The dust from the nuclear explosion suffered by Terra (LUNA) and its stablecoin UST is still far from settling. Speculation is already rife about how , or even who , is responsible for the disaster. Let’s try to dissect , as objectively as possible, the first elements of this chain disaster.

HOW DID TERRAUSD AND LUNA CRASH?

First, the facts : Since the night of May 9-10, 2022, the TerraUSD (UST) stablecoin of the Terra project has abruptly lost its peg to the US dollar. It even went down as low as $0.30 , and, although a bit back up ($0.50 at the time of writing), it still hasn’t regained parity with the US currency.

The finding is even more dramatic on the side of the LUNA token , which collapsed from 63 dollars before the start of the disaster on May 9, to less than 5 dollar cents . After the dread, some wonder how such a thing could have happened. Trader and analyst Onchain Wizard on Twitter presents first clues (beware, some are pure speculation):

“How to make over $800 million in cryptocurrency by attacking the former 3rd largest stablecoin, [George] Soros style. Everyone is talking about the $UST attack right now, including Janet Yellen. But no one talks about how much money the striker earned (or how brilliant it was). (…)”

800 MILLION DOLLARS IN THE POCKETS OF THE “DESTROYER” OF THE UST AND THE LUNA?

In this Twitter thread, our speculator believes an attacker took advantage of a scheduled liquidate drop (for a change in trading pool). First of all, the attacker would then have drained even more this liquidity to then resell his USTs en masse on Binance.

Then comes the Double kiss kool effect. While the supposed “bad guy” was selling off his USTs, the Luna Foundation Guard (LFG) had to sell his bitcoins in an attempt to raise the dollar for his stablecoin. After that, the cascade of various panics could be linked: liquidations of leveraged positions, blocking of UST withdrawals by crypto-exchanges increasing the bank run effect ,…

At the end of his unfolding of hypotheses, the analyst estimates that the “attacker” could have made $815 million in profits with this operation. A carefully concocted plan, which is indeed reminiscent of when George Soros blew up the Bank of England in 1992.

RUMORS ARE UNLEASHED: “BLACKSTONE”, “CITADEL”, “GEMINI”, EVERYTHING GOES!

While pieces of how the collapse of the UST (and LUNA) are just beginning to fit together (very slowly, puzzle-like for now), speculation about “who” is even more in the realm of hallway rumors. .

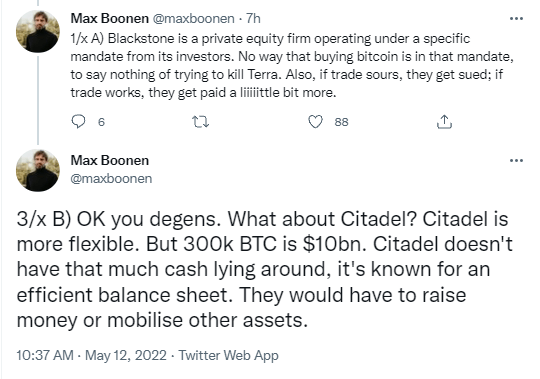

One of these crazy rumors would have it, hold on tight, the giant funds Blackstone and Citadel which would have perpetrated this nasty coup. This, with the help of Gemini , who would have lent them 100,000 bitcoins , or even 300,000 BTC in some versions of this rumor!

Besides Gemini’s quick denial on Twitter – claiming they never made such loans – a former Goldman Sachs trader, Max Boonen , says the thing would have had little a priori interest for the two big institutional funds . .

“A) Blackstone is a private equity firm operating under a specific mandate from its investors. Buying bitcoins is not part of that mandate, let alone trying to kill Terra. Also, if the trade goes wrong, they will be prosecuted; if the trade works, they will be paid only a little more. (…)

B) (…) Citadel is more flexible. But 300,000 BTC is $10 billion. Citadel doesn’t have as much cash, the fund is known to have an efficient balance sheet. They would have had to raise funds or mobilize other assets. »

In summary, it is still far too early to know if this massive and dantesque panic sell of the UST was initiated by voluntary manipulations (imaginable), and even more to know by whom (pure speculation). Let’s just hope for now that this isn’t too severe a ripple effect , as it almost did with Tether’s USDT stablecoin . Because he too, in the panic, briefly lost his indexation on the dollar.