Fantom (FTM) is a smart contract platform based on a directed acyclic graph (DAG), claiming to have solved the famous blockchain trilemma and more specifically the problem of scalability. One of Fantom’s strongest assets is its offering of a complete decentralized finance (DeFi) experience. Find out how Fantom works and what this ecosystem brings to the cryptocurrency industry.

- What is Fantom (FTM)?

- The Fantom ecosystem

- What are the roles of the FTM token?

- Fantom’s fundraising

- Fantom Team and Partners

- How to buy FTM tokens?

- Ratings and reviews on Fantom

What is Fantom (FTM)?

Fantom (FTM) is an open source project born in 2018 in South Korea. The team behind Fantom, the Fantom Foundation , believes that blockchain technology faces many problems, one of which is the lack of scalability. That is to say block confirmation times that are too long, resulting in relatively slow transactions.

To solve these problems, a model called “ directed acyclic graph ” or Directed Acyclic Graph (DAG) in English was developed and it is this technology that the project uses.

Fantom is therefore a blockchain network built on a DAG . It is also a form of distributed ledger technology that differs from traditional blockchain having a linear structure, i.e. each block has a block before and after it.

A DAG, on the contrary, has a tree structure, allowing it to process many more transactions simultaneously and thus solving the famous problem of scalability .

Representation of the Fantom DAG structure

A DAG is therefore very efficient at this level, and theoretically, Fantom is supposed to support up to 300,000 transactions per second according to the whitepaper. However, it should be noted that this ambitious number has been revised down to 4500 transactions per second in 2021 .

Fantom is also the first layer 1 smart contract platform to use a DAG. Transaction costs are very low, around a penny, while the finality of a transaction is around one to two seconds . The finality is the time necessary to be able to consider that a transaction is irreversible.

For comparison, the confirmation of a block (therefore the finality) is estimated at one hour for Bitcoin or a few minutes for Ethereum.

The ambition of this project is to be used on a large scale, to be able to offer a solid infrastructure allowing to carry out transactions in real time at very low costs , as well as to share data.

Fantom is therefore a project similar to other smart contract platforms such as Ethereum, Solana, Cardano or even BNB Chain. It is possible to create many decentralized applications (DApps), whether exchanges, non-fungible token (NFTs) marketplaces or decentralized finance protocols (DeFi).

Fantom (FTM) logo, by Cryptoast

The Fantom network ecosystem

The Lachesis Protocol

Fantom’s consensus, Asynchronous Byzantine Fault-Tolerance (aBFT), is called Lachesis . It is achieved by combining a leaderless Proof of Stake (LPoS) consensus with the architecture of a DAG. The Lachesis protocol is the native algorithm and foundation of Fantom’s layer 1 blockchain.

The specificity of a leaderless PoS consensus implies that there is no validator or groups of validators who play a privileged role in securing the network. Each node in the network constructs its own transactions. In other words, each node is an independent blockchain on the Fantom network .

This is how Fantom is asynchronous , with each node being independent and able to operate at different times. So they don’t all need to come to an agreement at the same time. The data is propagated through the network thanks to a system of gossip , that is to say that the nodes only transmit the data to the surrounding nodes.

