More and more crypto cards are offered by platforms like Binance, Bitpanda or Coinbase. But how do you choose the right one for you? Which platform to trust? What are the characteristics of each crypto-card? Here is our comparison of the best bank cards to pay in cryptocurrencies in 2022.

- What is a crypto card?

- The best crypto cards

- Top 4 best crypto cards in detail

- Conclusion on crypto bank cards

What is a crypto card?

The origin of crypto cards

In recent years, the popularity of cryptocurrencies has only increased and we are gradually entering a new era of finance . It was in this context that crypto cards were born, and few saw it coming.

While cryptocurrencies were originally created as a substitute for traditional finance, we are seeing them increasingly used as traditional finance products. Satoshi Nakamoto, for example, certainly did not aim to see Bitcoin (BTC) being spent on a Visa bank card, and yet it is now possible.

One thing is for sure, crypto cards play a big role in this change . Already in 2017, the Monaco Technology company presented its mobile application and its Monaco card operating on the Visa network, among other projects. In 2018, the Monaco Visa Card was launched in several countries. Finally, Monaco rebranded itself as Crypto.com in 2020 and many other companies will follow suit.

Figure 1: Monaco Technology unveils its 5 crypto cards in 2017 (Crypto.com today)

The popularity of crypto cards is well established, Visa reports that $2.5 billion in cryptocurrency payments were made with its crypto cards between October and December 2021.

Today, more than 60 companies offer a crypto card, we will help you see more clearly by offering you the four best cards currently on the market in 2022 according to Cryptoast.

How does a crypto card work?

A crypto card is intended to allow its user to pay like any other bank card, but in cryptocurrencies . For this, companies are partnering with payment processing networks such as Visa , which is the main interlocutor in the sector, although Mastercard ended this at the end of 2021.

It is good to note that each crypto card works differently, but overall a wallet is associated with an application whose account is linked to your crypto card.

The classic process is to deposit your cryptocurrencies on this wallet, and when you use the card for a payment or to withdraw cash from an ATM, the cryptocurrencies in your wallet will be automatically and instantly converted into fiat currency .

The best crypto cards

Here is a comparative overview of the four crypto bank cards that we are going to present to you:

| Binance | Crypto.com | Bitpanda | Coinbase | |

| Fees charged at payment | In euros: No fees In cryptocurrencies: Up to 0.90% | No charges | In euros: No fees In cryptocurrencies: 1.49% | In France: No charge In the EEA: 0.20% |

| Cashback | 0.10 to 8% | 0 to 5% | 0 to 2% | / |

| Payment limits | 8,700 euros daily for the physical card and 870 euros for the virtual card | 2,000 euros monthly to unlimited | 10,000 euros daily | 10,000 euros daily (20,000 euros monthly) |

| Payment in euros possible | Yes | Yes | Yes | Nope |

| Other advantages | Funds insured by Binance | Depending on the model: reimbursement of subscriptions (Netflix, Shopify and Prime) and access to premium offers | Possible to pay in stocks or even in precious metals | / |

| Card order | OrderBinance Card | Order the Crypto.com Card | Order the Bitpanda Card | Order Coinbase Card |

Top 4 best crypto cards in detail

As you will have understood, the cards we present in this article are the Binance, Crypto.com, Bitpanda and Coinbase cards.

