Most people know Bitcoin at the surface level; they know that it’s a form of money and maybe have even bought some.

This article is for everyone who wishes to have a macro-understanding approach to it and gather insight on why it quickly obtained its popularity.

To understand how it came to be though, we must zoom back and deeply analyze the world at that time.

The World before the Great Financial Crisis of 2008

Excessive risk-taking in a favorable macroeconomic environment

Economic conditions in the United States and other major countries were encouraging. Economic growth was strong and stable, and rates of inflation, unemployment, and interest were relatively low. In this environment, house prices grew strongly boosted by strong confidence in the markets.

Expectations that house prices would continue to rise led households to borrow imprudently to purchase and build houses not having been properly assessed by the lenders, who were lending money without closely evaluating borrowers’ abilities to make loan repayments.

Increased borrowing by banks and investors

In the lead up to the Global Financial Crisis, banks and other investors in the United States and abroad borrowed increasing amounts to expand their lending and purchase Mortgage-Backed Securities.

Mortgage-Backed Securities (or MBS) are essentially bonds (aka promises of repayment) secured by home and other real estate loans. They were created when a number of these loans (aka a form of debt incurred by an individual or other entity), usually with similar characteristics, are pooled together.

Borrowing money to purchase an asset (known as an increase in leverage) magnifies potential profits but also magnifies potential losses. As a result, when house prices began to fall, banks and investors incurred large losses because they had borrowed so much.

Regulation and policy errors

There was insufficient regulation of the institutions that created and sold the complex and opaque MBS to investors. Not only were many individual borrowers provided with loans so large that they were unlikely to be able to repay them, but fraud was increasingly common.

The perfect mix for the perfect storm

The catalysts for the crisis were falling US house prices and a rising number of borrowers unable to repay their loans.

House prices in the United States peaked around mid-2006, coinciding with a rapidly rising supply of newly built houses in some areas. As house prices began to fall, the share of borrowers that failed to make their loan repayments began to rise. Loan repayments were particularly sensitive to house prices in the United States because the proportion of US households (both owner-occupiers and investors) with large debts had risen a lot during the boom and was higher than in other countries.

At the same time, a huge amount of stress in the financial system emerged from having some lenders and investors who began to incur large losses because many of the houses they repossessed after the borrowers missed repayments, could only be sold at prices below the loan balance.

