For its 50th Launchpool, the Binance platform allows holders of BNB and FDUSD to farm ENA tokens from Ethena, the protocol behind USDe, a “synthetic dollar”. How to participate in the Ethena Launchpool and receive ENA tokens?

Ethena ENA token farming begins on Binance

The farming period will last for 3 days, from March 30 at 00:00 UTC to April 1 at 23:59 UTC.

Participate in the Ethena Launchpool on Binance and earn ENA tokensAs soon as the farming period closes, participants in the Ethena Launchpool will share 300 million ENA tokens (i.e. 2% of the total supply), in proportion to their participation in the BNB and FDUSD pools.

Then, on April 2 at 8:00 UTC, the ENA token will be listed on Binance. Those who have received ENA tokens will then have the option of selling them to make a profit or keeping them to participate in the governance of the protocol.

Here is a summary of the essential information regarding the Ethena Launchpool on Binance :

- The farming period runs from March 30 at 00:00 UTC to April 1 at 23:59 UTC;

- 240 million ENA tokens will be distributed to participants who have locked BNB, while 60 million will be intended for FDUSD holders;

- The number of tokens allocated to each user will depend on the amount of BNB and/or FDUSD placed in the pools, as well as the total farming duration;

- The ENA token will be listed on Binance on April 2 at 8:00 UTC, with trading pairs including BTC, USDT, BNB, FDUSD and TRY.

What is Ethena and what is ENA used for?

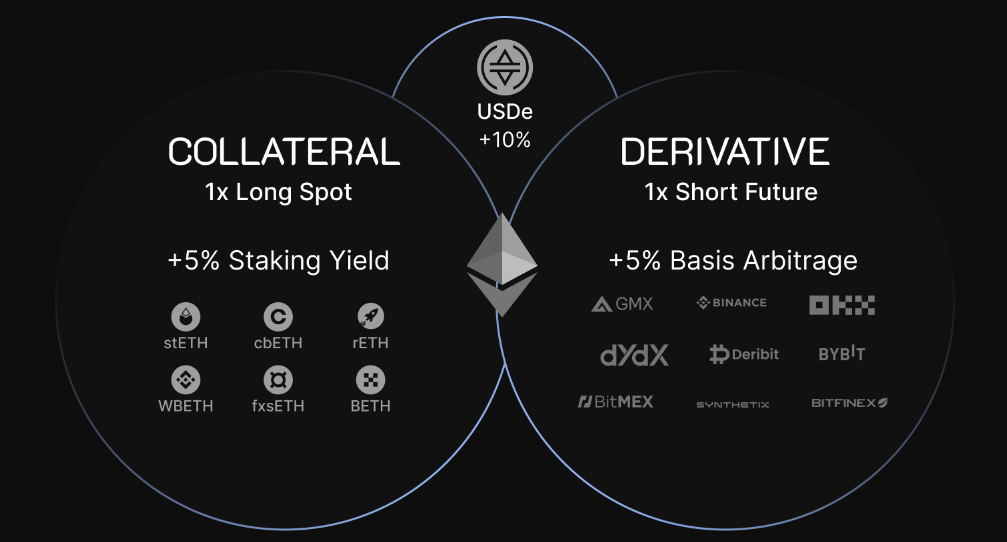

Ethena is the decentralized finance (DeFi) protocol behind USDe , a “synthetic dollar” (understand a stablecoin). The stability of USDe’s parity with the US dollar is ensured by the use of derivative hedging positions against collateral held by the protocol, as well as a mint arbitrage and buyback mechanism.

Holders of USDe can receive an annual return of around 35% at the time of writing.

- Staking rewards on Ethereum with the holding of liquid staking tokens (stETH, rETH, cbETH, etc.);

- Financing and spread revenues obtained from delta hedge derivative positions.

A controversial protocol?

The ENA token, for its part, will mainly occupy functions in the governance of the Ethena protocol . ENA holders will thus be able to participate in governance votes on several components of Ethena such as:

- Composition of USDe collateral;

- Integrations of new DEXs and blockchains;

- Distribution of grants for the community;

- Size and composition of the reserve fund;

- and many others.