Binance bank card

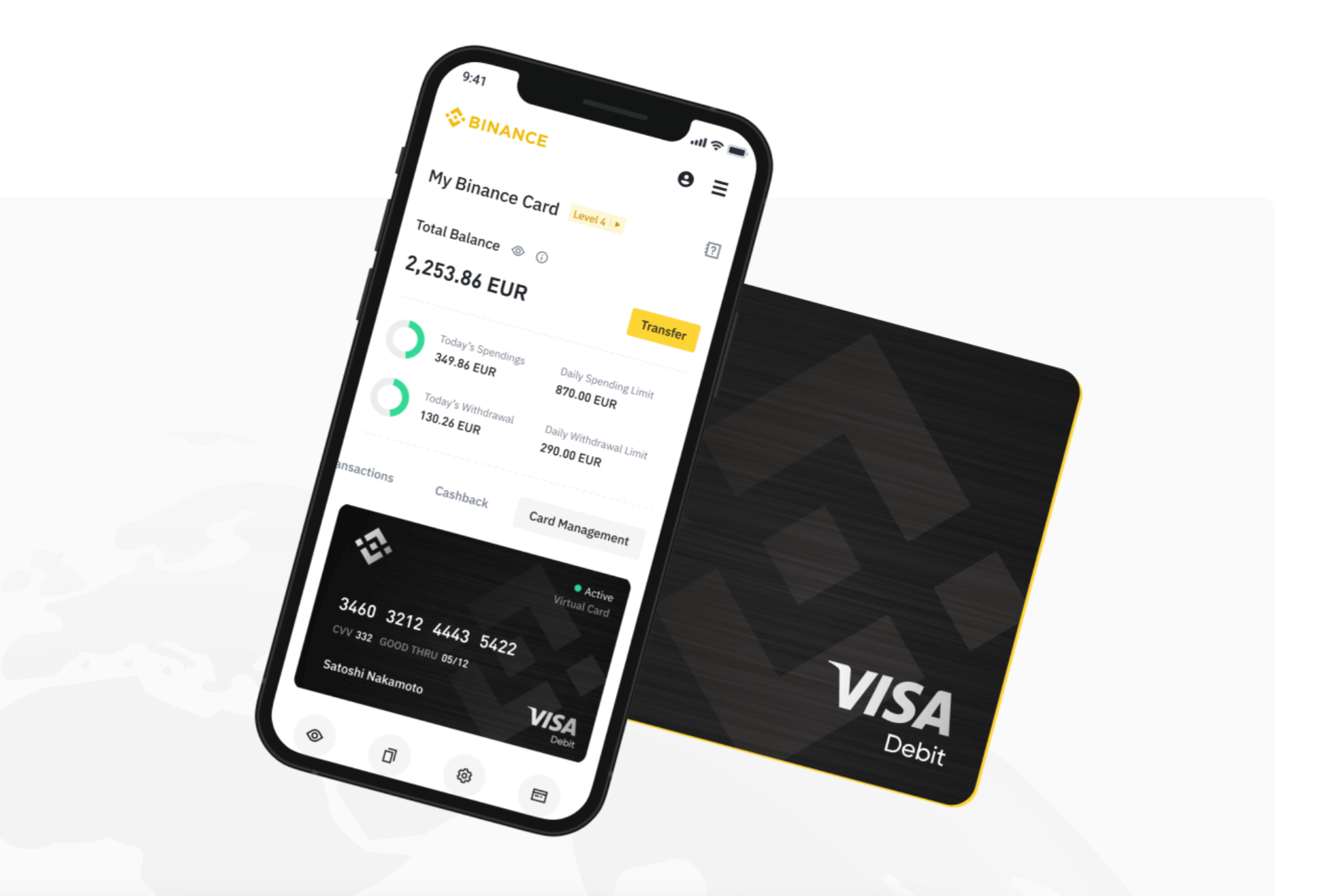

Binance offers a debit crypto bank card in France as well as in many other European countries. After a Know Your Customer (KYC) verification, you will receive your virtual card directly and the physical card delivered to your home.

It is possible to access your Binance Card Dashboard directly from the Binance website or app.

Figure 2: Binance Card Dashboard Overview

Here is the list of cryptocurrencies that you can use with the Binance Card: BNB, BUSD, BTC, SXP, ETH, EUR, ADA, DOT, LAZIO, PORTO, SANTOS and USDT. It is in this order that the cryptocurrencies will be debited if you have more than one from this list.

Binance Card Cashback

Binance offers a Visa card with up to 8% cashback in BNB tokens on every purchase. This cashback, paid daily, is capped and depends on the level of the card. There are 7 tiers on the crypto card offered by Binance, and the cashback increases based on the monthly average balance of BNB tokens held in your Binance wallets, ranked as follows:

| Amount of tokens (BNB) | cash back | Monthly limit on cashback | |

| Level 1 | 0 | 0.1% | €5 |

| Level 2 | 1 | 2% | EUR 100 |

| Level 3 | 10 | 3% | EUR 150 |

| Level 4 | 40 | 4% | EUR 200 |

| Level 5 | 100 | 5% | 275 EUR |

| Level 6 | 250 | 6% | €350 |

| Level 7 | 600 | 8% | EUR 500 |

Daily spending limits and fees

The Binance Visa card charges very low fees and this is the strength of this card: 0% in euros and up to 0.90% only in cryptocurrencies . Daily spending is capped at 870 euros for the virtual card, 8,700 euros for the physical card and 290 euros for an ATM withdrawal.

