Silence, it’s falling! – Bitcoin starts the week with a – sad – record. This is the first time since April 2014 that Bitcoin has been in the red for five weeks in a row. With this data, Bitcoin seems rather resilient given the current situation. The stock market is in a correction phase and some stocks look like our best shitcoins… For the moment, Bitcoin seems to find interest near $40,000 and a large majority of players are starting to talk about a bear market. It seems that the situation is different compared to 2018, but the stock market could take Bitcoin to the abyss… Let’s see if the situation is catastrophic or if the market can still be saved!

BITCOIN: LOSS OF SELLING POWER?

Bitcoin lost 20% in April. It is possible that buyers will regain control quickly :

Bitcoin remains on a bullish structure in weekly time units. However, in daily time units, sellers have regained control since this “M top” . On the momentum RSI, a potential divergence is currently emerging. For it to be confirmed, the RSI must close above 48 .

A divergence is not a sign of top or bottom. It just means that the actors are losing strength, that the movement is running out of steam .

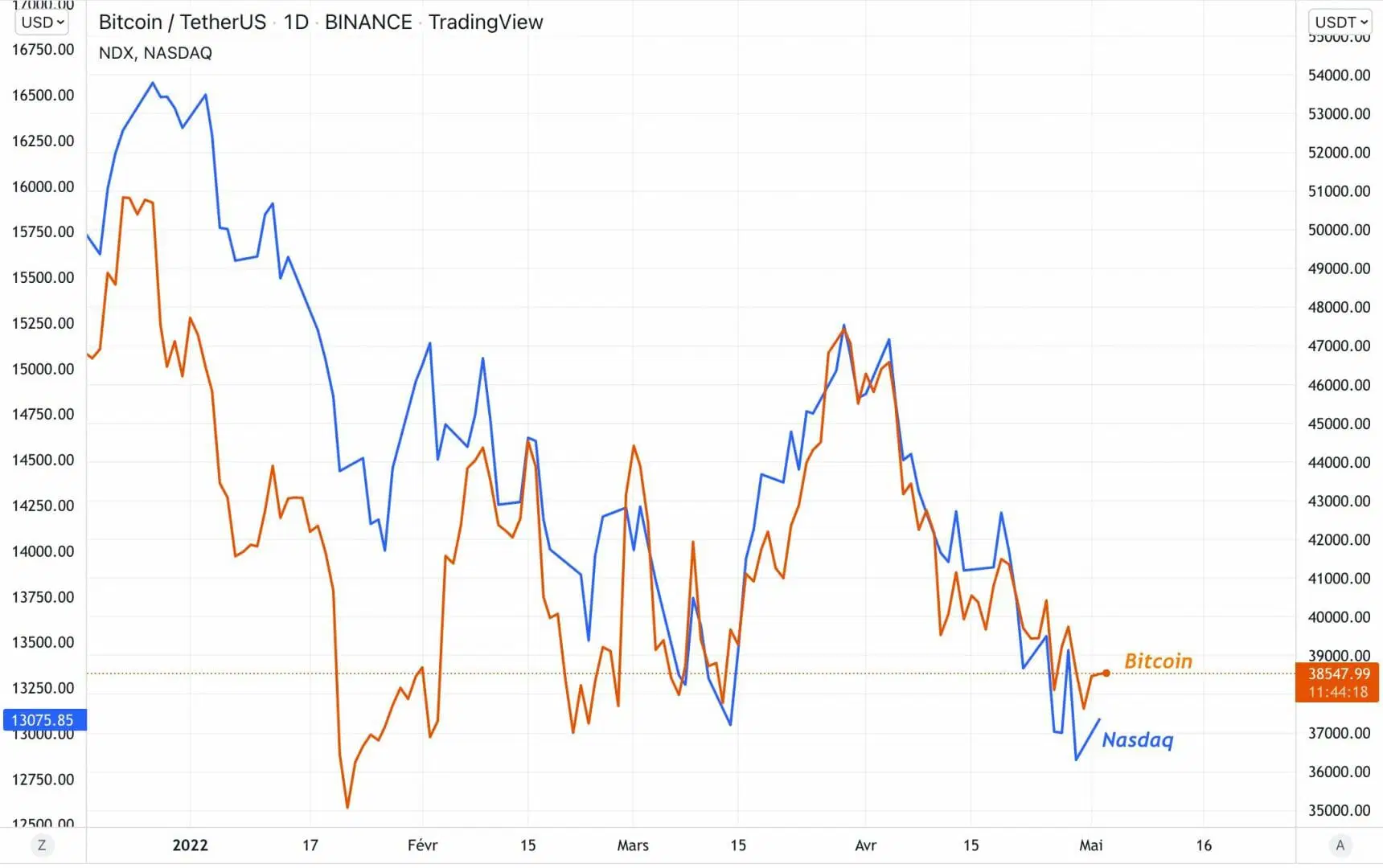

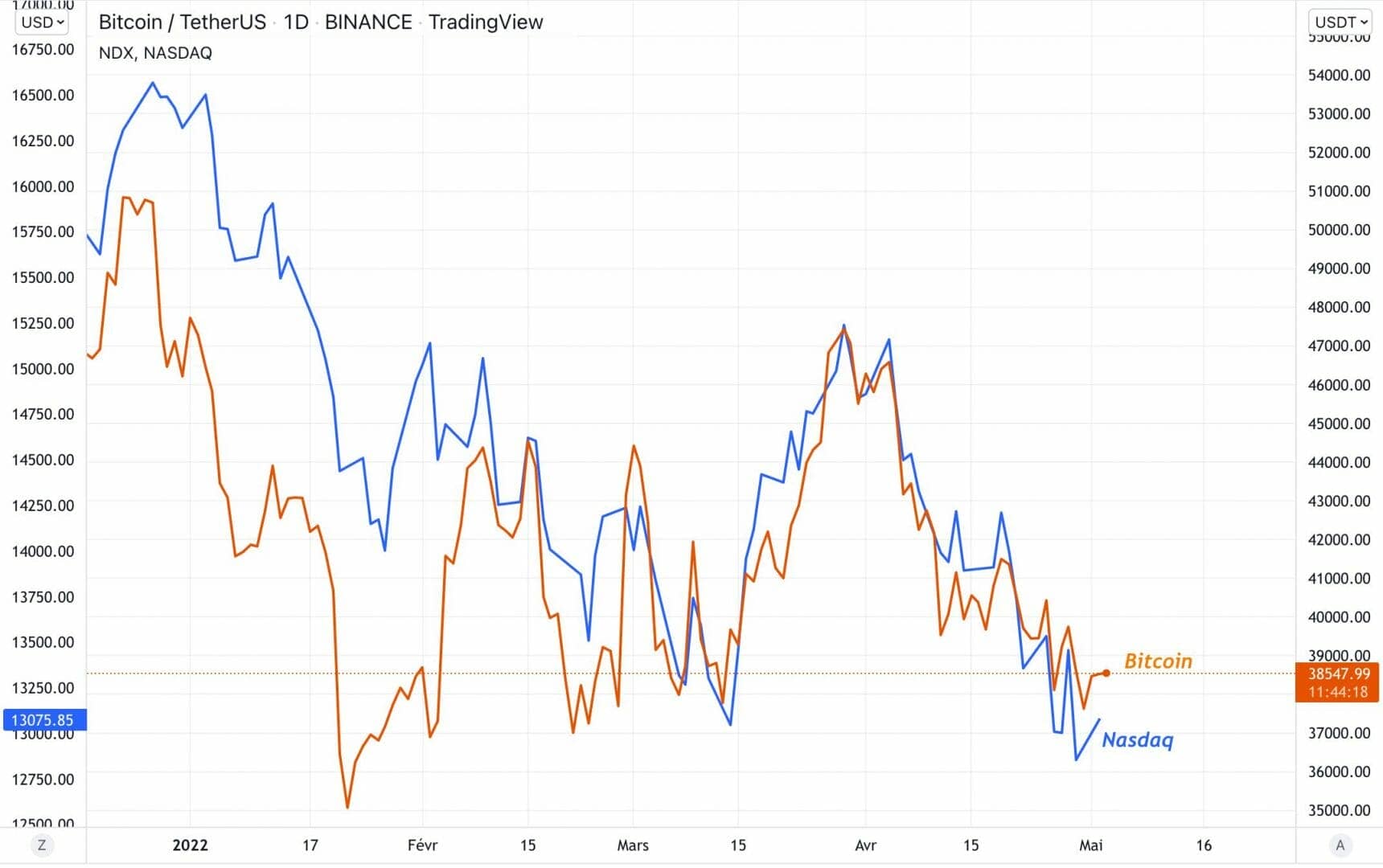

Bitcoin is highly correlated to the stock market and especially to the NASDAQ , it seems that we have to wait for a buying return on the stock side to see Bitcoin express itself again:

The two risky assets are highly correlated . We will see later, the NASDAQ is not doing very well. Bitcoin must be able to get out of this correlation or else the stock market must recover if we want to see the king of cryptocurrencies rise again.

