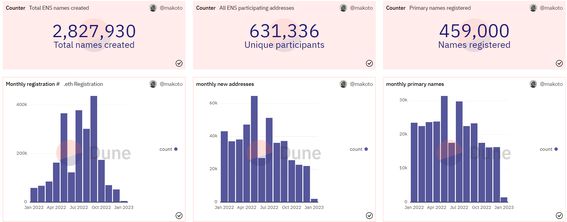

The figure represents 80% of all registrations since the service launched.

Ethereum Name Service (ENS) saw a lifetime record number of domain registrations in 2022 amid a broader market frenzy in which some traders treated the domains as investments.

ENS is a decentralized domain name protocol that runs atop the Ethereum network. It provides users with an easily readable name such as “abc.eth” instead of a complex, long-form alphanumeric address for their crypto wallets, similar to the way the Domain Name System substitutes memorable names such as “coindesk.com” for websites’ numeric internet-protocol addresses.

Data from Dune Analytics shows that more than 630,000 unique wallets created 2.82 million domain names, with 459,000 of those classified as “primary names.” Primary names are ENS addresses that resolve to a user’s crypto wallet and can be used as a proxy to search for information on blockchain explorers, such as Etherscan. The 2.82 million figure represents over 80% of all registrations since the service started in 2017.

September saw the most ENS registrations at more than 430,000 unique domains, and December recorded the lowest at just 52,000 domains, the data shows. The month of May, however, saw the most new users at more than 64,000.

Some ENS buyers treat the names as investments, purchasing popular and common names and selling them for a profit, research firm Delphi Digital said in a July note. At the time, “000.eth” was sold for a record 300 ether (ETH), fueling interest in three-digit ENS names as “traders tried to capitalize on the hype,” according to Delphi analysts.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/8ba9bdd5-0fa0-4f4f-864f-0da5c290a777.jfif)