The Binance Card is for you if:

- You want to have low or even non-existent costs when spending money;

- You want to benefit from attractive cashback (up to 8%), despite the monthly limit;

- For you, the security of your cryptocurrencies is a priority, Binance having proven itself at this level.

The Binance Card is not for you if:

- You do not want a monthly limit on your cashback;

- You don’t like being forced to own many tokens to level up your card. Level 7 is equivalent to $232,000 in BNB tokens at the time of writing.

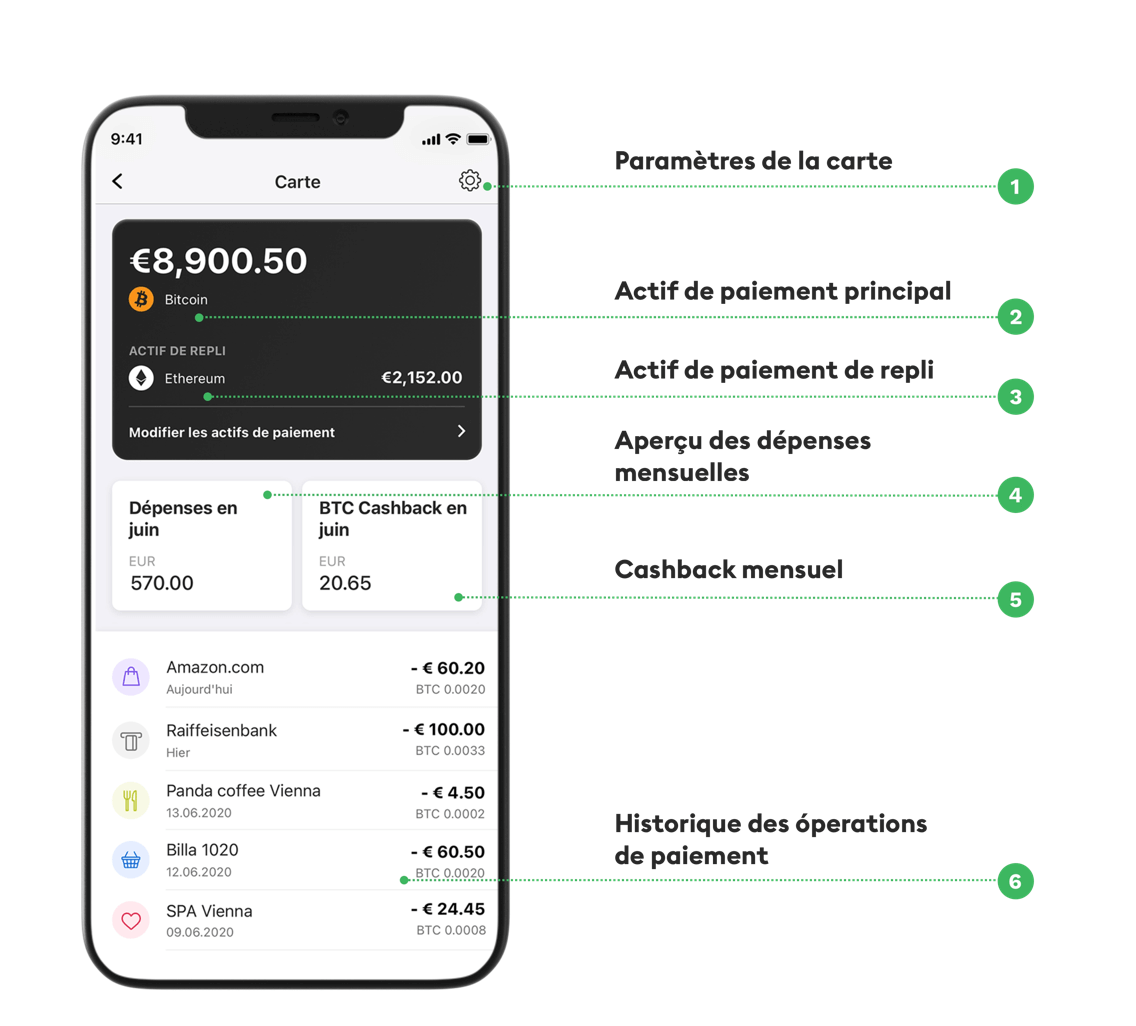

The Bitpanda crypto card

Bitpanda is an Austrian company that offers an exchange of cryptocurrencies, commodities, stocks and ETFs. It also offers its own crypto Visa card which can be ordered after creating a Bitpanda account.

