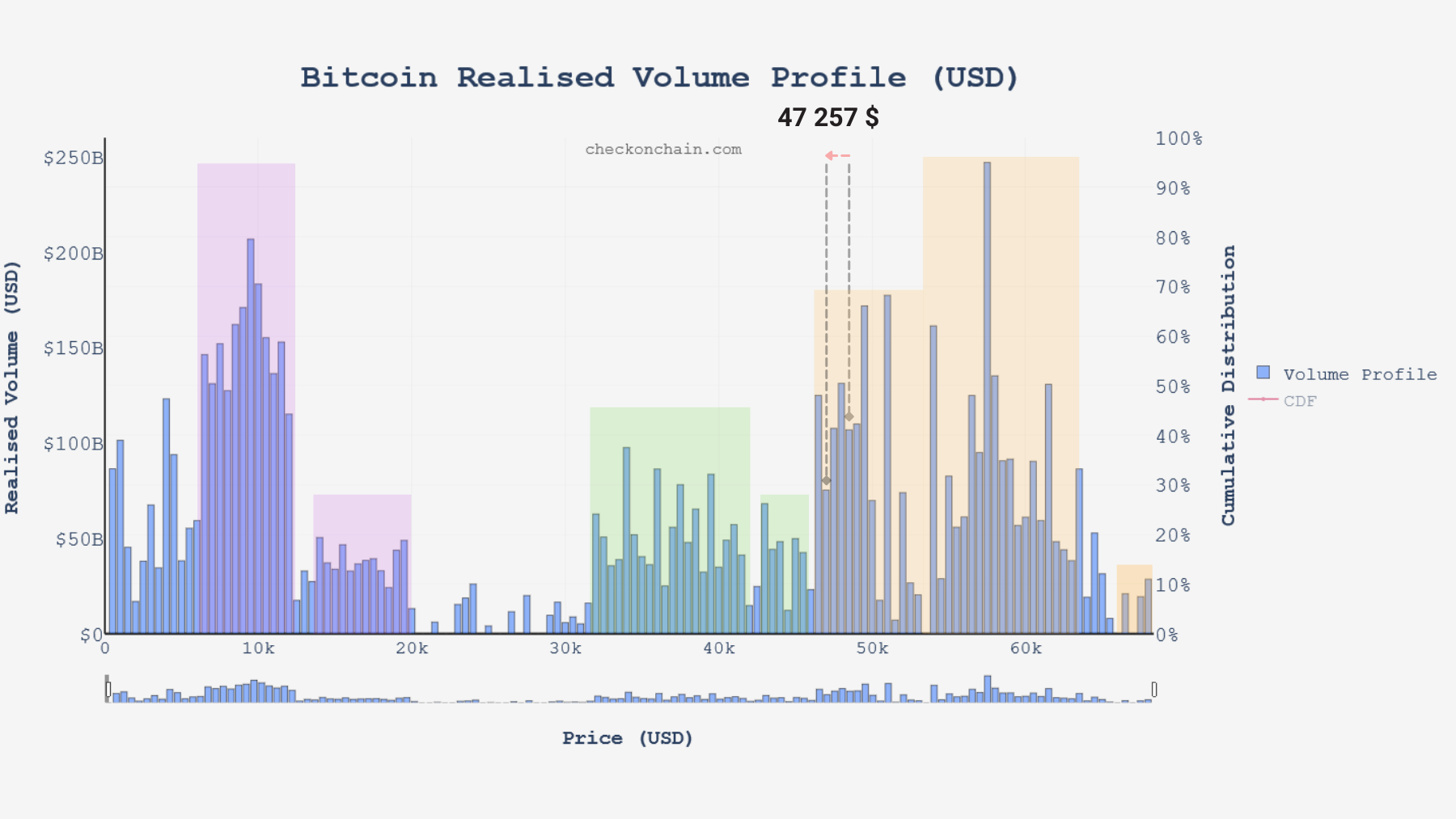

Bitcoin (BTC) is always moving in a moderately dense cluster of volume where the $ 50,000 zone serves as a threshold to be crossed in the short term.

Bitcoin Realized Volume Graph (BTC) – Source: checkonchain.com

This week, we analyze the upsurge in inflows on trading platforms before observing the rapid resumption of the influence of derivative markets on the price of BTC and the evolution of participant engagement throughout the period. year.

End-of-year deposits on exchanges

To begin with, note that Bitcoin (BTC) is advancing in a moderately dense cluster of volume where the $ 50,000 zone serves as a threshold to be crossed in the short term. since our finding on December 17th .

Although this may be a sign of caution from some investors, this micro-trend can also be explained by the propensity of a significant number of participants to sell some of their tokens in order to finance their expenses. year-end or to report losses for the following fiscal year.