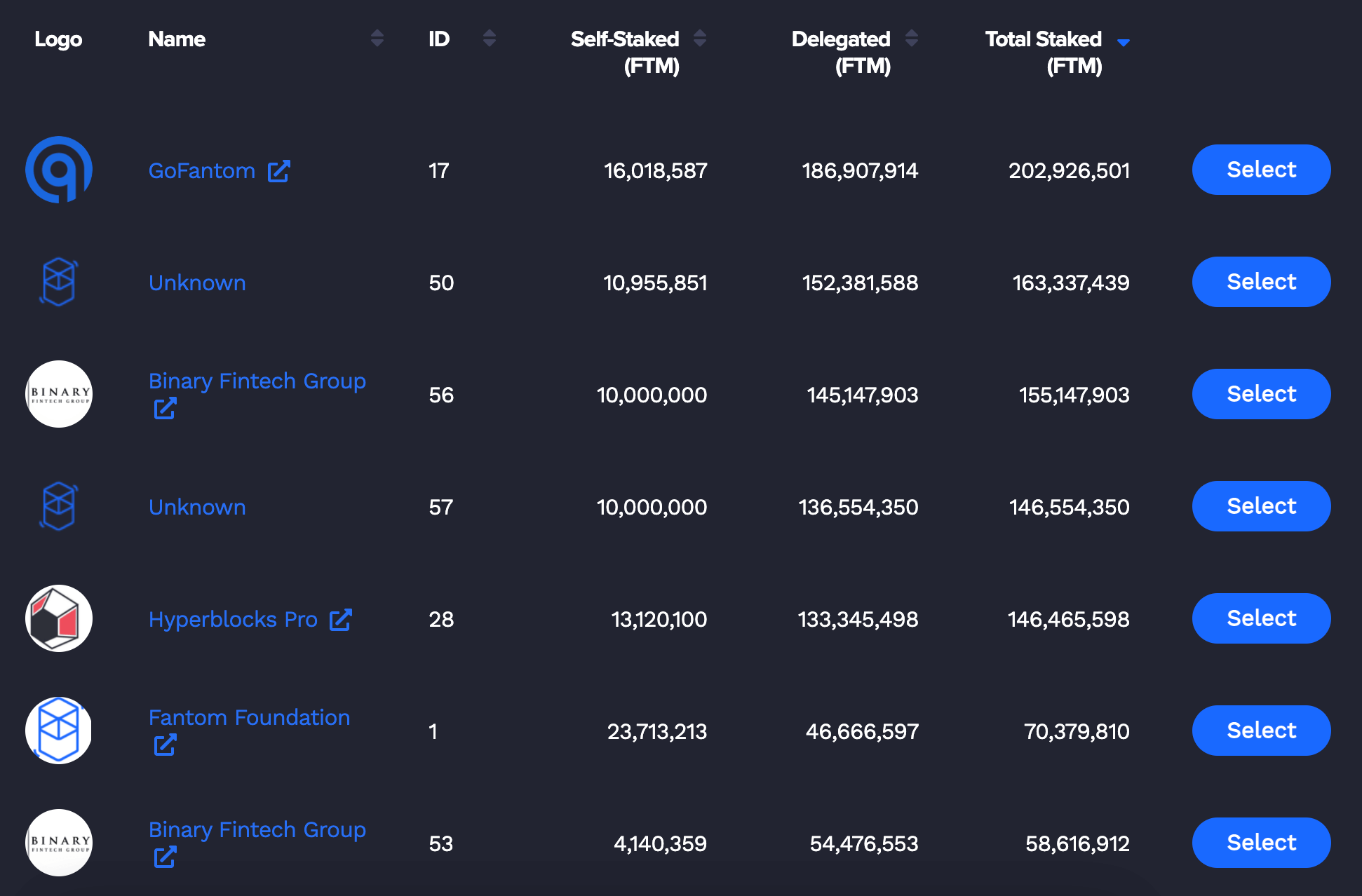

At the time of writing these lines, there are 57 validators on the Fantom network. It should be noted that it is of course possible to delegate your FTM tokens to one of these 57 validators to generate passive income proportional to the amount delegated.

Top 7 Biggest Fantom Network Validators

It should be noted that it is on this point that the relative decentralization of the Fantom network is called into question. There are only 57 validators, with a very high barrier to entry compared to other smart contract platforms like Ethereum.

Of these validators, 5 control approximately 811 million FTMs staked at the time of writing, while 1.33 billion FTMs are currently staked, making 5 validators controlling 61% of the FTMs staked on the network . Among these 5 validators, two are unknown.

It is therefore difficult to say that Fantom is a truly decentralized project at the moment (February 2022).

It should also be noted that the Fantom network has zero tolerance for nodes that behave dishonestly. These can lose 100% of their staked FTMs.

EVM compatibility and Fantom network interoperability

Fantom’s mainnet is called Opera , an infrastructure developed specifically for this project to address scalability issues. This infrastructure makes it possible to process transactions in real time, but also to store data.

Opera is where Fantom’s native cryptocurrency, FTM, resides. However, it is also an interoperable cryptocurrency , since FTM exists in ERC-20, a standard for Ethereum tokens, as well as BEP-2, a standard for BNB Chain tokens.

