Decentralized finance (DeFi) was one of the key topics of the year 2021, as evidenced by the volumes of exchanges that have passed through decentralized exchange platforms (DEX). These topped $ 1 trillion, an 858% increase from 2020.

DEX volume increased by 858%

According to the annual report published by the analytics platform The Block, decentralized exchange platforms posted more than $ 1,000 billion in transaction volumes in the year 2021.

This figure represents a whopping 858% increase over the trading volumes experienced by DEX in the year 2020, based on data as of December 23. In fact, last year, just over $ 115 billion passed through these decentralized platforms.

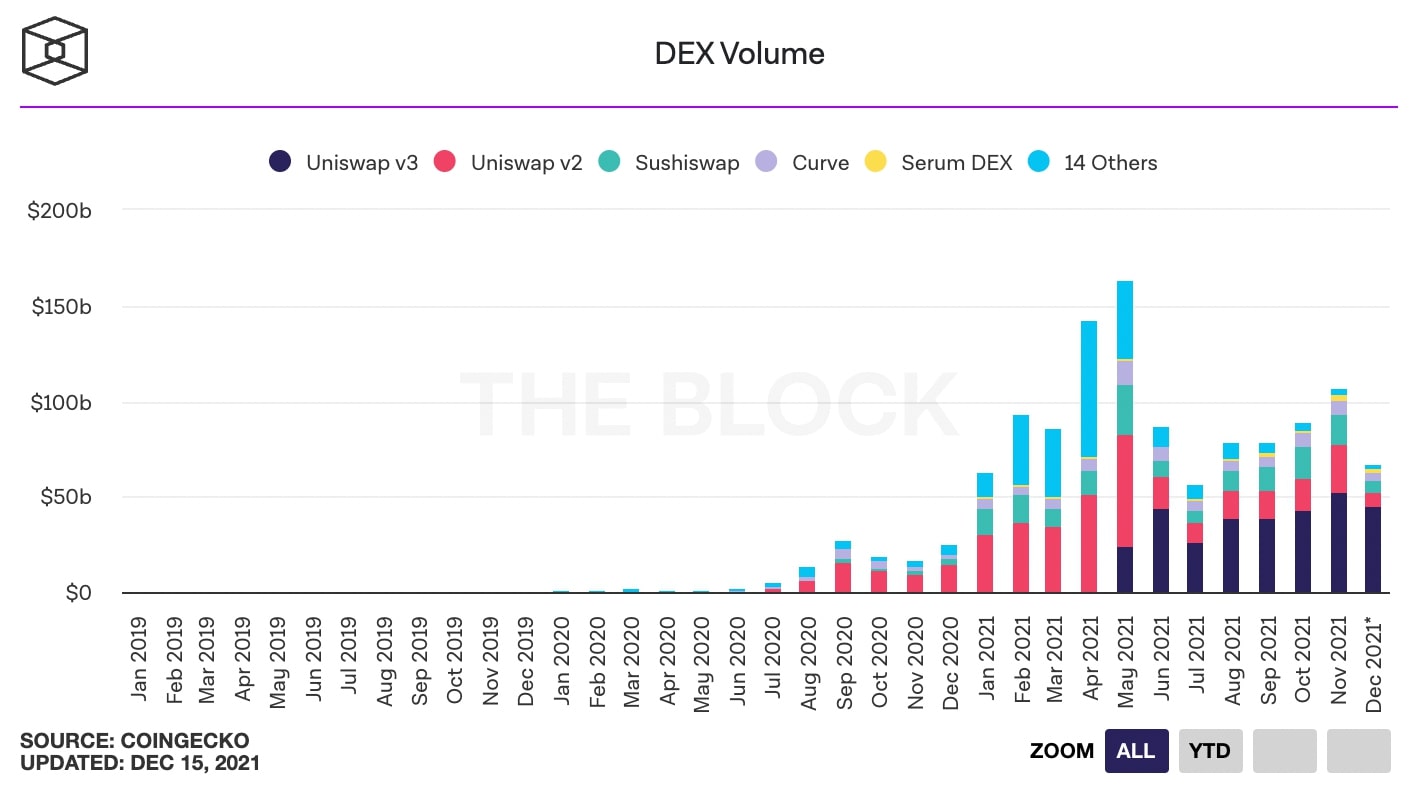

Cumulative monthly volume of decentralized trading platforms – Source: The Block report

Monthly volumes peaked in May 2021 , at $ 162.8 billion. With a gain of 137.3% over the previous month, January saw the most significant growth. In fact, the month of November recorded the third highest volume of monthly transactions.

