DR. FABIAN SCHÄR, PROFESSOR FOR DLT (BLOCKCHAIN) AND FINTECH, UNIVERSITY OF BASEL

The Ethereum Blockchain is home to an alternative financial infrastructure. It is implemented in a highly transparent, trust-minimizing and interoperable way. In particular, everything is built on smart contracts and protocols are composable (meaning, that they may freely interact with each other). Moreover, there is no need for trusted third parties, such as custodians or central clearing houses – at least in theory.

In reality, most Decentralized Finance protocols are subject to severe dependencies and centralized governance processes. The focus seems to have shifted towards interoperability and away from trust-minimization. Consequently, Decentralized Finance is starting to look a lot like open banking, or to be more precise, an actual realization of open banking’s long-term vision.

Layered Architecture

To get an understanding of Decentralized Finance, it is essential to analyze its architecture. In this short blog post, we will not get too technical but instead, focus on a general overview.

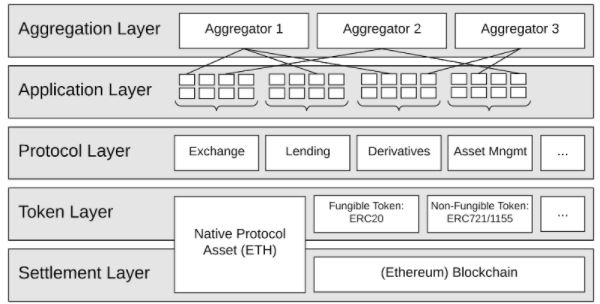

To achieve composability, the Decentralized Finance infrastructure is split and implemented in various layers, each of which serves a distinct purpose. In particular, it consists of the settlement layer, the token layer, the protocol layer, the application layer, and the aggregation layer – Schär 2020.

Figure: The DeFi Technology Stack

Source: Schär, Fabian, Decentralized Finance: On Blockchain- and Smart Contract-based Financial Markets (March 8, 2020). Available at SSRN: ssrn.com/abstract=3571335

The settlement layer is used as the foundation on which tokens are issued, financial protocols deployed, transactions executed and changes to the current state persisted. Essentially it is the database on which everything is stored and serves as the heartbeat of the Decentralized Finance Stack. It is important to understand, that anything that is built on top of this layer can only be as secure and decentralized as the settlement layer itself.

The token layer creates the assets that are issued on top of the platform. These tokens usually represent the right to a good or service, or can be seen as a claim against a protocol. Tokens use standardized interface definitions (such as ERC-20 or ERC-721) to ensure that they can be used by any of the protocols and applications on subsequent layers.

The protocol layer employs the settlement layer’s smart contract platform to create a large variety of financial protocols, used to store, operate on and transfer tokens. It can be further categorized in exchange, lending, derivatives and asset management protocols and provides interfaces for market participants, third party protocols, applications and aggregators. Most protocols are used by a large variety of applications.

These applications are part of the application layer. In contrast to the protocol layer, they are more user-oriented and provide a simplified UI, that abstracts the technical details. In many cases protocols provide a default application, but due to the composable nature of DeFi, additional applications may be provided by any third party.

Finally, the aggregation layer creates a single point of access to several applications and protocols. It allows its users to interact with selected services, from within a single aggregating platform. As such, aggregators do not necessarily provide any new financial services but rather acts as a curation and abstraction layer.

Composability

The layered architecture provides several advantages and creates a highly transparent and interoperable infrastructure. Tokens may be bought on any decentralized exchange and used in any of the protocols, either directly through the smart contract interface, via an application frontend or through an aggregator. In most cases, there are no restrictions. Users can move their funds with ease and choose the services they like best.

To give you an example: Let us assume that Alice currently owns some Ether (ETH) and would like to leverage her holdings while still having exposure to ETH. She may lock some of her ETH as collateral in a lending pool, borrow a stablecoin, use the stablecoin alongside ETH to provide liquidity to an automated market maker, where she earns fees, while locking the liquidity pool shares in another protocol to “farm” governance tokens. She essentially is in full control over her assets and may implement her own investment strategy, all governed by smart contract code and interoperable financial services. If she does not want to implement her own strategy, she may allocate her tokens to an investment vault, where it gets automatically invested in accordance with the vault’s strategy.

Obviously, this has immense potential and allows for an unprecedented growth of financial innovation. However, the complexity comes at a cost. While – in theory – it is true, that Decentralized Finance is completely transparent, analyzing complex transaction flows can get quite cumbersome. All the information is stored on a public ledger, but must be manually interpreted and pieced together. Moreover, each layer adds new complexity and potential risks to the equation. If one of the lego pieces fails, a large number of investors and dozens of seemingly unrelated protocols, applications and aggregators may be affected as well.

False Advertising?

In addition to this problem, one must be aware that many of the protocols are in fact much less decentralized than they claim to be. Contracts mostly use upgradable proxy patterns and rely on admin keys, or highly concentrated governance token ownership to decide on the implementation of changes. In some cases, developers even have the power to unilaterally pause the contract, blacklist certain addresses or reallocate the tokens. In addition, most protocols rely on heavily centralized and potentially corruptible providers of external data (so-called oracles). Unfortunately, this is just the tip of the iceberg and a small selection of potential attack vectors through which protocol developers, malicious third parties or regulators may intervene, if the protocol is not implemented properly.

I would therefore like to stress the importance of closely examining the implementation and the technical details underlying these protocols. Unfortunately, Decentralized Finance lacks a clear definition and reporting standards on the extent of decentralization. Just because it is true that there is the option to implement financial services in a transparent and trust-minimized way, does not necessarily mean that the protocol developers are willing and able to do so. As such, I highly encourage investors, regulators and finance researchers to go down the rabbit hole and familiarize themselves with the potential and the risks of this new technology – A technology that may very well play an important role in the future of our financial system.

References

Schär, Fabian, Decentralized Finance: On Blockchain- and Smart Contract-based Financial Markets (2020). Available at SSRN: ssrn.com/abstract=3571335

Schär, Fabian and Berentsen, Aleksander, Bitcoin, Blockchain and Cryptoassets: A Comprehensive Introduction (2020). MIT Press.

About the Author

Prof. Dr. Fabian Schär is the Credit Suisse Asset Management (Schweiz) AG Professor for Distributed Ledger Technology (Blockchain) / FinTech and the Managing Director of the Center for Innovative Finance at the University of Basel. His research focus is on Public Blockchains, Asset Tokenization and Decentralized Finance. He has a PhD in cryptoassets and blockchain technology and co-authored several publications, including the bestselling book «Bitcoin, Blockchain and Cryptoassets». He is the organizer of the «Blockchain Symposium», the «Blockchain Challenge» and the co-initiator of the «Blockchain Diploma project». Moreover, he is a member of several boards, an advisor to prestigious Blockchain projects, an invited speaker at numerous renowned conferences, and has professional experience in the financial industry.