Polygon (MATIC) is a protocol linking several scalability solutions for the Ethereum blockchain. It allows developers to quickly build a scalable bespoke blockchain compatible with the Ethereum Virtual Machine (EVM). Thanks to its technology based on Plasma, Polygon makes it possible to reconcile speed and security, without neglecting decentralization. Let’s discover together the unique architecture of Polygon, synonymous with great modularity.

- What is Polygon (MATIC)?

- The Polygon ecosystem

- What are the roles of the MATIC token?

- Polygon’s fundraising

- Polygon team and partners

- How to buy MATIC cryptocurrency?

- Ratings and reviews on Polygon (MATIC)

What is Polygon (MATIC)?

In 2017, at the dawn of decentralized finance (DeFi), the question of the scalability of the Ethereum (ETH) blockchain , i.e. its ability to process many transactions in a short time, began in earnest. to ask. It was then that the Matic Network protocol was born in India, the fruit of the work of three developers from the Bitcoin community.

In their research, the Matic Network team came across a post from Ethereum co-founder Vitalik Buterin and Lightning Network co-founder Joseph Poon detailing a new scalability solution: “ Plasma ”. This solution is based on the duplication of a mother blockchain , the copy of which will be faster while maintaining its security. The Plasma solution will form the basis of the Matic blockchain .

Matic Network becomes Polygon at the beginning of 2021. Much more than a name change, this redesign signals a reorientation from a single blockchain to an aggregator of scalability solutions for Ethereum . Any developer can therefore come and create a scalable blockchain there .

Logo of Polygon (MATIC), by Cryptoast

The different types of blockchains on Polygon

Polygon is a very modular platform offering great flexibility in consensus methods . We can still distinguish two main categories of blockchains:

Secured chains are actually Layer 2 . This category includes solutions from Optimistic Rollups, ZK Rollups, Plasma, etc. The security of these blockchains is maintained through a security service (SaaS).

This SaaS exists in two forms:

- Security is maintained through the parent blockchain using proofs of validity ;

- The blockchain is secured by a set of validators selected by Polygon in exchange for a fee (similar to Polkadot’s parachains).

This SaaS option is perfect for young protocols who lack a large enough community to secure the blockchain. Projects requiring increased security are also the targets of this option.

Stand -alone chains or autonomous chains are sovereign. They are entirely responsible for their security (so they have their own set of validators). Their degree of flexibility in the consensus method is thus high. They are particularly used by companies or well-established protocols that require such a level of customization.

The general architecture of Polygon

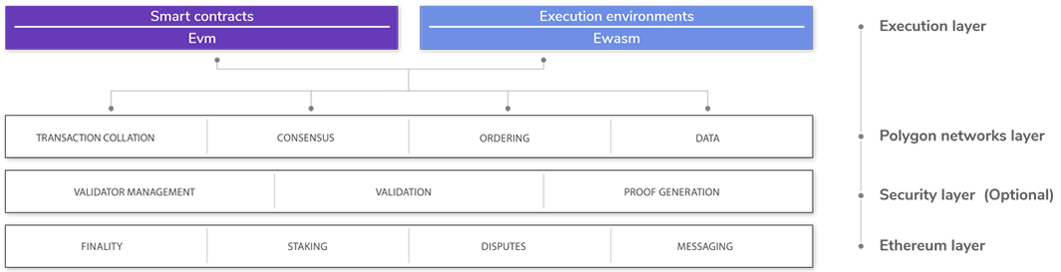

Any new scalability solution deployed on Polygon must respect a structure. It is divided into 4 modular and customizable parts :

- The Ethereum layer is the layer where all of Polygon’s smart contracts are stored . They enable transaction finality , staking , or information transfer between Polygon and Ethereum. They are also used to resolve any conflicts between the various actors in the network.

- The security layer contains a set of validators that secure Polygon blockchains that want it in exchange for a fee. In particular, it hosts the SaaS validators and the services necessary for its operation. This layer exists in two forms: one running on a blockchain parallel to Ethereum (called meta-blockchain ) and one hosted on Ethereum directly.

These first two layers are optional , because a solution built on Polygon can decide its sovereignty and its mother blockchain (Ethereum is still largely prioritized today). The following two are mandatory .

- The Polygon layer contains all the blockchains deployed there . Compliance with this allows communication between all the solutions. It is on this layer that block production and local consensus are managed.