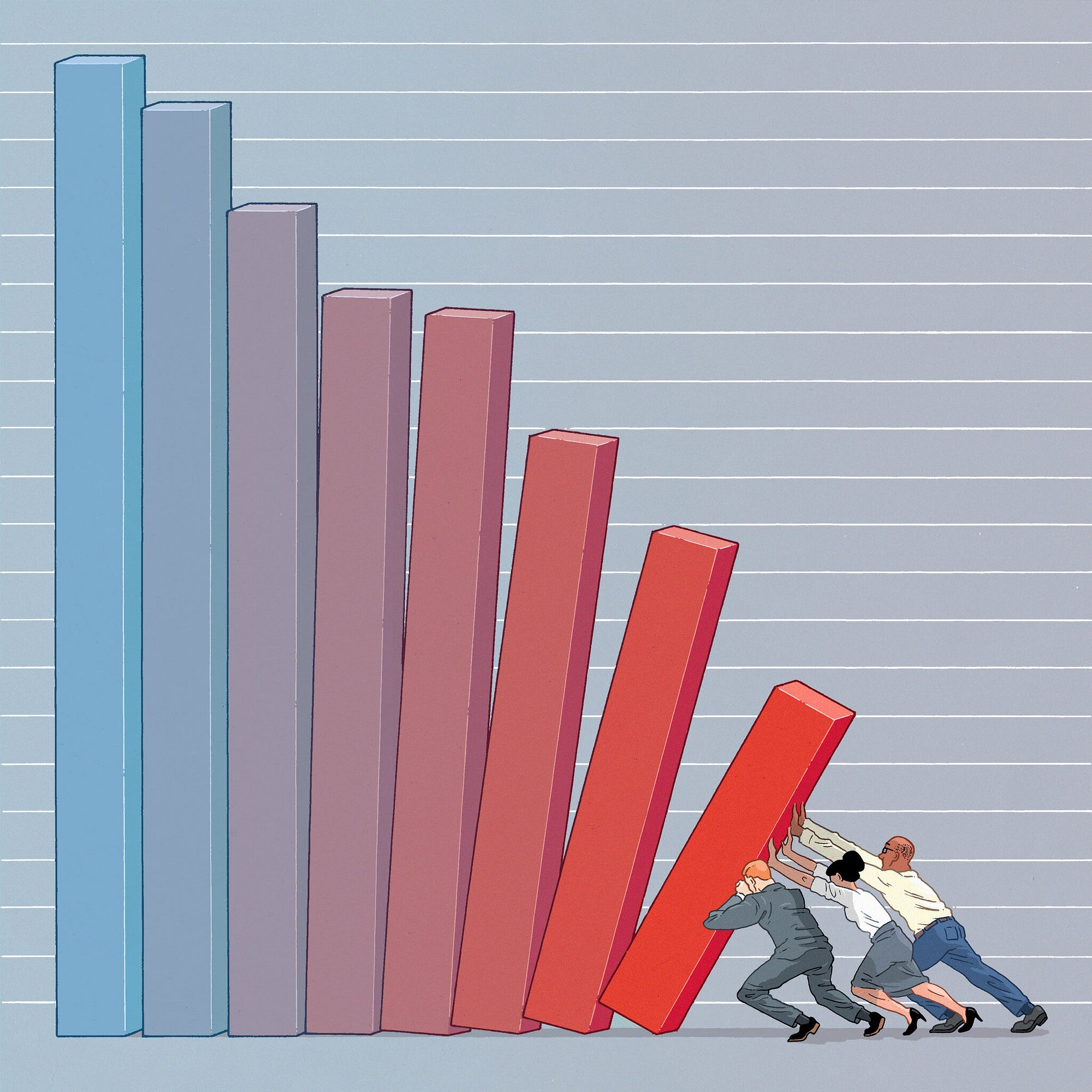

This created a domino effect: investors became less willing to purchase MBS products and were actively trying to sell their holdings; as a result, MBS prices declined, which reduced the value of MBS and thus the net worth of MBS investors. In turn, investors who had purchased MBS with short-term loans found it much more difficult to roll over these loans, which further aggravated MBS selling and declines in MBS prices.

Foreign banks were active participants in the US housing market during the boom, including purchasing MBS (with short-term US dollar funding) while parallelly US banks also had substantial operations in other countries. These interconnections provided a channel for the problems in the US housing market to spill over to financial systems and economies in other countries.

Failure of financial firms, panic in financial markets

Financial stresses peaked following the failure of the US financial firm Lehman Brothers in September 2008. Together with the failure or near failure of a range of other financial firms around that time, this triggered a panic in financial markets globally. Investors began pulling their money out of banks and investment funds around the world as they did not know who might be next to fail and how exposed each institution was to subprime and other distressed loans. Consequently, financial markets became dysfunctional as everyone tried to sell at the same time, and many institutions wanting new financing could not obtain it. Businesses also became much less willing to invest and households less willing to spend as confidence collapsed. As a result, the United States and some other economies fell into their deepest recessions since the Great Depression.

How Governments and Institutions reacted?

Until September 2008, the main policy response to the crisis came from central banks that lowered interest rates to stimulate economic activity, which began to slow in late 2007.

However, the policy response ramped up following the collapse of Lehman Brothers and the downturn in global growth.

Lower interest rates

Central banks lowered interest rates rapidly to very low levels (often near zero); lent large amounts of money to banks and other institutions with good assets that could not borrow in financial markets; and purchased a substantial amount of financial securities to support dysfunctional markets and to stimulate economic activity once policy interest rates were near zero (known as ‘quantitative easing’).

Increased government spending

Governments increased their spending to stimulate demand and support employment throughout the economy; guaranteed deposits and bank bonds to shore up confidence in financial firms, and purchased ownership stakes in some banks and other financial firms to prevent bankruptcies that could have exacerbated the panic in financial markets.

Stronger oversight of financial firms

In response to the crisis, regulators strengthened their oversight of banks and other financial institutions. Among many new global regulations, banks must now assess more closely the risk of the loans they are providing and use more resilient funding sources. For example, banks must now operate with lower leverage and can’t use as many short-term loans to fund the loans that they make to their customers.