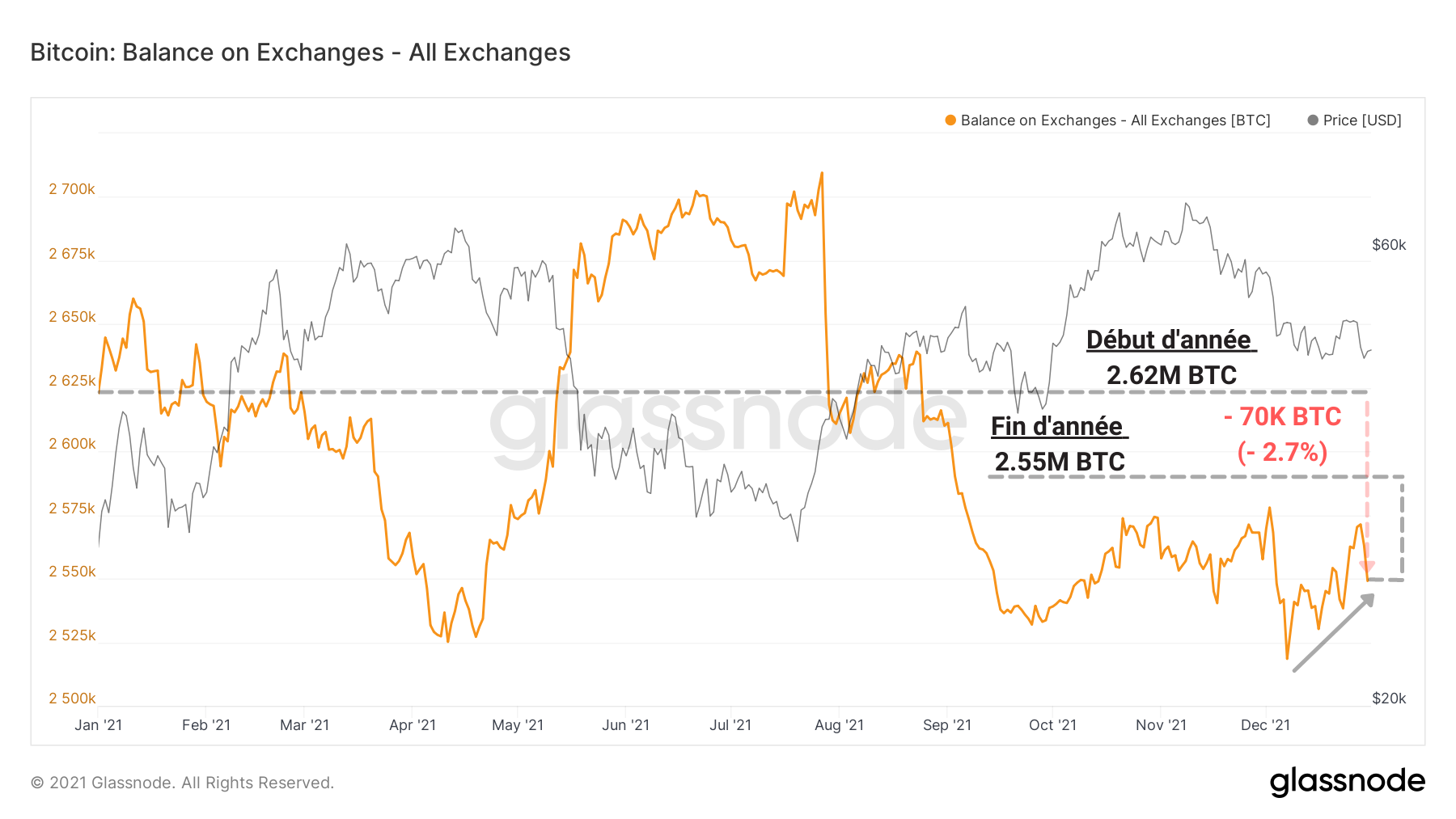

Trade reserves graph – Source: Glassnode

Finally, trade reserves will have seen only a very slight net change this year , although the downtrend remains intact from a long-term perspective.

From 2.62 million BTC at the start of the year to 2.55 million BTC today, this is a net drop of 70,000 BTC, a reduction of 2.7% .

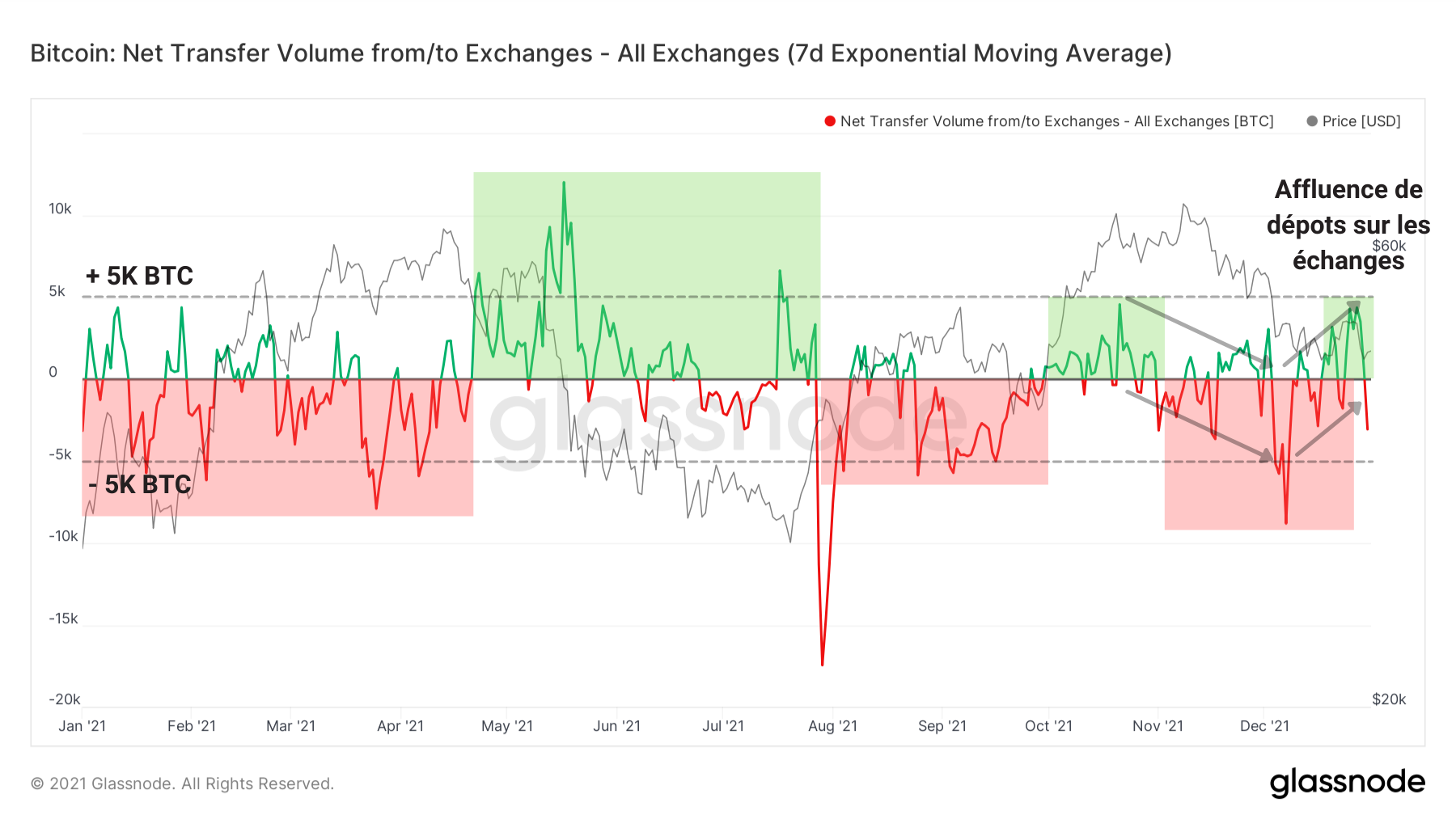

We can clearly spot this behavior through the net transfer volume of the exchanges, which has spent the entire year hovering between plus and minus 5,000 BTC.

Graph of net trade transfer volume – Source: Glassnode

That said, over the past week we have seen another turnaround: Inflows have dominated again as bitcoin (BTC) finds itself close to its support.

