Alexandre Stachtchenko, blockchain and cryptocurrency director at KPMG France, gives us a complete paper which dismantles point by point the current prejudices concerning Bitcoin (BTC).

This column is published with the agreement of its author, Alexandre Stachtchenko , co-founder and board member of Adan, co-founder of Blockchain Partner and director of blockchain and cryptocurrencies at KPMG France. Thanks also to Grégory Raymond , journalist at Capital and creator of the premium 21 Millions newsletter, media that initially relayed this column.

Put an end to the anti-Bitcoin arguments

On December 17, I was invited to discuss with Nicolas Dufrêne on France Culture about the role of Bitcoin as a currency. Mr. Dufrêne had just published a column in Le Monde reiterating the classic clichés with regard to the first of cryptocurrencies.

However, the initial format being strongly limiting, I will try to deconstruct these arguments more in writing. This paper is intended more generally for journalists, economists, and other academics or curious people who would like to research the subject and go beyond the classic criticisms leveled at Bitcoin.

Discover the 21 Millions newsletter

Understand the utility before moving on to reviews

Let’s start by recalling the usefulness of Bitcoin. In reality, this point is at the root of the problem: something whose usefulness we do not understand can only be polluting, harmful, dangerous, or at best useless.

Bitcoin is both a payment system (Bitcoin, large B) and a unit of account (bitcoin, small b). It allows you to make transactions on the Internet as well as to secure your own assets. That is to say, keep it not “at” an intermediary, such as a bank, but a bit like cash, in a safe, this time digital.

If you live in an OECD country, where (almost) everyone is banked, transfers work well, and the local currency is (normally) stable, Bitcoin, for now, may seem uncompetitive in the face of to traditional currencies on its payment dimension.

Although … With international transfers made in seconds, for a few fractions of a cent, Bitcoin is useful even for a French person who would like to interact with abroad. I myself in December sent $ 10 worth of bitcoins to sub-Saharan Africa. It took me less than 5 seconds, and cost about the equivalent of $ 0.005. Traditional payment systems simply cannot compete with this. It is also no coincidence that CNBC headlined , when Bitcoin was legalized as legal tender in El Salvador, that this decision could cost Western Union and its colleagues $ 400 million per year.

Still, when you live in a rich country, the current volatility of Bitcoin, compared to those of the strong currencies of this world (euro, dollar, etc.), makes it unsuitable for managing your money and payments. Daily.

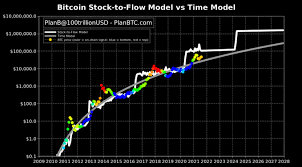

However, that is another matter for long term savings. The very model of Bitcoin makes it a store of value, since the number of bitcoins is finite and known, in a transparent manner (21 million). Obviously, like gold, it is social consensus that will determine its value. But 13 years after its creation, Bitcoin is gathering a growing consensus, among individuals and companies, which suggests that it is at least a credible challenger to gold in the coming years, particularly in a context of inflation that is picking up again.

Indeed, if we were used to a world where inflation has been absent for almost 20 years, it is returning now, and probably to stay. After the recent realization of the Fed, which recently recommended removing the qualifier “transient” to describe it , there is little left but the ECB to continue to say that inflation is a small temporary bump .

So, for an average French person, at the present time, if Bitcoin is only a currency in the making, it still has at least one utility: to diversify, to preserve its heritage. For the rest (payments in particular), the use of Bitcoin is possible, sometimes advantageous (especially internationally), but remains difficult, because acceptance is marginal. Of course, all of this is progressing, and the future will likely bring more adoption and simplicity.

In reality, when we take a step back, it is mainly in countries outside the OECD, that is to say for 85% of the world population , who do not live our great economic, financial and luxury luxury. monetary, that Bitcoin takes all its power.

For example, if the banking rate in France is almost 95%, it is only 15% in Niger .

Moreover, all government currencies are not as stable as the euro or the dollar. Just look at the recent fates of countries like Lebanon, Turkey, Argentina, Nigeria, Brazil, Venezuela, etc., which have all seen their currencies depreciate by at least 20% against the dollar in 2020 .

Also, it is clear that the use of the American dollar in the world as a reference currency is an economic weapon that our friends across the Atlantic do not hesitate to use to impose fines, forced sales of companies , and what the hell to entities that have the misfortune of overriding US embargoes, or simply competing with US companies in strategic markets.