There is a level system named BEST VIP which offers various benefits depending on the number of BEST tokens held. The BEST is Bitpanda’s ecosystem token. As a staker, you can take advantage of advantages linked, among other things, to the crypto card, such as cashback of up to 2% in BTC .

There is no monthly cashback limit. It should be noted, however, that if you pay with Euros, USDT or USDC tokens, cashback will not work.

Figure 4: Bitpanda Map Dashboard Overview

A special feature of the Bitpanda crypto card is the possibility to pay not only with around 40 cryptocurrencies available on Bitpanda, but also with precious metals and fiat currencies.

The BEST VIP levels of the Bitpanda card and the benefits associated with them

Here is an overview of the different levels of the Bitpanda card:

| Amount of tokens (BEST) | cash back | Foreign currency payment fees | Number of free ATM withdrawals | |

| BESTVIP 0 | 0 | 0% | 2.50% | 0 |

| BESTVIP 1 | 10 | 0% | 2.50% | 0 |

| BESTVIP 2 | 1,000 | 0% | 2.50% | 0 |

| BESTVIP 3 | 5,000 | 0.5% | 1.75% | 1 |

| BESTVIP 4 | 10,000 | 1% | 1.00% | 5 |

| BESTVIP 5 | 50,000 | 2% | 0.25% | Unlimited |

Daily spending limits and fees

Bitpanda does not charge any fees for card operation or for opening an account. On the other hand, with each purchase in cryptocurrencies, a fee of 1.5% is charged . There is only a daily payment limit of 10,000 euros.

As for ATM withdrawals, they are charged 1.50 euros apart from free withdrawals, with a limit of 350 euros per day.

The Bitpanda card is for you if:

- You want a high payment ceiling : 10,000 euros per day;

- You want to have flexibility in the means of payment since Bitpanda offers payment in cryptocurrencies, precious metals and fiat currencies;

- You want to take advantage of the cashback to the maximum since there is no ceiling.

The Bitpanda Card is not for you if:

- You desire a higher cashback ;

- The 1.49% fee in cryptocurrencies puts you off;

- You do not want to stake tokens to use a crypto card.

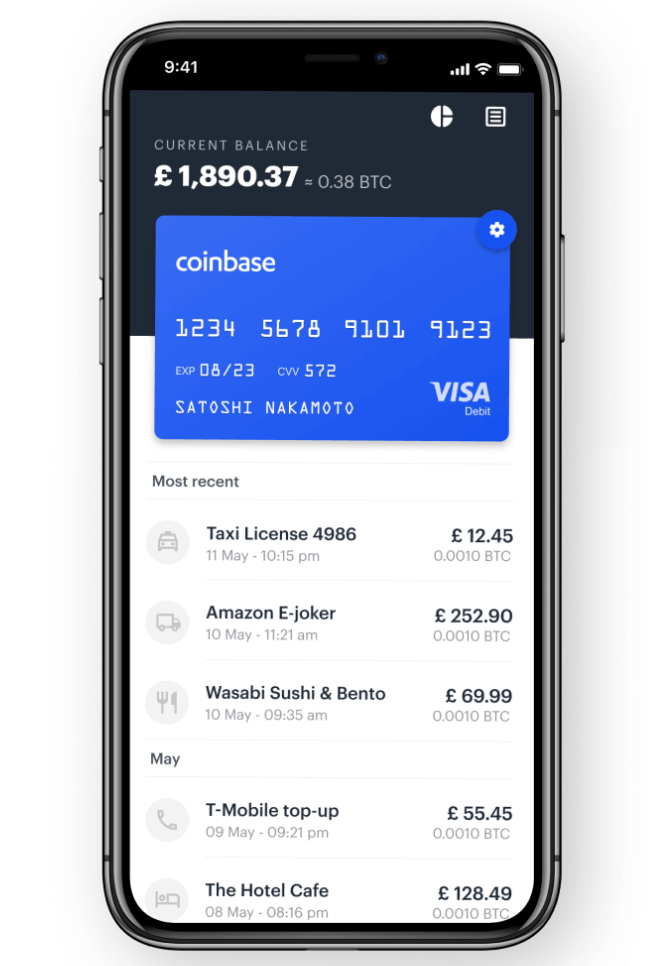

The Coinbase crypto card

Coinbase also offers its crypto Visa card which is linked directly to the Coinbase account. It is available throughout Europe.