- The execution layer is responsible for executing and coordinating transactions on Polygon blockchains. It is composed of two sub-layers:

- The execution environment (also called the EVM ).

- The layer of execution logic that defines the state of a particular Polygon blockchain. It is in the form of an Ethereum smart contract.

Polygon Network Architecture – Source: Polygon

The Polygon Consensus Method

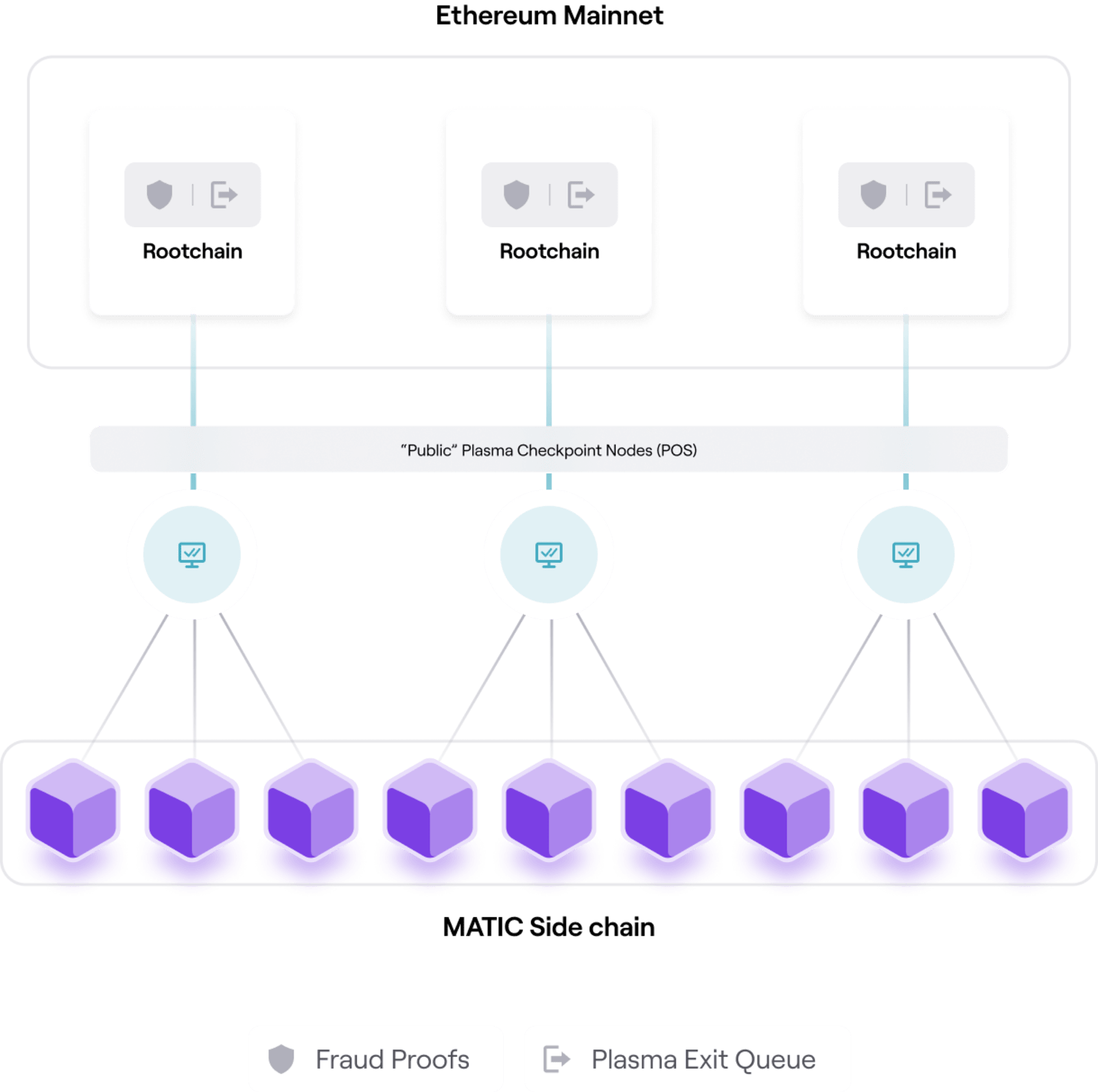

To allow the Polygon network to be fast without compromising security or decentralization, the team designed a two-stage solution, based on Plasma . The first, called Bor , is responsible for producing the blocks on the various Polygon blockchains. The second, Heimdall , must secure the global network with the help of the mother blockchain. Both of these tiers are proof-of-stake (PoS) blockchains .