For the Venezuelan who wants to leave his country and the humanitarian disaster unfolding there , the Congolese who wants to receive donations from around the world following a volcanic eruption and participate in local financial inclusion, Afghan women who wish flee the Taliban regime or simply live there with the beginnings of financial freedom , UNICEF which wishes to ensure the use of its funds, the utility of Bitcoin no longer needs to be demonstrated. “Without borders”, “resistant to censorship” … these inimitable advantages of Bitcoin, incomprehensible to the average French, yet save lives and have a major utility, including in OECD countries. Indeed, it is these same qualities of Bitcoin that have allowed and still allow whistleblowers like Snowden or Assange to finance themselves and to continue their essential work.

Finally, let’s mention two “use cases” of Bitcoin, at least, for states.

First, this is an industry that creates jobs, unicorns (eg Ledger), profitable businesses. Banning Bitcoin today would put hundreds of people out of work, and mortgage thousands of future job creations.

Second, the usefulness of Bitcoin for international trade is a given that even banks are starting to convert to. The American bank Citi, for example, evoked in 2021 that Bitcoin was on the verge of being massively adopted and could one day become “the currency of choice for international trade”. For operational reasons of course (costs, delays, disintermediation, etc.), but also for reasons of sovereignty. Bitcoin makes it possible not to go through the dollar, the use of which alone is subject to American law. Only its volatility hinders its use today, but adoption helps, volatility will drop. In the meantime, its use remains possible, with immediate conversion into local currency if necessary – or into stablecoin.

Ill-informed critics

Bitcoin and the evil speculation

Let’s start with one of the most recurring clichés: Bitcoin would be speculative. Be careful, this may shock some people, but… wheat is also speculative. Energy, gas, oil and more are speculative. Real estate is speculative. Currencies are speculative. In fact, and at the risk of irritating my collectivist friends, everything is speculative. It’s called the market economy.

To speak out against “speculation” selectively makes no sense. Does Mr. Dufrêne take offense at the 6.6 trillion dollars speculated every day on the currency market, according to the BIS (Bank of International Settlements)? Does he take offense at the $ 24.5 million sale of a torn piece of art ? Does he take offense at numismatics, philately and other passions for collecting, which can carry unusable stamps up to 130,000 euros ?

All this is not to say that the market economy works perfectly, it is not the subject of the debate here. But, in reality, Bitcoin is not criticized for its use for speculative purposes: it is criticized especially when it is not understood for its usefulness. The argument “Bitcoin is speculative” brings absolutely nothing to the debate, and is moreover not an argument, but a rhetorical device which tries to blacken the image of Bitcoin.

“Bitcoin is concentrated and unequal”

On Bitcoin, unlike the traditional banking system, anyone can create an address without asking for anyone’s advice or permission. This leads to a fairly simple truth: a person can own multiple addresses without knowing it. As a mirror, you can also create addresses managed by several people: either “on-chain”, multi-signature portfolios for example, or “off-chain”, by introducing cash management rules on an address, by dividing passwords, etc. In the same way that if only the CFO is responsible for the treasury of a company, the latter can delegate signature, and can be controlled by various governance mechanisms, a Bitcoin address can be managed by a single person, multiple people, on their own account,

Therefore, the assertion “2% of Bitcoin addresses own 95% of bitcoins” cannot lead to any conclusion. A person may well own hundreds of millions of dollars in bitcoin, and spread it over thousands of addresses, and conversely, one address may hold tens of thousands of bitcoins, but actually represent millions of individual holders. And this does not only apply to exchange platforms like Coinbase (a few addresses, but more than 70 million customers): three examples illustrate this well.

First, Grayscale: this investment fund alone has $ 30 billion in bitcoins . However, its shareholders are itself made up of other funds, which can be purchased on the open market, and therefore by individuals.

Likewise, MicroStrategy has between 6 and 7 billion dollars of bitcoins. When we look at the shareholding, we find… the Norwegian sovereign wealth fund! So, the real holders of these bitcoins are, in part, all Norwegians!

And finally, the WBTC token, a representation of Bitcoin on Ethereum, requires the immobilization of nearly 250,000 bitcoins (or about $ 11 billion) on a few addresses, themselves managed by only a few off-chain entities. But these bitcoins are actually blocked in escrow to ensure a 1: 1 ratio in exchange for the WBTC token, which circulates on Ethereum. Token distributed over … nearly 43,000 different addresses !