The Aftermath…

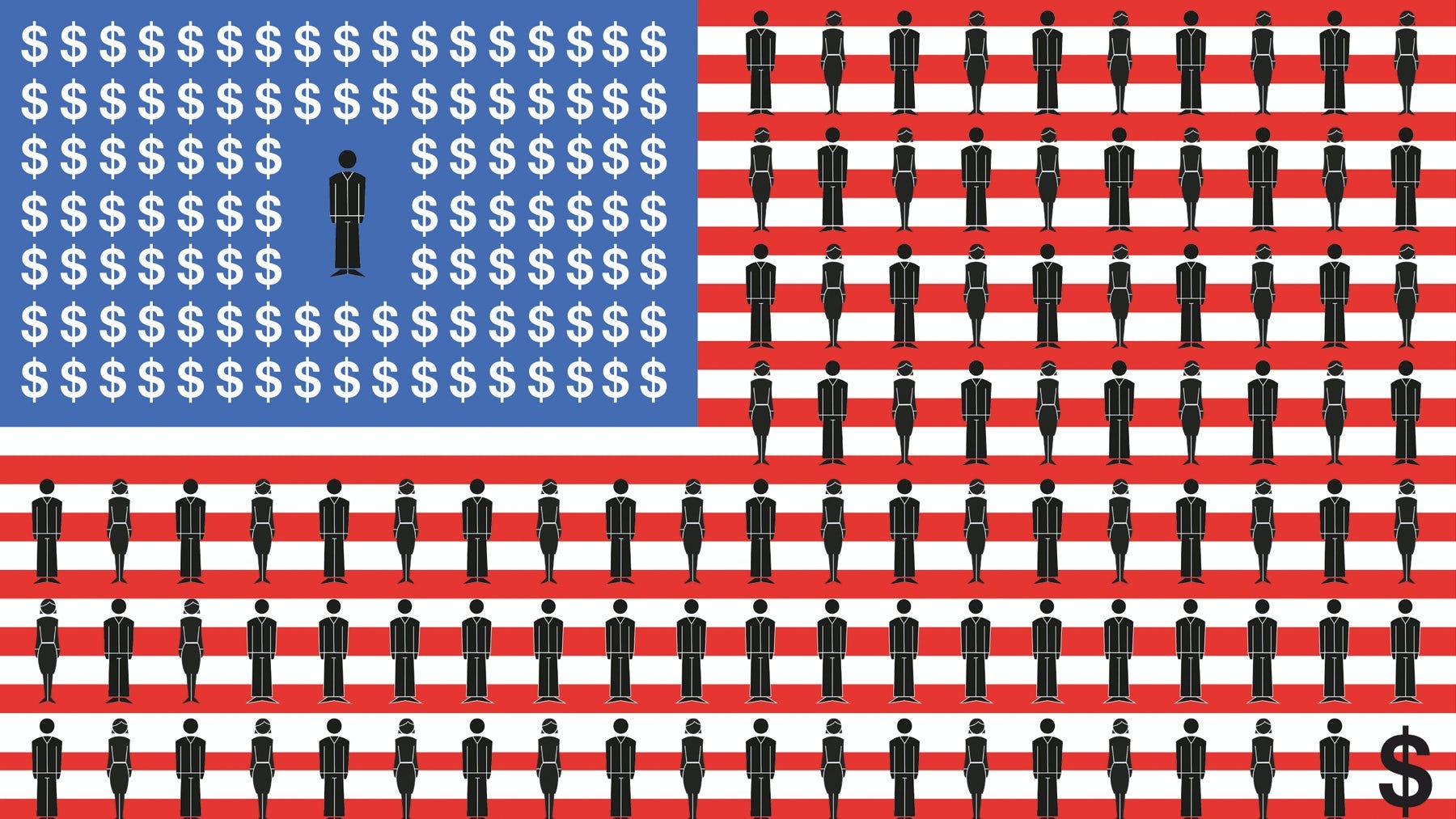

Toconclude, we can say that several parties have been involved to trigger a financial crisis, and it is still highly complex to answer the question of accountability in this sense. What we know is that these banks, institutions, and people created a crisis that cost tens of millions of people their savings, their jobs, and their homes.

Despite regulators becoming more vigilant about the ways in which risks can spread throughout the financial system and enforcing actions to prevent the spreading of such risks, the Great Financial Crisis left a deep wound that affected both the financial and social tissue of society by increasing INEQUALITY and created a profound fracture in the TRUST in such institutions and what they represent.