Automize your crypto tax report with Cointelli

Over the past years, the cryptocurrency sphere has evolved into a vast and complex reality where enthusiasts and investors alike can access a multitude of financial products that come in all sorts. And if (like me) you are one of them, you will likely be actively using multiple digital wallets across different crypto platforms and exchanges.

As your crypto portfolio grows and your transaction volume begins to accumulate, sooner or later you will want to take stock of your holdings, firstly to determine your profit and/or losses but also to make sure your ducks are in a row when the inevitable tax reporting deadline looms.

Up until recently, I’ve done my best (not without a struggle) to achieve this by manually recording each crypto transaction using excel. In the process, the first crypto tax platforms started to surface. While their utility was valuable and potentially time-saving, the available platforms didn’t cater for all the exchanges and blockchains I traded on, which meant they weren’t good enough for me to shift my manual tracking thereon.

Manually keeping track of transactions became even more complex with the larger-than-life boom of NFTs in 2021. At this stage, I figured I needed more bandwidth in order to keep up.

Sure enough, this struggle became too much of a common experience in the crypto space for it to remain under the radar. As such, more comprehensive crypto tax platforms started to enter the scene.

Cointelli is one of them. Cointelli is a crypto tax reporting company founded by Mark Kang, a certified tax professional whose long experience serving his community as a CPA motivated him to develop user-friendly tax software. In one of Cointell’s recent blog posts, Mr Kang remarked that:

“Life is complex and stressful enough. Preparing and filing your cryptocurrency taxes shouldn’t be. That’s why I created Cointelli, to make it easy and hassle-free for anyone to produce accurate crypto tax documents to file themselves or share with their accountant or tax preparer.

I came up with the idea for Cointelli last year when a client named Julie came to my CPA firm with her cryptocurrency transactions and asked for help with her crypto filings. We didn’t offer that service at the time, but as a professional tax preparer I decided to tackle her crypto taxes myself. I quickly realized that the calculations were too complex, time consuming, and labor intensive for any individual taxpayer to do on their own.

Cointelli is your intelligent, all-in-one crypto tax solution to help you take care of the tax preparation process in one place, from start to finish.”

In this review, I explore what Cointelli is, its different benefits, and how you can utilize this platform to simplify your crypto tax submissions.

However, before I continue I would like to draw your attention to the fact that currently, Cointelli is only available to US-based crypto investors and only generates US-tax reports. If on the other hand you are a non-US investor, I invite you to check out my review of other alternative crypto tax platforms.

Crypto Tax in the US – A Brief Background

One of the main selling points of cryptocurrency has been the above-average market returns available to investors. However, as with every other tradable asset, higher earnings will almost inevitably lead to higher amounts of tax payable. Unless you decide to move to a crypto-friendly nation, that is.

Crypto tax filings can be quite a pandora’s box, even to someone with a sound financial background. This is particularly true in today’s context when the rules and regulations concerning cryptocurrencies are ever so dynamic.

These days, US investors are being called to be more cautious when it comes to reporting taxes on cryptocurrency. With approximately 16% of US adults investing in cryptos (a figure which is expected to continue rising sharply), the US government has been mounting its effort to get its share of the pie. Further to the IRS (Internal Revenue Service) first drafting its cryptocurrency tax rules back in 2014, Washington has recently beefed up the arsenal of its IRS with another $80 billion to track down tax evaders.

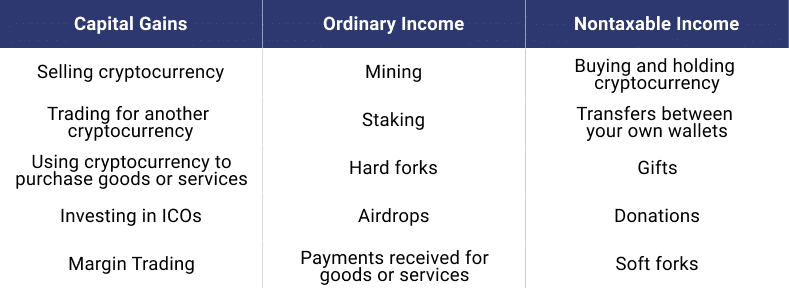

For taxation purposes, the IRS considers crypto as property, unlike stocks, which are considered securities. Crypto transactions can fall into the following three categories: capital gains, ordinary income, and nontaxable income.

The IRS applies different tax rates depending on which of the above categories a particular transaction falls under.

When you report cryptocurrency on taxes, it’s important to combine all your profit and loss data from all the platforms you use before analyzing it. It’s very unlikely that all your income comes from a single platform or exchange. And because the crypto scene only continues to grow, the IRS also continues to update its guidelines.