For now, this trend should be watched to determine if it will ease or strengthen during the month of January 2022.

Power regain of the derivatives markets

Let us now look at the dynamics of the derivatives market, nemesis of the spot market where speculation is rife.

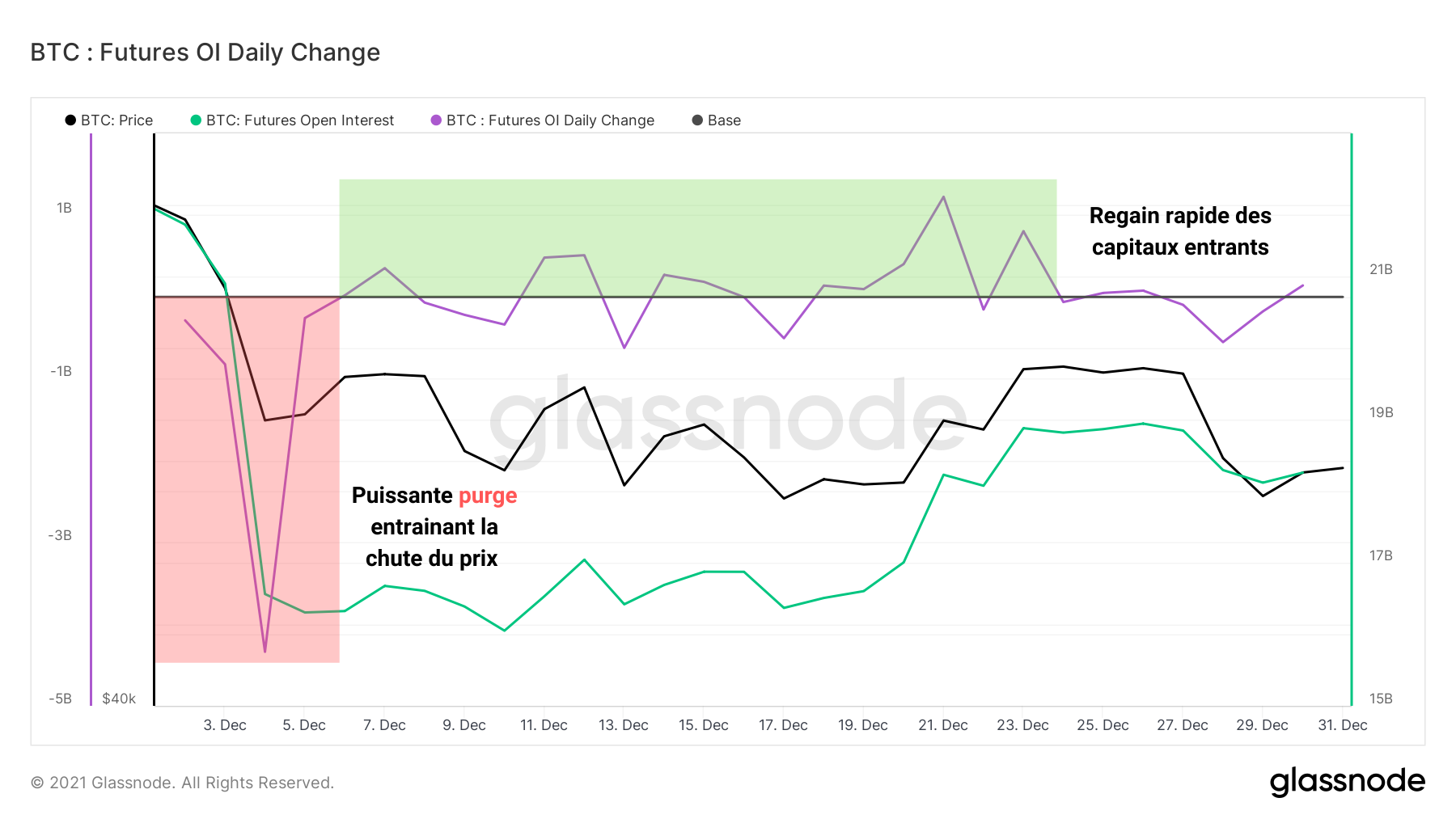

While the successive waves of liquidation in November and December seemed to have purged this environment of its excess leverage, it appears that this effect was only short-lived .

Indeed, the funds allocated to future contracts quickly flowed (green) after the purge in early December (red).