Bor (or “MATIC Side Chain”) is a secondary chain (called a child chain ) copied from Ethereum. The creation time of a block is very low, in particular thanks to the few actors who produce them (between 7 and 10). This layer is responsible for aggregating transactions into fast blocks.

Heimdall (or “Plasma Checkpoint Nodes”) is actually a set of validators (between 100 and 120), who wear a customs hat. Indeed, their role is to aggregate several blocks of the Bor chain into a single Merkle root (a transaction of several transactions). This then passes through a checkpoint where a fraud check is performed. This root is then sent to the Ethereum blockchain (the parent blockchain ), where transactions are finalized.

Polygon Consensus Method – Source: Polygon

The peculiarity of this two-stage operation is that both layers use the same set of validators . The 7 to 10 validators that produce blocks on Bor are selected using the Peppermint method (from the Cosmos protocol) among the 100 to 120 Heimdall validators . These are then responsible for the production of blocks for a certain period of time (a ” span “), before being replaced.

On Heimdall , the same Peppermint mechanism is used. A validator is randomly selected in proportion to the MATIC tokens in their possession. It must verify and publish the Merkle root on the Ethereum blockchain .

The Polygon ecosystem

Polygon’s ecosystem is flamboyant . This is particularly due to the proximity that the platform maintains with Ethereum, unlike other solutions like Avalanche or Polkadot which are not really close natively.

Polygon’s internal ecosystem

Within Polygon itself, there are already 7 scalability solutions developed in the space of 1 year. Two of them are already usable at the time of writing these lines (February 2022):

- Polygon PoS , the successor to Matic Network. It is still today the most used blockchain in the Polygon ecosystem thanks to its age and ease of use;

- Polygon Hermez , the first scalability solution implementing Zero Knowledge Proofs on Polygon. This is added when Polygon announces the acquisition of the ZK Rollups Hermez blockchain in mid-2021.

Four other solutions are under development:

- Polygon Miden , a solution from ZK Rollups based on STARK technology, also in development at Starkware;

- Polygon Nightfall , a one-of-a-kind solution that combines technologies from Optimistic Rollups and ZK Proofs . Developed in collaboration with EY, it is focused on the confidentiality of transactions;

- Avail , a scalable blockchain dedicated to availability and data flows;

- Polygon Zero , a super-fast ZK Rollups blockchain for generating zero-knowledge proofs in record time.

A final solution was developed by the main team: Polygon Edge , a Software Development Kit (SDK) that can be compared to a toolbox. It allows any developer to create their own scalability solution on Ethereum, fully compatible with the Ethereum Virtual Machine (EVM ) and Ethereum tools. The consensus mode can also be chosen and modified very simply.

Polygon’s external ecosystem

Due to its complicity with Ethereum, low fees, and use of EVM, Polygon has a very large catalog of decentralized applications (DApps). Today, there are more than 7,000 applications on its network. The vast majority of these applications are hosted on the Polygon PoS Chain .

Many mature DeFi applications have migrated to Polygon (or integrated alongside Ethereum) such as Aave, Curve and Uniswap. Others like Quickswap, a fork of Uniswap, are native to Polygon.

There are also multiple applications related to non-fungible tokens (NFTs ) such as OpenSea, Unstoppable Domains, Decentraland or The Sandbox.

Polygon is also compatible with bridges like Hop Exchange or Multichain. These make it much easier to transfer assets between different blockchains.

According to the Defi Llama site, which lists the largest decentralized applications on each blockchain, Polygon is positioned in 8th place in terms of total value locked (TVL) at the time of writing these lines.

The tweet below presents a non-exhaustive overview of the Polygon ecosystem.

What are the roles of the MATIC token?

The ERC-20 MATIC token is the native cryptocurrency of the Polygon platform. It is what is called a utility token , that is to say a token that one buys in order to access services.

Like ETH on Ethereum or BTC on Bitcoin, MATIC tokens are used to pay fees on all blockchains that make up the Polygon network. These costs vary according to the scalability solution used, but remain minimal.