To minimize your taxes, you not only have to keep up with all those developments, but you also need to apply those updates to your tax returns. This can indeed prove to be quite a taxing (pun intended) piece of work!

This is where Cointelli comes in. Cointelli’s service is intended to ease this pressure by automatically compiling your transactions from across your wallets and exchanges, fixing errors therein, preparing a comprehensive report for tax purposes and having it sent out to your accountant or other relevant tax platforms. Apart from freeing up a great deal of precious time, Cointelli will also help you generate the required stats and reports with more accuracy, thus potentially even saving you money.

How does Cointelli Work?

Cointelli achieves this through the following 4 easy steps:

1. Import your data – synch your wallets and exchanges in just a few clicks or manually upload a CSV or your trade history.

The critical first step in filing your cryptocurrency taxes through tax reporting software is to collect and import your transaction data from across multiple exchanges and wallets. Cointelli counts every type of cryptocurrency transaction, such as buys, sells, staking, trade, and transfers as one transaction each. These are counted automatically based on data provided by the exchange.

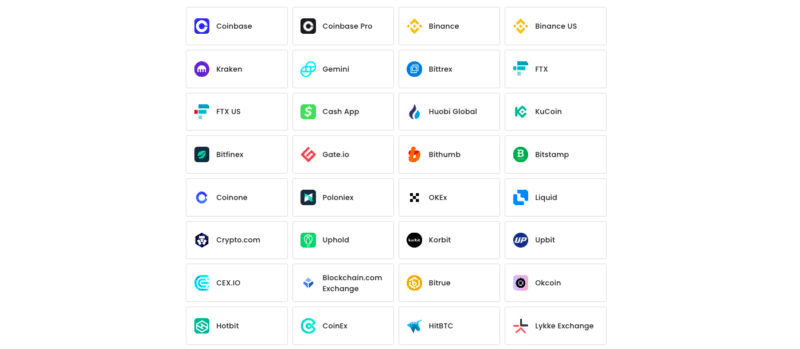

Cointelli not only boasts support for many of the major wallets and exchanges (such as Coinbase and Binance) and several other niche ones, but also provides seamless methods of importing transaction data from across these platforms, including API or CSV. To add to this, Cointelli also features support for at least 15 blockchains, including major ones like Bitcoin, Ethereum and Polygon. I also noted that Cointelli supports a number of other crypto service platforms like BlockFi, Nexo and Celsius. This makes Cointelli very easy to use for first-timers.