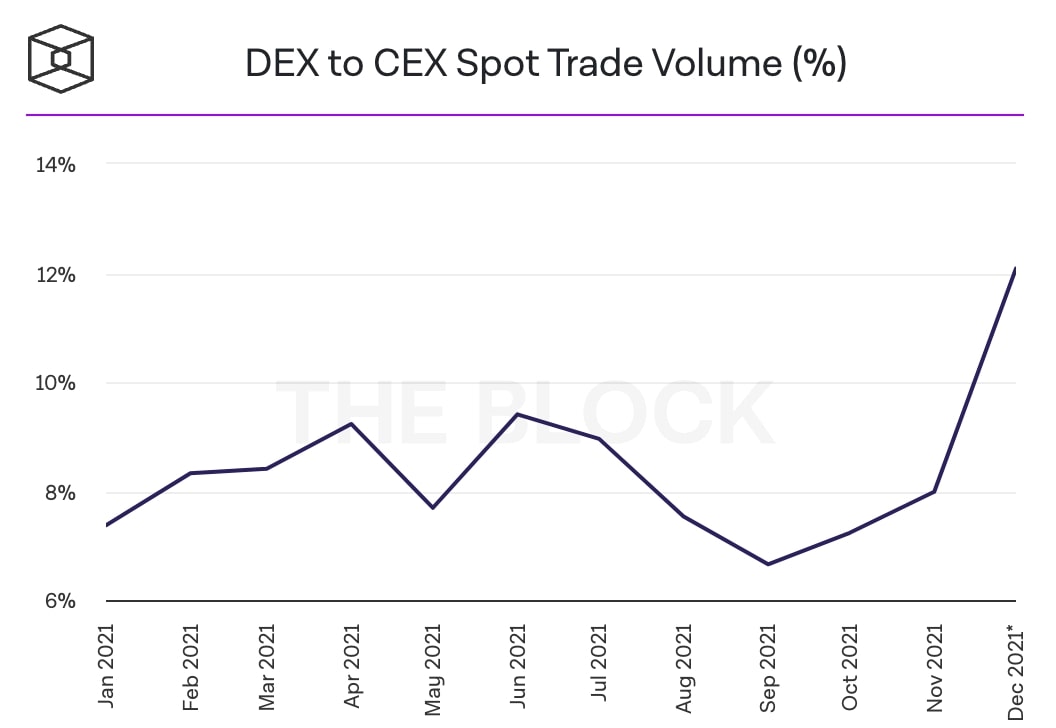

An increase in volumes which testifies to the rise of decentralized trading platforms compared to their centralized competitors, increasingly under the fires of regulators. As the following graph indicates, the dominance of DEX over CEX is diminishing from month to month:

Dominance of monthly volumes between DEX and CEX – Source: The Block report

One of the reasons for this trend is the repression of certain countries against cryptocurrencies and therefore, centralized exchange platforms. For example, last September, the Central Bank of China forced the Huobi exchange to ban all user accounts located in mainland China. A wave of investors who have probably redirected to alternative solutions such as DEX.

Focus on the main market players

This year, decentralized finance (DeFi) was also marked by a transfer of power between players in the DEX sector. While in January 2021, Uniswap v2 was the first in terms of blocked value (TVL), it is now Curve Finance which totals the most .

Indeed, the protocol has succeeded in establishing itself in the hearts of users and in the ranking of DeFi , taking first place ahead of Uniswap and Sushiswap. Curve is currently hitting the $ 14.7 billion stranded , 43% more than its direct competitor.

Top 5 Decentralized Exchanges by Total Locked Value – Source: DeFi Pulse

However, Uniswap continues to lead the market in terms of transaction volumes. At the height of business in May, Uniswap v2 posted a monthly volume of $ 59.2 billion before being eclipsed by its successor. Launched in May 2021, Uniswap v3 dominated the industry by 50% ($ 47 billion) in the last fiscal year. By cumulating with v2, Uniswap processes nearly 70% of the volumes that pass through decentralized trading platforms.

Finally, quite surprisingly, the report’s data shows that 13.9% of users choose to use DEX aggregators to complete their trades. With nearly 70% of the market share, the 1inch protocol is positioned as the leader.