The “hold” continues to dominate among Bitcoin (BTC) investors. Three quarters of bitcoins in circulation are now illiquid, according to a new report from analysis firm Glassnode. What does that mean ?

76% of Bitcoin’s supply is illiquid

As the publication of Glassnode points out , the price of Bitcoin (BTC) started the year without fanfare, stuck in the range it had already occupied for several weeks. Calm is also generalized, according to the analysis:

“ There is a general lack of activity , despite a moderately bullish trend in supply dynamics. “

The supply of Bitcoin is indeed tending to become more and more illiquid . That is, BTC is sent to wallets that have never spent coins, or dormant wallets. This suggests that they are stored for the long term, and that they are not intended to be sold quickly.

A rather positive trend?

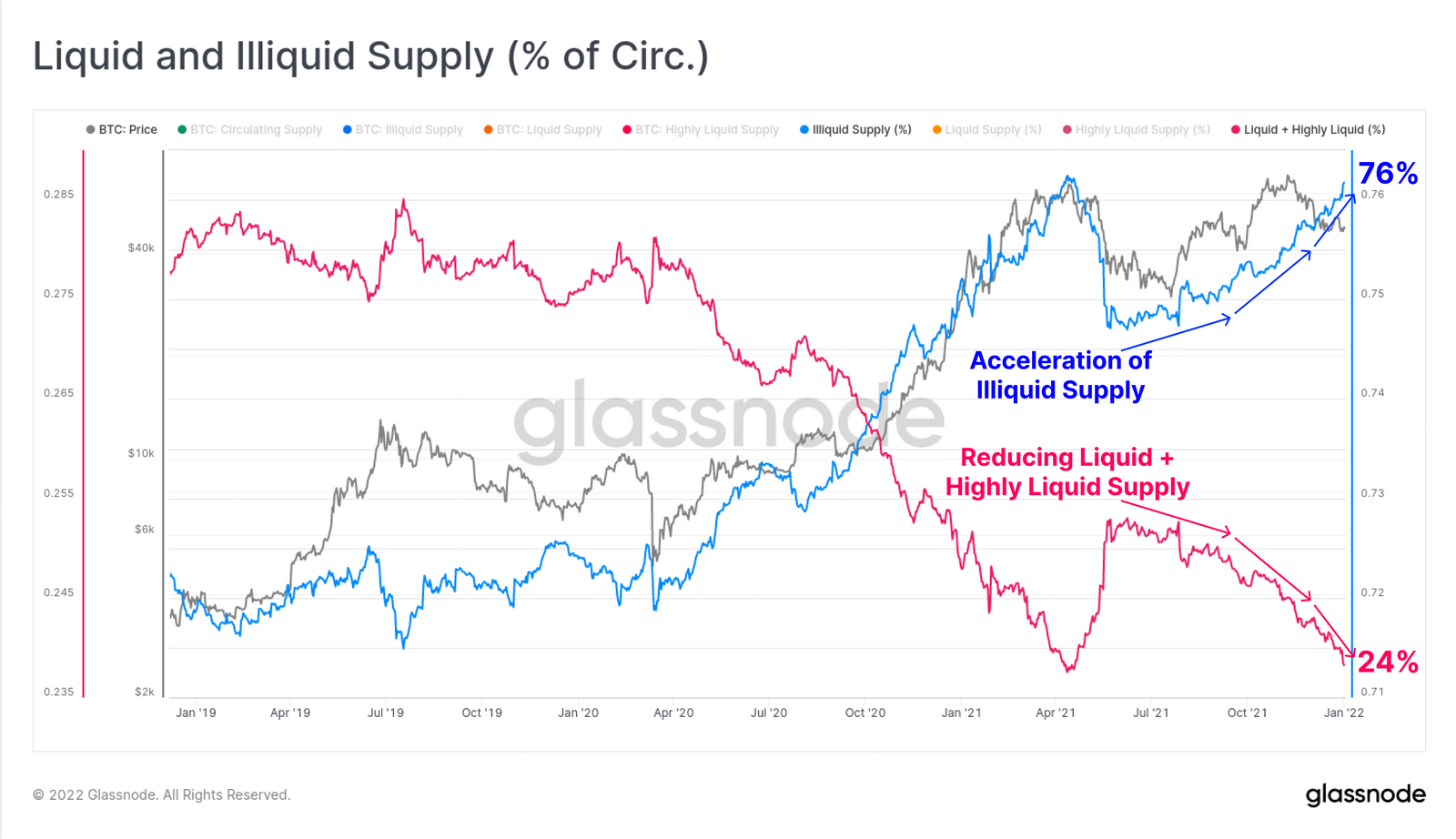

As can be seen in the following graph, this trend has been observable over time, since the fall in prices last spring:

Evolution of the liquid / illiquid supply of Bitcoin – Source: Glassnode

T kings quarter s of the supply of Bitcoin is now illiquid. This is notable if we consider the lack of evolution of the price of BTC:

“ Current conditions show a divergence between what appear to be constructive supply dynamics, and“ bearish ”or neutral price movements . “

Translation: when so many coins are directed to inactive portfolios, it is usually at the time of price increases, and not in a “bearish” context such as the one we know today. In any case, this shows that massive sales do not seem to be on the immediate horizon for Bitcoin.