2. Review your data – see your entire transactions history and automatically or manually fix any errors therein.

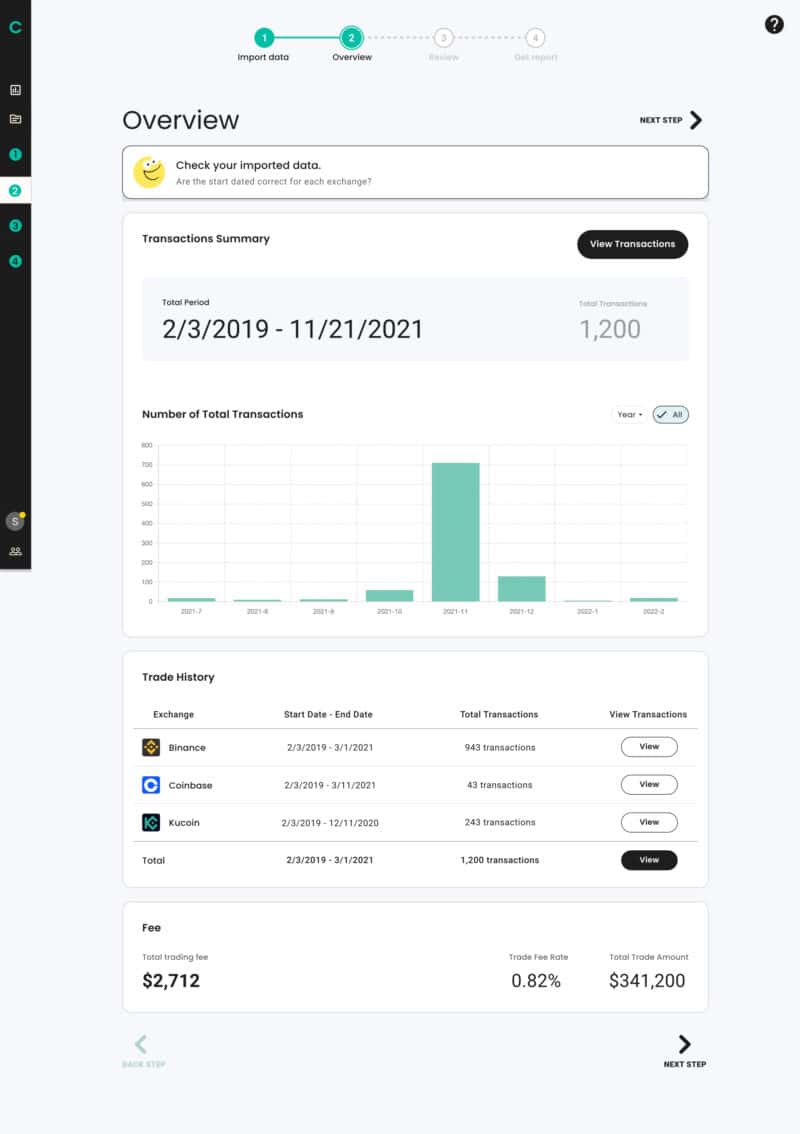

Once your data has been imported you will get an overview of all the imported transactions, categorized according to the related exchange or wallet.

Once your data has been imported you will get an overview of all the imported transactions, categorized according to the related exchange or wallet.

From here you will then be able to review the individual transactions in more detail.

As mentioned previously, not all transactions are taxed in the same way; some transactions may count as capital gains or ordinary income (taxed at different rates), and other transactions may be considered tax-exempt. If the imported data is not correctly categorized upon compilation, you risk being over-taxed. Cointelli helps to mitigate this risk by providing a review function that allows you to look through the transaction data and correct any miscategorized transactions, including internal transactions, to make sure you submit an accurate picture to the IRS and avoid paying unnecessary tax. The review feature is quite unique to Cointelli in that it is not common with other crypto tax software.

Cointelli allows you to review your data in either Manual or Auto Mode. While manually inputting specific transactions would typically be laborious, Cointelli makes it easy by means of a simple and user-friendly process. Cointelli’s Auto Mode is just as effective at getting the job done. Those who are still relatively new to the crypto trading experience may struggle with tweaking their data in Manual Mode, which is why Auto Mode is there to make the process more straightforward. At the click of a button, Auto Mode fixes any gaps or inconsistencies in your data.

3. Get your report – preview or download your comprehensive tax report

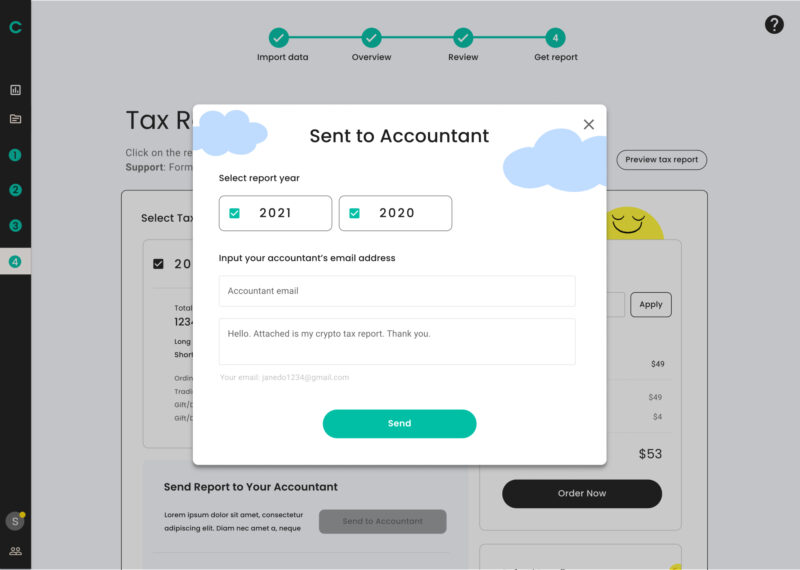

Once you have ensured that all the relevant transactions have been compiled and categorized correctly, you can preview and download your tax report. You can then also forward directly to your accountant.

4. Send your report out – share a copy of your report with your CPA or other tax platforms

Another advantage with choosing Cointelli is that the tax report generated by its software is compatible with popular accounting software applications such as TurboTax and TaxAct given that many accounting professionals participated in its design and development. With Cointelli, your accountant can therefore swiftly generate tax reports that work with their accounting software.

Cointelli Pricing

Cointelli’s pricing structure is lean with a one-size-fits-all price for consumers and customized packages for large transaction-volume enterprises.

For a single flat fee of $49 annually, clients benefit from all the Cointelli suites and services for up to 100,000 crypto transactions, be it DeFi, margin trades, or NFTs. If during a given year your trading volume increases after you have paid, you will not be charged with an additional fee. This compares well with other similar platforms which typically offer tiered pricing depending on the number of transactions in your portfolio. From a general comparison with other market players, Cointelli’s price is competitive particularly if your yearly transaction count exceeds 100.

