Bitcoin resumes light colors at the beginning of June. The price seems to leave the range in which it has been evolving for several weeks now. Bullish recovery scenario or simple trap for buyers? Still led by US markets and fear of the macro backdrop, the pessimist wins and every green candle is a real achievement. Be that as it may, the markets seem to be in total limbo, in particular due to a macro-economy that has not been seen for more than 15 years. In parallel with bitcoin, I plan an analysis of Ethereum(ETH) which in this complicated period for cryptos, looks like one of the strongest cryptos. Without further ado, we’re off to this week’s Bitcoin 360°. I will try to be as complete as possible in sharing my feelings about the market. Good reading !

A bitcoin that regains volatility

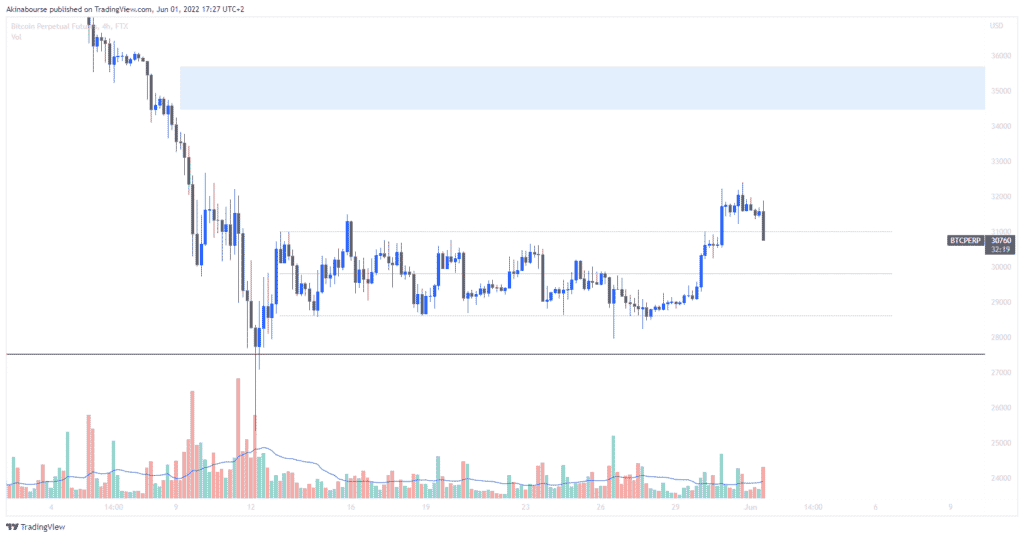

As much as the last few weeks, Bitcoin seemed to decorrelate slightly from the American markets, as much as in the last few days, it’s more complicated for our digital gold. Bitcoin loses more than 5% in 2 days when the SP500 is at -3%. Of course, the beta is always higher on cryptos so don’t panic.

Volatility finally seems to be back, but on the decline. Our assets have been evolving for more than a week between an upper limit of $31,000 and the lower limit of $28,500. Although an exit has been attempted in recent days, on Wednesday June 1, the scenario is no longer so clear. The 2 highly conceivable scenarios here are:

-A simple pullback on the top of the range to accumulate momentum and look for the $35,000 area

-A buyer trap for the simple purpose of liquidating even more people, re-entering the range and then breaking it down to new lows.

For more information on these scenarios, we will have to wait for the week end and hope for a buying force to preserve this exit from the zone.

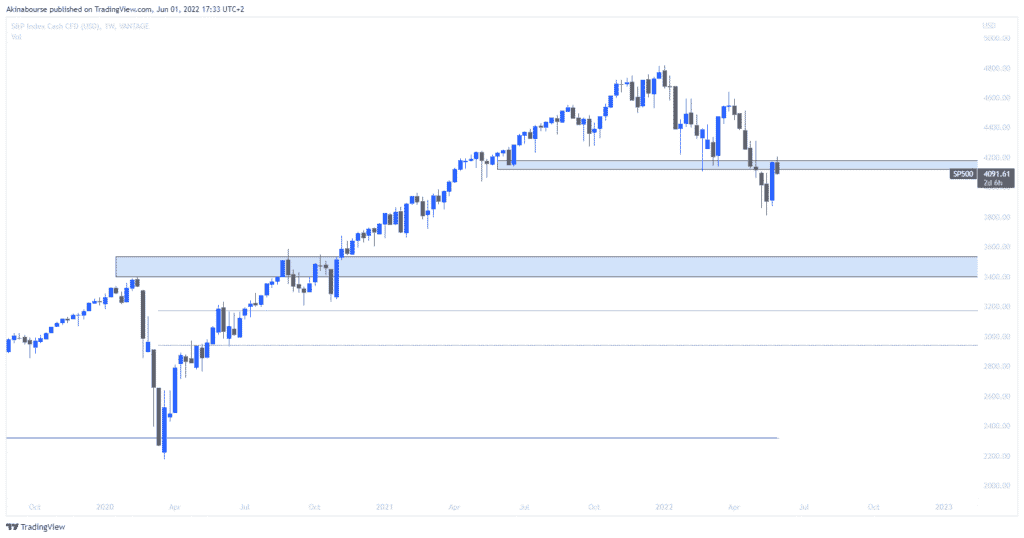

Personally, I dwell a lot on the SP500 which is not the most bullish, but delivers good information.