Graph of the daily variation of open interest – Source: Glassnode

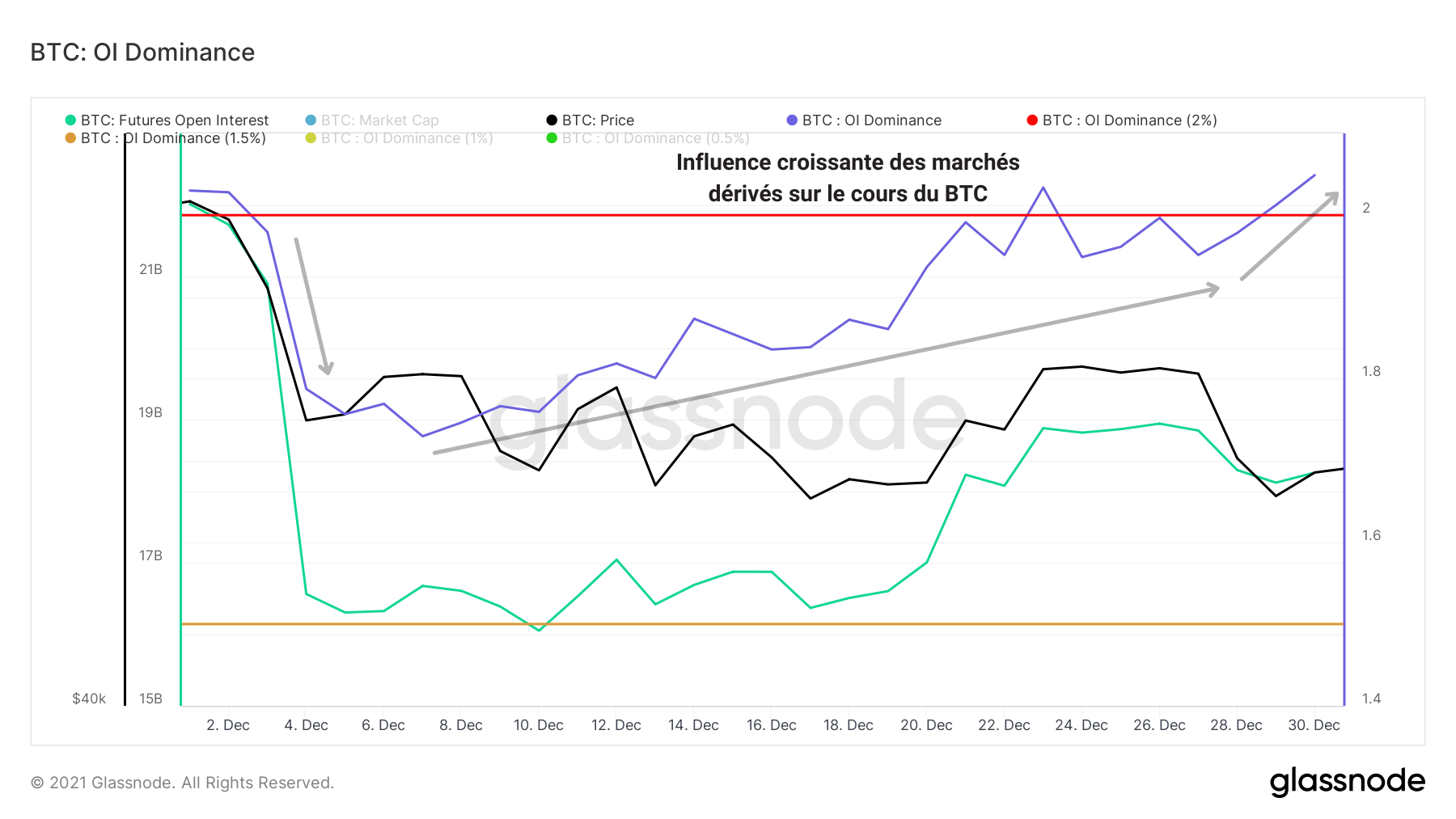

This return of interest in risk taking is reminiscent of the backlash that accompanies it: the growing influence of speculation on the spot market .

Illustrating this observation, the dominance of open interest has again crossed the 2% threshold , the level at which the impact of derivatives markets is sufficient to cause the price of bitcoin (BTC) to fall or take off, depending on the size, the frequency and direction of liquidations.

Open Interest Dominance Chart – Source: Glassnode

At this point, it would be appropriate to be cautious in terms of investments, the likelihood of a new cascade of liquidations increasing day by day .

Moreover, it is still too early to venture to guess the direction the market will take at the turn of the year 2022, although the study of the liquidations will be useful for us in the coming weeks.

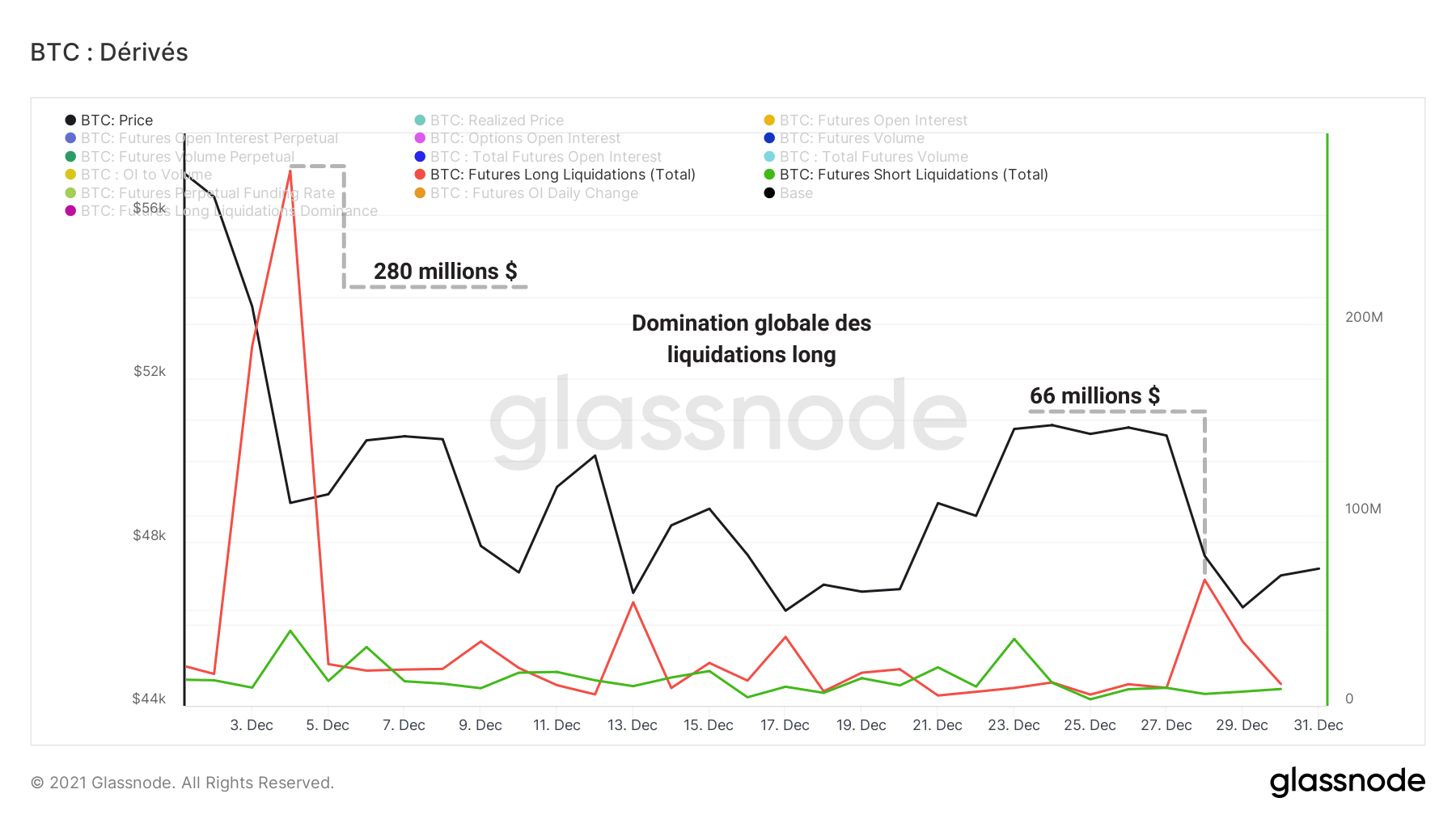

As it stands, bullish speculators have maintained a moderately dominant liquidation rate since the early December purge while shorters are mostly weak.