Add to that the lost bitcoins. A significant number of them are grouped together on a limited number of addresses, which were among the first to obtain bitcoins for a ridiculous price. For example, the address “1FeexV6bAHb8ybZjqQMjJrcCrHGW9sb6uF”, created in 2011, holds nearly 80,000 bitcoins , valued today at around $ 4 billion. These bitcoins have never moved since the creation of the wallet, making the hypothesis of the loss of the keys extremely likely. Estimated at around 4 million units , or 20% of the total capitalization, these lost bitcoins distort the calculation of the supposed “unequal” distribution of Bitcoin.

In short, even outside of the exchange platforms, there are very many entities which hold bitcoins on behalf of third parties, and which are counted in this “concentration” of bitcoins.

Can I suggest a fairly easy way to ‘take down’ Bitcoin, if that is a problem at all? Buy it yourself. Have them bought and held by the Banque de France. Have it undermined by EDF, which would make its electrical installations profitable at the same time (see next section).

In any case, it is not the role of money to distribute itself “well”. For this, there is work, capital, investment, the economy in general, or the State, to ensure a more equitable redistribution of wealth, according to laws passed by representatives of the people. Whether in euros, dollars, or bitcoins. In the same way that we cannot accuse the euro on its own of being badly distributed, we cannot accuse Bitcoin of this defect. In 2018, 26 people owned as much as the poorest half of humanity – 4 billion people. Bitcoin’s fault?

The problem is not related to the unit of account used to measure wealth, but in the distribution of it.

“Bitcoin is destroying the planet! “

Most of the studies that point to Bitcoin’s environmental footprint completely fail to understand how this system works or what it replaces. One example among many is that Bitcoin is often compared to Visa in terms of transactions per second, and energy consumption per transaction.

First, Bitcoin’s energy consumption does not depend on the number of transactions made. The energy consumed by the network does not depend at any time on the number of transactions in a block, since it serves to secure the consensus of the network. An empty block and a full block can consume the same energy.

Second, Bitcoin is a complete system, which Visa is not. Indeed, Bitcoin, as we have seen, is both a payment system, a unit of account, and also includes an autonomous way for everyone to create and manage their own funds. Visa is just a payment channel: take away the banks, take away the euro or the dollar, and Visa can no longer operate. It would then be necessary to compare the energy consumption of Bitcoin with that of the entire banking system, as well as all industries related to gold mining .

The problem is that this comparison is very difficult to establish, in particular because the banking system, it is not transparent about its figures and its consumption, as well as, incidentally, its financing to fossil industries. The NGO Oxfam estimated, for example, in 2020 that the carbon impact of French banks alone was 8 times greater than that of the whole of France.

In addition, the use of higher technical layers, deporting off-chain transactions while keeping synthetic evidence on the first layer, allows a comparison much more to the advantage of Bitcoin. Indeed, thanks to the Lightning Network, Bitcoin is able to process millions of transactions per second without affecting its energy consumption.

All this, beyond alerting us to the quality of the media treatment of the subject, is quite serious, insofar as we can consider, conversely, that Bitcoin is an opportunity for the energy transition, and this for at least two major aspects. The first is operational, the second is systemic.

From an operational point of view, mining is an industry that has two main characteristics: the very strong dependence of its business model on electricity costs on the one hand, and geo-independence on the other. Concretely, mining can be carried out anywhere on the planet, without any geographic constraint. Indeed, unlike most industries, which require setting up next to a consumption basin, a deposit of natural resources, or a logistics platform (port, airport, etc.), to mine Bitcoin only requires an Internet connection, even intermittent or of poor quality.

Bitcoin miners therefore use this enormous advantage in order to be economically profitable, and counterbalance their heavy dependence on electricity prices: they are extremely mobile, and will seek electricity where it is cheapest, everywhere on the planet. planet.

It happens, circumstantially, that this cheaper electricity comes from high carbon sources. In reality, this is rare: carbon energy sources (mainly coal, oil, gas) are controllable, which makes them much more practical for most industries and consumption areas. To simplify, if we turn up the heating, we put more coal in the plant. Producers adapt in order to be profitable, and sell their energy to many consumers, who compete to buy it at a high price. If demand decreases, production is adjusted downward.