Fantom is compatible with the Ethereum Virtual Machine (EVM) as well as Cosmos SDK . More concretely, this means that any DApp developed on the Ethereum network can be easily deployed on Opera to take advantage of the advantages of Fantom, in particular its scalability. Smart contracts on Fantom are also written in Solidity , Ethereum’s native programming language.

Another peculiarity of the Fantom network is that each DApp deployed on its network has its own blockchain , thanks to the Lachesis protocol, which as we have seen allows each node to have its own independent blockchain.

Thus, each application developed on the Fantom network is independent and can define its own rules concerning its governance such as the issuance of a token, while being able to interact with other DApps on Fantom. On this point the project is similar to others like Cosmos and Polkadot.

This is where Fantom is particularly interesting as it is a very flexible interoperable network, which can be a Layer 2 (L2) solution for Ethereum . And the strength of the Lachesis protocol, which can theoretically allow any blockchain to benefit from the Fantom network.

Fantom therefore makes it possible to use Ethereum DApps natively, while being interoperable with other blockchains and offering a flexible environment for DApps on the network.

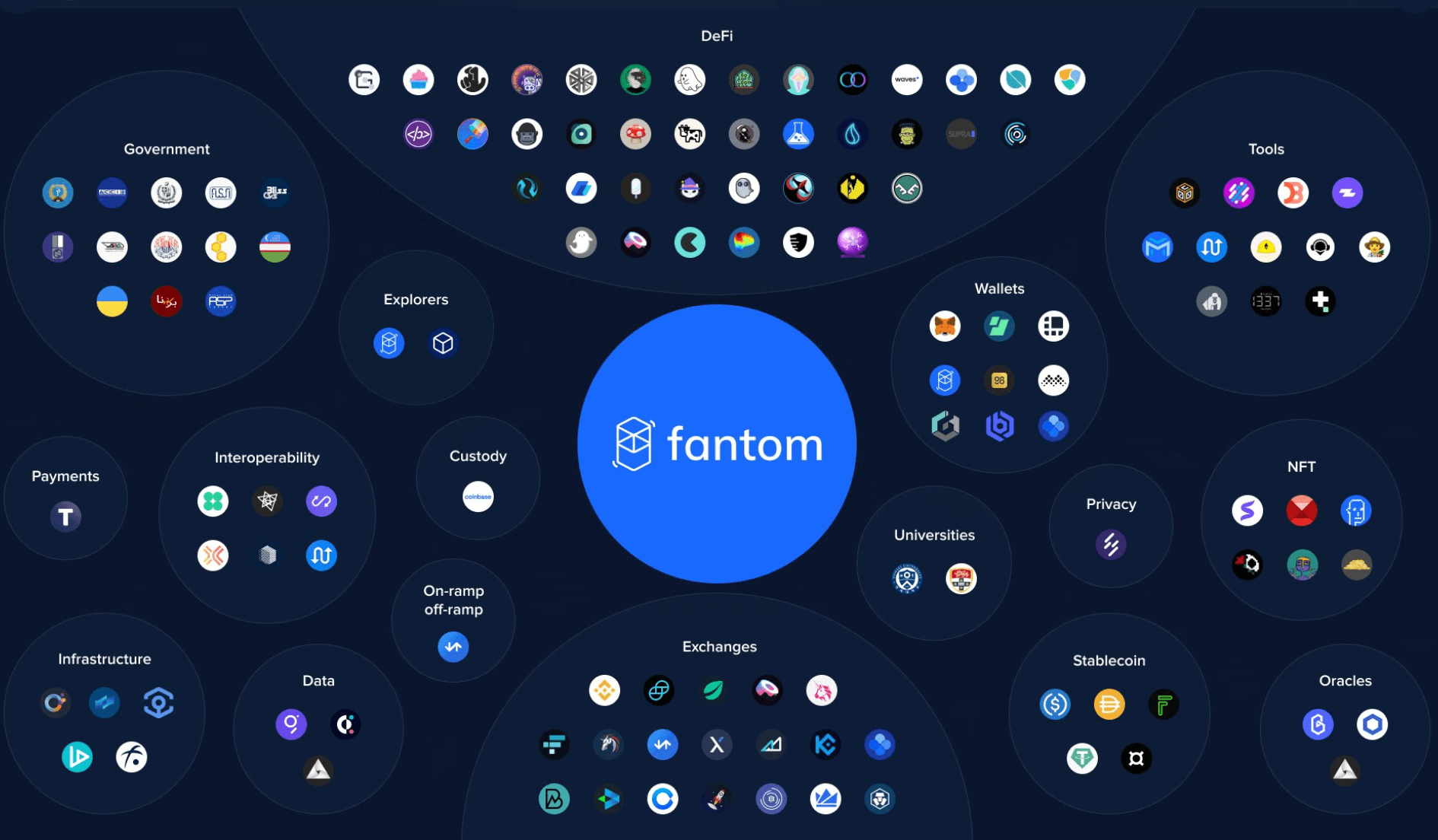

Fantom network apps

There are over 120 decentralized applications and 300,000 smart contracts deployed as of this writing on the Fantom network. These DApps combine approximately $8 billion in Total Value Locked (TVL) of assets, which puts Fantom in the top 5 of L1 blockchains in this regard.

These numbers vary all the time, but 60% of this value comes from Multichain, a crosschain bridge. Here are some of the other popular apps deployed on the Fantom network:

- SpookySwap , Fantom’s largest decentralized exchange;

- Yearn Finance , a yield optimizer;

- Scream and Geist Finance , lending protocols.

There are many others of course, most of them created with the aim of expanding and improving Fantom’s DeFi ecosystem.

DApps originating from Ethereum have of course been deployed on the Fantom network, such as SushiSwap .

Overview of the Fantom ecosystem