A single, level-less map

The Coinbase card charges a fee for issuing the physical card : it is the only company in this top that does so, at a price of 4.95 euros. You will then have to deposit cryptocurrencies in your Coinbase account. The card will then allow its holder to make payments directly, with Coinbase automatically converting your cryptocurrencies into fiat at the time of purchase without any fees in France.

Figure 5: Coinbase Card Dashboard Overview

The Coinbase card is also the only one in this top not to offer different levels, and does not offer cashback in France.

Payment limits and fees

In terms of payment limits, those of the Coinbase card amount to 10,000 euros per day, 20,000 euros per week, or finally 100,000 euros per month.

ATM withdrawals are limited to 500 euros per day, with 200 euros of free withdrawal per month. Above this amount, 1% is charged by Coinbase for domestic withdrawals and 2% for international withdrawals.

The Coinbase Card is for you if:

- You do n’t want to have to own tokens and stake them to use a crypto card: the Coinbase card being the only one in this top not to offer various levels of cards;

- You want to be able to pay free of charge ;

- You prioritize the security and reputation of the platform, Coinbase having also proven itself at this level.

The Coinbase Card is not for you if:

- You wish to benefit from a cashback;

- You wish to benefit from special advantages linked to your card;

- You do not want to pay a fee for issuing the card (4.90 euros).

.

The Crypto.com crypto card

Crypto.com is one of the pioneers in the field and its particularity lies in its offer of 5 different Visa crypto cards . These are all debit cards. To receive your Crypto.com bank card, you will need to create an account on the Crypto.com application and do the KYC verification. You will then need to stake CRO tokens to be able to apply for them, except for the Midnight Blue card.