Conversely, renewable energies (ENR) are said to be non-controllable. Concretely, wind turbines turn when there is wind, solar panels work when there is sun, etc. The renewable energies are thus intermittent, which represents a major disadvantage for the energy system. For example, since the decision to stop nuclear power, Germany has had to install renewable energy production capacity that is much greater than consumption in order to compensate for times when production is unexpectedly reduced. As of this writing, solar in Germany is at 8.83% of its installed capacity (it’s 4 p.m., not even at night).

Result: renewable energies regularly find themselves in overproduction, that is to say that they produce energy that nobody needs, and which is “wasted”, because the storage of energy (excluding hydroelectric dams ) remains extremely complicated and expensive today. This makes renewable energies difficult from an economic point of view, which, of course, except massive subsidies to counterbalance, slows down the ecological transition. In Russia alone, for example, there would be 2,000 TW of hydroelectric power that is not being exploited . This is nearly 35 times the power of the French nuclear fleet, enough to power the Bitcoin network around 15 times throughout the year .

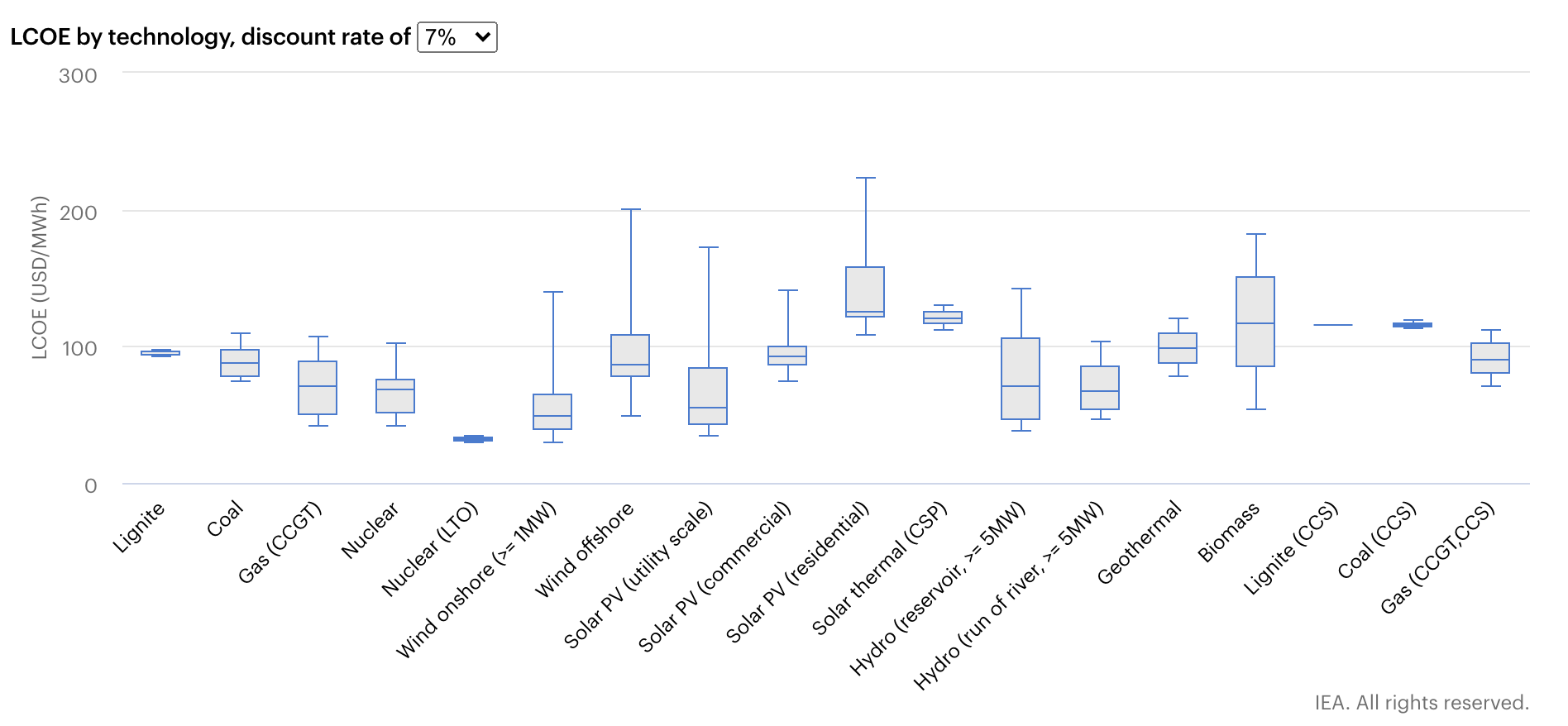

As this graph from the International Energy Agency shows, the cost of renewable energies varies much more than that of controllable energies, and can sometimes be the lowest on the market.