RISK OFF ASSETS: GOLD WEAKENS, NOT THE DOLLAR

BACK TO $1,750 FOR GOLD?

Gold is down 8% since its local high on March 8. Granted, that doesn’t sound like much, but gold is far less volatile than Bitcoin. Here is the graph in daily time units:

Gold seemed to be strong, but it failed to hold the support at $1,900 . We were talking about it last week during the 12th edition , it was showing some signs of weakness . The buyers failed to hold the support which was also the first stop (0.382 fibonacci retracement). This is a level not to be lost in an uptrend.

With the first stop lost, gold is likely to recover between $1,750 and $1,820 . This is the reload area, where buyers can regain control . The momentum is now bearish on a daily basis, it will be necessary to reverse the trend if the buyers want to see a new all-time high on gold.

The momentum shows that the sellers have the upper hand . Here again, it will be necessary to find a bullish momentum to see a possible loss of breath of the sellers.

THE DOLLAR INDEX, A THORN IN THE SIDE OF RISKY ASSETS, CONTINUES TO CLIMB

The dollar index measures the dollar against a basket of currencies. The euro, which is present at 57.6%, is weakening at the moment. The dollar continues to appreciate :

The dollar is soaring and this does not bode well for risky assets. As long as the dollar is strong , risky assets find it difficult to express themselves. We have seen it since May 2021 , the dollar is soaring. This date corresponds to the fall of Bitcoin for those who remember.

At the moment, there are no signs of dollar weakness . We remain in an area that could provide resistance, but, for the moment, nothing indicates it. The dollar is to be watched in the coming weeks.

THE STOCK MARKET: IS IT BREAKING?

Tomorrow, there is a meeting regarding the rate hike to counter historical inflation in the United States. The market is expecting a rise of 0.5 points and J. Powell (Chairman of the Federal Reserve) and his colleagues should not surprise the market. Indeed, the market does not like surprises.

If rates have come back up as expected, it is possible that the market has already priced this rise and the market could then regain some buying momentum . Nothing certain of course.

S&P 500 SUPPORT MUST HOLD!

The US index is on a very important support . The S&P 500 absolutely needs to hold onto $4,150 . If the support does not hold, it could quickly end up at $3,820 . There is no doubt that tomorrow’s meeting will be important to maintain this support. Right now, technically, the S&P 500 is bearish on a daily basis.

At the momentum RSI level, if the buyers manage to hold the support , there could be a divergence taking shape. For the moment it is only potential, like Bitcoin.

COINBASE: THE ACTION IS BEARISH BUT THE SELLERS ARE RUNNING OUT OF STEAM?

The Coinbase action is bearish , it has been seen for several weeks in the Point Macro Hebdo. At the moment, the action remains bearish, but the buyers have a chance:

Coibase is really very feverish and shows that institutional players are not very interested in cryptocurrencies. However, a potential divergence is emerging. Again, as with Bitcoin and the S&P 500, we need to confirm . This would set up a range on this recent action.

THE NASDAQ MUST RECOVER, QUICKLY!

As we saw at the beginning of the article, Bitcoin is highly correlated to NASDAQ. The index must quickly recover:

The NASDAQ has been bearish on a daily basis since the top found at the end of November 2021. It is currently trying to hold the support at $13,000 , but it remains very feverish.

The momentum shows that it is possible for the sellers to lose strength . Divergence is possible on a daily basis, but buyers will need to hold support . Tomorrow’s meeting will make it clearer. It is possible that yesterday’s move was liquidity hunting and that the index took advantage of the meeting to rally. Otherwise, we could see the index at $11,000 .

In the end, Bitcoin, S&P 500 and NASDAQ are on important technical levels. They must absolutely maintain these levels or risk seeing their price drop sharply. Tomorrow’s (FOMC) meeting will be very important, it seems that the players are waiting for this event. The US Federal Reserve has to deal with inflation while trying not to bring financial markets down. Risk assets should take a direction following this important meeting. Gold, which is supposed to be a safe haven asset, does not confirm for the moment, while the dollar continues to climb. The dollar needs to find resistance quickly so that risky assets can express themselves again.