Bitcoin is still evolving in a long-term range that reflects the indecision that reigns in the various markets. Nevertheless, there is a slight upturn in momentum with nearly 10% gain since April 17. Simple rebound or true bottom? We’re off to this week’s Bitcoin 360°. As usual, I don’t have a crystal ball, but I can give you my perspective on the market. Good reading !

Bitcoin and crypto in general are not immune to the uncertainty that weighs on the various markets. The most optimistic will tell you about simple balances while waiting for a continuation of the bullrun when the most negative already see bitcoin on the 20k because, you know, “there is a balance to be filled”.

A Bitcoin stuck between 2 terminals

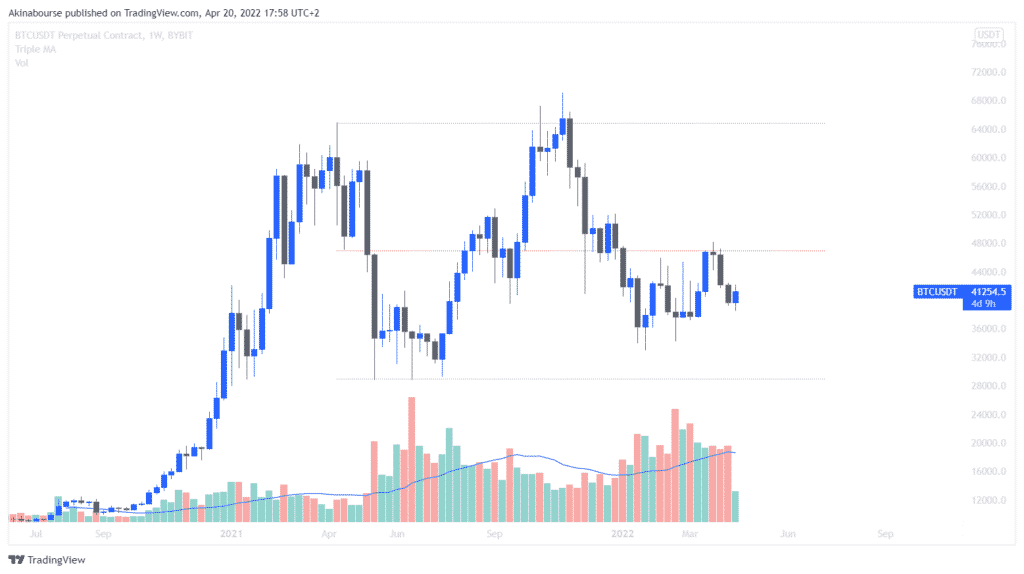

On a weekly basis, Bitcoin wanders between an upper limit of $65,000 and a low of $29,000. I think that a return to the bottom of the range is an interesting first thing, especially before re-entering or consolidating some of our positions . The impatient continue to be swallowed up by this selling pressure. For the most optimistic, a liquidity grab under the last wicks of last June, i.e. $28,000, would be ideal. The slight rebound that Bitcoin is doing to us seems to me to be of little or no interest.

I am of the opinion that these zones are interesting, if, and only if, we observe a reaction on these levels.

The middle of the range is blocking the price which is struggling to break this resistance. Nevertheless, there has been an increase in volume in recent weeks which testifies to the struggle between buyer and seller.

Declining open interest

As we get closer to the lower limit of the range, the “open interest” of buyers decreases . It is now much more interesting than 3 months ago.

Buyers are no longer foolishly skirting along as they used to, this underscores some fear of the market. It’s that kind of conditions like having in case of Bottoms. This is partly why the drops are less and less devastating. Few stops and buyers selling their positions.

This fear of buyers is also transcribed through the fear and greed index which fluctuates between 20 and 30 points. Despite everything, in the event of an increase, it quickly finds itself at 50 or more.

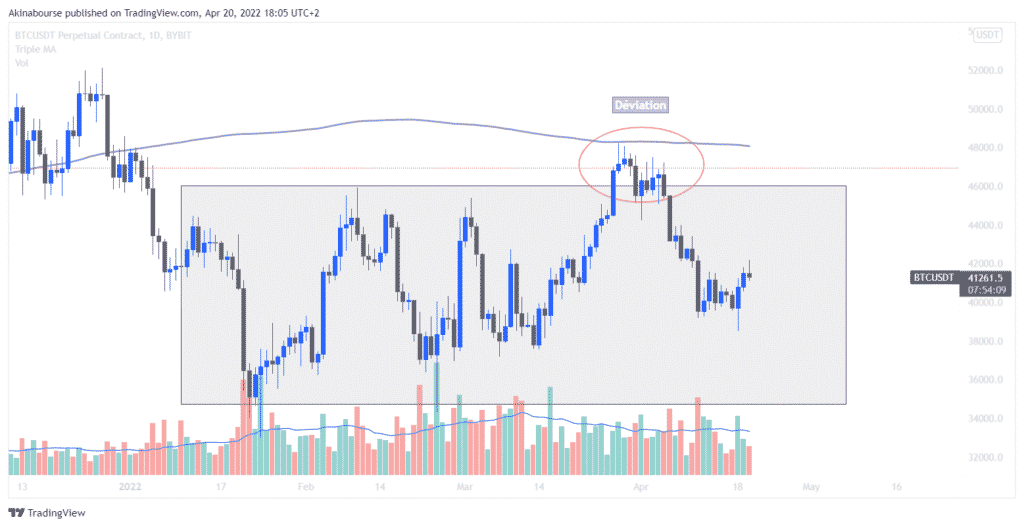

In daily, we can see a reintegration of range. The price to deviate to look for the MM200 before reintegrating and stumble (for the moment), on the middle of this zone. I can see the price coming back to the bottom of the range and seeing liquidity take over $33k.

bitcoin dominance

Personally, I find it difficult to take a position on altcoins in the sense that I see a decline in the latter in favor of altcoins. I would like a return on resistance towards 50% dominance to resume positions deemed riskier. I could be wrong in this analysis, but I can’t imagine Bitcoin not regaining momentum to at least wait for 48%.

An SP500 in a state of indecision

The SP500 is also in an undecided and “slightly” critical situation .

-Break of the market structure

-Increase in liquidity

-Rebound on the 61.8 of Fibonacci

-The bracket + OB must hold.

An agonizing macro, but not alarming

In addition, evoke the macro context which is undecided.

The rise in interest rates is generally frightening but does not systematically generate market declines. However, the end of Quantitative Easing is bad.

Finally, it is now more interesting to borrow short-term (3 years) than long-term (10 years) bonds. This rare phenomenon often leads to a recession.

As you will have understood, everything is very undecided, whether it is the SP500 or the macro context. This is transcribed through a range market that advances one step then retreats two.

The weeks and months to come won’t be as enticing as 2021, but that doesn’t mean we won’t be able to have fun.

Personally, I adapt by taking positions for less time, I exit quickly and advocate solid values fundamentally with yield. In this type of market you have to be flexible and adapt!

I give here a potential scenario, of course, my role is not to predict the market, only to react to it, that’s why I take big tweezers about this scenario.

Finally, I receive many questions asking me on which site I analyze my values. Personally, and for many years, I use TradingView , an intuitive interface with a lot of tools and a wide choice of assets. It is clearly the most developed and used interface on the market.