It should be noted that a grant program totaling 370 million FTM has been set up to finance developers capable of developing original and useful DApps for the Fantom network. They can therefore receive compensation of up to $1 million per month for DApps encouraging users to lock their tokens on the Fantom network.

This initiative offers a particularly attractive environment for developers .

What are the roles of the FTM token?

The FTM token, which is Fantom’s native cryptocurrency, is useful in network governance, for payment of transactions, and for participating in the network’s DeFi suite.

FTM for staking and governance

The primary use of FTM is obviously staking to benefit from rewards, in order to secure the protocol.

It is possible to stake FTM to become one of the validators of the network, but for this it is necessary to accumulate a minimum amount of 500,000 FTM , which is the equivalent of 1 million dollars at the time of writing these lines.

It is worth noting that this amount is adjusted by the governance of Fantom according to the price of the FTM.

It is also possible to stake your FTM tokens by delegating them to one of the validators. This is accessible to anyone with a minimum amount of 1 FTM. In exchange, the staker will benefit from an annual interest rate depending on the lock period of the staked FTMs, ranging from 14 days for 4.63% to 365 days for 14.18% annual interest.

Finally, in the event that a user needs to recover their FTMs before the end of the predetermined staking period, it is doable, but in this case the rewards will be almost all lost.

At the governance level of the Fantom network, since 2021, an on-chain voting system has emerged. It allows anyone holding FTMs to vote when submitting a proposal on Fantom. 1 FTM will be equal to 1 vote, so the more tokens one holds, the more weight a user’s vote will have.

Fantom Governance Representation

Conversely, to be able to submit a proposal to the network, one simply needs to stake FTMs and pay the cost of submitting a proposal, namely 100 FTMs.

This also happens on fWallet in the “Governance” tab.

Access to Fantom’s DeFi Suite

FTM is also crucial for accessing Fantom’s native DeFi ecosystem , all from within fWallet.

We just mentioned staking, and one of the special features of FTM is the liquidity of its staked tokens . Concretely, by locking its FTMs, it is also possible to use them in Fantom’s DeFi ecosystem to earn additional rewards.