MATIC tokens can also be delegated to validators for the purpose of securing the Polygon PoS Chain . On this Proof of Stake (PoS) Blockchain, the first 120 validators (classified by number of blocked MATICs) are rewarded in proportion to the number of tokens in their possession.

In the near future, the MATIC token will also be used in the Polygon DAO . This initiative comes with the aim of decentralizing the governance of Polygon.

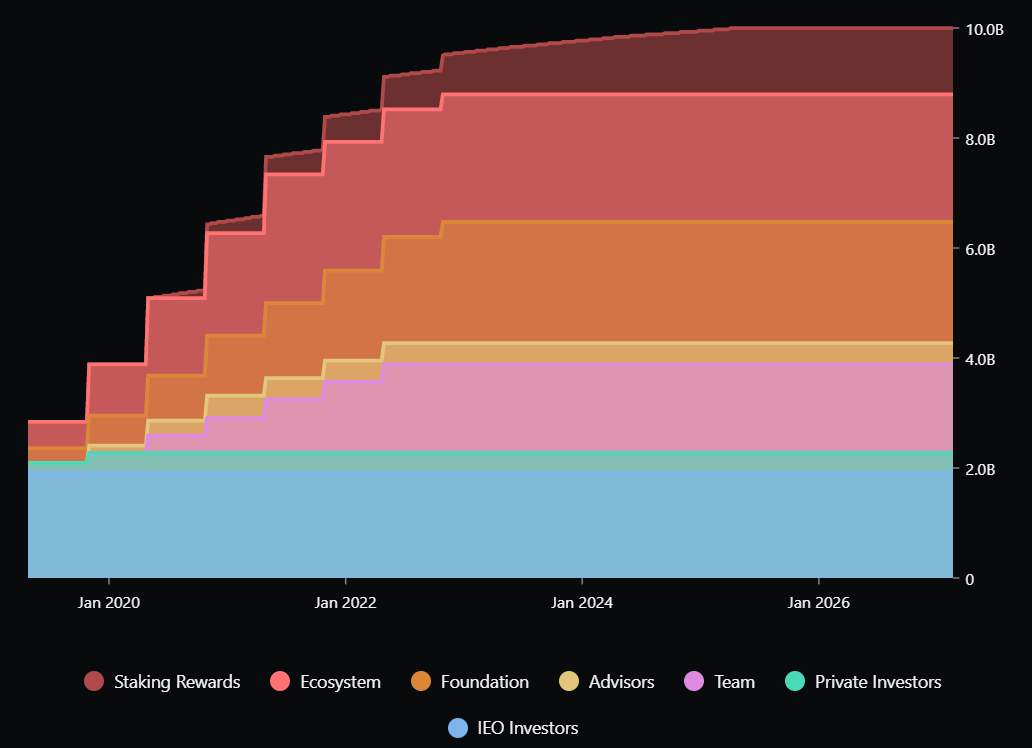

MATIC is currently an inflationary cryptocurrency, which makes it possible to pay delegators and validators. However, the maximum number of tokens is set at 10 billion units . All MATIC tokens will be in circulation by mid-2025.

Release of MATIC tokens over time – Source: Messari

In January 2022, the Polygon PoS Chain integrates Ethereum ‘s EIP-1559 , introducing the burn mechanism to each transaction. Since the maximum of MATIC tokens was set at 10 billion units at its inception, it will become deflationary by mid-2025.

Polygon’s fundraising

Polygon’s first fundraising came in April 2019 during its Initial Exchange Offering (IEO) on the Binance Launchpad . During this IEO, 1.9 billion MATIC went on sale at a unit price of $0.00263, raising a total of $5 million .

At the same time, Polygon is conducting a private fundraising in which 209 million MATIC are sold to private investors such as Coinbase at a unit price of $0.00079. 171 million MATICs are also being sold for $0.00263 to early supporters . During this private fundraiser, $615,000 was raised by the Polygon team.

In May 2021, famous American investor Mark Cuban added Polygon to his website listing all of his investments. In addition to the purchase of MATIC tokens, Mark Cuban ensures that he regularly uses the Polygon blockchain and intends to integrate it into his NFTs platform Lazy.com .

Polygon ‘s last fundraising dates back to the beginning of February 2022. During this one, the Polygon team announced that it had raised $450 million from numerous venture capital funds. Participants include SoftBank , Sequoia Capital India or Alameda Research . During this round, MATIC tokens were sold to investors at an undisclosed discounted price.