Graph of liquidation of future contracts – Source: Glassnode

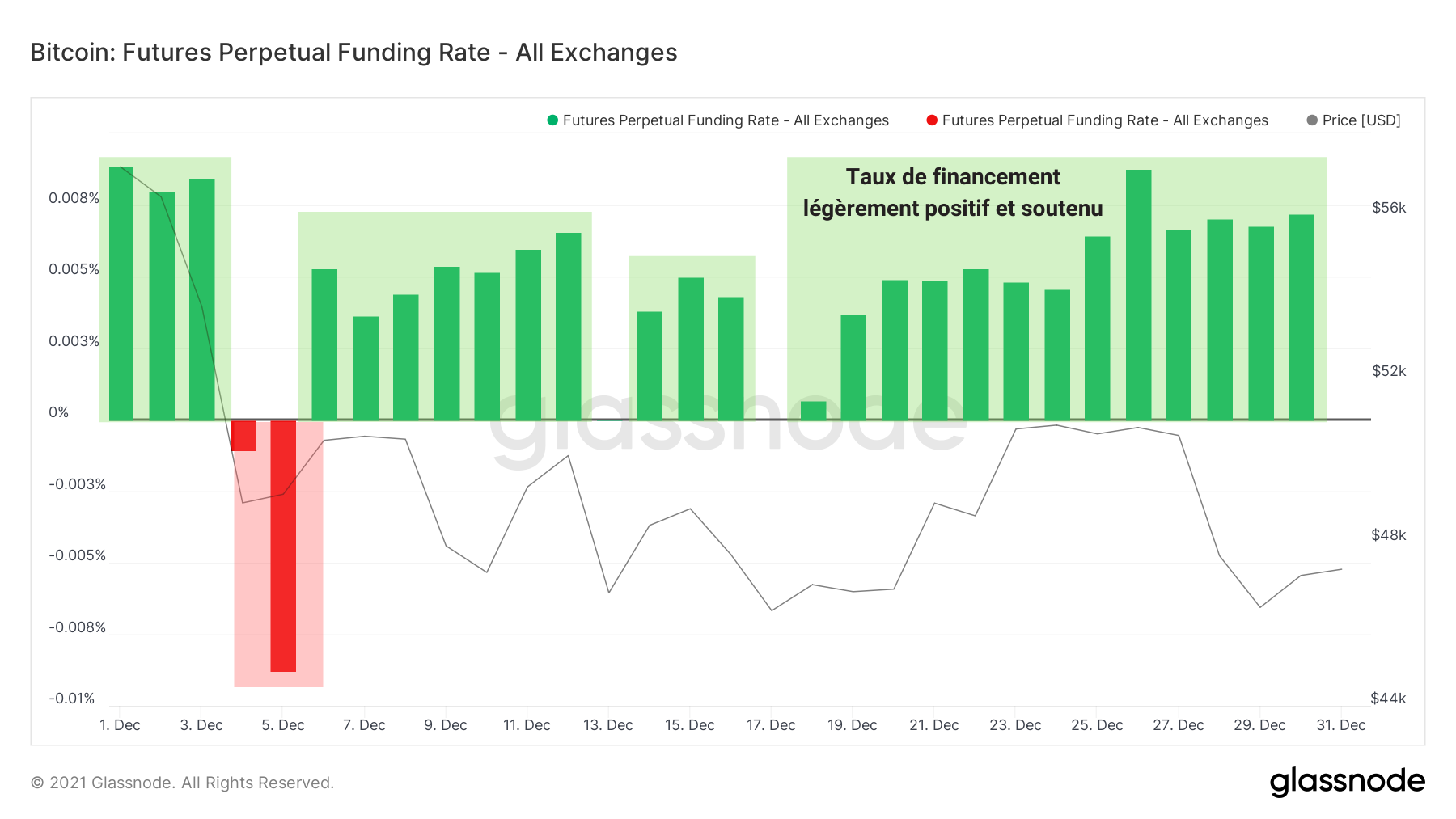

Add to these observations the fact that the financing rate of perpetual futures contracts is slightly positive (> 0.01%) and sustained.

This implies that speculators maintain a moderate bullish bias but not take excessive risks in view of the current state of the market.