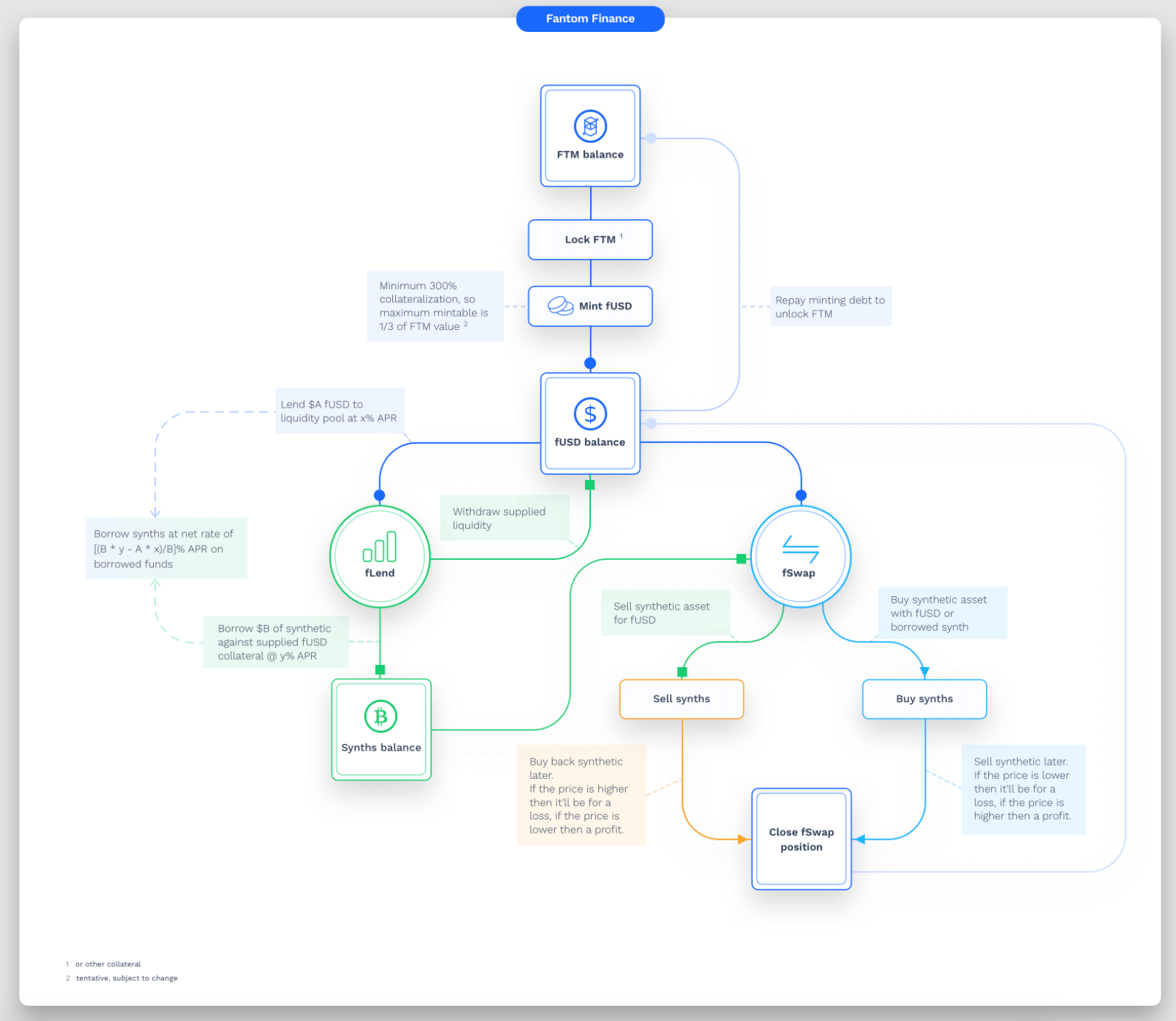

Indeed, staked FTMs can be used as collateral for mint fUSD tokens , Fantom’s stablecoin following the price of the dollar. This is the first step to accessing Fantom Finance, Fantom’s native decentralized synthetic asset exchange .

To do this, go to fWallet. It is first necessary to exchange its FTM for wFTM (wrapped FTM) at the rate 1 FTM = 1 wFTM using fSwap. If the FTMs are already staked and locked, you must exchange your FTMs for sFTMs (staked FTMs).

Then, in the fMint tab, it is possible to put your wFTM/sFTM as collateral for fUSD mint. The ratio of wFTM/sFTM as collateral to fUSD mint cannot be less than 300%.