Some will see a W which seems to mark some semblance of daily bottom, conceivably. In this case, I would like to see a strong break of the blue resistance at $41,000. What I’m looking at more is a simple bounce up to resistance to look behind for new lows and potentially the $35,000 area.

The key is to follow the SP500 which could give indications as to the crypto movement with more % up or down. However, volatility remains very high, so always be very careful with your positions, especially in futures. Waiting for a rebound still seems risky. Bearish days can go to -4% like on the NASDAQ recently, while bullish days are not very prolific.

A risk-off market

Picking up a position or two on strong corners can make sense. Be careful all the same not to expose yourself enormously to altcoins given that the market is increasingly risk off. That is to say that investors are moving towards rather safe assets with a beta and therefore a rather low volatility to counter the risks and the uncertainty that hangs over these markets. Waiting for several days or weeks of increases on risky assets such as altcoins will be a first sign that flows have returned to this asset class. On the contrary, buying heavily on the big red candles may not be the best solution except DCA (Dollars Cost Average) smart.

A short-term rebound is possible, but I still have a long-term bearish bias with uncertainty dominating the markets.

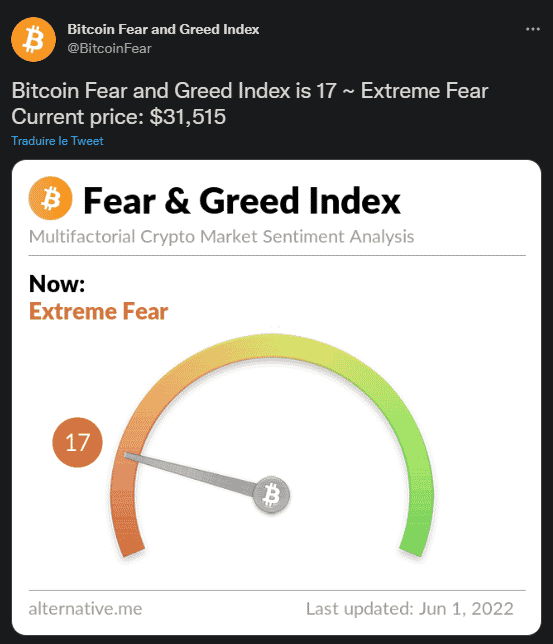

The Fear and Greed index remains at very low levels, reflecting this uncertainty, but despite everything encouraging to buy spot given this element.

For me, it lacks a catalyst that could cause the markets to pull themselves together. The rebound is really weak and shows that buyers are struggling to be heard.

Pessimistic analysts in the traditional market

despite encouraging economic figures, this Wednesday seems very red for the various markets. JPMorgan Chase CEO Jamie Dimon told a conference this morning that the economy was “a hurricane” and that “you better be prepared”.

Well, just because someone is pessimistic doesn’t mean you have to sell everything, however, understanding the mindset of other investors is essential.

Nine of the S&P’s 11 sectors are down, with real estate trailing the pack. Energy and information technologies which are on the rise. In this morning’s economic data, the ISM manufacturing index for May posted an unexpected rise to 56.1, which didn’t make it any easier for buyers. The JOLTS report for April showed a drop in new posts to 11.4 million, as expected.

“Layoffs remain incredibly low,” tweeted Indeed economist Nick Bunker. “This data only covers the end of April, but there is still a long way to go before layoffs start to run high. »

“The resignation rate remains high but has stabilized in recent months. There is even a slight drop compared to the end of last year,” he added. “A notable drop in the quit rate in the leisure and hospitality sector was observed, with a decrease of half a percentage point during the month, to 5.2% in April. The leisure and hospitality sector has been one of the epicenters of quits, but things are calming down in this area. »

How do traditional and macro markets impact us? If there’s one thing to know, it’s that the markets are all highly correlated. The macroeconomy impacts investors in the same way and understanding what is happening around us is essential for good management of its crypto and other positions.

An Ethereum close to 2.0

Altcoins are not in their Olympic form. Indeed, the beta, which measures the volatility of the assets, is much higher on the latter. They therefore often find themselves in distress. Gold Ethereum is considered by many to be more of an altcoin. Anyway, it is still less volatile than Bitcoin in most cases but the rest less than its fellow altcoins.