Graph of the financing rate of future contracts – Source: Glassnode

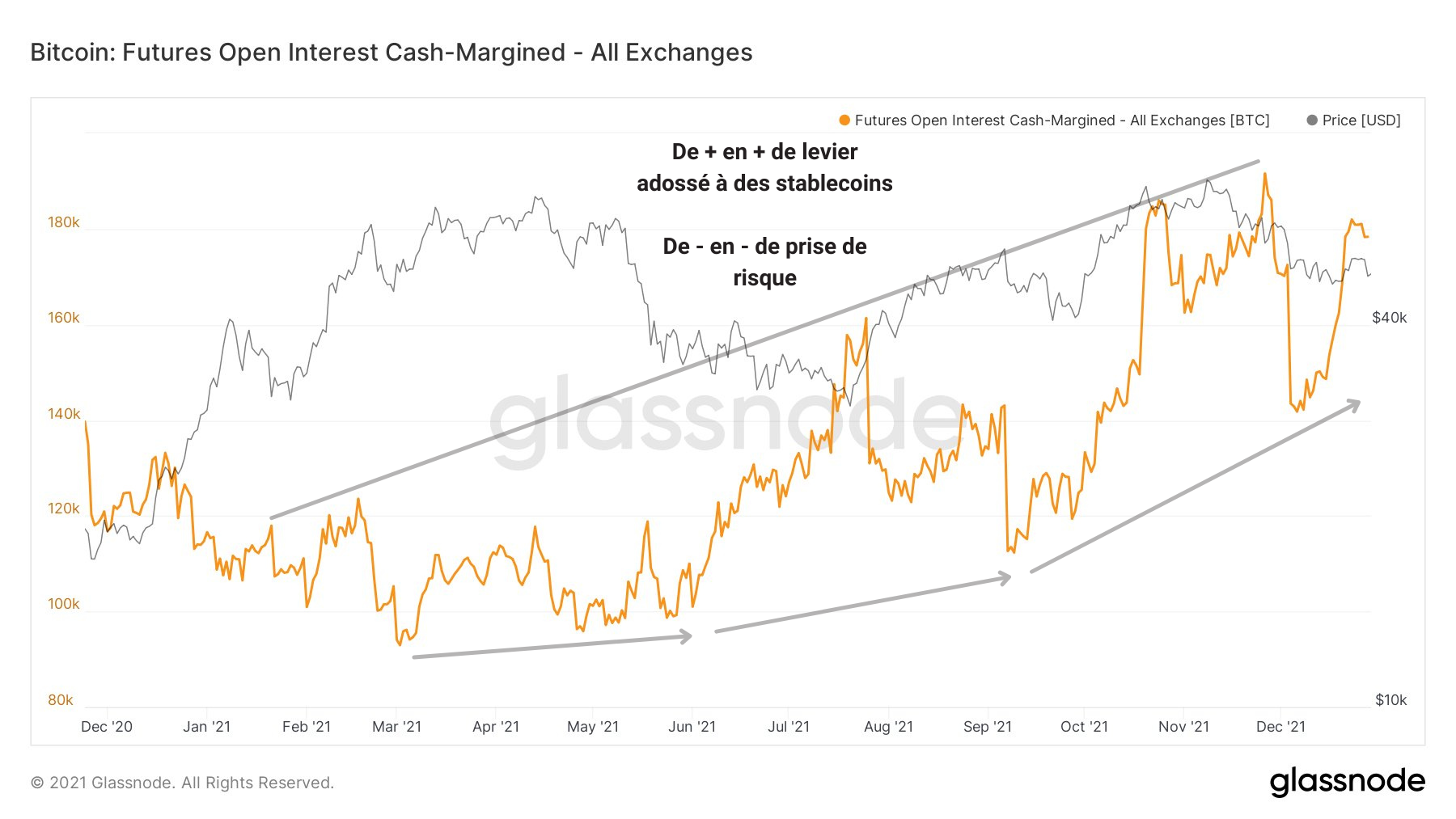

Corroborating this lack of aggressiveness, the leverage backed by stablecoins continued to grow throughout the year.

By choosing to provide stablecoins as collateral rather than native tokens, speculators protect themselves from volatility by lowering their risk of loss (and gain).

Open interest chart backed by stablecoins – Source: Glassnode

This trend indicates that some of the derivatives market participants, although attracted by the idea of high profit, have chosen the lower risk card for the time being.

Traders are missing

Let us close this analysis by identifying a notable change in the commitment of the entities present on the network during this year.

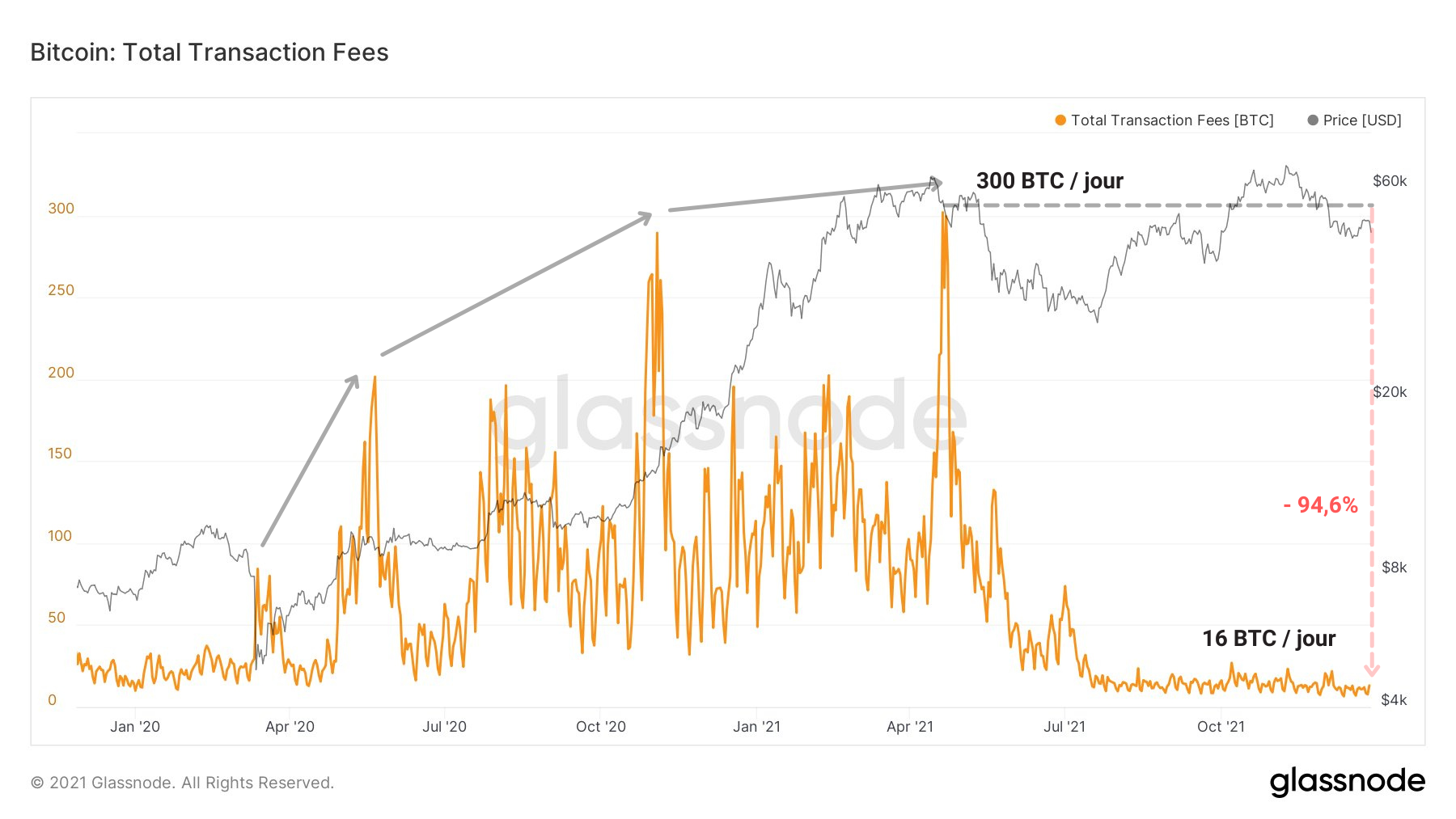

Evidenced by the drastic drop in transaction fees, channel usage has greatly declined since the May surrender.

Bitcoin (BTC) transaction fees graph – Source: Glassnode

As mentioned several weeks ago, some entities, ejected during this phase of strong bearish volatility, have still not recovered from this trauma .

And some will never get over it. As in every capitulation, only a minority remains while the majority panics.