Concretely, this means that for mint 100 fUSD it is necessary to lock 300 dollars of wFTM/sFTM. It should be noted that if this ratio is equal to 500% or more, it is possible to benefit on its fUSD from 6% annual interest rates in wFTM .

These fUSD then have many uses. Indeed, they can be exchanged for 176 synthetic assets on Fantom Finance . These are derivatives of financial products based on the Fantom network. Concretely, by partnering with Band Protocol, it is possible to mint synthetic assets like fBTC, fETH, fGOLD (for gold), fWTI (for oil) and so many others.

Overview of the possibilities of Fantom Finance

Finally, it is possible to lend its FTM and fUSD in order to generate interest. Conversely, locking fUSD as collateral is an option for users wanting to borrow synthetic assets.

Fantom’s fundraising

Fantom’s Initial Coin Offering (ICO) closed on June 16, 2018, and $40 million was raised. The price set at the public sale was 1 FTM for about $0.04 . While that of the private sale varied from 0.02 to 0.03 dollars.

38% of the FTM token supply was sold in the private sale, 2% in the public sale, 15% was allocated to advisors and 15% to the team behind the project. The remaining 30% has been reserved for staking rewards and for tax policy to fund developers building Fantom’s ecosystem.

FTM is an inflationary token , the maximum supply in circulation will never exceed 3.175 billion FTM. At the time of writing, 2.541 billion FTM have been issued, so 80% of the total supply is in circulation. Thus, 634 million FTM (20%) remains at mint through staking rewards.

This milestone will be reached by the end of 2023 , and after that, there will be no new FTMs issued.

Fantom Team and Partners

The company behind Fantom is the Fantom Foundation with over 60 employees.

- Michael Kong , CEO since September 2020 and CIO of Fantom Foundation;

- Andre Cronje , founder of the Yearn Finance protocol, he is also Fantom’s technical advisor and presents himself as the architect of DeFi. He is an important figure in the Fantom project;

- Quan Nguyen , technical director, he is also responsible for the research and development of Fantom;

- David Richardson , director of the Fantom project;

- Simone Pomposi , Marketing Director with over 15 years of experience.

Fantom has also forged many partnerships. We can cite the Chainlink and Band Protocol oracles , but also TheGraph , UniLend, Waves, OKX or even NEM.

In September 2021, the Fantom Foundation achieved a massive partnership as Fantom’s blockchain was chosen to craft Tajikistan ‘s central bank digital currency (MNBC) , the somoni.

How to buy FTM tokens?

FTM is available on many exchanges such as Binance , KuCoin, FTX, Huobi Global or Bitfinex.

Explanations for buying FTM on Binance

- Register on Binance;

- You will receive an email and need to click on a link to verify your account;

- Deposit funds on the platform;

- Click on the Market menu and look for the pair FTM/USDT ;

- All you have to do is buy FTM for the amount of your choice;

- Congratulations 🎉 You are now in possession of FTM tokens!

Ratings and reviews on Fantom

Fantom is a solid project, with a very efficient architecture and a competent team . 2021 was his year and Fantom doesn’t seem to be showing any signs of slowing down. Its strengths lie in its robust and practical DeFi ecosystem as well as its technical performance, particularly in terms of scalability.

The Fantom Foundation, the company behind the project, claims to have solved the famous blockchain trilemma , in particular thanks to the Lachesis protocol. This theory, developed by Vitalik Buterin, hypothesizes that it is very difficult for a blockchain to achieve both security, decentralization and scalability on their network, and therefore there is always a concession to make.

Fantom would therefore be able to solve this trilemma, but as we have seen in the ecosystem part of this article, we feel here that Fantom does not really deliver on the promise of decentralization . It is a relatively centralized project with 57 validators in total and only 5 controlling 61% of staked FTMs, not to mention the very high barrier to entry.

This is not really surprising for a project built on top of a DAG. Indeed, DAGs are notorious for not being able to offer a high level of decentralization. It is worth noting that actions have been taken by the governance to make Fantom more decentralized, particularly at the level of the submission of proposals on the network as well as on the votes.

Fantom remains an extremely interesting and promising project due to its high-performance technical architecture, its full compatibility with Ethereum and Cosmos , and its focus on DeFi.