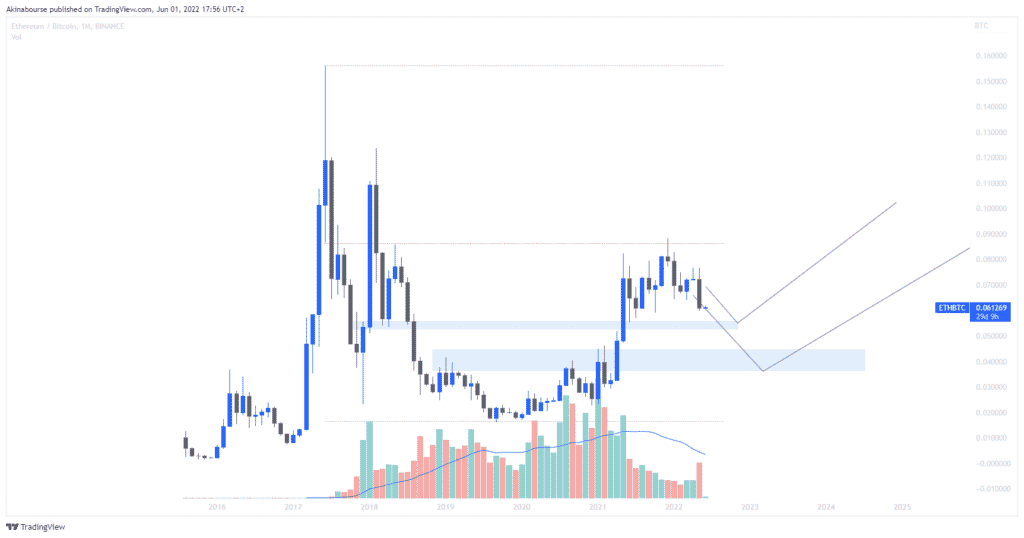

Precisely, when we compare ETH to BTC we see that in recent years Vitalik Buterin’s token has performed much better than Satoshi’s.

However, I see this relationship changing in the coming weeks. This has already started with a loss of momentum. A return to 0.05 or 0.04 seems like a good time to regain strength and upside on ETH compared to Bitcoin.

As I often say, this is not the best time to invest in risky assets.

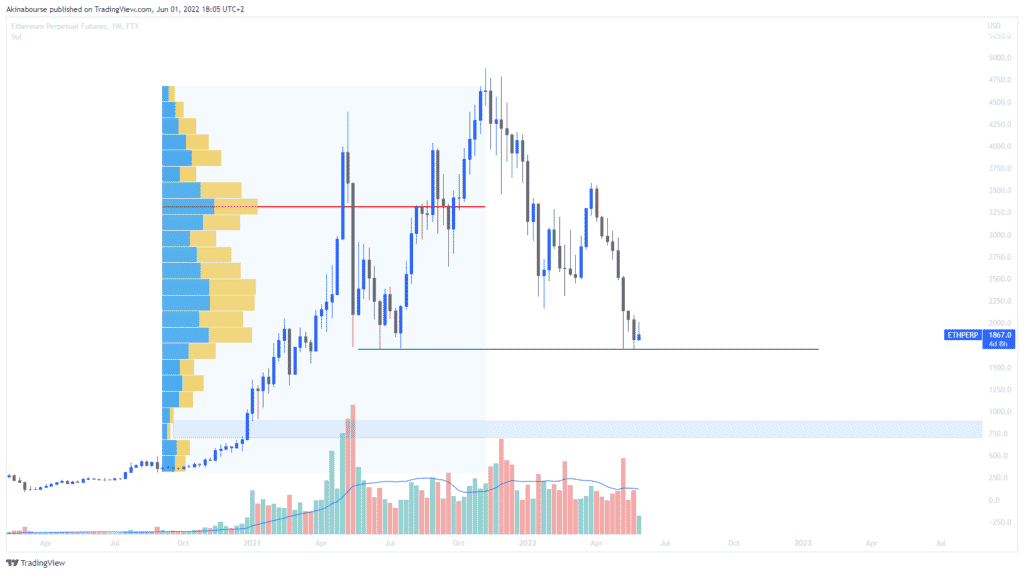

If we compare the Ethereum to the Dollar, we see that the latter is at the bottom of this range, on support.

A lot of cash is to be found just below, and I can’t see a scenario without which we will look for it. Buying on these levels makes sense and can be a strategy. But as I said, the uncertainty in the markets is likely to mean that few buyers will favor this scenario.

My second scenario, the most bearish, is that of a filling of a single print, zone with little exchange which is at the level of $700. For many it’s scary, but it’s still 6 times more than the old bottom.

Anyway, the goal is not to predict the court, but to react to what it offers us. Buying below the range nevertheless seems to me to be a good long-term opportunity.

Of course bitcoin is not helping it and this will continue as long as the underlying trend is bearish and altcoins are in the shadow of BTC.

Finally, I receive many questions asking me on which site I analyze my values. Personally, and for many years, I use TradingView , an intuitive interface with a lot of tools and a wide choice of assets. It is clearly the most developed and used interface on the market.