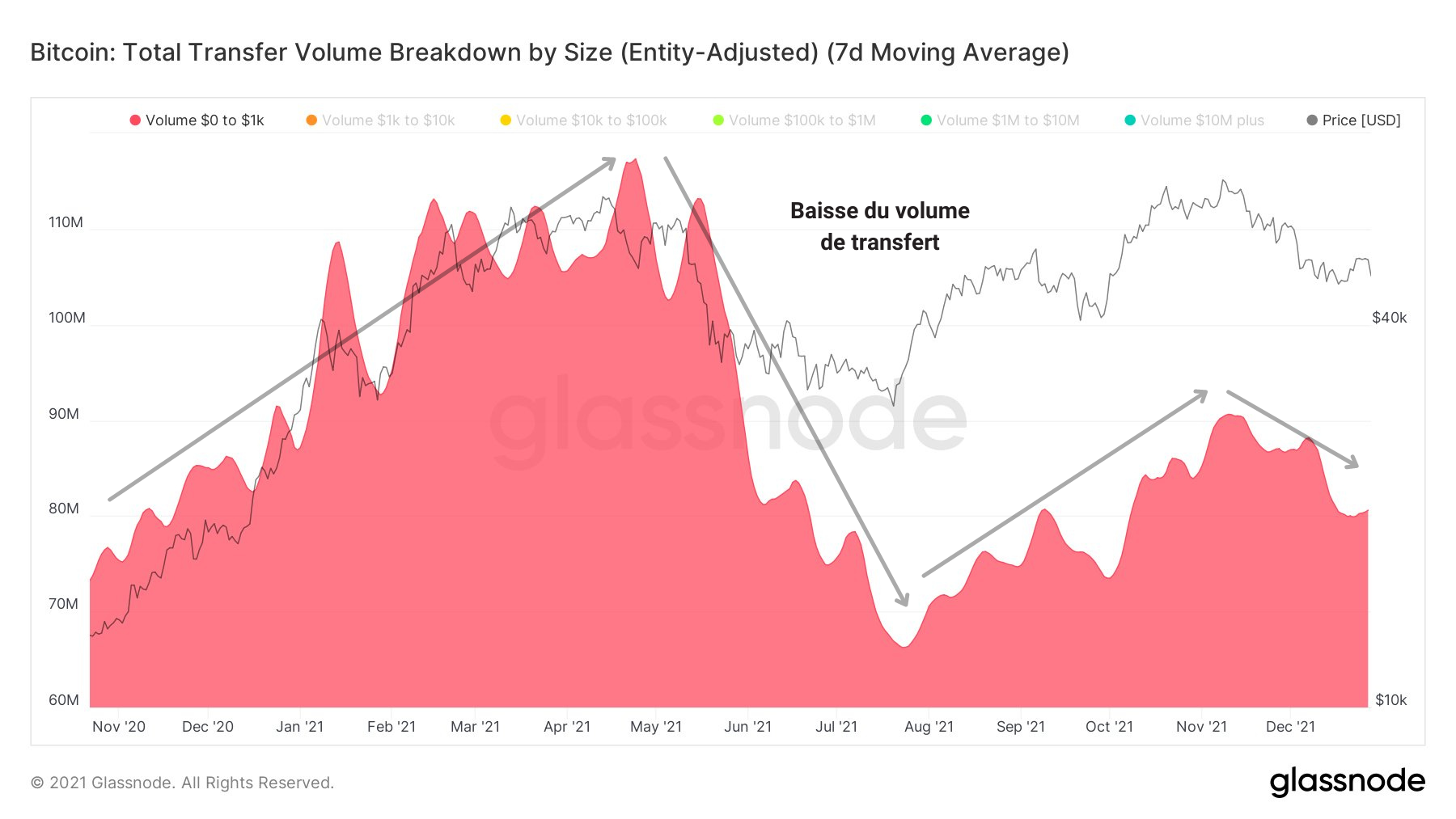

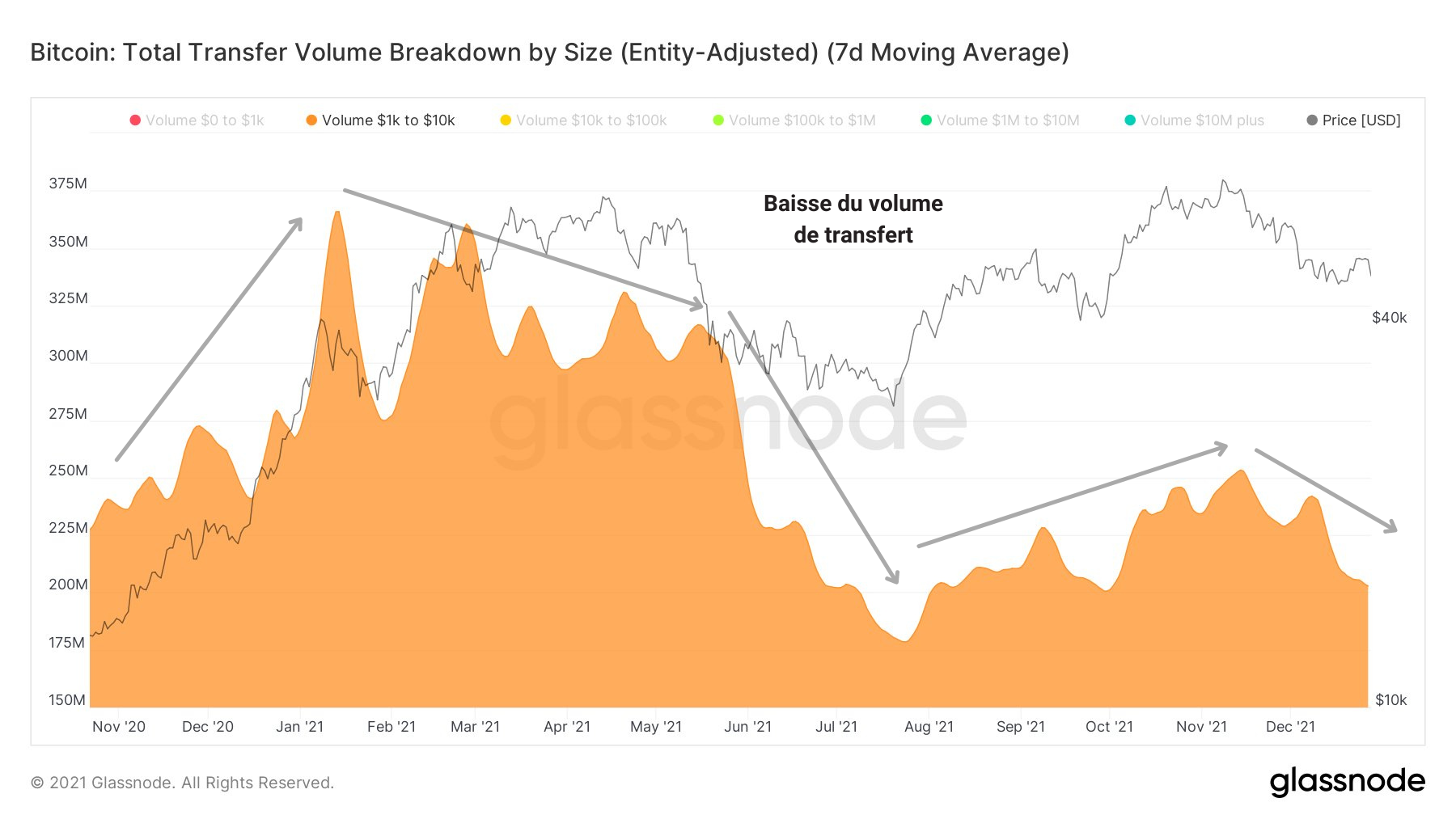

This behavior is evident on the transfer volume curves of different transaction sizes.