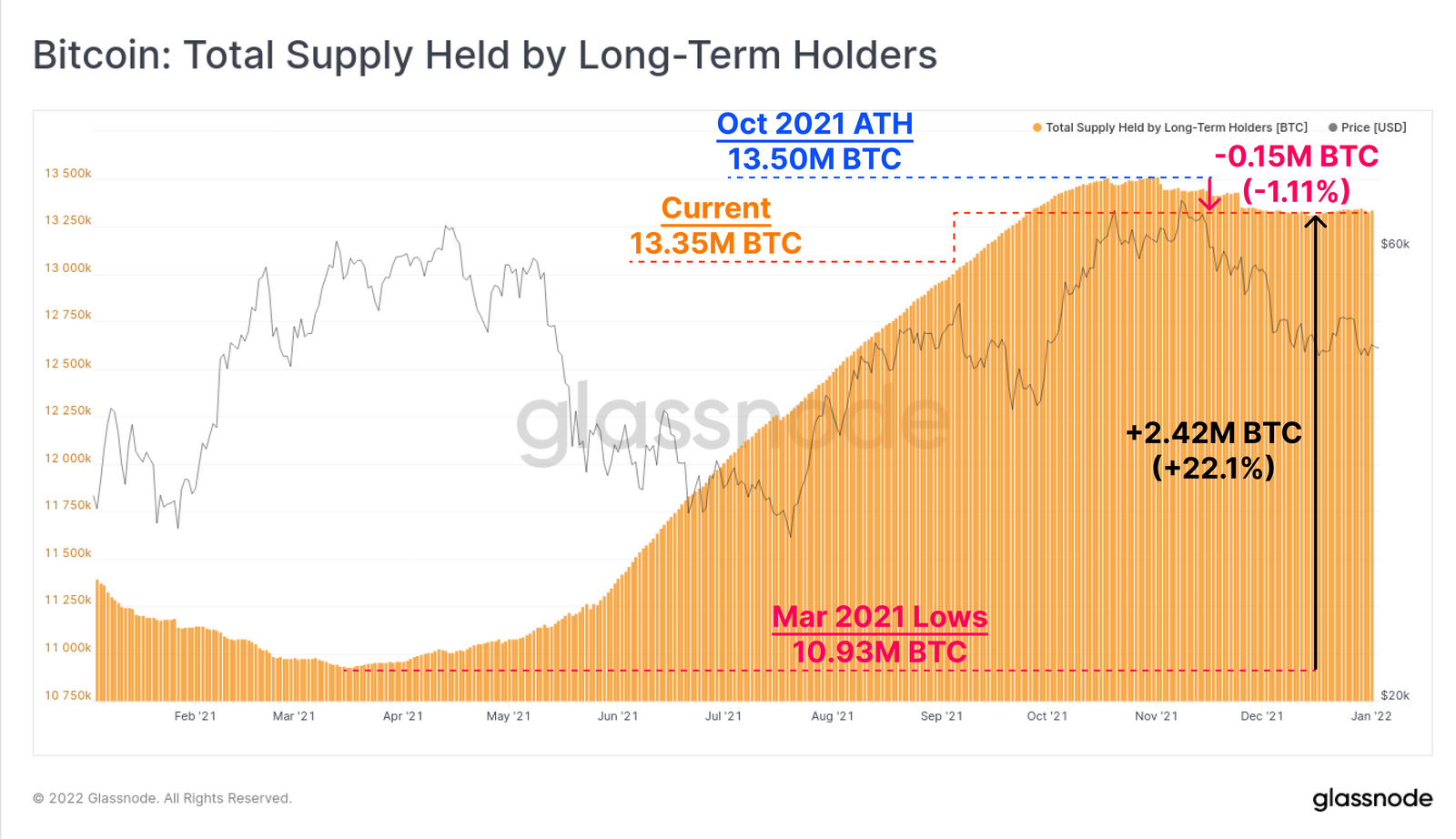

This is also confirmed by another indicator: the number of long-term holders, that is to say the BTCs stored for more than 155 days according to the Glassnode methodology. These currently hold 13.35 million BTC , close to last October’s record high at 13.50 million BTC:

Number of BTCs held by investors over the long term – Source: Glassnode

If the price of BTC does not arouse the enthusiasm of the crowds at the start of the year, these data therefore indicate that confidence does indeed seem present on the side of investors. It remains to be seen whether this will allow Bitcoin to start rising again.