Harmonized energy cost in USD / MWh – The ends represent the minimum and maximum values possible for a given energy source, the box represents the 2nd and 3rd quartiles.

To make renewable energies profitable and accelerate their deployment, we would therefore need an extremely mobile industry, able to set up anywhere, to absorb surplus energy when they are present. That’s good news: Bitcoin mining meets this definition exactly.

Even beyond conventional renewable energies, mining will also use waste to feed itself. Because indeed, what is cheaper than waste? As such, the case of “gas flaring” is emblematic.

When oil is extracted from a well, in general, other hydrocarbons are released, such as condensates, liquid gas and natural gas. Due to a lack of outlets, this gas is, in a quarter of cases, literally burned on the spot. Indeed, transporting it would be too expensive, and letting it evaporate would be even worse for the environment .

Some miners have started to find a solution to this problem by using this gas to power their mining machines . According to the University of Cambridge and the International Energy Agency, there would be enough to power the Bitcoin network almost 6 times using only the energy recoverable from this “gas flaring” .

Moreover, from a systemic point of view, unless you still believe in green growth , Bitcoin is indeed the only currency that allows people to get out of an economic system based on an illusion of infinite growth and free natural resources.

Unlike traditional fiat currencies, based since 1971 on nothing more than Bitcoin, namely trust, and whose survival depends on the creation of debt and infinite growth (without growth, everything stops), Bitcoin is rare, limited, and not easy to handle.

This prompts economic agents to behave completely differently from “rational” behavior than usual by inflation: the longer they wait and postpone their consumption, the more purchasing power they gain. This principle should lead to a decrease in immediate and superficial consumption and promote a forward-looking and long-term behavior.

So of course that creates other major economic problems, because credit becomes complicated and so does the capitalist system. It is a debate that should be had with the whole of society. But from a systemic point of view, it is nonsense to call Bitcoin anti-ecological, when compared to its competitors. As Alex Gladstein of the Human Rights Foundation reminds us, the dollar monetary system is based on the existence of the US military and Persian Gulf monarchies who undertake to sell their oil in this currency . We have known more ecological.

At a time when planes are running empty to preserve slots at airports , while the economy is semi-confined, I think there are other more important ecological concerns than hitting Bitcoin for reasons. fallacious, especially when the latter is a lever of ecological transition.

“Blockchain is the real revolution: long live the MNBCs!” “

Now let’s come to another boring review, but useful, because it instantly identifies anyone who hasn’t worked on the subject: “Bitcoin is not good, but at least thanks to Bitcoin we have the blockchain. And now we’re going to be able to do better than Bitcoin with Central Bank Digital Currencies ”(MNBC).

If by “blockchain” we mean “chain of cryptographic hashes”, then it is not Bitcoin that allowed the blockchain, since it has existed since at least 1982 with the proposal of David Chaum “Computer Systems Established, Maintained, and Trusted by Mutually Suspicious Groups ” . It is therefore rather the blockchain that preceded Bitcoin. But then, how come no one is talking about this thing that has been around since 1982, but suddenly, since the invention of Bitcoin, everyone is talking about it?

In reality, when we talk about “the blockchain” and its revolutionary nature, we often resort to an abuse of language when talking about cryptocurrencies, and in particular Bitcoin.

For a fairly simple reason: Bitcoin’s major innovation is not blockchain, as many would have us believe. It is the consensus without intermediary in a computer network, making it possible to manage and transfer value online. The blockchain is one of the elements of this innovation, but it is not the only one.

The novelty brought by Nakamoto is the remuneration of minors in a dedicated unit of account, bitcoin. Because it is this economic incentive that allows the network to be independent, and to align the rational and economic interests of the participants, in order to build a reliable and incensurable network, without trusting anyone.

And this is why blockchains, or at least those that bring real breakthrough innovation, are inseparable from cryptocurrencies: these independent units of account, which must be able to be generated autonomously, by everyone, with the least possible amount of money. link to the real world to avoid any distortion and disparity.