Often associated with small transactions (from 0 to 10 dollars), merchants, or retailers (retail in English) , actors necessary for the adoption and use of bitcoin (BTC) by people have been missing since spring .

Graph of the transfer volume of transactions between 0 and 1 dollars – Source: Glassnode

Indeed, whether for micro-payments (0 to 1 dollar) or small payments (1 to 10 dollars), the transfer volume has never managed to return to its pre-May levels .

This drop in transfer volume, resulting from a lack of commitment from retailers but also from small carriers, was one of the most solid bearish aspects mentioned by the community to announce a market entry into the bear market .

Graph of the transfer volume of transactions between 1 and 10 dollars – Source: Glassnode

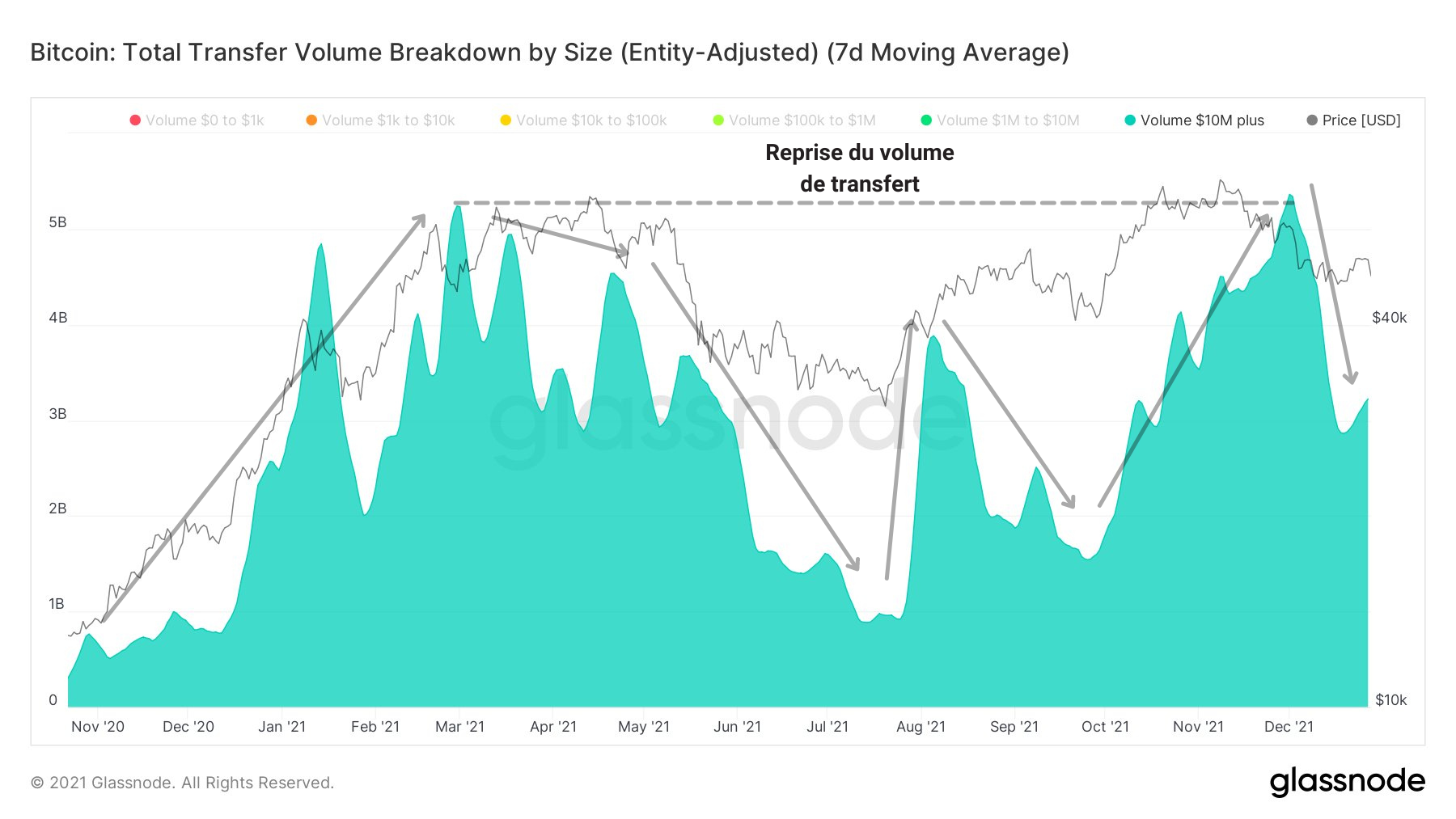

However, despite this decline in the use of the channel, it seems that large companies , investment funds and institutional players have not sounded the death knell for the current upward phase , described by some as a macro range.

Symbolized by transactions exceeding $ 10 million, these entities quickly recovered from the capitulation of May and regained a commitment similar to that of early 2021.

Graph of transfer volume of transactions exceeding $ 10 million – Source: Glassnode

Whatever one might think, this year marks the beginning of an all- new chapter for bitcoin as a network and as a market.

The arrival of institutions , the development of derivatives markets , the advent of the Lightning Network but also the popularization of on-chain analysis will have allowed Bitcoin to become more accessible, more understandable, more efficient but also more manageable.

Synthesis

In conclusion, trade flows will have changed little during this year , although the transfer of tokens from LTHs to STHs was the main dynamic following the May capitulation.

The rise of derivative markets, carriers of volatility and risk, so soon after the purge at the beginning of December, indicates to us that speculators wish to remain present in the market for the months to come .

Finally, the lack of use of the chain by traders and small carriers suggests that the adoption of bitcoin by individuals still has a long way to go .