Any enterprise handling large volumes of more than 100k transactions per year can negotiate a bespoke plan with Cointelli’s sales team.

Furthermore, Cointelli have just announced a limited-time offer of a 20% discount at checkout if you sign up to their service using the below link:

Do Your Crypto Taxes With Cointelli

Cointelli also offers a free preview of what your tax report would look like after having imported and reviewed your transactions in line with the above-described procedure. In this case, you would only be required to pay should you want to download the tax report.

Cointelli Safety

According to Cointelli, their team is trained to safeguard your data, protect your privacy (GDPR and CCPA compliant), and respond quickly to incident reports. This is driven by the Cointelli Information Security Committee which also ensures that security awareness and initiatives permeate throughout the organization.

To keep all your work secure, Cointelli encrypts data that is both in transit and at rest. While Contelli’s services are hosted in US-based AWS (Amazon Web Services) facilities, the servers live within Cointelli’s own virtual private clouds (VPCs) to prevent unauthorized network requests. Cointelli also runs daily comprehensive backups for additional protection. Its payment processing partner is Stripe, which has the most stringent level of certification available and is one of the most trusted names in the payments industry.

Furthermore, all Cointelli logins are protected by Amazon Cognito to keep your ID safe and secure. When Amazon Cognito detects unusual sign-in activity, such as sign-in attempts from new locations and devices, it blocks the sign-in request and notifies the user of the attempt.

Cointelli thus appears to be both a safe and sound platform. The firm has also not reported any data breaches until now.

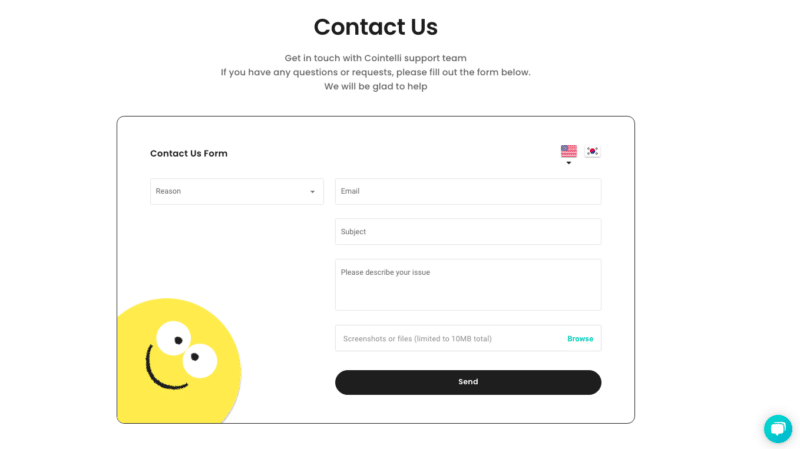

Cointelli Customer Support

Customer service commitment and availability are some of Cointelli’s strengths. In fact, Cointelli not only offers customer support via email and chat widget, but also provides 24/7 live customer service with dedicated tax experts. This level of cover and support stacks up well to other platforms providing a similar service.

Notwithstanding that Cointelli has only been around since 2021, a TrustPilot scan indicates an overwhelmingly satisfied customer pool with an average rating of 4.7. Apart from its quality of customer support, Cointelli seems to be particularly voted for its accurate and swift tax report production (half an hour seems to be the average process time) and relatively cheap service.

Notwithstanding that Cointelli has only been around since 2021, a TrustPilot scan indicates an overwhelmingly satisfied customer pool with an average rating of 4.7. Apart from its quality of customer support, Cointelli seems to be particularly voted for its accurate and swift tax report production (half an hour seems to be the average process time) and relatively cheap service.

Cointelli – Room for Improvement

An important feature that Cointelli does not cater to as yet is the facility to be able to track your holdings and growth. With Koinly for example, you will be able to see how much capital you have invested into digital coins and how much returns you are getting along other details, such as profit and loss and any unrealized capital gains.

That said, I anticipate that it won’t be long before Cointelli adds this facility to its service given its data capture mechanisms are already in place.

Concluding Thoughts

Overall, Cointelli’s software seems to be a viable option for US cryptocurrency users to simplify their crypto tax filing by making the entire process much easier to manage. The platform is intuitive and can be configured with minimal effort.

Apart from integrating with most cryptocurrency services (allowing you to extract all your transactions in one place) Cointelli allows you to manually or automatically review these transactions individually prior to finalizing your tax report.

Cointelli has essentially managed to cover the needs of US investors playing in the ever-dynamic crypto field. If you require help or want to save time and money in preparing your crypto tax report, Cointelli is one of the best tools you can currently use.