Imagine if it was necessary to satisfy such an organization or that institution to validate its reward in bitcoins: in addition to creating a barrier to entry, this would recentralize all the power in the hands of the said organization or the said institution, which would unilaterally decide the rules. The network would then be recentralized, and all interest would be lost, since it would become censurable.

Miners mine precisely because they have the assurance that the rules are the same for everyone, and that they will receive a reward if they win the mathematical competition in which they participate. This reward must be kept safe from any arbitrary monetary creation, decided in an office of a centralized body, which could have an impact on the value of the units of currency received.

There are other cryptocurrencies: ether, for example, from the Ethereum blockchain, making it easy to build more complex financial applications compared to Bitcoin. However, there is one central point on which it is very difficult if not impossible to catch up with Bitcoin: the absence of identifiable founder (s). It is an incredible force guaranteeing the incensurability of the network. Indeed, without a founder, foundation, association, or company representing Bitcoin, there is literally no hold, no point of attack for anyone who wants to attack the network.

In addition, Bitcoin remains the number one cryptocurrency today, in terms of decentralization (number of nodes in the network), capitalization, number of users, etc. The network effect of its exponential adoption makes it stronger every year.

Any blockchain without crypto is doomed, at best, to provide only a marginal operational gain (at the cost of often very significant costs); at worst, to be just a well-marketed version of an Excel table, which will be used for advertising.

Now, let’s talk about MNBCs: we are promised that thanks to “the blockchain”, we will be able to make Central Bank Digital Currencies, that is to say take advantage of the characteristics of Bitcoin, but without the bad Bitcoin.

Two possibilities are mentioned: “retail” or “wholesale” MNBCs.

Retail MNBC would allow the central bank to manage cash online, and allow any citizen to access central bank money while benefiting from digital services. However, the impasse is the following: to function, an MNBC would have to organize a “consensus” similar to that invented by Nakamoto, that is to say decentralized, open, public, etc. But this very infrastructure would preclude precisely the control over money that central banks aspire to. So, we have two ways out of this impasse.

Either, after years of procrastination, the idea of a retail MNBC will be abandoned, because in addition to being technically impossible, no bank will allow itself to be bypassed, and probably no central bank will wish to improvise itself as a manager of account. In this case, we will do a wholesale MNBC, which will only consist of optimizing the way in which commercial banks exchange central money. No change for citizens, relative change for financial institutions, and I don’t see why we are making so much noise about it.

Either, and this is more worrying, the idea is not abandoned, and we try at all costs to force a circle into a square: at all costs, we will try to allow the citizen to have an account at the bank central, and to manage “digital cash. In this scenario, it is literally impossible that this will not come at the cost of individual freedoms, the right to confidentiality and privacy. We would end in a Chinese model, where the slightest side step could end in an asset freeze.

Let me specify: the ECB ensures that commercial banks will be included in the “digital euro” device in the event of an MNBC issuance. Concretely, they would probably be in charge of KYC controls, account management and therefore distribution of the MNBC. No short-circuit, therefore, although at the accounting level the assets would appear in the balance sheet of the central bank and not in that of banking establishments.

But what added value for the digital euro, ultimately? Not circulating on public blockchain (eg Ethereum), which cannot be used in an interoperable, auditable, transparent and automatable ecosystem (thanks to smart contracts), nor to buy any type of asset in the form of a token that is issued on blockchain, it would ultimately be another computerized version of the euro in a closed and centralized system. The only winner: the ECB, which would keep control of the circulation of money with a view to decreasing use of cash. And could use this new tool to expand the arsenal of monetary policies, for better or for worse.

In reality, and in conclusion, Mr. Dufrêne confuses two assertions: “Bitcoin is not a currency” and “I do not want Bitcoin to be used as a currency”.

The first assertion is in reality indefensible today, if only because it is legal tender in a country of the world (El Salvador).

The second is argued, although I do not agree, and it seems futile to prohibit the use of Bitcoin, as it is futile to ban the Internet (except to end “Chinese”). But everyone would benefit from the debate being at the right level. History that we stop wasting time on useless questions, while other countries are remaking us the Internet blow.

Thanks to Alexandre Stachtchenko for this forum , which, we hope, will become a reference in the French crypto-sphere. Do not hesitate to follow him on Twitter and on LinkedIn .