Polygon team and partners

The team behind Polygon

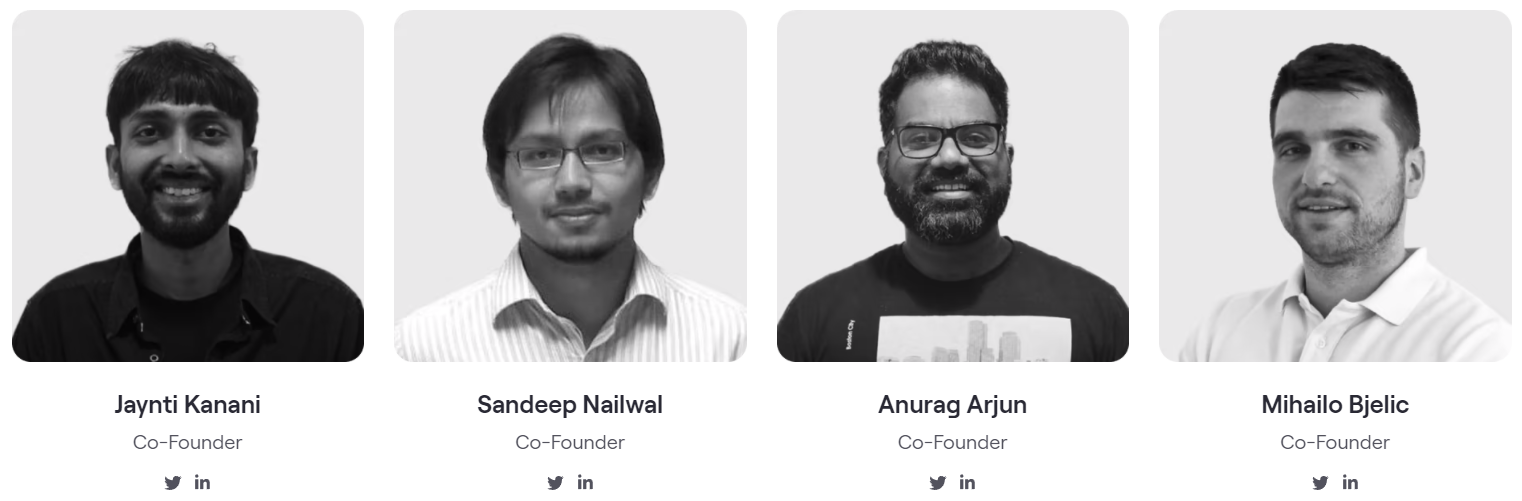

It was in 2017 that Jaynti Kanani , Sandeep Nailwal and Anurag Arjun , three Indian developers, founded Matic Network . So very active members of the Bitcoin community , the trio is looking at the Ethereum blockchain , looking at all costs for a scalability solution for it.

While researching, they came across a post from Ethereum co-founder Vitalik Butherin and Joseph Poon detailing a scalability solution called “ Plasma” . This will later be improved by Jaynti Kanani and a team of developers into ” More Viable Plasma” , the technical basis of the future Polygon PoS Chain .