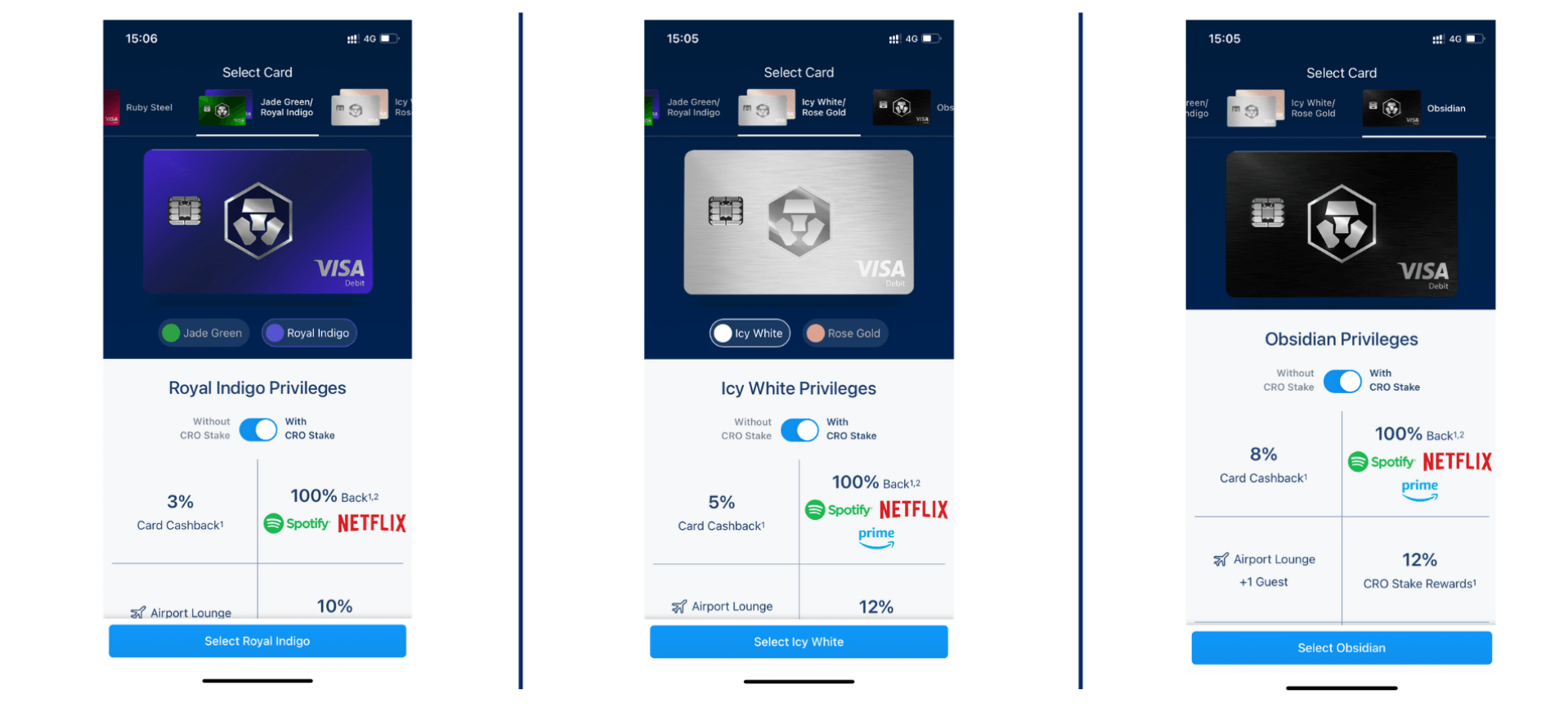

Figure 3: Overview of Crypto.com card selection

There is the possibility to stake its CRO tokens for a period of 180 days to benefit from more advantages. The amount of your staking will determine the level of the card you can obtain.

It is then possible to unstake your CRO tokens after 180 days and keep the card, but the cashbacks will be much lower and you will lose benefits. Therefore, you will have to continue to stake your tokens in order to keep all the advantages linked to your Crypto.com crypto-card.

The different Crypto.com cards

The level of the card determines the amount of cashback in CRO tokens you will receive on each purchase, as well as certain premium benefits. Here are the details regarding the levels of the Crypto.com cards, note that we have taken into account the data of the new offer which starts from June 1, 2022 .

| Amount owned (in CRO) | Cashback (without staking) | Cashback (180 days staking) | Monthly cashback limit | Interest on staking | |

| Midnight Blue | 0 EUR | 0% | 0% | 0 | 0% |

| Ruby Steel | €350 | 0% | 1% | $25 | 0% |

| Royal Indigo & Green Jade | €3,500 | 0.5% | 2% | $50 | 4% |

| Frosted Rose Gold & Icy White | €35,000 | 1% | 3% | Unlimited | 8% |

| Obsidian | €350,000 | 2% | 5% | Unlimited | 8% |

Other benefits are granted depending on the level of the card such as 100% refunds of Spotify, Netflix and Amazon Prime subscriptions, 10% discounts on the Expedia and Airbnb platforms as well as other exclusive benefits such as access at airport lounges .

Daily spending limit and fees

Crypto.com does not charge any fees with their crypto cards. Cash withdrawals from ATMs are free for an amount between 200 and 1,000 euros depending on the card, beyond which a 2% fee will be charged, with a limit of 10,000 euros per month.

It is also possible to recharge your card in euros, dollars or any other fiat currency to pay directly in fiat if necessary, to use it like a perfectly normal bank card. Finally, closing your account with Crypto.com is charged 50 euros .

The Crypto.com card is for you if:

- You want to benefit from many advantages and have sufficient funds to obtain the best cards (Frosted Rose Gold & Icy White and Obsidian);

- You want to be able to pay free of charge ;

- You want to be able to use many cryptocurrencies when shopping.

The Crypto.com card is not for you if:

- You don’t like having to lock your tokens for a period of 6 months , because you rightly find it risky;

- You have little or no funds to stake , the low level cards being unattractive (especially the first levels).

Conclusion on crypto bank cards

Crypto cards are very interesting solutions if you want to directly spend your cryptocurrencies while earning rewards with cashbacks and staking.

This top is of course not exhaustive , it reviews the four best cards available in Europe, and especially those most secure. There are obviously others like those of Nexo, Celsius or Plutus.

We particularly draw attention to the spending of cryptocurrencies via a crypto card because this involves a transaction of cryptocurrencies in euros. It is therefore a taxable and tax-generating operation , to be included in your tax return . Companies providing crypto cards do not offer support in this area.

Each card we have seen has its strengths and weaknesses. For example, if what interests you the most concerns the exclusive advantages of having substantial funds available, the Crypto.com card stands out as the most interesting.

It will be interesting to watch how this sector evolves in the future, with many competitors arriving always offering more innovative offers .