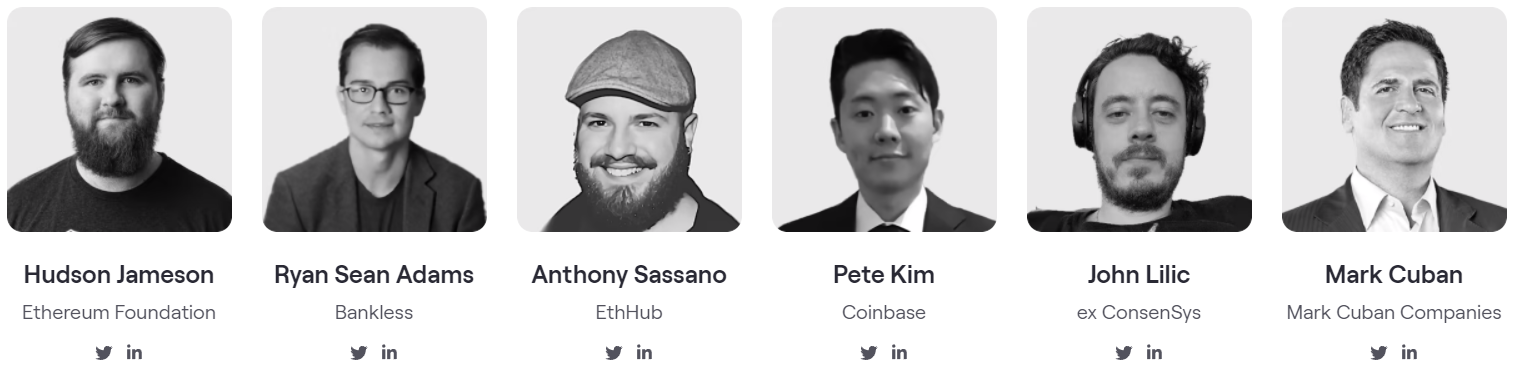

At the beginning of 2021, Mihailo Bjelic , a Serbian developer, joined the Indian trio and together they co-founded Polygon Technology, the successor to Matic Network. With this revamp, many well-known developers like Anthony Sassano and investors like Mark Cuban join Polygon’s advisory board.

Part of the Polygon team (top: co-founders – bottom: advisory board) – Source: Polygon

According to their official LinkedIn , Polygon Technology has over 230 people contributing regularly to Polygon and its growing ecosystem.

Polygon partners

Being the most used Ethereum scalability solution, Polygon has many partnerships. In particular, we can distinguish the two stablecoin giants DAI and USDC which joined the Polygon network in 2018 and 2020 respectively.

In order to build a decentralized finance ecosystem, the Chainlink oracle network chooses Polygon in 2020 to be the first non-Ethereum blockchain to receive its valuable decentralized data streams .

In 2021, with the growth of NFTs and blockchain games , Polygon announces a partnership with the famous console and video game company Atari , becoming the platform of choice for its blockchain activities. The same year, partnerships were concluded with OpenSea , The Sandbox and Unstoppable Domains with the aim of deploying these protocols there and making them more efficient.

The two data query giants The Graph and Google BigQuery are also announcing a partnership with Polygon in 2021. This collaboration aims to provide developers with a tool to analyze the Polygon PoS Chain simply and quickly.

AU21 Capital also announces in 2021 the creation of a $21 million fund in collaboration with the Polygon team. It intervenes in the form of financial aid to developers who wish to build on Polygon.

Many other partnerships have been entered into by Polygon since 2018 and can be seen on their dedicated news page .

How to buy MATIC cryptocurrency?

The MATIC token is in the top 20 and is the most popular Ethereum scalability utility token. From these facts, it is available on all major exchange platforms such as FTX , Coinbase , Kraken , Crypto.com, but also Binance , its IEO platform, where liquidity is greatest.

Explanations for buying MATIC on Binance

- Register on Binance;

- You will receive an email and need to click on a link to verify your account;

- Deposit funds on the platform;

- Click on the Market menu and look for the MATIC/USDT pair ;

- All you have to do is buy MATIC for the amount of your choice;

- Congratulations 🎉 You are now in possession of MATIC tokens!

Ratings and reviews on the Polygon and its MATIC token

Driven by the ambition to create an Internet of scalable blockchains, the Polygon project is showing itself as a serious ally of the Ethereum blockchain , in a period where the blockchains which are technically superior to it are multiplying.

Thanks to its proximity to Ethereum, multiple developers have decided to jump into Polygon and its proof-of-stake blockchain. Its ecosystem is now one of the most mature thanks to the migration of recognized protocols such as Aave or Uniswap to Polygon .

2021 was a booming year for the blockchain and its MATIC token . Its TVL jumped over 18,000% from January to December 2021, reaching the value of $4.5 billion at the end of February 2022. The MATIC token also saw a very strong rise over the same period, from 0.02 $ in January 2021 to over $2.5 at the end of the same year, or one x125 .

The aggressive takeover and expansion policy since the change from Matic Network to Polygon has enabled the creation of 6 new scalability solutions. They were added to the original Polygon PoS chain , and this, in the space of only 1 year.

However, this new policy has its share of disadvantages . It is indeed often preferable to focus on a single solution , which can be developed in depth. The expansion certainly offers more solutions, but these frequently lack technical depth .

This reasoning is especially true when competing teams develop their own unique scalability solution. We can name Starkware (ZK Rollups), Optimism or Arbitrum (Optimistic Rollups), among others.